How To Know If You Qualify

Those who are eligible will automatically receive a stimulus payment from the IRS:

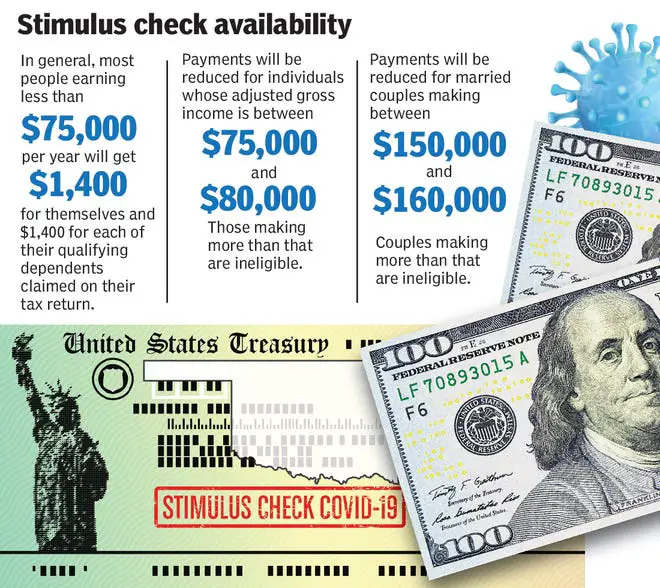

- Tax filers with adjusted gross income up to $75,000 for individuals and up to $60,000 for married couples filing joint returns will receive the full payment.

- If youre single, you could receive up to $1400.

- Single filers with income exceeding $80,000 will likely not receive a check.

- You could see your payment in a matter of days.

If you need more information , please visit the IRS website.

What About Partial Payments

In this round of stimulus payments, partial payments will be available for those just slightly above the limits. Brummond says, Taxpayers above these thresholds may receive a partial payment if they have an AGI of less than $80,000 for a single filer, less than $160,000 for married filing jointly, or less than $120,000 for head-of-households.

Find out about stimulus checks/payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

What To Know If You’re A Nonfiler And Don’t File Your Taxes

If you’re a nonfiler and typically aren’t required to file income taxes, you’re eligible to receive the third stimulus check. However, if you’re missing money from a previous check you may need to take an extra step to get your money by filing your taxes this year. If there’s an issue receiving some or all of a third check, it’s likely you would need to file a claim during next year’s tax season.

Also Check: When We Getting Stimulus Checks

Your Stimulus Check Eligibility Could Depend On Your Taxes

If youre right on the cusp of the income limits described below, when you file your taxes could make the difference between qualifying for a partial check or not. Thats because a third stimulus check is now arriving during tax season.

The language in the stimulus bill makes it clear that the IRS will base your next stimulus check on your 2019 or 2020 taxes, whichever is on file when it processes your payment. However, the IRS is reportedly delayed in processing new tax returns. If you made more in 2020 than in 2019, time is on your side. The new tax deadline is May 17. If you need more time, you might want to request a tax extension.

At this point of the stimulus check delivery cycle, filing taxes sooner may not be to your advantage. The IRS is prioritizing stimulus check distribution over tax returns, and when the processing happens is outside your control.

If you did already receive your third stimulus check and it was based on your 2019 taxes but you qualified for more with your 2020 return, the IRS will be sending plus-up payments to correct the amount between now and Dec. 31, 2021. If you dont receive your catch-up payment by then, youll need to claim it on your taxes next spring.

Contribute To A Traditional Ira

If your AGI is a bit too high, contributing to a traditional individual retirement account might be the key to getting a third stimulus checkâif you donât have a retirement plan like a 401 through your job.

You can contribute up to $6,000, or $7,000 if youâre 50 or older, to a traditional IRA before April 15, 2020. If you donât have a retirement plan through work, you can deduct the full amount of your contributions from your taxable income.

If youâre single and took home $81,000 in gross income in 2020, contributing $6,000 to a traditional IRA would lower your AGI to $75,000 and earn you a full stimulus check.

As an added bonus, if your spouse didnât earn income in 2020, they can still contribute to a spousal IRA, which could allow you to deduct up to another $6,000 , depending on your income level.

⢠Potential Income Reduction Amount: $6,000 to $14,000, depending on marital status, age, income level and access to workplace retirement plan.

⢠If youâre self-employed, check out a notes Julie Welch, managing partner and director of taxation at Meara Welch Browne, P.C. This could let you deduct up to $57,000 of your income in 2020 and allows you to contribute up until April 15, 2021, as well.

Also Check: What Was The Amount Of The Third Stimulus Check

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Also Check: Is There Any Stimulus Coming

How Much Are The Payments Worth

The third round of stimulus payments is worth up to $1,400 per person. A married couple with two children, for example, can receive a maximum of $5,600.

Families are allowed to receive up to $1,400 for each dependent of any age. Earlier rounds limited the payments to dependents under the age of 17.

Generally, low- and middle-income US citizens and US resident aliens are eligible for either a full or partial third-round stimulus payment.

Individuals earning less than $75,000 of adjusted gross income, heads of households earning less than $112,500 and married couples earning less than $150,000 are eligible to receive the full amount of $1,400 per person.

But the payments gradually phase out as household income increases. Individuals who earn at least $80,000 a year of adjusted gross income, heads of households who earn at least $120,000 and married couples who earn at least $160,000 are not eligible for any money regardless of how many dependents they have.

Undocumented immigrants who dont have Social Security numbers are not eligible for the payments. But their spouses and children are eligible as long as they have Social Security numbers.

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

Recommended Reading: Any More Stimulus Money Coming

You May Like: When Was The 4th Stimulus Check Sent Out

I Didn’t File A 2019 Or 2020 Tax Return And Didn’t Register With The Irsgov Non

Yes, if you meet the eligibility requirements. While you won’t receive an automatic payment now, you can still get all three payments. File a 2020 return and claim the Recovery Rebate Credit.

The IRS urges people who don’t normally file a tax return and haven’t received any stimulus payments to look into their filing options. The IRS will continue reaching out to non-filers so that as many eligible people as possible receive the stimulus payments they’re entitled to.

The IRS encourages people to file electronically, and the tax software will help figure the correct stimulus amount, which is called the Recovery Rebate Credit on 2020 tax forms. Visit IRS.gov/filing for details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in the community or finding a trusted tax professional.

Do I Need A Social Security Number

- As with past stimulus payments, those without a valid Social Security number do not qualify. However, eligibility for mixed-status families has been changed. Now, dependents of any age can qualify if they have a valid SSN even if their parents do not. For example, in a household where both parents have ITINs and their children have SSNs, the children may qualify for the third stimulus check, even though the parents dont.

Dont Miss: What To Do If I Never Got My Stimulus Check

Read Also: When Will The Stimulus Checks Be Sent Out

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

How Soon Will The Checks Arrive

Hard to say. The Treasury Department hasnt indicated when it will start distributing the money.

Garrett said the timeline will probably be similar to the second round of payments approved in December. Americans who got their checks via direct deposit started to receive the payments about two weeks after the legislation was signed into law. Those who got a paper check had to wait longer.

Biden said last week that many Americans should receive their payments before the end of the month.

The IRS said in mid-February it had distributed all checks to everyone who was eligible in the first two rounds.

More than 160 million payments totaling $270 billion were distributed during the first round last spring, the agency said. More than 147 million payments totaling more than $142 billion were delivered during the second round late last year.

Michael Collins covers the White House. Follow him on Twitter @mcollinsNEWS.

Also Check: Irs.gov Stimulus Check Deceased Person

You May Like: Ssdi Payment Schedule 2022 Stimulus

Returning An Economic Impact Payment

COVID Tax Tip 2020-73, June 18, 2020

Millions of eligible individuals have already received their Economic Impact Payment. Some people, including those who received a payment for a deceased individual, may be unsure whether they should return a payment.

Here is additional information about returning an Economic Impact Payment.

Donât Miss: I Havent Received My Stimulus Check

Looking For More Stimulus Information

Find out about stimulus checks/payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

You May Like: What Was The 2021 Stimulus Check

Read Also: Change Address For Stimulus Check

How To Track Your Stimulus Payment

If youre wondering where your plus-up payment or stimulus payment are, you have the ability to track the status to determine whether the IRS believes you are eligible and if the IRS has sent it out yet. As with the stimulus payments, you will use the IRSs Get My Payment tool to see the status of your plus-up payment. If you are eligible, the tool will tell you how and when the money will be sent to you.

You can also use the USPS Informed Delivery system to keep an eye on your mailbox if youre expecting to see a paper check arrive in the mail.

Rd Round Of Stimulus Checks

What is a stimulus check? What should veterans, people in uniform, and their families know about economic stimulus packages and how they are paid? There have been two stimulus checks mailed to American citizens related to COVID-19 economic relief and at least one more on the way in 2021.

Most recently more than 320,000 payments, with a total value of $450 million, went to Veterans Affairs beneficiaries who receive Compensation and Pension benefit payments but who dont normally file a tax return and didnt use the Non-Filers tool last year.

You May Like: 3rd Stimulus Check 2021 Amount

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

Whats The Difference Between A Stimulus Payment And A Recovery Rebate

The stimulus payment was an amount of up to $1,400 that was paid directly to the account of qualified individuals. However, the rebate works slightly differently, in that it wont get paid to your account. Instead, it will be removed from the amount of taxes you owe or increase the tax refund amount that you receive after you put in your tax return.

Although this may not seem quite as attractive as a one-off payment to your bank account, it still equates to money in your pocket, as its removed for the total amount that you owe back to the IRS at the end of the fiscal year.

Recommended Reading: I Never Got My California Stimulus Check

Wheres My Third Stimulus Check

OVERVIEW

The American Rescue Plan, a new COVID relief bill, includes a third round of stimulus payments for millions of Americans. Get updated on the latest information as it evolves.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

A third round of stimulus checks is on the way for millions.

The American Rescue Plan, a new COVID relief bill, was signed into law on March 11, 2021. The bill includes a third round of stimulus payments for millions of Americans. We know these funds are important to you, and we are here to help.

If you are eligible, you could get up to $1,400 in stimulus checks for each taxpayer in your family plus an additional $1,400 per dependent. This means a family with two children could receive $5,600.

The IRS began issuing the first batch of stimulus payments, and they could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks. If youre eligible, check the status of your stimulus payment and the way itll be sent to you by going to the IRS Get My Payment Tool, which will be live on March 15th.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.