Stimulus Check Update: These States Will Send Out Payments In June

Americans in two states and homeowners across the country could see additional COVID relief checks this month.

While it remains unclear whether there might be a fourth payment from the federal government, Maine and New Mexico residents are eligible to receive stimulus checks thanks to state governors and lawmakers who pushed for more payments in light of decades-high inflation.

In Maine, the first round of $850 relief checks will go out this month to residents who have filed 2021 state income tax returns. As the state receives more income tax returns, the payments will go out until the end of the year.

To be eligible, individuals must file their state income tax returns by October 31. But they cannot be claimed as a dependent on anothers return and must have a federal adjusted gross income of less than $100,000 for those filing as single, $150,000 for a head of household and $200,000 for couples filing jointly.

It is estimated that 858,000 residents will receive the stimulus checks, which will total $729.3 million.

Tax rebates in New Mexico are also expected to roll out in June.

The stimulus measure approved by the Legislature earlier this year will provide refund payments of $250 for single filers or $500 for joint filers. Second payments in the same amount will be sent out in August.

Meanwhile, homeowners across the country will be eligible for financial relief under the U.S. Treasury Departments Homeowner Assistance Fund .

Stimulus Check 2 2021

The timeline for the distribution of the second stimulus check was much shorter. Congress approved the coronavirus relief bill on Dec. 21, 2020 and it was signed into law on Dec. 28. The first direct deposits were made Dec. 29, and the first paper stimulus checks were put in the mail on Dec. 30.

The deadline for the IRS to provide the second check via mail, direct deposit, or debit card was Jan. 15, 2021. Anyone who did not receive their second check by Jan. 15 will have to file a tax return to get it.

How Much Money Will I Get

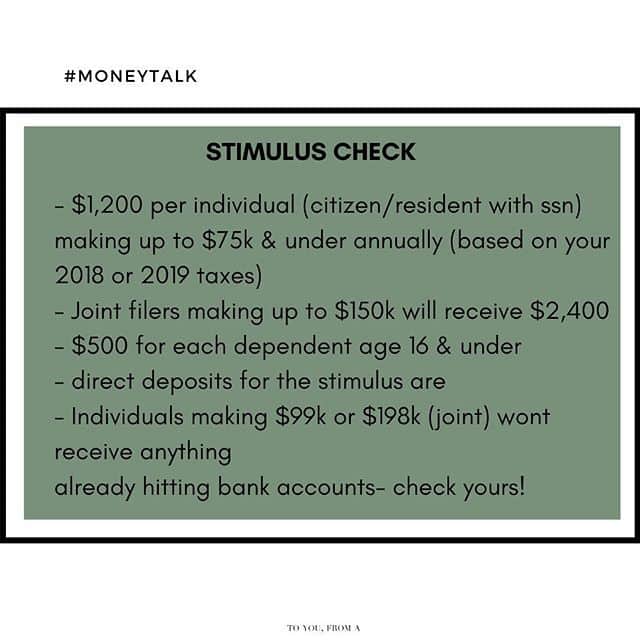

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Read Also: Contact Irs About Stimulus Check

Havent Received Your Third Stimulus Payment Yet

The IRS will continue to send checks via the Treasury. The majority who have received a first or second payment dont need to do anything more to get the third payment, which often will be sent out automatically. Following the model of the second round of checks, payments should be issued automatically to people who:

- Filed 2019 or 2020 federal tax returns. The IRS will use the taxpayers latest processed return.

- Registered for the first round of stimulus payments through the non-filer portal on IRS.gov by Nov. 21, 2020.

- Receive Social Security , Supplemental Security Income , or Railroad Retirement Board or Veterans Affairs benefits.

Those receiving Social Security and other federal benefits will generally receive this third payment the same way as their regular benefits.

The IRS Get My Payment Tool allows you to provide information to the agency for a stimulus check and to track payment status.

If you got your payment based on your 2019 return and find that youre entitled to more based on your 2020 return, the IRS will compute the additional amount owed to you.

Can Creditors Take My Check

Can back taxes or child support be taken out of the checks? The stimulus payments are not taxable and are not subject to garnishment by the government for back taxes or student loan defaults. The same is true for past due child support payments or private debtsfor the second and third stimulus checks.

Can my bank take my stimulus check? If your bank account is overdrawn because of overdrafts or outstanding fees, your bank may take part or all of your stimulus check to bring your account even. However, when the second stimulus check came out, many large banks stated that they would bring customers bank balances to zero, temporarily, so that customers could access their stimulus checks. This includes Bank of America, Wells Fargo, Citigroup, and JPMorgan Chase.

You May Like: How To Check Stimulus Payments

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

You May Like: 4th Stimulus Checks For Social Security Recipients

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

How To Get A Stimulus Check Faster

To get your stimulus check as soon as possible, make sure you do two things:

File your taxes for the 2018 or 2019 tax year, if you haven’t already.

Provide the IRS with your direct deposit information.

Your tax return includes your adjusted gross income and the ages of any dependents you claim. That’s all the information the IRS needs to determine if you’re eligible for a stimulus check, and how much money you get.

The first coronavirus stimulus payments will be made directly to the bank accounts of taxpayers whose information is already on file with the IRS from the last time they did their taxes. That’s why you should make sure the IRS has your bank direct deposit details if you haven’t given this information to the IRS, it could take a lot longer to get your stimulus check.

Read Also: How To Claim The Stimulus Check

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couples total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individuals online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Second Round Of Stimulus Checks Will Be Sent Out In Days And Will Likely Reach You Faster Than First Payment

- 10:46 ET, Dec 28 2020

THE second round of stimulus checks will be sent out in days and will likely reach Americans faster than the first payment.

On Sunday, President Trump signed off on the $900billion relief bill, ending days of chaos after he initially refused to agree to the bipartisan deal.

Trump signed the long-awaited coronavirus stimulus package at his private club, Mar-a-Lago, in Florida and announced the news in a statement shared by the White House.

The announcement came less than a day after some 14million Americans lost their unemployment benefits, which ran out because of the stalemate.

The massive bill includes $1.4 trillion to fund government agencies through September and contains other end-of-session priorities such as money for cash-starved transit systems and an increase in food stamp benefits.

As part of the package, members of the House also agreed to vote on increasing the $600 stimulus checks to $2,000, according to a statement.

The value of stimulus checks may increase, however, as the House is set to vote on increasing the amount from $600 to $2,000 for individuals with an additional $600 per dependent.

This would give a family of four $5,200.

The coronavirus bill would also offer extended emergency unemployment benefits of $300 and provide relief on evictions that are set to expire on December 31.

How much will you receive?

Families of four could get a $2,400 payout.

Double check if you owe any money

Also Check: Where Is My First And Second Stimulus Check

Heres How Many Stimulus Checks Have Been Sent Out So Far

More than 1.1 million stimulus checks are on the way to Americans bank accounts.

Thats according to the Internal Revenue Service, which announced yesterday that, along with the Department of the Treasury and the Bureau of the Fiscal Service, it began processing the eighth batch of payments at the end of April. The latest round, which was officially disbursed on May 5, is valued at more than $2 billion.

More from Footwear News

The agency added that more than 585,000 payments went to eligible individuals for whom it previously did not have information to issue a check but who recently filed a tax return. The batch also included 570,000 plus-up payments or additional ongoing supplemental payments for those who have received payments based on their 2019 tax returns but are now qualified for a new or larger payment based on their recently processed 2020 tax returns.

About 600,000 payments were made via direct deposit payments, with the remainder on paper. The IRS shared that it would continue to make Economic Impact Payments on a weekly basis. Individuals who havent yet received their payment are encouraged to check its status using the Get My Payment tool.

Sign up for FNs Newsletter. For the latest news, follow us on , , and .

Also Check: How To Check Eligibility For Stimulus Check

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

You May Like: File For Missing Stimulus Check

Also Check: How Many Stimulus Checks Were Issued

Congress Is Considering A Third Round Of Payments

Congress is negotiating a fresh stimulus package that may include a third round of stimulus checks. Democrats in the House have proposed sending direct payments worth up to $1,400 per person. A family of four could receive up to $5,600.

Individuals earning less than $75,000 a year and married couples earning less than $150,000 would be sent the full amount.

But not everyone who received a previous stimulus check would be eligible for this round. The payments would phase out faster and completely cut off individuals earning more than $100,000 and families earning more than $200,000 regardless of how many children they have.

The payment will be calculated based on either 2019 or 2020 income. Unlike the previous two rounds, adult dependents would be eligible for the payments.

Lawmakers hope to get legislation passed by mid March. The full House may vote on the bill as soon as next week, but it could face hurdles in the Senate.

Donât Miss: Second And Third Stimulus Checks

How Can I Check My Stimulus Check Status

The IRS has created a website where you can check the status of your stimulus payment.

The Get My Payment tool is no longer updating for either the first or second stimulus check. However, you can use it to see the status of your third check.

- If your payment has been processed. the IRS will specify its status including whether it has been sent, the date issued, and whether the money will be directly deposited or mailed.

- If your status reads “Payment Not Available.” The IRS either hasn’t yet processed your payment or you aren’t eligible for one.

- If it reads “Need More Information.” Your check was returned to the IRS after an attempted delivery. Give the IRS your bank information to receive your money.

If you did not get your first or second check, you’ll need to file a 2020 tax return to get the payment.

Recommended Reading: What Were The Three Stimulus Payments

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card can allow you to pay intro 0% interest into 2023! Plus, there’s no annual fee. Those are a few reasons our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Why Am I Getting An Error Message When Answering The Security Questions

If the information entered does not match the IRS records, you will receive an error message. Be sure you entered the information accurately. Check your most recent tax return or consider a different way to enter your street address and use the help tips provided when entering your personal information. If you enter incorrect information multiple times you will be locked out of Get My Payment for 24 hours.

Recommended Reading: What Stimulus Was Given In 2021

What Happens If You Dont Receive Your Payment Or Only Receive A Partial Amount

If you havent received your payment yet, dont panic, although its easier said than done. Compared with the first round of stimulus checks, the IRS and Treasury Department have significantly shrunk the delivery timeline by weeks, if not months. However, the text of the American Relief Plan still gives both agencies until Dec. 31, 2021, to distribute all funds, meaning the last round of checks might not hit consumers mailboxes until January 2022.

Consider signing up for the U.S. Postal Services informed delivery service, so you know in advance of any mail youll be receiving on a given day. If the IRS says it already mailed your check but you didnt receive one, down the road you might also decide to order a stimulus check payment trace. You can arrange one by calling a hotline at the IRS or submitting a completed Form 3911, Taxpayer Statement Regarding Refund by mail or fax. But be prepared: This process can take weeks. The IRS may also ask that you sit tight for the time being in some cases, for a period as long as nine weeks.