How To Complete A Form 8822

On the website hosting the blank, press Start Now and go to the editor.

Use the clues to fill out the relevant fields.

Include your individual information and contact information.

Make certain you enter true information and numbers in appropriate fields.

Carefully check the content of your document so as grammar and spelling.

Refer to Help section in case you have any concerns or contact our Support staff.

Put an electronic signature on your change of address printable using the help of Sign Tool.

Once blank is done, press Done.

Distribute the ready form by means of electronic mail or fax, print it out or download on your gadget.

PDF editor lets you to make adjustments to your change of address Fill Online from any internet linked gadget, personalize it in accordance with your needs, sign it electronically and distribute in several means.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

How To Send Notice Using An Irs Form 8822

Fill out Form 8822, available here. For a change in your business address, you can use Form 8822-b, here. Download and print the forms here, or order them by calling the phone number 800-TAX-FORM . You can mail these to the address listed on the forms.

If you don’t change your address and the IRS sends you notices to your previous address, you are considered notified and the clock starts to run on any taxes, penalties or interest you may owe. Make sure you notify IRS of your change of address.

Also Check: How Much Was Last Stimulus Check

You May Miss Future Child Tax Credit Payments

The new child tax credit payments are going out monthly to eligible parents through December â you can calculate your payment here. If you donât have direct deposit set up with the IRS, your payments will likely arrive as paper checks. And if youâre still waiting for a child tax credit check and you qualify for the money, a wrong address could be the problem. You can track your payment or file a payment trace to see if it went to the wrong address.

However, if youâve moved recently and you havenât updated your information with the IRS or USPS, itâs likely your money could wind up at your old address, potentially causing a delay as you wait for your check to be rerouted. You can now update your mailing address using the Child Tax Credit Update Portal to make sure your payments are being sent to the right place.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

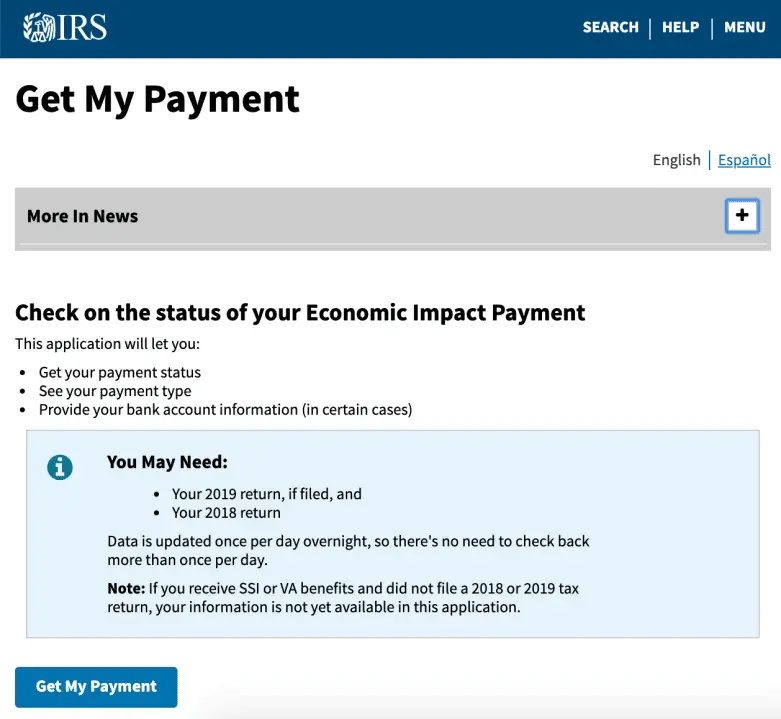

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Read Also: I Didn’t Receive Stimulus Check

File Your Tax Returns

If you havent filed your 2019 or 2020 tax return yet, you can still receive your third stimulus payment. How? By filing as soon as you can. The IRS urges filers to visit a tax professional or local community organization for tax assistance to get help with their tax returns. The stimulus payments will be available through 2021.

According to the IRS, If you didnt get a first and second Economic Impact Payment or got less than the full amounts, you may be eligible to claim the 2020 Recovery Rebate Credit. To get this credit, you must file a 2020 tax return even if you dont usually file a tax return. Learn more about the credit here.

Download our free Financial First Aid Guide! Itll walk you through the best ways to manage your money during uncertain times. Well show you how to take inventory and review all your expenses, assess your debts, prioritize bills and communicate with creditors, and so much more!

Others are reading:

Read Also: Irs Sending Letters About Stimulus 2021

If There Is A Second Stimulus Check

If you are unable to recover the first stimulus payment, it is still worth updating your address so that, should there be a second payment, it goes directly to you without the need for Nancy Drew-level detective work. Currently, the HEROES Act has passed through the Senate and is being negotiated in the House. House majority leader Mitch McConnell claims that the HEROES Act will not be approved without some serious revisions.

Like what you see? How about some more R29 goodness, right here?

Also Check: Who Got The 1400 Stimulus Check

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

How To Notify The Irs Of A Change Of Address Online

The IRS doesnt currently offer a universal option for changing your address online. As noted above, theyre very cautious about the potential for identity theft. Automated online identity verification isnt as secure as a personalized approach.

Still, there are exceptions to every rule. If the IRS mailed you a refund check and it got returned to them, you may have the option to update your address online.

The IRS offers an online Wheres My Refund? tool that allows you to search for your refund status. Youll need to plug in the following information:

- Your SSN or ITIN

- Your filing status

- The exact amount of your expected refund

Once youve done that, you may be given the option to change your address online. If not, you will need to call the IRS, write in, or visit a TAC in person.

You May Like: How Much Third Stimulus Check

Moving Soon Heres Why You Should Tell The Irs Not Just Usps

Thanks to the competitive housing market, more people are moving â whether buying or selling. Between packing up and settling down in your new place, itâs easy to forget to let the United States Postal Service know â let alone the Internal Revenue Service. But if you donât, you could be missing out on important letters and money.

Mail boxes voting ballots mail-in mail in election elections vote by mail

For example, if you move and donât inform the IRS, you could miss out on the rest of your child tax credit checks or one of the stimulus check payments that you may still be waiting for. And even if you update the USPS, not all post offices forward government checks.

Weâll explain a few other reasons to update your address sooner, rather than later. And hereâs what we know about the possibility of child tax credit payments being extended. And hereâs when you should expect your federal tax refund check and unemployment refund details. This story was recently updated.

Stimulus Check: Economic Impact Payment

A federal court ruled that qualifying incarcerated people are eligible to receive a federal stimulus check under the Coronavirus Aid, Relief, and Economic Security Act . In order to receive a check, an incarcerated person must fill out an IRS Form 1040 with EIP 2020 written at the top and mail it to the IRS. Additional information on how to obtain an IRS Form 1040 or the Economic Impact Payment has been posted in housing unit wings and the offender library.

Read Also: First Second And Third Stimulus Checks

So You Can Receive This Years Tax Return And Refund

Tax season starts Jan. 24 and if you plan to move after you submit your taxes, make sure you update your information in the system. This will prevent any errors or delays with your tax refund.

If you decided to opt out of your child tax credit payments in 2021, theyll be tied to your tax refund this year. You dont want to miss out on a potential $3,600 payment per kid. Add another $16,000 max that you can potentially claim as a tax break this year for any child care expenses you paid last year.

Read Also: Latest Update On Stimulus Check

What You Need To Know

The current $1.9 trillion American Rescue Plan includes an additional $1,400 stimulus payment to qualifying individuals. The latest proposal for the payments looks like this:

-

Individuals will receive $1,400

-

Individuals with dependents will receive $1,400 per dependent

As with the first and second stimulus payments, an income threshold will be included for the third payment. On Feb. 9, the House Ways and Means Committee put forth the firstdraft of the bill, which included information on the income thresholds. As thebill currently reads, the income thresholds will remain the same as they werewith the first and second stimulus payments but the point at which the paymentswill begin to phase out were lowered. The total stimulus payment would phaseout for Single filers with incomes between $75,000 and $100,000 and $150,000and $200,000 for joint filers. As we learn more, well update this section tohelp you accurately calculate your potential 3rd stimulus payment.

Past stimulus payments were based off adjusted gross income , and we assume the third round will be the same.

When it comes to receiving your third stimulus payment quickly and accurately, it is in your best interest to file your 2020 tax return as soon as possible. Once the stimulus payments are signed into law, the IRS will be tasked with promptlyissuing those payments. Filing your 2020 tax return now will give the IRS the updated information it needs to process your payment.

Don’t Miss: Can I Still Claim My First Stimulus Check

Can You Change Your Address With The Irs Online

While you have several options for changing your address with the IRS, you canât do it online. You can change your address with the post office online, and that may update your address with the IRS. If youâre expecting a check, you should still contact the IRS to update your address, as not all post offices forward government checks.

Also Check: When Can We Expect Our Third Stimulus Check

Send Notice In Writing

You can notify the IRS of your change of address with a written and signed statement. Provide your full name, old address, new address, Social Security number, or other tax ID number.

Be sure your statement includes both your printed name and your signature. Send your statement to the address where you would send a paper tax return. You and your spouse should both sign the written statement if you file a joint return and have both changed your address.

Read Also: How To Get Stimulus Check On Taxes

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

How Do You Change Your Address With The Irs To Get Your Stimulus Check

If you already filed your return, see the following to change your address with the IRS.

———————————–

If you have not filed a 2019 or are not required to file a tax return, you can register with TurboTax Stimulus Registration.

Don’t Miss: Sign Up For Stimulus Check

How To Change/update Your Address With The Irs

The IRS needs your updated address in order to send you important correspondence or mail you a refund check. The IRS provides several options for notifying the agency of an address change. Since it can take up to six weeks to process an address change, starting the process sooner rather than later can help you get your tax refund check faster.

S To Change Your Address

First, go to the website usps.com/move.

Second, fill out the form to change your mailing address. Here you need to give your contact information, old address, new address, date when you want mail to be sent to the new address, etc. After filling out the form, verify that the information entered is accurate, and then click Next.

Third, you now need to make the payment to change your mailing address. It costs $1.05 to change your address. You cant use prepaid credit or debit cards to make the payment.

Fourth, after you make the payment, you will get a confirmation email that your request for the change of address is filed. You will also get a USPS Confirmation Notification Letter and welcome kit at your new address.

As per USPS, it could take between three days to two weeks before you start getting mail at your new address.

After you have changed the address with USPS, you also need to inform the IRS about it so that your coronavirus stimulus check arrives at the right address. To inform the IRS, you can either fill out Form 8822 or sent a letter to the IRS about the same. You can also do it over the phone.

If you plan to send a letter, then you need to mention your full name, old and new address, Social Security number, individual taxpayer identification number or employer identification number and your signature. The IRS may take about four to six weeks to process your address change application.

You May Like: Irs.gov Stimulus Check Deceased Person

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Want Your Third Stimulus Check Sooner Try These Things Before Its Approved

With a third stimulus check getting closer, these tips can help speed up delivery and potentially keep you from waiting for your stimulus payment to arrive. Plus, they can help you get your missing stimulus money.

You can try to speed up your payment by making sure you have everything in order before the new stimulus bill is finalized.

Congress is working to pass the $1.9 trillion stimulus bill, and the third stimulus check for up to $1,400 per person that would come with it, into law by mid-March. That means youre running out of time to make sure youre on course to receive the new payment when its sent. Once approved, itll go straight to the Senate for a vote, then passed along to President Joe Biden to sign into law. So what do you need to do to prepare? Use this tax season to tie up any loose ends.

If youre missing stimulus money from the first two payments, youll need to request a Recovery Rebate Credit when you file your 2020 taxes in order to get your payment. To ensure a speedier delivery of payment, set up direct deposit with the IRS and file your taxes electronically. Well explain more below.

Keep reading for our recommendations of what you can do to clear any hurdles you may encounter before a third stimulus check is sent out. Also keep in mind that a third check could will be more targeted, which means you could qualify for more money for your family. This story is frequently updated.

Recommended Reading: Sign Up For Stimulus Check 2022