How Much Were The Stimulus Checks

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

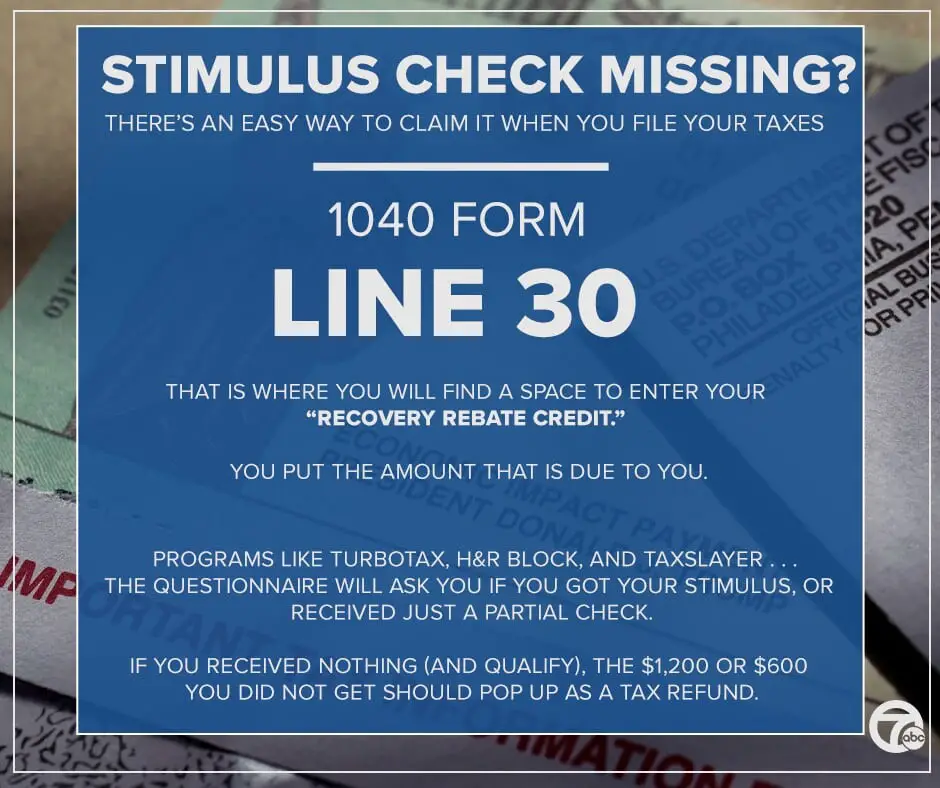

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

Recommended Reading: What Were The Three Stimulus Payments

I Didn’t File A 2019 Or 2020 Tax Return And Didn’t Register With The Irsgov Non

Yes, if you meet the eligibility requirements. While you won’t receive an automatic payment now, you can still get all three payments. File a 2020 return and claim the Recovery Rebate Credit.

The IRS urges people who don’t normally file a tax return and haven’t received any stimulus payments to look into their filing options. The IRS will continue reaching out to non-filers so that as many eligible people as possible receive the stimulus payments they’re entitled to.

The IRS encourages people to file electronically, and the tax software will help figure the correct stimulus amount, which is called the Recovery Rebate Credit on 2020 tax forms. Visit IRS.gov/filing for details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in the community or finding a trusted tax professional.

The Irs Classifies Me As An Older Adult What Should I Know

Many older adults, including retirees over age 65, received a first stimulus check under the CARES Act and were eligible for the second one — and are for the third as well. For older adults and retired people, factors like your tax filings, your AGI, your pension and if you’re part of the SSI or SSDI program will affect whether you receive a stimulus payment.

The third stimulus check makes older adult dependents eligible to receive more money on behalf of the household. Here’s how to determine if you qualify for your own stimulus check or count as a dependent.

How much stimulus money you could get depends on who you are.

Don’t Miss: Is There Anymore Stimulus Checks Coming

If You Miss Out This Year

If you receive no $1,400 payment or a reduced check, but your income changes, you may be able to claim the money you are due when you file your taxes next year.

“Any change, either a slight reduction in earnings or even just putting more money in a traditional IRA or a 401 could yield a much bigger total payment when they do their 2021 taxes,” said Garrett Watson, senior policy analyst at the Tax Foundation.

“There’s a subset of folks who will be in that situation,” Watson said.

That also goes for this year’s tax-filing season for people who missed out on the previous $1,200 or $600 payments. You can claim a recovery rebate credit to recoup any money you were possibly owed. This is also available to people who typically do not file tax returns because their income is too low.

Citizenship: Does The Irs Consider My Household Mixed

In the $900 billion stimulus package from December, a US citizen and noncitizen spouse were both eligible for a payment as long as they both had Social Security numbers. This has been referred to as a “mixed-status” household when it comes to citizenship. Households with mixed US citizenship were left out of the first check.

The new stimulus bill includes all mixed-status households where just one member has a Social Security number for a third stimulus check. That potentially includes families with citizen children and noncitizen parents.

In the CARES Act from last March, households with a person who wasn’t a US citizen weren’t eligible to receive a stimulus check, even if one spouse and a child were US citizens.

You May Like: Didn’t Get Stimulus Payment

Stimulus Checks: Marriages And Divorce

Q. We got married in 2020 how does that affect the amount we will get?A. Filing as jointly married versus separate for 2020 wont change the total maximum stimulus amount and you wont have to repay any stimulus you already received. However, now that youre married, you should determine whether it makes more sense to file jointly or separately, and its possible that one spouse with a higher income could affect eligibility for the recovery rebate credit.

For example, lets say you and your spouse had AGI amounts of $35,000 and $105,000 respectively. As single filers, youd receive the full stimulus payment because your AGI of $35,000 is below the threshold, but your spouses AGI of $105,000 would be over the limit and wouldnt qualify for a stimulus payment. However, if you file jointly for 2020, your combined AGI of $140,000 is below the threshold for joint filers, so you could claim your spouses portion as the recovery rebate credit.

Those who get married in 2021 will have a similar situation when they file their 2021 return.

Q. How does a recent divorce affect my stimulus check?A. What if you were married and filed jointly on your tax return and have since become separated or divorced? If the IRS issued a payment based on a jointly filed return, you will allocate half of each payment to each spouse when you calculate your credit on your single status returns.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

You May Like: How To Look Up Stimulus Check

Which Tax Year Is Used To Determine Eligibility

The IRS will use the most recent tax return on file . Its issuing plus-up payments for individuals who now qualify for more money based on their 2020 tax return.

For example, if your income in 2019 was too high to receive a stimulus payment up front, but your 2020 income decreased to a level that would make you eligible to receive a full or partial payment, submit your tax return ASAP to be eligible for a plus-up payment. The IRS says it will continue to process plus-up payments on a weekly basis going forward as it receives 2020 tax returns . Tax Day has been pushed back from April 15 to May 17, 2021 so you have more time to file

Read more: Tax Season Will Look Different This Year. Heres What You Need To Know

On the other hand, if you think your adjusted gross income increased in 2020 beyond the point of eligibility for this stimulus payment but you would benefit from the financial relief, you may want to hold off on filing until after the payments are distributed You wont have to pay your stimulus check back to the government if you ended up making too much money in 2020 or 2021.

If you receive Social Security but didnt file a return in 2019 or 2020 because you earn too little to be required to file, youll also receive a stimulus check. The amount will be based on the information sent to the IRS on forms SSA-1099 and RRB-1099.

Im A Nonfiler Do I Have To File Taxes This Year To Receive My Stimulus Money

A nonfiler is a person who isnt required to pay taxes to the IRS during tax season. The requirement to file a tax return depends on your gross income, which is all income you receive in the form of money, goods, property and services that arent tax-exempt .

People who are considered nonfilers dont need to do anything to receive a third stimulus check, according to the IRS. However, if youre claiming missing stimulus money in a Recovery Rebate Credit, even nonfilers will have to file a tax return this year. You may be able to use a special form and file for free. You will, however, need some specific information.

If youre age 65 or older, you should file taxes under the following circumstances:

- Single filer with at least $13,850 in gross income.

- Head of household with at least $20,000 in gross income.

- Qualifying widow age 65 or older with at least $25,700 in gross income.

In the 2019 tax year, the IRS introduced Form 1040-SR, US Tax Return for Seniors. This form is basically the same as Form 1040, but has larger text and some helpful information for older taxpayers.

You May Like: When Did We Get Stimulus Checks In 2021

You Must File A Federal 2020 Tax Return To Claim A Stimulus Check For Your Household

If youve never filed taxes before, you will need to get an Individual Taxpayer Identification Number . The Internal Revenue Service issues ITINs to people who are required to have a U.S. taxpayer identification number but who dont have, and are not eligible for, a Social Security number .

If you already have an ITIN and it was issued before 2013, you should have already received a notice from IRS to renew it. If you havent used your ITIN on a U.S. federal tax return in the last three years you will need to renew it.

To apply for or renew an ITIN, you must complete IRS Form W-7, Application for IRS Individual Taxpayer Identification Number. You will need to submit the form to the IRS with a completed tax return and documents to verify identity and foreign status. You will need original documents or certified copies from the issuing agencies. A list of the documents that can be used is in the instructions for Form W-7.

To get help applying for an ITIN, you can schedule an appointment at an IRS Taxpayer Assistance Center or with a Certifying Acceptance Agent . Some CAAs also offer free tax preparation to help you file a tax return. If you go to one of the other locations, you will need to bring your completed tax return so it can be sent with Form W-7.

The IRS does not charge a fee to get or renew an ITIN. Some CAAs may charge for their services to prepare your return and W-7. Ask a CAA about their fees before scheduling an appointment.

Is Any Action Needed By Social Security Beneficiaries Railroad Retirees And Those Receiving Veterans’ Benefits Who Are Not Typically Required To File A Tax Return

Most Social Security retirement and disability beneficiaries, railroad retirees and those received veterans’ benefits in 2020 should not need to take any action to receive a payment. As with the first two stimulus payments, the IRS is to send out the new payments the same way benefits are normally paid. The IRS is working directly with other federal agencies to obtain updated 2021 information for recipients.

Some people who will receive an automatic third payment based on their federal benefits information may need to file a 2020 tax return even if they don’t usually file. If your third payment does not include a payment for your qualified dependent who did not receive a third payment, you must file a 2020 tax return to be considered for an additional third payment even if you don’t normally file.

If you’re eligible and didn’t get a first or second Economic Impact Payment or got less than the full amounts, you may be eligible for the 2020 Recovery Rebate Credit but you’ll need to file a 2020 tax return. See the special section on IRS.gov: Claiming the 2020 Recovery Rebate Credit if you aren’t required to file a tax return.

You May Like: How Much Were Stimulus Checks In 2021

Why Did Mitch Mcconnell Block The $2000 Stimulus Checks Vote

McConnell blocked the Democrats from bringing the bigger Covid-19 relief checks up for a vote, saying on December 29 that the chamber would begin a process to address the issue alongside two other concerns.

The relief bill had been passed by the House one day earlier.

McConnell addressed Trumps statement that called for not only larger checks but also new curbs on tech companies and an investigation into the election, according to The Washington Post.

Those are the three important subjects the president has linked together, McConnell said, according to the newspaper.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Read Also: When Will Arizona Get Stimulus Checks

Which States Are Sending New Stimulus Checks

California announced the Golden Gate Stimulus deal, which will provide a payment to 5.7 million people. The aid is already being distributed. Taxpayers earning between $30,000 and $75,000 per year will receive one-time payments of $600. Households with dependents will receive an additional $500.

New Mexico has issued payments to low-income households, who for whatever reason didn’t receive the first three rounds of stimulus checks. There will be one-time payments of $750 per household.

In Texas, some local school districts are providing their employees with stimulus checks in the form of retention bonuses.

In Maryland, taxpayers with qualifying income could receive up to $500. Income caps vary from $21,710$56,844. In Colorado, anyone who receives unemployment benefits between March and October 2020 automatically received a one-time payment of $375.

Through its unique offer, Vermont is trying to lure people to move to the state. It will reimburse people up to $7,500 for qualifying moving expenses if you’re ready to work in certain industries.

In Georgia, Florida, Tennessee, Texas, and Colorado, teachers will be receiving a lot of stimulus money. As part of the American Rescue Plan, state and local governments have received $350 billion in assistance. Most of this aid will go to schools, which will pay their teachers and other school staff a bonus of up to $1,000. In Minnesota, grocery store workers and medical center staffers received bonus checks.