Fourth Stimulus Check Possible Timeline

Right now, there is no fourth stimulus check timeline or fourth stimulus check release date. Until legislation is in motion, we cant say how soon more relief money might arrive. We cant say whether more relief money is coming, at all.

That said, the third stimulus check timeline happened rather quickly following Bidens inauguration Jan. 20. It only took a few weeks for Congress to debate his American Rescue Plan. Once the president signed the bill on March 11, $1,400 checks were put in motion.

The IRS can begin sending out possible fourth stimulus checks in the same manner it sent the previous stimulus payments. Since the framework is already in place, Americans could begin receiving the fourth stimulus checks about two weeks after a relief bill allowing another round of direct payments is approved.

How Do I Get An Update On My Child Tax Credit Check Status

Your recurring monthly payments shouldve hit your bank account on the 15th of each month through December. According to the IRS, you can use the Child Tax Credit Update Portal to see your processed monthly payment history. Itll be a good way to watch for pending payments that havent gone through your bank account yet.

If you still havent received the money youre owed, see if the Processed Payments section of the update portal has any information. If the payment was delivered, make sure your address and banking information are correct especially if youve moved or changed banks.

To check on your payments online, youll need to register with your IRS username and ID.me account information. First-time users will need to have a photo ID .

If youre checking your bank account, look for the deposit labeled CHILDCTC. If your bank has not received the deposit from the IRS, it wont have any processing information for you if youre trying to locate your check. If you think theres an error, start by using the update portal to double-check the bank details the IRS has on file, including your account information and routing numbers.

Where Can I Find My Routing Number And Account Number For Direct Deposit

The routing number for Lake Trust Credit Union is 272078268. You can find your account number several ways:

- Find it on your monthly statement.

- Log into Online Banking or Mobile Banking, click on the account you want the deposit to go into, then click on Account Details or Details to show your account number.

- If you have printed checks, you can find your checking account number at the bottom of the check immediately after the routing number.

You May Like: When Do The Stimulus Checks Go Out

Stimulus Check Irs Phone Number: How To Call About Your Payment

You can call the IRS about your stimulus checks. Here’s how.

Looking for the stimulus check IRS phone number? Yes, you can call the IRS for help with your third stimulus check payment. A representative might be able to questions that can’t be answered through its website.

The IRS’s dedicated stimulus check website is a good resource if you’re wondering where your stimulus check is, if you’re eligible or how much you should get. But if your question is more specific, or you have trouble navigating the available online tools, there’s a phone number you can call for help.

- Stimulus check notifications let you know when your payment arrives

- Use this third stimulus check calculator to find out how much you’ll get

The IRS hotline isn’t equipped to handle an exorbitant amount of inquires. Rather, people are encouraged to seek answers using the economic impact payment Information Center .

The IRS has an app for tracking the status of your stimulus check called Get My Payment. When you enter a bit of personal information, you can find out whether the government has sent your check. If it has, consider using the USPS Informed Delivery tool to receive notifications about where your payment is in transit.

For other logistical questions, the IRS’s hotline is at your disposal. Keep in mind that an automated recording will attempt to help you before you’re connected with an actual representative, so have your questions and basic personal information ready.

How Can You Request An Irs Trace For Missing Stimulus Money

To request a payment trace, call the IRS at 800-919-9835 or mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund . Note: If you call the number, you’ll have to listen through the recorded content before you can connect with an agent.

To complete Form 3911 for your third stimulus check, the IRS provides the following instructions:

1. Write “EIP3” on the top of the form

2. Complete the form answering all refund questions as they relate to your payment.

3. When completing item 7 under Section 1:

- Check the box for “Individual” as the Type ofreturn.

- Enter “2021” as the TaxPeriod.

- Do not write anything for the DateFiled.

- Sign the form. If you’re married and filing together, both spouses must sign the form.

You should not mail Form 3911 if you’ve already requested a trace by phone. And the IRS said you should not request a payment trace to determine if you were eligible to get a check or confirm the amount you should have received.

You May Like: Amount Of All Stimulus Checks

Here Are Some Key Things To Know About This Tool And Who Can Use It

- Before using the tool, people must verify their identity by answering security questions.

- If the answers do not match IRS records after multiple attempts, the user will be locked out of the tool for 24 hours. This is for security reasons. Those who cant verify their identity wont be able to use Get My Payment. If this happens, people should not contact the IRS.

- If the tool returns a message of payment status not available, this may mean the IRS cant determine the persons eligibility for a payment right now. There are several reasons this could happen. Two common reasons are:

- A 2018 or 2019 tax return is not on file and the agency needs more information or,

- The individual could be claimed as a dependent on someone elses tax return.

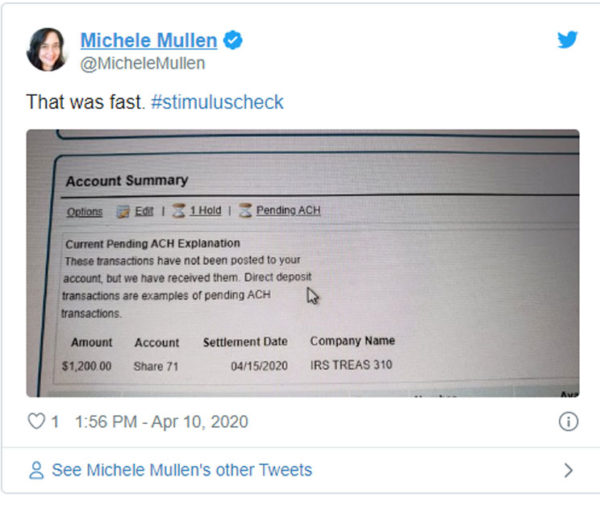

How Do You Get Your Stimulus Payment

The IRS is responsible for issuing payments.

- If you got a refund via direct deposit, the IRS should issue your refund to the same bank account.

- If you paid your taxes using bank payment on the IRS website, the IRS should issue your refund to the same bank account.

- If you paid by check, debit card, credit card, or some other third-party service, the IRS should issue a check to the address on your tax return.

- Most other payments will go by check. Some payments have gone out on a prepaid debit card instead.

- If you closed your bank account, there is no way to update your bank account information. The IRS should mail you a check after your payment gets returned for your bank account being closed.

- If you moved, the IRS will continue to use the address on your last tax return unless you filed an IRS change of address Form 8822.

Recommended Reading: 2021 Homeowner Relief Stimulus Program

Prepare For Your Appointment

- Schedule your appointment ahead of time.

- Bring the following items with you:

- A current government-issued photo ID.

- A taxpayer identification number, such as a Social Security number.

- Any other documentation you need for your appointment.

Get My Payment Says Payment Issued But I Haven’t Received It

The IRS says that it may take three to four weeks to receive a check after it’s mailed. If it has been weeks since the Get My Payment tool says the payment was mailed, and you haven’t received it, you can request a payment trace. The IRS will research what happened to your check if the check wasn’t cashed, you will need to claim the “Recovery Rebate Credit” on your next tax return. If the IRS finds that the check was cashed, you’ll receive a claim package from the Treasury Department with a copy of the cashed check and instructions on filing a claim.

Similarly, if the Get My Payment tool says your payment was direct-deposited, but the money doesn’t show in your bank account after five days, first check with your bank. If the bank says it hasn’t received a payment, you can request a payment trace.

To request a payment trace, call 800-919-9835 or fill out IRS Form 3911, Taxpayer Statement Regarding Refund.

You May Like: What Stimulus Was Given In 2021

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

What Do I Do With Letter 6475

Hold onto it until you or your tax preparer are ready to file your 2021 federal return, then use the amount shown on your Recovery Rebate Worksheet to determine if any credit applies.

Having the wrong amount on your return could trigger a manual review,according to the H& R Block website, which could delay a refund for weeks.

Also Check: Will My Third Stimulus Check Be Garnished For Child Support

Don’t Miss: Apply For Stimulus Check Online

Why Did We Get Only Half The Amount

Many couples are finding that they are getting direct deposits for only a portion of what they think their stimulus payment should be. Some have gotten half of their payment deposited one week and half the next, and other couples are finding that their dependents’ share of the stimulus money is split between the two parents.

The IRS has explained that the first payment made might be based on a taxpayer’s 2019 tax return, and the second payment is a “plus-up” payment that is based on the taxpayer’s 2020 tax return.

The IRS has also said that part of the problem may be with “injured spouse” claims on a tax return. of only one spouse, the “injured” spouse can request a refund.) The IRS says that these couples will get their payments as two separate payments.

If you haven’t received the full amount, wait until you get your Notice 1444, Your Economic Impact Payment, from the IRS. That letter should have the correct amount of your stimulus payment. If you don’t receive deposits or checks in that amount, you may have to file a Recovery Rebate Credit . You can also read the IRS’s press release from April 1, which contains a lot of helpful details.

Who Qualifies For The Middle Class Tax Refund

You must have lived in California for at least half of the 2020 tax year and filed your state tax return by Oct. 15, 2021, to qualify.

California taxpayers who filed individually and made $250,000 or less are eligible for the Middle Class Tax refund, as are couples who filed jointly and made $500,000 or less. According to the Franchise Tax Board, an estimated 25 million Californians qualify for a refund. Individuals who earned over $250,000 in 2020 — and couples who made more than $500,000 combined — are not eligible for the refund, nor is anyone who was claimed as a dependent in the 2020 tax year.

In addition, you must have lived in the state of California for at least half of the 2020 tax year, have filed your state tax return by Oct. 15, 2021, and still be a California resident on the date your payment is issued.

Read Also: Is There Anymore Stimulus Checks Coming

My Third Stimulus Payment Was Too Low

Many individuals and families will find that their third stimulus checks are lower than they thought. That could be because people who make over a certain amount have part of the $1,400 payment taken away. For example, single people who make over $75,000 in adjusted gross income will have their second stimulus checks reduced by 28% of the income over $75,000. Married people filing jointly and heads of household will have their payments reduced by a similar amount.

The third stimulus payment is technically based on your 2021 income, but the IRS is using your 2020 tax return to estimate it. If your income goes down in 2021, making you eligible for a payment, or a higher payment, you’ll be able to file a tax return for your 2021 taxes and you’ll receive the stimulus money you didn’t getâit’s called a recovery rebate credit.

Reach The Irs By Mail

While the IRS itself discourages doing so, its still possible to send in your tax forms by mail, including tax payments. This is usually the slowest method of interacting with the IRS by a long shot. Minimum wait times for a reply by mail from the IRS is around 30 days, and youll often have to wait considerably longer than that. As of publishing time, the IRS even warns of additional delays due to staffing shortages.

We wont provide the address here because the IRS could change them at any time, and they vary from state to state and whether youre including a payment or not. To find the right mailing address for your correspondence, visit this resource from the IRS.

Also Check: If I Owe Taxes Will I Get A Stimulus Check

Also Check: When Did The Stimulus Checks Go Out In 2021

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money.

What Else Can I Do

If the IRS Economic Payment line doesnt work for you, then you can also try to contact the IRS through the IRS Customer Service hotline at 1-800-829-1040. Similarly, you can contact the IRS to inquire about income taxes at 1-800-829-1954. However, both these numbers have automated messagesbut they dont provide information about stimulus checks. There are two other approaches you can take:

Within 15 days of after the payment of your stimulus check is made, the IRS should send you a letter with details about your stimulus check, including the amount and how you were paid. The letter also includes the same phone number for the IRS Economic Impact Payment line800-919-9835to contact the IRS with any questions regarding your stimulus check.

Don’t Miss: How Much Should I Have Received In Stimulus Checks

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.