What If I Still Haven’t Received The First And/or Second Payment

The IRS has sent all of the first and second stimulus payments to qualifying Americans that the agency has taxpayer information for. If you believe you are eligible and didn’t receive one, or received less than you qualify for, then you will claim a Recovery Rebate Credit on your 2020 tax return. This is line 30 of your 2020 Form 1040 or 1040-SR.

On this line, you will list the difference between what you are owed and what you received . People who don’t earn enough money to file taxes will also need to file a return to get any missing payments.

How Will I Get My Third Stimulus Check

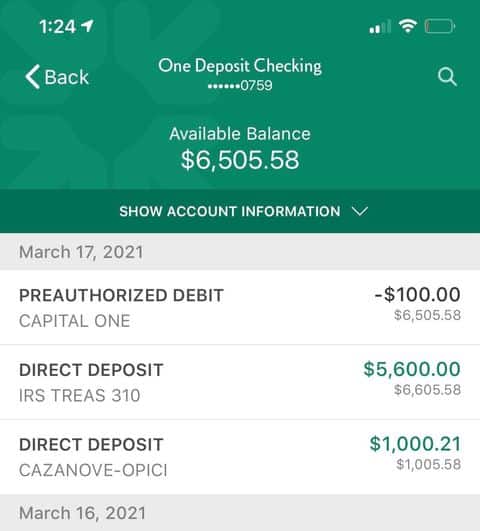

You dont need to do anything to get your stimulus check. The IRS will determine eligibility based on the last tax return that you filed, either 2019 or 2020, and will likely send your payment to the bank account where your tax refund was deposited.

As part of the income tax filing, the IRS receives accurate banking information for all TurboTax filers who received a tax refund, which the IRS is able to use to quickly and effectively deposit stimulus payments.

How Your 2021 Adjusted Gross Income Could Lead To A Bigger Stimulus Check Next Year

Since the third stimulus checks are a 2021 Recovery Rebate Credit, if your income is lower in 2021 than in 2020 or 2019 making you eligible for a stimulus payment or a bigger stimulus payment you can claim the correct payment when you file your 2021 taxes next year. This also applies for other changes in circumstances, like if you had a child. Its unclear exactly when or how people would receive these payments. The IRS hasnt responded to Moneys request for comment on how the agency will handle these additional payments, or if the agency will look at amended 2020 returns at the additional payment determination date.

Even if you cant lower your way to a third stimulus check, reducing your AGI still generally results in a smaller tax bill. And youve set away funds for the future. Unless the tax deadline gets pushed back, you have until April 15.

Also Check: What’s The Update On The 4th Stimulus Checks

When Will The Third Stimulus Checks Arrive

The IRS will issue the stimulus payments through direct deposits and mailed checks. You can check the status of your payment with the IRS Get My Payment tool. It will show you both how and when you will receive your stimulus payment. The tool does not allow taxpayers to update their direct deposit info, its only purpose is to show the status of stimulus payments.

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually will receive a rebate of $250 . The rebate will be issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate will be issued to all taxpayers. Single filers will receive $500, and joint filers will receive $1,000. This rebate will be split into two equal payments, delivered in June and August 2022. The funds will be sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns will also receive a rebate in July. Single individuals without dependents will receive $500 households with married couples or single adults with dependents will get $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Dont Miss: Do I Have To Claim Stimulus Check On 2021 Taxes

You May Like: Is Economic Impact Payment Same As Stimulus

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

You May Like: Where Is My Stimulus Refund

How Does The Third Stimulus Plan Impact Me If I Have Not Already Filed My Taxes

The IRS will use your most recent tax return to determine if you are eligible for the third stimulus payment and how much.

If you saw a significant drop in income from your last tax return, filing your taxes quickly could be important as you could be missing out on the stimulus payment you are entitled to.

For example, say you reported an AGI of $95,000 in 2019, but your AGI dropped to $50,000 in 2020. If you have not yet filed your 2020 tax return, the IRS will look at your 2019 return and not issue the third stimulus payment, as your 2019 income was over the qualifying threshold.

If you plan to claim unemployment income and earned less than $150,000, you should wait to file your taxes in order to take advantage of the tax exclusion. This will help reduce your AGI and may help you qualify for a larger stimulus payment.

Don’t Miss: How To Claim Missing Stimulus Checks

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

California: Up To $1050 Rebate

Californias new budget includes payments of $350 for individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Californians can expect to receive payments between October 2022 and January 2023 via direct deposit and debit cards.

Read more: California Families To Receive Stimulus Checks Up To $1,050

Read Also: Is There Another Stimulus Check On Its Way

What Is The Stimulus Check

As part of several different COVID-19 relief packages, the federal government issued three payments by check or direct deposit to millions of income-qualified Americans. This is what we mean by stimulus check or stimulus payment. The purpose of the payments was to help people cover basic needs when many people were told to stay home and lost income because of the pandemic.

Claiming Your Stimulus Check In Your 2020 Tax Return

Eligible individuals who did not receive an Economic Impact Payment this yeareither the first or the second payment due to a myriad of possible reasons will be able to claim it when they file their 2020 taxes in 2021. People will see the Economic Impact Payments referred to as the Recovery Rebate Credit on Form 1040 or Form 1040-SR since the EIPs are an advance payment of the RRC.

If you did not give the IRS your direct deposit account information through your federal tax return in the last two years, and have not provided the IRS with your information as a non-filer, you will likely receive a US Treasury check or debit card in some circumstances. The check will be mailed to the address on file at the IRS from the prior year tax return. It could take 5 to 6 weeks to get the check via mail.

Get the latest money, tax and stimulus news directly in your inbox

Recommended Reading: Where Is My First And Second Stimulus Check

Can I Still Get A Stimulus Check

If you think youre eligible for a COVID stimulus payment or the 2021 child tax credit, and didnt already receive those funds, you can file a simple tax return by visiting ChildTaxCredit.gov.

But youll need to move quickly. Thats because if youre not required to file a tax return, this year’s deadline to file a simplified return is November 15. If you are required to file, but missed the April 18 filing deadline, you have until on ChildTaxCredit.gov and see if youre eligible to receive a stimulus payment or child tax credit.

However, if you don’t owe taxes to the IRS, the IRS has said that you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. But because that can get confusing, it’s probably best to file for the 2021 tax year as soon as you can.

According to the Government Accountability Office, groups that were most likely to have missed out on pandemic relief stimulus payments or the child tax credit , were people who never filed a tax return or who filed for the first time during the pandemic. The federal government also had difficulty getting stimulus checks and child tax credits to people without bank accounts or reliable internet access, and people who were experiencing homelessness in 2020 and 2021.

State And Local Aid $745 Billion

Non-public

$0.4 bil.

At the outset of the pandemic, governments used the funds largely to cover virus-related costs.

As the months dragged on, they found themselves covering unexpected shortfalls created by the pandemic, including lost revenue from parking garages and museums where attendance dropped off. They also funded longstanding priorities like upgrading sewer systems and other infrastructure projects.

K-12 schools used early funds to transition to remote learning, and they received $122 billion from the American Rescue Plan that was intended to help them pay salaries, facilitate vaccinations and upgrade buildings and ventilation systems to reduce the viruss spread. At least 20 percent must be spent on helping students recover academically from the pandemic.

While not all of the state and local aid has been spent, the scope of the funding has been expansive:

Utah set aside $100 million for water conservation as it faces historic drought conditions.

Texas has designated $100 million to maintain the Bob Bullock Texas State History Museum in Austin.

The San Antonio Independent School District in Texas plans to spend $9.4 million on increasing staff compensation, giving all permanent full-time employees a 2 percent pay raise and lifting minimum wages to $16 an hour, from $15.

Alabama approved $400 million to help fund 4,000-bed prisons.

Summerville, S.C., allocated more than $1.3 million for premium pay for essential workers.

What was the impact?

Read Also: How Many Stimulus Checks In 2020

First Round Of Economic Stimulus Checks: April 2020

The CAREs Act included a provision for a round of stimulus payments eligible tax-paying adults received a check of up to $1,200 while eligible dependents under 16 years of age received $500 each .

The payments were made to everyone earning under the income limits, which were set at Adjusted Gross Income of $75,000 with the stimulus check value reducing in a tapered fashion up to a maximum of $99,000 . The very first stimulus checks were paid into people’s bank accounts over the weekend of the 11 and 12 of April, either via direct deposit into individuals bank accounts, paper checks sent through the post or in some cases, through a prepaid debit card, the Economic Impact Payment Card which were sent out in late May/early June last year.

Do I Need To Claim My Stimulus Check On My 2021 Taxes

Stimulus checks are not taxable, but they still need to be reported on 2021 tax returns, which need to be filed this spring. The 2021 stimulus checks were disbursed to eligible recipients starting in March of last year. They are worth up to $1,400 per qualifying taxpayer and each of their dependents.

You May Like: When Are We Receiving Stimulus Checks

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Who Qualifies For A Payment

Taxpayers must have a Social Security number to be eligible for a payment and meet the income requirements detailed above.

While the steeper income phase out reduces the number of taxpayers qualifying for this stimulus payment, all dependents of eligible taxpayers will also receive a payment for the first time. That includes millions of college students, disabled adults and elderly Americans. Mixed-status families in which some members have Social Security numbers and some do not are also eligible, as they were for the second payment.

Like the second stimulus payment, those who owe child support should not have any of their stimulus money withheld.

Don’t Miss: Is The $1 200 Stimulus Check Taxable

You May Not Receive A Check This Round Even If You Got One Before

The income limits for this new round of stimulus checks have changed. So even if you previously received a stimulus check, you may not qualify for this one.

The adjusted gross income maximum income for the American Rescue Plan Act are:

- Individuals earning $80,000

- Head of households earning $120,000

If your AGI exceeds these amounts, your household will not qualify for the stimulus payment.

Additionally, the phase-out for stimulus reductions is more complicated to calculate this time around. Since the maximum income threshold is fixed, your total stimulus check will be reduced proportionately by the amount earned over $75,000 for individuals, $112,500 for heads of households, or $150,000 for joint filers until it hits the phase-out limits above.

Who Was Eligible To Receive A Stimulus Payment

Generally, U.S. citizens and green card holders were eligible for the stimulus payments. Also, a 2021 law expanded who was eligible for a stimulus payment.

In the first round of payments, joint returns of couples where only 1 member of the couple had a Social Security number were not eligible for a payment unless they were a member of the military. Under a 2021 law, these families became eligible to receive a stimulus payment, including the additional payment for their dependent children.

The 2021 law also made this expansion retroactive to the first round of stimulus payments. If your family did not receive the first stimulus payment because only 1 spouse had an SSN, you could claim the Recovery Rebate Credit when you filed your 2020 federal income tax return.

Read Also: Track My Second Stimulus Check

Who Is Getting The 1400 Stimulus Checks

The $1,400 stimulus payments are a part of March’s $1.9 trillion package. Single filers earning up to $75,000 are eligible for $1,400, while couples filing jointly earning up to $150,000 can get $2,800. No payments are being sent to single filers earnings above $80,000, or couples earning jointly above $160,000.

How Much Are The Payments Worth

The third economic impact payment is worth up to $1,400 per individual and dependent.

Single filers earning an adjusted gross income up to $75,000 and heads of household earning up to $112,500 will receive $1,400, and married couples earning up to $150,000 are eligible for $2,800. Those taxpayers will also receive $1,400 for each dependent.

After that, there is a steep income phase out: The payments decrease to zero for single filers at $80,000, for heads of household at $120,000 and for married couples at $160,000 AGI. Taxpayers will receive the same amount for each dependent.

The phase out rate is not uniform for the third round of direct payments, according to the Tax Foundation. It will depend on a taxpayer’s filing status and the number of dependents.

Single filers, for example, will experience a 28% phase out rate, meaning that they will receive $280 less for every $1,000 over $75,000 they earn, says Garrett Watson, a senior policy analyst at the Tax Foundation. An individual with an AGI of $77,000 would receive $840.

At the same time, while a married couple with no dependents would also see a 28% phase out rate, a couple with one dependent would see a 42% phase out rate. A couple with one dependent and an AGI of $155,000 would receive $2,100 total.

To see how much relief you may receive, use this calculator.

Don’t Miss: Apply For Stimulus Check Online

Who Will Not Get 3rd Stimulus Check

U.S Citizen or US resident aliens will not receive the third Economic Impact Payment if their Adjusted Gross Income exceeds:

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household