Where Is Your Payment Being Sent

The IRS will issue a check by mail or direct deposit based on the data the agency already has in its systems. Taxpayers will receive their check through their bank account if their direct deposit information is already on file. Otherwise, the payment will be sent by mail.

If that bank account on file is closed or no longer active, the bank will return the deposit and the individual may be issued a check instead.

Calculating Your Third Stimulus Check Amount

Under the American Rescue Plan, every eligible person will receive a $1,400 third stimulus check “base amount.” For married couples that file a joint tax return, the base amount is $2,800. Then, for each dependent in your family, an additional $1,400 will be tacked on.

But not all people will receive the full amount. As with the first two stimulus payments, third-round stimulus checks will be reduced potentially to zero for people reporting an adjusted gross income above a certain amount on their latest tax return. If you filed your most recent tax return as a single filer, your third stimulus check will be phased-out if your AGI is $75,000 or more. That threshold jumps to $112,500 for head-of-household filers, and to $150,000 for married couples filing a joint return. Third-round stimulus checks will be completely phased out for single filers with an AGI above $80,000, head-of-household filers with an AGI over $120,000, and joint filers with an AGI exceeding $160,000.

You can use our handy Third Stimulus Check Calculator to get a customized estimated payment amount. All you have to do is answer three easy questions.

Amount Of Third Stimulus Checks

Question: How much money will I get?

Answer: Everyone wants to know how much money they will get. You probably heard that your third stimulus check will be for $1,400 but it’s not that simple. That’s just the base amount. Your check could actually be much higher or lower.

To calculate the amount of your check, Uncle Sam will start with that $1,400 figure. If you’re married and file a joint tax return, then both you and your spouse will get $1,400 . If you have dependents, you get an additional $1,400 for of them. So, for example, a married couple with two children can get up to $5,600.

Now the bad news. Stimulus payment amounts will be phased-out for people at certain income levels. Your check will be gradually reduced to zero if you’re single with an adjusted gross income above $75,000. If you’re married and file a joint tax return, the amount of your stimulus check will drop if your AGI exceeds $150,000. If you claim the head-of-household filing status on your tax return, your payment will be reduced if your AGI tops $112,500. You won’t get any payment at all if your AGI is above $80,000 , $120,000 , or $160,000 .

Also note that the IRS, which is issuing the payments, will look at either your 2019 or 2020 tax return for your filing status, AGI, and information about your dependents. Because of this, the amount of your third stimulus check could depending on when you file your 2020 tax return.

Also Check: Fourth Stimulus Check Irs.gov

When Is The Irs Deadline To Send New Stimulus Checks

At this point, the US treasury and the IRS are working fast to send all the stimulus checks as soon as possible. At the same time, they set a deadline for December 31st, 2021 to send out all of the payments.

In a way, this is good news this means they havent set a compressed deadline, meaning that should an issue appear, you have the time to address it. There is also the reassurance that since it wont be a rushed project, theres a lower chance of payments being missed or problematic.

At the same time, this means that numerous people may have to wait for a fair amount of time before they receive their stimulus check. Certain people have priority, but we have still much to learn about the IRS delivery system. In most cases, all we can do is wait as we track the stimulus check online.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Will Washington State Get Another Stimulus Check

Experts Explain Bidens American Jobs Plan

White House National Climate Advisor Gina McCarthy and United States Secretary of Labor Marty Walsh have held a web chat to explain the ins and outs of Joe Bidens American Jobs Plan.

Millions of Americans received unemployment benefits in 2020 and a fair number of them filed a tax return prior to the passing of the American Rescue Plan which provided unexpected tax relief on those benefits.

The American Rescue Plan passed in March had a last-minute addition in some horse trading. Although those still receiving unemployment benefits wouldnt get the extra $400 per week on top of other jobless assistance until September, it was dropped to $300, they got a waiver on up to $10,200 per person claimed while receiving unemployment compensation in 2020.

Also Check: Update On Next Stimulus Check

Will The Federal Government Issue Another Stimulus Package

At this time, most people believe that another large stimulus package from the federal government is a long shot. Nonetheless, some senators continue to advocate for another stimulus package to assist Americans suffering from rebuilding due to COVID-19 and its economic consequences. With the economy and job creation on the rise, the need for a stimulus package is far lower than before the pandemic began. Not to mention, many people have received extra money each month from the Child Tax Credit. When you add it all up, its simple to see why there might not be another stimulus check. But dont worry, well let you know if there is one.

Don’t Miss: How Much Stimulus Money Did I Get In 2021

Heres What Americans Are Spending Their Irs Stimulus Checks On

According to The Wall Street Journal, Federal Reserve researchers estimate that over 95% of working families have enough money to continue their usual expenses for the next six months using savings, the IRS stimulus checks and unemployment benefits. However, the longer the pandemic-related shutdowns last, the more a second round of coronavirus stimulus will be needed.

Citing economists from Northwestern University, Columbia University, the University of Chicago and the University of Southern Denmark, reports that the first round of IRS stimulus checks was mostly spent on basic necessities like rent and mortgage payments and groceries.

The economists said they might have expected spending on large categories like vehicles, electronics, furniture and appliances. However, their study of the spending habits of over 1,600 people who received their check by April 21 indicates that the money went for necessities, as it was aimed to do.

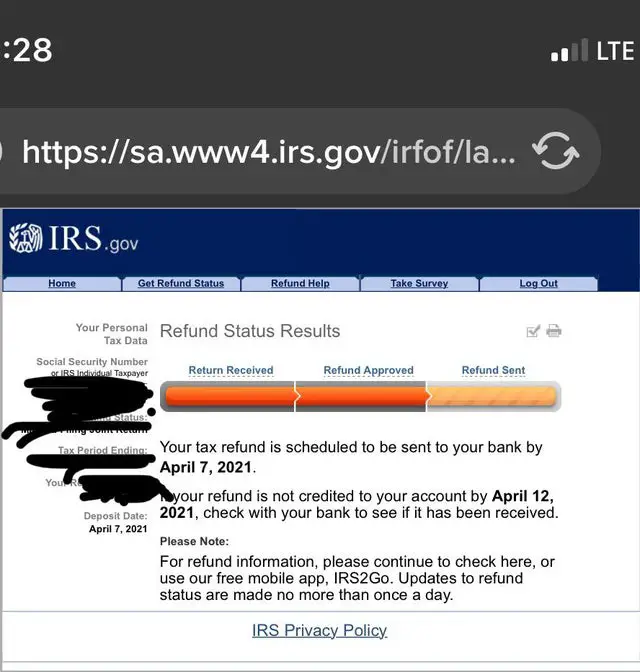

Can You Track Your Stimulus Online

Considering that not everyone receives their money at the same time, the need for a tracking system is also understandable. With that in mind, todays technology makes it very easy for you to track your stimulus online. This is why the IRS set up Get My Payment last week so that you can see exactly where your payment is at.

With this tool, you may see precisely when your stimulus check is supposed to arrive whether you are supposed to get it in your bank account or the mail. This tool will also tell you whether there is an issue with the pending payment or not. This will give you time to address it so that you may receive the payment in the end.

Don’t Miss: What’s The Latest News On Stimulus Check

Eligible Parents Of Children Born In 2021 And Families That Added Qualifying Dependents In 2021 Should Claim The 2021 Recovery Rebate Credit Most Other Eligible People Already Received The Full Amount And Wont Need To Claim A Credit On Their Tax Return

The third-round Economic Impact Payment was an advance payment of the tax year 2021 Recovery Rebate Credit. The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individuals 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individuals 2021 income tax return.

Families and individuals in the following circumstances, among others, may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020. These families and individuals may be eligible to receive more money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return:

- Parents of a child born in 2021 who claim the child as a dependent on their 2021 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this child.

- All eligible parents of qualifying children born or welcomed through adoption or foster care in 2021 are also encouraged to claim the child tax credit worth up to $3,600 per child born in 2021 on their 2021 income tax return.

Tracking Your Third Stimulus Check

The IRS fired up the popular “Get My Payment” tool again so that you can track the status of your third stimulus check. The online tool lets you:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

For more information about the tool, see Where’s My Stimulus Check? Use the IRS’s “Get My Payment” Tool to Get an Answer.

Don’t Miss: Nc $500 Stimulus Check Update

How Can I Find The Bank Information Where My Stimulus Is Being Sent

The account number and routing number where your tax refund are being direct deposited can be found on the printable .pdf version of your tax return.

The last four digits of the bank account being used for direct deposit can be found in your account under Transaction History.

To find the last four digits of your bank account on file:

Log in to your account > My Account > Transaction History

If theres no bank information on my transaction history but on my copy of my taxes theres some bank info what does that mean? Does the IRS have my bank information to send my stimulus?

If you paid your filing fees out of your tax refund and got the rest of your refund by direct deposit, the account number where your funds were deposited is on the printed copy of your tax return. This is the account information the IRS has on file, and your stimulus payment will be sent to this same account.

Heres How To Claim The Payment On Your Tax Return

Those who believe they are due more money must file a 2021 tax return, even if they dont usually file taxes, and claim whats called the Recovery Rebate Credit. If a taxpayer is eligible for more money, it will either reduce any tax the personowes for 2021 or be included in a tax refund.

In order to claim the Recovery Rebate Credit, a taxpayer will need information that was sent in a letter from the IRS in the past couple of months. Known as Letter 6475, it confirms whether a taxpayer was sent a third stimulus payment and the amount. Alternatively, that information can be obtained by accessing your IRS online account.

For most taxpayers, the federal tax return filing deadline is April 18, though its a day later for residents of Maine and Massachusetts. Taxpayers having difficulty meeting the deadline can file for an automatic six-month extension by using Form 4868.

Also Check: When Was The 3rd Stimulus Check 2021

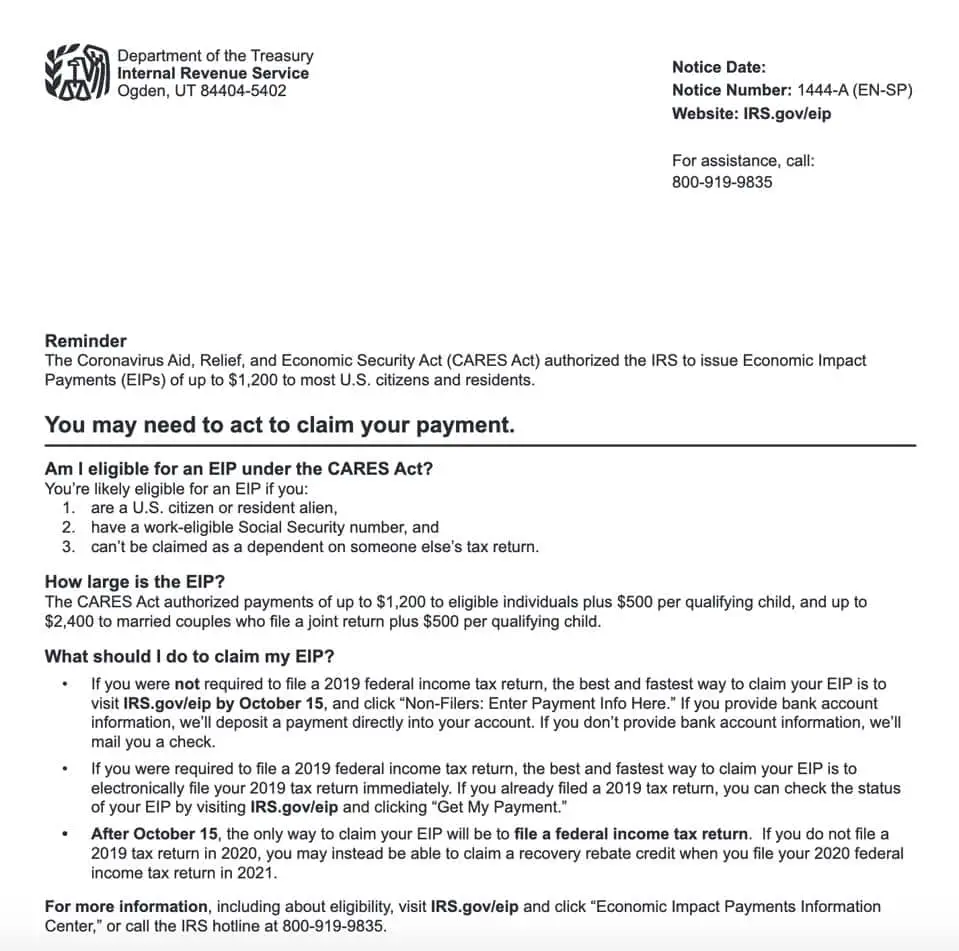

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a Recovery Rebate Credit. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Dont Miss: Recovery Rebate Credit Second Stimulus

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually received a rebate of $250 . The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns should have received a rebate in July. Single individuals without dependents received $500 households with married couples or single adults with dependents received $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Recommended Reading: Whats The Update On The 4th Stimulus Checks

Recommended Reading: When Will South Carolina Receive Stimulus Checks

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Don’t Miss: Stimulus Update For Social Security

Back Taxes Child Support And Other Debts

Question: Can the IRS or other creditors take my third stimulus check if I owe back taxes, child support or other debts?

Answer: Your third stimulus check is not subject to reduction or offset to pay child support, federal taxes, state income taxes, debts owed to federal agencies, or unemployment compensation debts.

However, the American Rescue Plan doesn’t include additional protections that were included in the legislation authorizing the second round of stimulus checks. For example, second-round stimulus checks weren’t subject to garnishment by creditors or debt collectors. They couldn’t be lost in bankruptcy proceedings, either. The IRS also had to encode direct deposit payments so that banks knew they couldn’t be garnished.

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Also Check: When Will We Get 4th Stimulus Check

Also Check: When Will The Stimulus Check Come Out