Reconciling Your Covid Stimulus Payment On Your Tax Return

The COVID stimulus payment provided earlier this year brought financial relief to many who were struggling near the beginning of the pandemic. But it also brought some confusion to tax payers about how this stimulus check would be handled when it was time to file taxes. While we have touched on this topic in the past, we wanted to provide you with some more specific information regarding how this income is reported on your return, as well as addressing some other common questions about the stimulus payments.

Do You Need to Report Your Stimulus Payment?

Because your COVID stimulus check was non-taxable income, you do not need to report it on your 2020 tax return. The amount you received was not an advance on your tax refund, and will not reduce any refund you get in 2021 or increase any amount you may owe.

There will be an additional worksheet available for some tax filers this year for reporting your total Economic Impact Payment. However, the IRS has advised that this worksheet is only for those who did not receive a stimulus payment or who received less than the maximum payment amount.

Receiving Additional Stimulus Payments

Fill out the new worksheet and submit it along with Notice 1444. If you qualify for any additional stimulus payments, the Recovery Rebate Credit will be applied to your tax return. Note that, if you owe taxes, this may simply reduce your tax bill otherwise, any extra amount you qualify for will be distributed with your tax refund.

Stimulus Checks: 9 Million People Have Until November 17 To Claim Payments

The IRS last month began alerting 9 million people that they could still claim thousands in stimulus and Child Tax Credit payments. If you are one of those people, you have only one day left to claim the funds, with the tax agency setting a deadline of November 17 to get the money.

The IRS said it began mailing the letters in mid-October to reach millions of people who haven’t claimed benefits such as stimulus checks, the expanded Child Tax Credit and the Earned Income Tax Credit.

People who are eligible must file a tax form by end of day on Thursday, November 17 to claim the money, the IRS said. The filing site will remain open until midnight E.T. on Thursday, the IRS said.

In disbursing billions of dollars in stimulus payments to help keep households financially afloat during the pandemic, the IRS relied on tax returns to determine eligibility as well as where to send the payments, as tax returns include bank account information or home addresses for mailing the checks. But about 9 million Americans have yet to claim the funds because they didn’t file a 2021 tax return, according to the agency.

The IRS noted that people who are eligible can file a tax return even if they didn’t receive a letter. The agency added that there’s no penalty for taxpayers who receive a tax refund even if they file after the regular April 2022 tax deadline.

The letters include information on how to claim the money, the IRS said.

Nonfilers Are Likely Eligible To Get Both Of The 2020 Stimulus Checks

Most nonfilers fall below the income limits stipulated by each stimulus package and would be eligible for the full amount in each round $1,200 per person under the 2020 CARES Act passed in March 2020, and $600 per person under the December 2020 stimulus bill. Find the full eligibility rules for each stimulus check here.

If you receive SSI or SSDI, you should have received at least a portion of both of those stimulus checks automatically the IRS obtained the names of Social Security recipients and SSI beneficiaries from the Social Security Administration in the spring and made the payments to them automatically, according to Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center.

If either of your checks are missing, however, youll have to take the extra steps below.

The IRS started processing tax returns on Feb. 12. The federal tax return deadline was extended to May 17.

Read Also: H& r Block Stimulus Tracker

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Americans Who Didnt Receive The Full Stimulus Amount That They Were Entitled To

If you received a payment but you dont think it was as much as it shouldve been, you should claim your Recovery Rebate Credit.

Americans should first think back to what they were eligible for from both rounds of stimulus payments. Individuals earning up to $75,000 in adjustable gross income were eligible for the full $1,200 payment in March and the second $600 payment from late December and early January. Married couples earning up to $150,000 were eligible for payments twice that size. Those earners were also eligible for an extra $500 and $600 for every dependent claimed on their taxes.

After that, payments phased out by $5 per every $100 over those income thresholds. This is probably where it gets a bit trickier.

Because the first stimulus check was larger, payments phased out at a later point on the income scale than they did for the second round. Reduced $1,200 checks went out to individuals who made up to $99,000 a year and married couples who earned up to $198,000. In the second round, individuals and married filers were eligible for a partial check up until earning $87,000 and $174,000, respectively.

Its important to calculate first for yourself how much youre owed. Then, compare that with official documents from the IRS showing your stimulus check amount. Those can include the letter accompanying your payment, as well as another special form, Notice 1444 or Notice 1444-B, which most likely came with your first check earlier in 2020.

Also Check: How To Claim Stimulus Check On 2020 Tax Return

Irs Free File Available Today Claim Recovery Rebate Credit And Other Tax Credits

- Do Your Taxes for Free with Free File English | Spanish

IR-2021-15, January 15, 2021

WASHINGTON IRS Free File online tax preparation products available at no charge launched today, giving taxpayers an early opportunity to claim credits like the Recovery Rebate Credit and other deductions, the Internal Revenue Service announced.

Leading tax software providers make their online products available for free as part of a 19-year partnership with the Internal Revenue Service. There are nine products in English and two in Spanish.

As we continue to confront the COVID-19 pandemic, IRS Free File and certain other similar online tax preparation products such as MilTax Tax Services for the Military offered through the Department of Defense offers taxpayers a free way to do their taxes from the safety of their own home and claim the tax credits and deductions they are due, said Chuck Rettig, IRS Commissioner. We encourage eligible taxpayers to take a look at using Free File, MilTax and similar free online tax preparation products this year, to follow the lead of over 4 million people who took advantage of these free services just last year. An IRS tax refund is often the single largest payment families receive during the year. We know how critical that refund is, especially this year.

IRS Free File online products are available to any taxpayer or family who earned $72,000 or less in 2020. MilTax online software will be available on January 19, 2021.

I Used The Irs 2020 Or 2021 Non

The IRS has issued all first, second, and third stimulus checks. If you have not received your first,second, or third stimulus check, you will have to claim your stimulus checks asthe Recovery Rebate Credit. You will need to file a 2020 tax return to claim the first or second stimulus checks and file a 2021 tax returnto claim the third stimulus check. .

Learn more about how to get your stimulus checks.

You May Like: Will There Be Another Stimulus Check In 2020 To

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What If Letter 6475 Says That I Received Money But I Didnt

First, the IRS recommends that you check your bank account records for 2021 to make sure. They particularly advise looking for deposits from the IRS in spring or early summer.

Next, check your online IRS account. The info on the IRS website will be more up to date than Letter 6475, particularly if a payment was returned. If your online account says that you received stimulus payments, but you didnt see the money, you should contact the IRS immediately to see if a payment trace is required.

You May Like: How To Get My Second Stimulus Check

Recommended Reading: Do I Have To Claim Stimulus Check On 2021 Taxes

How Much Stimulus Money Can I Get

The first payment, approved in March 2020, is worth up to:

- $1,200 for single filers and heads of household

- $2,400 for married joint filers

- $500 for each qualifying child

The second payment, approved in December 2020, is worth up to:

- $600 for single filers and heads of household

- $1,200 for married joint filers

- $600 for each qualifying child

People who had a baby in 2020 may be able to claim the additional $500 for a qualifying child , even if they received the maximum payment as an individual or couple. Additionally, the second round of stimulus allowed mixed-status families where only one spouse has a work-eligible Social Security number to be eligible for single and qualifying child payments. The rule is retroactive to the first round of stimulus as well.

Coronavirus Aid Relief And Economic Security Act

As Coronavirus continues to disrupt the U.S. economy, many have turned to the federal government for hope. To help provide relief in these unprecedented times, the Coronavirus Aid, Relief and Economic Security Act a $2 trillion stimulus package to help individuals, families and businesses was signed into law.

This relief takes many shapes, such as:

- Widespread stimulus legislation, including efforts such as stimulus checks, mortgage relief for those adversely impacted by the economic slowdown, student loan interest relief, and more.

- The Federal Reserve has announced actions to stabilize and backstop the economy.

But how do some of these efforts work and who will they directly impact? Let’s take a look at the stimulus checks, how they work, who qualifies, how do you get one, and how your taxes will be affected.

You May Like: How To Get 1400 Stimulus Check

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Sign Up For The Stimulus Check

Whos Eligible For This Money From The Irs

Who are these 9 million people who could be eligible to get thousands of dollars from the IRS?

To be blunt, were mostly talking about low-income households. The IRS says people who werent required to file 2021 tax returns are typically individuals earning less than $12,500, or married couples who earned less than $25,000 last year.

But there are also higher-earning people who, for various reasons, havent gotten around to filing their 2021 taxes. However, the IRS is only mailing letters to people who appear to qualify for these tax credits but havent filed a 2021 tax return yet.

Which means if you dont hear from the IRS, theyre not trying to give you money, so youre not missing out on anything. Sorry.

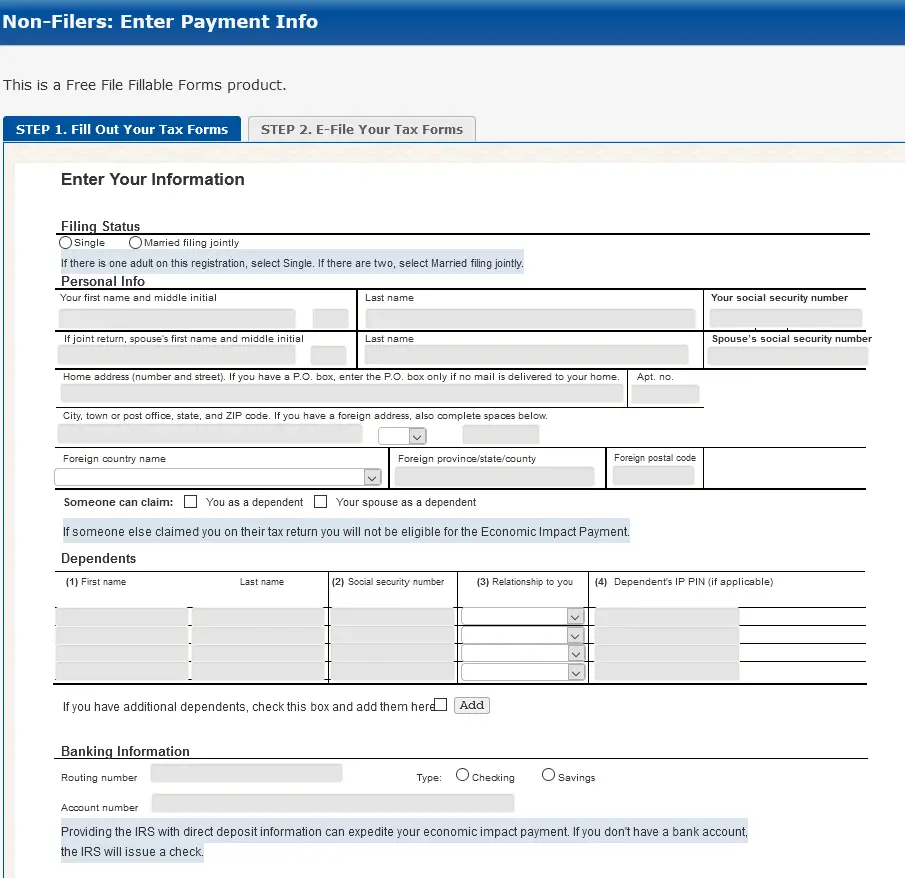

Fill Out Filing Status Claim Dependents And Provide Banking Information

For STEP 1. Fill Out Your Tax Forms, there is required and optional information to complete. Skip the optional fields if they do not apply to you.

Required:

- First name, middle initial, and last name

- Social Security Number or Individual Identification Number

- Dependents in 2020: First and last name, SSN, relationship to you. Check the box if they qualify for the CTC.

Note: these fields are required for both you and your spouse if you are married filing jointly. If you have a new qualifying child in 2021, you will be able to provide their information in a separate tool this summer.

Optional info:

- Check the box if you or your spouse can be claimed by someone else as a dependent

- Recovery Rebate Credit amount: If you didnt get the full first or second stimulus check, you can enter the amount you are owed

- Bank account routing info: If you leave this blank, your payments will be mailed.

- Identity Protection PIN: only include if the IRS provided you a number because youve experienced identity theft.

After entering all the information that relates to you, click Continue to Step 2.

If you didnt receive your full first or second stimulus check, you can enter your Recovery Rebate Credit amount to get your money. Be sure you know the exact amount you received. If you dont enter the right amount, your CTC and stimulus checks may be delayed.

Heres how you calculate how much you are owed.

First stimulus check: $1,200 OR $2,400 + $500 per dependent

Don’t Miss: Stimulus Check Direct Deposit Date

Why Did I Receive Irs Letter 6475

According to the IRS, Economic Impact Payment letters include important information that can help you quickly and accurately file your tax return, including the total amount sent in your third stimulus payment.

This could include plus-up payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

Even though it is not taxable income, you still need to report any stimulus money on your IRS return. In 2020, the IRS received over 10 million returns that incorrectly reported stimulus money, according to IRS Commissioner Charles P. Retting, resulting in manual reviews and significant refund delays.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but thats not what you want to use to prepare your 2021 return.

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Read Also: N.c. $500 Stimulus Check