Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Projected Timeline For Sending Third Stimulus Checks

The IRS delivered virtually all of the second round of stimulus checks in less than a month, starting Dec. 29, 2020, two days after then-President Donald Trump signed the $900 billion bill into law.

Congress gave the IRS until Jan. 15, 2021, to issue the bulk of the 147 million payments so that the agency could quickly pivot to preparing for tax-filing season. After that, taxpayers were instructed to claim any missing stimulus money from the first or second rounds on their 2020 tax returns in the form of a tax credit.

The third round of payments hit at the height of the 2020 tax-filing season, and it was difficult for the IRS to ship all of the stimulus checks in less than a month and process millions of returns at the same time. To give itself some breathing room, the IRS moved the deadline for filing and paying federal income taxes to May 17.

The third stimulus payments are being rolled out in tranches, or groups, by direct deposit and through the mail as a check or debit card. The vast majority of all economic impact payments will be issued by direct deposit, the IRS says, and it will continue to send batches of EIPs every week.

The IRS, via the Treasury, sent the first tranche of payments on March 12, a total of 90 million payments worth about $242 billion. Most of these payments went to people who had filed 2019 or 2020 federal income taxes, or who had used the online IRS Non-Filers Tool.

May 5

May 12

May 26

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

Also Check: Federal Government Pandemic Stimulus Bonus

How Much Are The Payments Worth

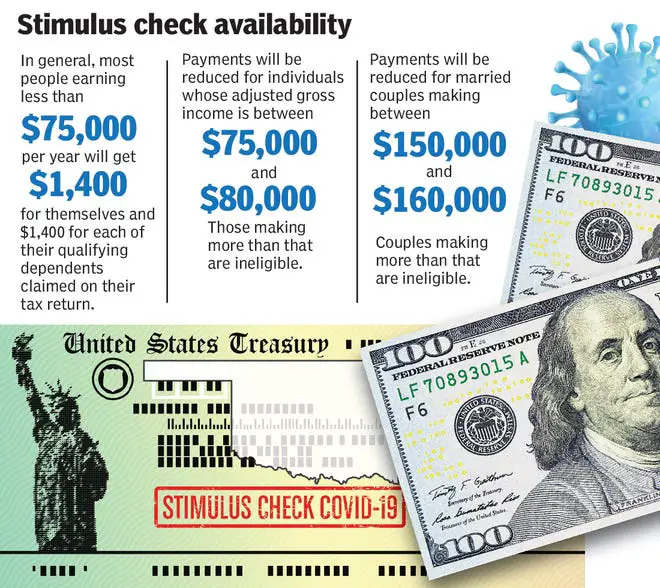

The third round of stimulus payments is worth up to $1,400 per person. A married couple with two children, for example, can receive a maximum of $5,600.

Families are allowed to receive up to $1,400 for each dependent of any age. Earlier rounds limited the payments to dependents under the age of 17.

Generally, low- and middle-income US citizens and US resident aliens are eligible for either a full or partial third-round stimulus payment.

Individuals earning less than $75,000 of adjusted gross income, heads of households earning less than $112,500 and married couples earning less than $150,000 are eligible to receive the full amount of $1,400 per person.

But the payments gradually phase out as household income increases. Individuals who earn at least $80,000 a year of adjusted gross income, heads of households who earn at least $120,000 and married couples who earn at least $160,000 are not eligible for any money regardless of how many dependents they have.

Undocumented immigrants who dont have Social Security numbers are not eligible for the payments. But their spouses and children are eligible as long as they have Social Security numbers.

Social Security Ssi Ssdi Veterans: What You Need To Know About Eligibility And Your Stimulus Payment

The majority of people who are part of the SSI or SSDI programs qualify for a check — read our guide for details. This time, many will get their payments on their existing Direct Express card, though some may receive stimulus money a different way. Consult our guide for more on what to know and do, including if you need to claim a dependent by filing a tax return for 2020.

Stimulus money for veterans who don’t usually file taxes are expected to receive their stimulus checks in mid-April, after many Social Security recipients. Here’s more to know about veterans and stimulus eligibility.

Recipients of the first check received their payments through a non-Direct Express bank account or as a paper check sent in the mail. In the , these recipients again qualified to receive payments, along with Railroad Retirement Board and Veterans Administration beneficiaries.

Also Check: Small Business Stimulus Check 2021

Will The Irs Tax My Third Stimulus Check

The IRS does not consider stimulus checks to be taxable income. This means that you do not have to report the money on your federal income tax return, or pay income taxes on your stimulus check.

You should also note, that if you owe taxes, you could still qualify to get a stimulus payment because the IRS does not use it to offset federal or state tax debts like it normally does with tax refunds.

For private debts, however, the American Bankers Association has pointed out a loophole in the new stimulus plan where banks and other financial services providers will be legally required to comply with court ordered garnishments. The association says that without legislation to shield your third stimulus payment, creditors or collectors can take it to pay off existing debt.

As a reference, the 2020 COVID-Related Tax Relief Act did shield stimulus payments from private debt collection: The Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

But while your stimulus money could be taken to pay for private debt, the new offsetting rules prevent the IRS from deducting overdue child support from eligible recipients. You should keep in mind, however, that the IRS intercepted or reduced payment from the first round of stimulus checks for past-due child support.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Read Also: Can You Still Receive Stimulus Check

How Will The Irs Know Where To Send My Payment What If I Changed Bank Accounts

Taxpayers with direct deposit information on file with the IRS will receive the payment that way. For those without direct deposit information on file with the IRS, the IRS will use federal records of recent payments to or from the government, where available, to make the payment as a direct deposit. This helps to expedite payment delivery. Otherwise, taxpayers will receive their payment as a check or debit card in the mail. If the direct deposit information is sent to a closed bank account, the payment will be reissued by mail to the address on file with the IRS. The IRS encourages taxpayers to check the Get My Payment tool for additional information.

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

You May Like: How Can I Get My Stimulus Checks I Never Received

Am I More Likely To Receive My Payment As A Direct Deposit This Time

Yes. By increasing the use of direct deposit and using prepaid debit cards, people will see an increase in the number of electronic stimulus payments to Americans affected by the pandemic.

Increasing the number of Economic Impact Payments made electronically gets relief to more people in the fastest and most secure way possible. It will also help recipients avoid the time needed and the potential expense of depositing or cashing checks.

To accomplish this, Treasury is drawing upon its records of electronic payments to and from the federal government and converting to direct deposits payments that would have otherwise been paid as checks.

Taxpayers should note that the form of payment for the EIP3 may be different than earlier stimulus payments. Those receiving EIP3 in the mail may get either a paper check or an EIP Card. This may be different than how they received their previous stimulus payments.

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

Recommended Reading: How Many Stimulus Checks Have Been Issued

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

I Think I’m Eligible What Do I Need To Do To Get A Stimulus Check

Nothing. The first two rounds were issued automatically, and the third will be, as well.

The fastest way to get your stimulus check is via direct deposit. Without that information, the IRS will mail you either a debit card or paper check. You can track your money using the IRS Get My Payment tool.

If you believe you qualify for the third stimulus check but don’t receive one â or you believe it’s in the wrong amount â there are options. Either the IRS will send you the money you deserve after you file your 2020 taxes or you’ll be able to claim the Recovery Rebate Credit on your 2021 return, according to The Wall Street Journal.

Read Also: Never Got First Stimulus Check

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household & 1 Dependent |

| AGI |

| $120,000 and up | $0 |

How Much Will The Third Stimulus Check Be

The relief package includes a third round of stimulus checks in the amount of $1,400 per person or $2,800 per married couple filing jointly.

The exact amount and your eligibility will be determined by your most recent tax returns.

Eligible Americans will also receive $1,400 per dependent, which can include college students and adult dependents.

Also Check: Income Limits For Third Stimulus Check

When Is The Third Stimulus Check Coming

Third checks cant come fast enough for the millions of Americans still out of work. More than a third of respondents to a recent survey from Money and Morning Consult say their situation is somewhat or much worse now than it was in February 2020 .

Biden signed the plan into law Thursday afternoon. Last time, it took just days for Americans to start seeing stimulus payments in their bank accounts after the relief package was signed.

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couple’s total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individual’s online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Don’t Miss: Can H& r Block Help With Stimulus Checks