What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Read Also: Is Texas Giving Stimulus Money

Get The Information You Need

The stimulus guide includes an FAQ section for understanding important info, including:

- Who is eligible to receive a stimulus check?

- How will the IRS determine income for the stimulus payment?

- How much money you will receive.

- Will the stimulus money be considered income that has to be claimed on taxes?

- How will you get the stimulus payment?

- The stimulus checks impact on other benefits or if debts are owed to other agencies.

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

Don’t Miss: How To Check For Stimulus Checks

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Stimulus Checks: Marriages And Divorce

Q. We got married in 2020 how does that affect the amount we will get?A. Filing as jointly married versus separate for 2020 wont change the total maximum stimulus amount and you wont have to repay any stimulus you already received. However, now that youre married, you should determine whether it makes more sense to file jointly or separately, and its possible that one spouse with a higher income could affect eligibility for the recovery rebate credit.

For example, lets say you and your spouse had AGI amounts of $35,000 and $105,000 respectively. As single filers, youd receive the full stimulus payment because your AGI of $35,000 is below the threshold, but your spouses AGI of $105,000 would be over the limit and wouldnt qualify for a stimulus payment. However, if you file jointly for 2020, your combined AGI of $140,000 is below the threshold for joint filers, so you could claim your spouses portion as the recovery rebate credit.

Those who get married in 2021 will have a similar situation when they file their 2021 return.

Q. How does a recent divorce affect my stimulus check?A. What if you were married and filed jointly on your tax return and have since become separated or divorced? If the IRS issued a payment based on a jointly filed return, you will allocate half of each payment to each spouse when you calculate your credit on your single status returns.

You May Like: Do We Supposed To Get Another Stimulus Check

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

When You’ll Receive Your Payment

The final date to qualify has already passed for filers other than those with pending ITINs. If you have already filed, you don’t have to do anything.

If you have not received a payment by now, you will most likely receive a paper check. In addition, if you did not receive a refund with your tax return or owed money at the time of filing, you will receive a paper check.

Payments will go out based on the last 3 digits of the ZIP code on your 2020 tax return. Some payments may need extra time to process for accuracy and completeness. If your tax return is processed during or after the date of your scheduled ZIP code payment, allow up to 60 days after your return has processed. Please allow up to three weeks to receive the paper checks once they are mailed out.

| Last 3 digits of ZIP code | Mailing timeframes |

|---|

You May Like: Where’s My Stimulus Check Nj

How To Get Your Stimulus Check

Using stimulus funds can help you manage your entire financial picture, including getting a handle on The guide helps you understand if you are eligible in these cases:

- If you havent filed federal taxes or have no income

- If you dont have a bank account or a pre-paid debit card

- If you have moved since you last filed taxes

- If you receive Social Security Benefits

- If youve already filed taxes and are signed up for direct deposit

The vast majority of Americans will be eligible to receive a third stimulus check from the federal government. Even if you have no income, you are still eligible but need to take action.

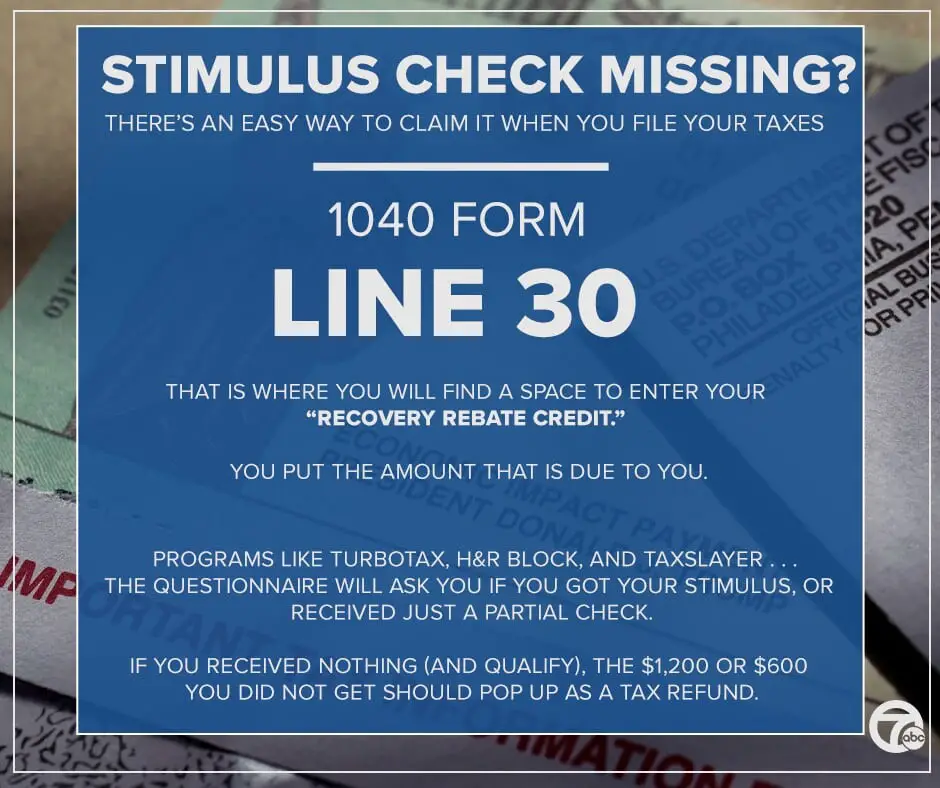

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that year’s income, number of dependents and other qualifying information.

Recommended Reading: Get My 2nd Stimulus Payment

Social Security Ssi Ssdi Veterans: What You Need To Know About Eligibility And Your Stimulus Payment

The majority of people who are part of the SSI or SSDI programs qualify for a check — read our guide for details. This time, many will get their payments on their existing Direct Express card, though some may receive stimulus money a different way. Consult our guide for more on what to know and do, including if you need to claim a dependent by filing a tax return for 2020.

Stimulus money for veterans who don’t usually file taxes are expected to receive their stimulus checks in mid-April, after many Social Security recipients. Here’s more to know about veterans and stimulus eligibility.

Recipients of the first check received their payments through a non-Direct Express bank account or as a paper check sent in the mail. In the , these recipients again qualified to receive payments, along with Railroad Retirement Board and Veterans Administration beneficiaries.

My Small Business Needs Help

My small business needs help.

The Treasury Department is providing critical assistance to small businesses across the country.

* How to file your taxes with the IRS: Visit IRS.gov for general filing information. Havent filed your taxes? Heres information for non-filers. If your income is less than $72,000 you may be eligible to file your taxes for free, or call 829-1040.

Don’t Miss: Recovery Rebate Credit Second Stimulus

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Don’t Miss: How Much Third Stimulus Check

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Don’t Miss: What Is Congress Mortgage Stimulus Program

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

Who Qualifies For Stimulus Checks In 2021

- Katrina Schollenberger, SEO Reporter

- 17:18 ET, Jan 5 2021

AMERICANS who have been affected by the coronavirus pandemic are eagerly awaiting their second round of stimulus checks.

According to CNET, the new stimulus package has an IRS deadline for January 15 – meaning payments must be decided and mailed by that date.

Don’t Miss: Irs Fourth Stimulus Checks Update

Important: Third Stimulus Check Qualification Details

The third stimulus checks now going out open up more avenues for people to claim a payment — so long as their yearly earnings in 2019 or 2020 fall within the brackets for receiving the third check. These new payments come with changes to the income limit for individuals and families who’d qualify for a full stimulus payment — it isn’t the same as it was for the first two rounds of checks approved in 2020. Check out the chart below for more and use our stimulus calculator to estimate how much you could get.

Will The Child Tax Credit Be Direct Deposited

If the Child Tax Credit Update Portal shows that a family is eligible to receive payments but not enrolled to receive direct deposits, they will receive a paper check each month. … With direct deposit, families can access their money more quickly. Direct deposit removes the time, worry and expense of cashing a check.

You May Like: I Never Received Any Stimulus Check

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Stimulus Checks: Children And Dependents

Q. I had a baby in late 2020. Am I eligible for the child stimulus payments?A. If you had a baby in 2020, you are eligible for the $1,400 credit in 2021. This will be paid in an advance third stimulus payment if you filed your 2020 return by the time the payments were issued. If you didnt receive the first or second stimulus payment for your baby, you can claim the recovery rebate credit when you claim the child on your 2020 return.

Q. I have joint custody of my daughter with my ex-spouse, and I claimed her on my 2019 taxes . What do we need to know when my husband claims her?A. For the first and second payments, the spouse claiming the child in 2020 will claim the children and could receive the recovery rebate credit on the 2020 return.

However, for the third payment, divorced parents who alternate claiming their dependents each year, if an advance payment is received by one spouse for the dependent, no additional payment can be made for the same dependent on the other spouses return.

For example, if the payment is issued to Parent 1 because they claimed the child on their 2020 return, Parent 2 cannot claim the credit on their 2021 return even though they didnt receive the payment from Parent 1.

The second way is claiming the Recovery Rebate credit on your 2020 taxes, which you can do for the first or second payments. Youll receive the correct amount in the form of a tax credit that either lowers your tax bill or gets added to your refund.

Also Check: Irs Sign Up For Stimulus