Does The Act Provide Student Loan Relief

The legislation does not provide much additional aid for students however it maintains President Biden’s earlier executive order stating that federal student loans will remain in forbearance through September 30, 2021. Although this federal relief is not applicable to private student loans, individual lenders may offer some sort of assistance at their discretion.

You can find further details about the American Rescue Plan, as well as the full text of the legislation, here.

What Do Federal Benefit Recipients Who Dont File Taxes Need To Get Payment

No further action will be needed to receive a direct payment for most beneficiaries of Social Security retirement and disability, railroad retirees and those who received veterans benefits last year. Like the first two rounds of stimulus checks, the new payments will be sent out the same way benefits are normally paid.

But there are instances where some people receiving the automatic third payment based on their federal benefits information will need to file a 2020 tax return, regardless of whether they normally dont file one.

For instance, if your payment doesnt include a check for your qualified dependent, and that person didnt get one, the federal benefits recipient would need to file a 2020 tax return to be considered for the additional payment.

Also, those who are eligible but didnt get the first or second stimulus check or got less than the full amount may need to file a 2020 tax return to be eligible for the 2020 Recovery Rebate Credit. More information on that can be found here.

How Much Are Stimulus Checks

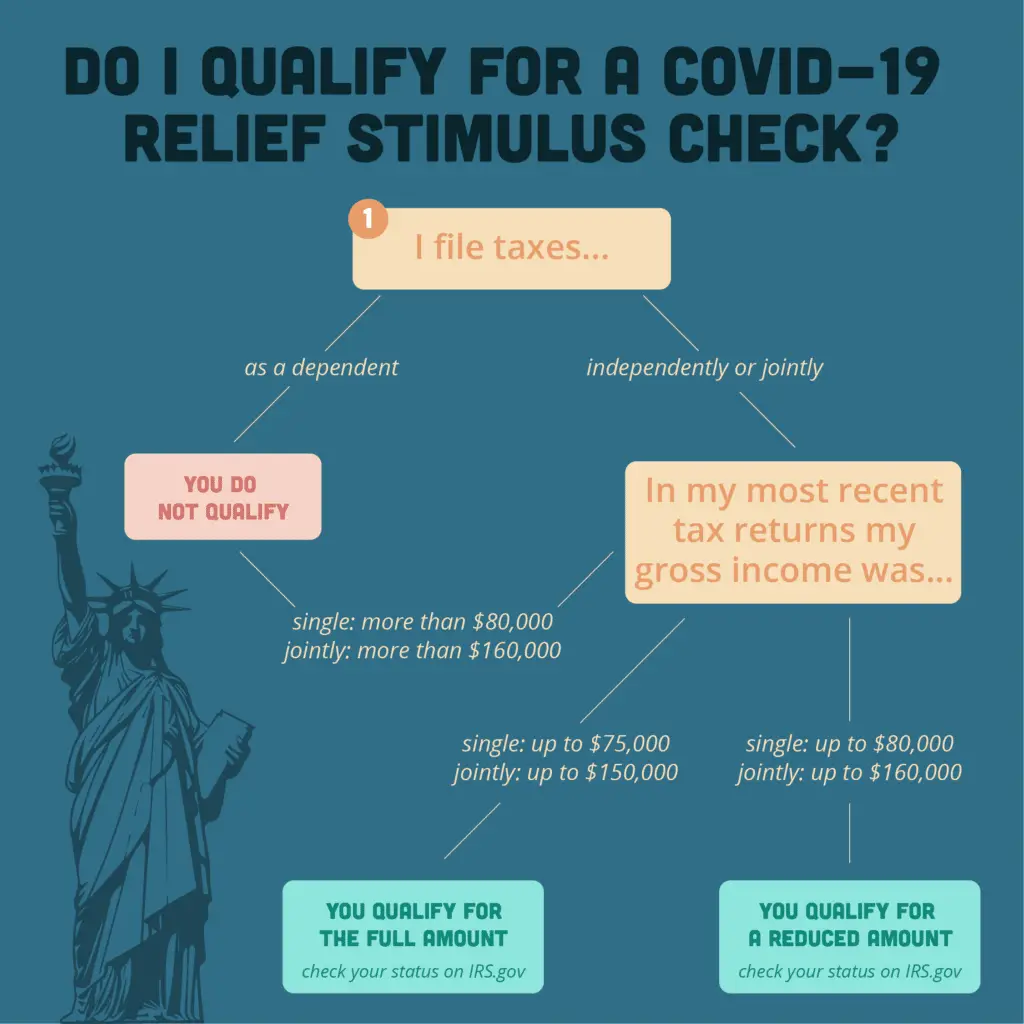

Eligible individuals with adjusted gross income up to $75,000 will automatically receive the full $1,200 payment. Eligible married couples filing a joint return with adjusted gross income up to $150,000 will automatically receive the full $2,400 payment. Parents also get $500 for each eligible child under 17.

Don’t Miss: Car Loan Stimulus Package 2021

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

All The Differences Between The Three Stimulus Checks And How They Affect You

Each round of stimulus payments has varied on the maximum amount per person and how many people qualify to receive the check. The second check was the least generous on both counts, and took 9 months to become law. However, it also made some groups of people eligible who weren’t before, while sticking with the status quo on other provisions that more-progressive lawmakers wanted to revise.

The new check changes the game again, becoming more generous in some spheres, as with dependents and families with mixed-status citizenship, while also finding its way to fewer people than perhaps even the second check — at least based on the new stimulus check formula.

Recommended Reading: Where Is My $600 Dollar Stimulus Check

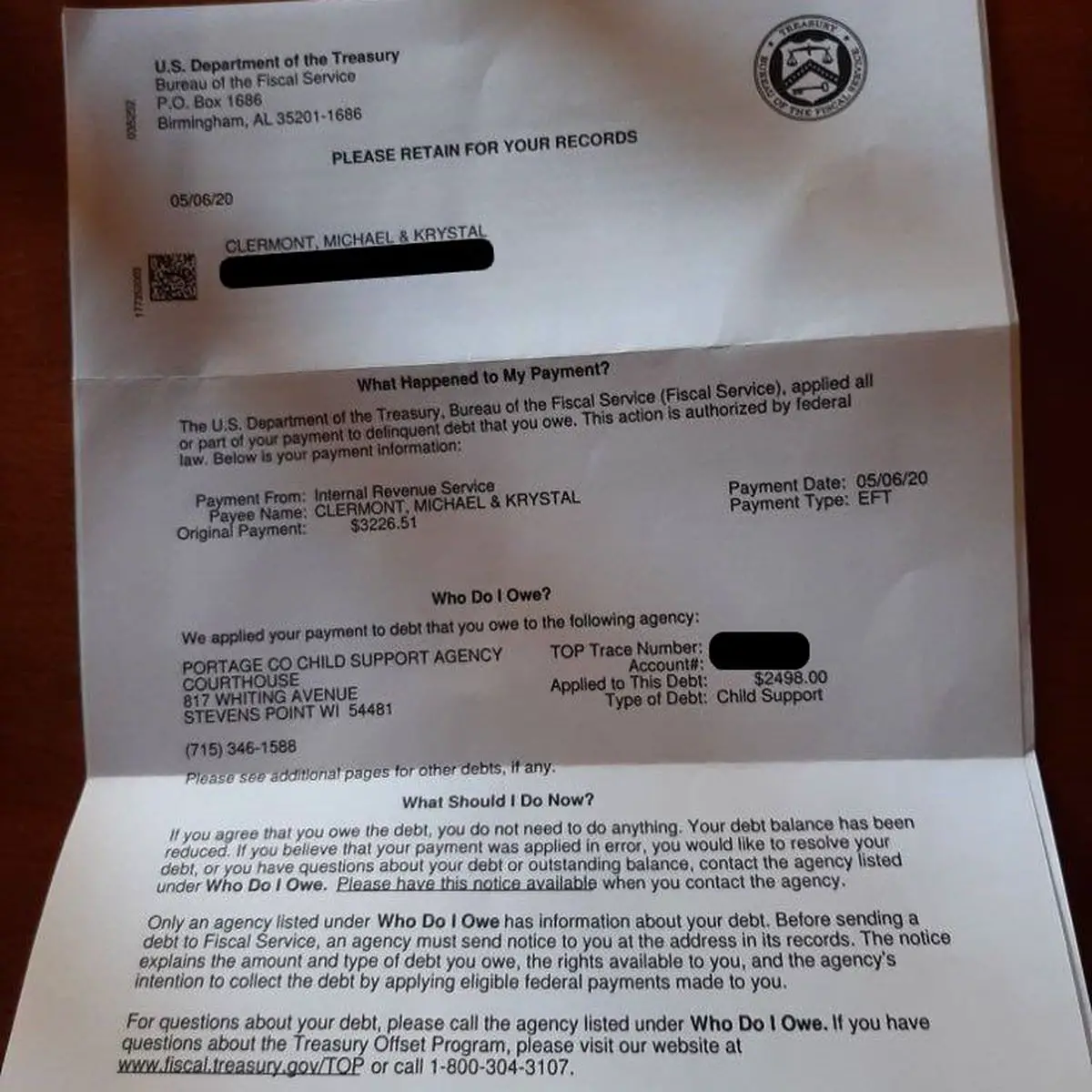

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Will The Irs Tax My Third Stimulus Check

The IRS does not consider stimulus checks to be taxable income. This means that you do not have to report the money on your federal income tax return, or pay income taxes on your stimulus check.

You should also note, that if you owe taxes, you could still qualify to get a stimulus payment because the IRS does not use it to offset federal or state tax debts like it normally does with tax refunds.

For private debts, however, the American Bankers Association has pointed out a loophole in the new stimulus plan where banks and other financial services providers will be legally required to comply with court ordered garnishments. The association says that without legislation to shield your third stimulus payment, creditors or collectors can take it to pay off existing debt.

As a reference, the 2020 COVID-Related Tax Relief Act did shield stimulus payments from private debt collection: The Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

But while your stimulus money could be taken to pay for private debt, the new offsetting rules prevent the IRS from deducting overdue child support from eligible recipients. You should keep in mind, however, that the IRS intercepted or reduced payment from the first round of stimulus checks for past-due child support.

Recommended Reading: Do You Have To Claim Stimulus Check On 2022 Taxes

Will People Receive A Paper Check Or A Debit Card

The IRS encourages people to check Get My Payment for additional information the tool on IRS.gov will be updated on a regular basis starting Monday, March 15. People who don’t receive a direct deposit should watch their mail for either a paper check or a debit card. To speed delivery of the payments to reach as many people as soon as possible, some payments will be sent in the mail as a debit card. The form of payment for the third stimulus payment may differ from the first two.

People should watch their mail carefully. The Economic Impact Payment Card, or EIP Card, will come in a white envelope prominently displaying the U.S. Department of the Treasury seal. It has the Visa name on the front of the Card and the issuing bank, MetaBank®, N.A. on the back of the card. Information included with the card will explain that this is an Economic Impact Payment. More information about these cards is available at EIPcard.com.

Whats The Maximum Amount You Can Receive

Individuals will receive up to $1,400, while married couples who file jointly will get up to $2,800. Additionally, dependents will receive as much as $1,400.

Unlike the first two payments, families will get the stimulus checks for all dependents claimed on their tax returns. That includes adult dependents, such as college students and older relatives. Previously, only children under the age of 17 qualified.

However, if youre in debt, you might not see some or even all of that money. Thats because debt collectors can garnish funds from the stimulus checks, something consumers were previously protected against.

Read Also: When Is The Next Stimulus Check Going Out

Recap Of First And Second Rounds Of Stimulus Payments

Most Americans have received their initial $1,200 stimulus checks, or economic impact payments , as the Internal Revenue Service calls them. The first round of stimulus money, which was approved under the $2.2 trillion CARES Act in March 2020, also included $500 payments for eligible dependent children under age 17. Payments were sent via direct deposit, paper check and prepaid debit card.

Congress included a second round of stimulus checks in a $900 billion coronavirus relief bill in December 2020 that offered most Americans payments of up to $600 for themselves and their dependent children under age 17. It was a way to put more money directly in the pockets of families still struggling to manage the economic fallout of the pandemic. By law the IRS had until January 15, 2021, to issue the bulk of the second-round stimulus checks.

If you didnt get the first two rounds of payments, or thought you didnt get as much as you deserved, you can collect your missing stimulus money by filing a 2020 tax return and claiming the Recovery Rebate Credit.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplinger’s Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. Waggoner’sUSA Todayinvesting column ran in dozens of newspapers for 25 years.

Also of Interest

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

Also Check: Where’s My Stimulus California

What To Do If The Irs Needs More Information

If the Get My Payment tool gave you a payment date but you still havent received your money, the IRS may need more information. Check the Get My Payment tool again and if it reports Need More Information, this could indicate that your check has been returned because the post office was unable to deliver it, an IRS representative told CNET. Here are more details on how the tracker tool works and what the messages mean.

Read Also: How Do I Go About Getting The Stimulus Check

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

You May Like: New Jersey Stimulus Check 2022

What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individuals 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individuals 2021 income tax return.

Read Also: How To Cash My Stimulus Check

‘a Blessing To’ Category

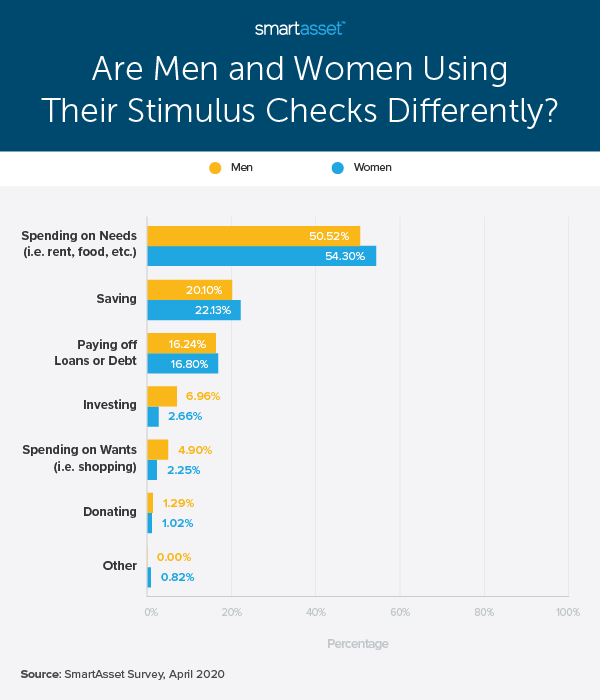

With the past year being a financially tumultuous one for many, families may want to think about designating a portion of their $5,600 stimulus cash to give back.

Consider looking up a local food pantry or community organization near you that you can use your funds to help out. You can also make a charitable gift to a non-profit or private foundation of your family’s choice.

“This will help the family focus on their own blessings, as well as receive the joy that comes from being able to help someone else out,” Wells says.

Also Check: How Much Were The 3 Stimulus Checks

Was There A Stimulus Check In 2021

Stimulus Update | 2021 $1,400 stimulus payment can be claimed for dead people in 2022. BALTIMORE The American Rescue Plan signed into law by President Joe Biden in March of 2021 delivered $1,400 stimulus checks to most Americans. The money was intended to help people get through the COVID-19 pandemic.

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

Read Also: When To Expect Stimulus Checks

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Looking Out For Direct Payments In The Mail

Payment sent through the mail will come in the form of either a paper check or a debit card, the latter of which is intended to speed up the delivery to people. As the IRS noted, the form of payment may differ from the previous two rounds of stimulus checks.

The debit card, known as the Economic Impact Payment Card, will have the Visa name on the front and MetaBank, N.A. on the back. It will come in a white envelope with the U.S. Department of the Treasury seal prominently displayed. More information can be found at EIPcard.com.

You May Like: How To Find Stimulus Check History

Who Gets A Stimulus Check

Stimulus checks are available to eligible U.S. individuals with Social Security numbers. However, eligibility rules vary depending on the checks.

For the first two payments, anyone claimed as a dependent wasn’t eligible for their own check. However, individuals who claimed dependents under 17 could receive a payment for them. The third check still prohibits dependents from claiming their own checks. However, individuals who claim dependents can now receive a payment for adult dependents as well as for dependent children over age 17.

There are also income limits. Each of the three checks is available in full to single tax filers with an income under $75,00. Heads of house with an income under $112,500 are also eligible, as are married joint filers with an income under $150,000. However, phase-out rules — the level at which high earners lose eligibility for checks — differ for each payment, as we’ll discuss in more detail below.

The IRS utilized tax return information from 2018 or 2019 to determine income and eligibility for the first two checks. It will use tax return information from 2019 or 2020 to determine income and eligibility for the third payment. The agency also obtained information from the Social Security Administration and VA to send payments to benefits recipients who don’t file tax returns. And it established an online form for non-filers to claim their payments.

Who Will Actually Get A Recovery Rebate Credit

Most Americans already received the full amount of the 2021 recovery rebate credit as a third stimulus check payment. For those people, subtracting the stimulus money they previously received will reduce their recovery rebate credit to zero. So, if you received a full third stimulus check, there’s no need to complete the worksheet to calculate the credit.

However, certain groups of people could very well end up with a positive credit amount, which will result in a lower 2021 tax bill or larger tax refund. For example, assuming you’re eligible, you may be able to claim a recovery rebate credit if:

- Your AGI was above the applicable phase-out threshold on your 2019 or 2020 tax return , but it’s lower on your 2021 tax return

- You added a dependent in 2021

- You share custody of your child, your ex-spouse claimed the child as a dependent for the 2020 tax year, and you claim the child as a dependent for 2021

- You got married in 2021

- You could be claimed as a dependent on someone’s 2019 or 2020 tax return , but not on anyone’s 2021 return

- You receive Social Security or veterans benefits, didn’t file a 2019 or 2020 tax return, and care for a dependent child, but the IRS didn’t get information about the child from the SSA or VA

- You didn’t have a SSN in 2021 but are issued one by the due date of your 2021 tax return

- The IRS sent you a third stimulus check that was less than what you were entitled to receive or

- The IRS didn’t send you a third-round stimulus check at all.

Recommended Reading: Va Stimulus Checks Deposit Date 2021

Third Stimulus Check: There’s Still Time To Claim Payment Worth Up To $1400 Per Person

As part of the relief package, all Californians with a registered vehicle would receive $400 tax rebates on a debit card, but when can taxpayers expect to see that money if the plan gets approved?

There’s still time to claim a third stimulus payment worth up to $1,400 per person.

Eligible taxpayers who didn’t receive the payment or may be due more money than they initially received are allowed to claim a tax credit on their 2021 federal tax return by the April 18 deadline.

The vast majority of the third stimulus payments were automatically delivered to taxpayers’ bank accounts or via a check in the mail last spring. The payments were authorized by the American Rescue Plan in March 2021 and were meant to help people struggling financially because of the Covid-19 pandemic.

But the payments were calculated last year based on the most recent federal tax return on file at the time. If a taxpayer’s income or family size changed in 2021, the individual may be eligible for more money.

Other people may have missed out on the stimulus payment altogether. Those with incomes so low they don’t have to file taxes may have never received their payment because the Internal Revenue Service did not have their information.