What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

How Much Stimulus Money Can I Get

The first payment, approved in March 2020, is worth up to:

- $1,200 for single filers and heads of household

- $2,400 for married joint filers

- $500 for each qualifying child

The second payment, approved in December 2020, is worth up to:

- $600 for single filers and heads of household

- $1,200 for married joint filers

- $600 for each qualifying child

People who had a baby in 2020 may be able to claim the additional $500 for a qualifying child , even if they received the maximum payment as an individual or couple. Additionally, the second round of stimulus allowed mixed-status families where only one spouse has a work-eligible Social Security number to be eligible for single and qualifying child payments. The rule is retroactive to the first round of stimulus as well.

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Recommended Reading: Change Address For Stimulus Check

Why Your Stimulus Check May Be Missing

Although the stimulus payments have provided some much-needed relief, the delivery process has not been without its flaws. In some cases, payments have been deposited into old, inactive bank accounts or checks mailed to the wrong address other individuals have received a payment for themselves, but not for their dependents and folks who dont typically file taxes may have slipped through the cracks entirelyparticularly those who missed the deadline to use the IRS non-filers tool to claim payment. Bottom line: There are a whole host of reasons why your Economic Impact Payment might have missed the mark, or just gone missing. Whatever the case may be, theres a fairly straightforward solution, and it comes down to filing your 2020 taxes.

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you dont spend it within 12 months, the Social Security Administration will count the money as a resource.

Dont Miss: Do We Have To Pay Taxes On The Stimulus Check

Also Check: Where Is My First And Second Stimulus Check

Golden State Stimulus Taxation

While individual states that offered stimulus checks may have different rules, the California Franchise Tax Board confirms on its website that the Golden State Stimulus payments are not subjected to state tax.

As with the federal stimulus payments, the Golden State Stimulus cannot be claimed as income.

Therefore, it cannot be claimed on an income tax return.

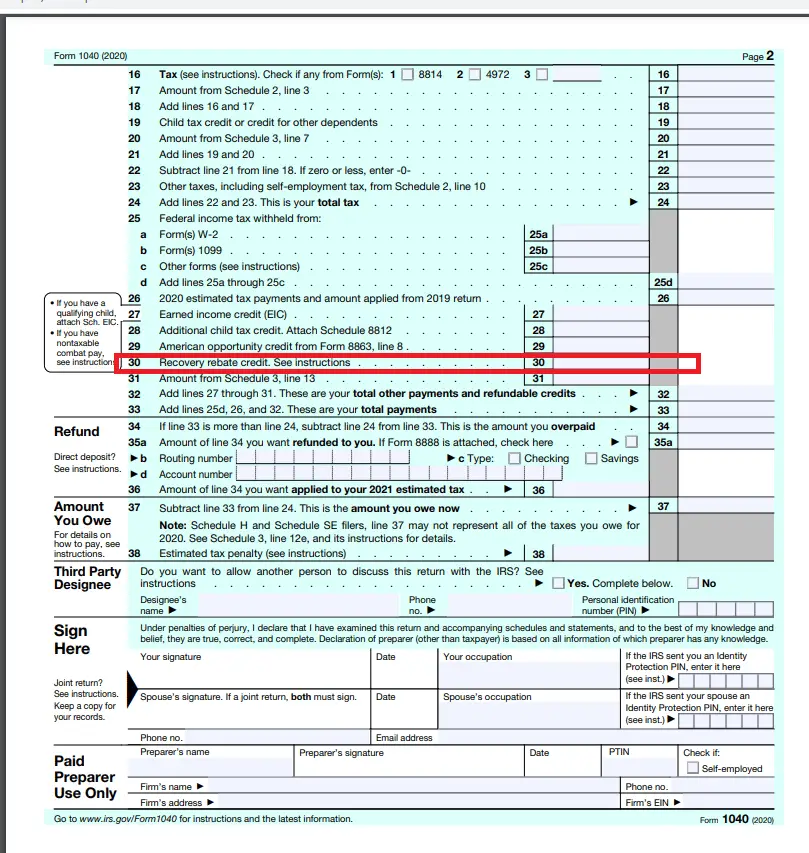

How To Claim A Missing Stimulus Check On Your 2020 Tax Return

Good news: The recently passed American Rescue Plan Act means that many Americans will be receiving a third stimulus check in the coming weeks, bringing up to $1,400 per person in your household. But what if you never received your first or second stimulus payment, for your or your dependents? Heres how to claim the stimulus check you so deserve. Spoiler: It involves the drudgery of filing your taxes .

You May Like: Is Texas Giving Stimulus Money

Coronavirus Aid Relief And Economic Security Act

As Coronavirus continues to disrupt the U.S. economy, many have turned to the federal government for hope. To help provide relief in these unprecedented times, the Coronavirus Aid, Relief and Economic Security Act a $2 trillion stimulus package to help individuals, families and businesses was signed into law.

This relief takes many shapes, such as:

- Widespread stimulus legislation, including efforts such as stimulus checks, mortgage relief for those adversely impacted by the economic slowdown, student loan interest relief, and more.

- The Federal Reserve has announced actions to stabilize and backstop the economy.

But how do some of these efforts work and who will they directly impact? Let’s take a look at the stimulus checks, how they work, who qualifies, how do you get one, and how your taxes will be affected.

Claiming A Missing Stimulus Check : Issued April 2020

Heres how to claim your first missing stimulus check:

- Verify you qualified based on your 2018 or 2019 income.

- Make sure you didnt receive what you should have.

- Use the IRS worksheet to figure out how much you shouldve received. You could also use an online calculator or your electronic filing software.

- Claim that amount as the Recovery Rebate Credit.

- Wait for your money to arrive as a tax refund. If you owe the IRS more than it owes you in missing stimulus funds, your tax debt will be reduced by that amount. In other words, if youre due $600 in stimulus but you owe the IRS $1,000, youd just send the IRS $400.

Unfortunately, you can no longer use the IRSs Get My Payment tool to see how much you were entitled to under the first two stimulus rounds. At this point, that tool only works for the third stimulus payment.

You May Like: Irs 1044 Form For Stimulus Check

What To Know About Free Government Money

Economic stimulus payments are designed to help citizens pay their bills and increase consumer spending to improve the economy. Those stimulus payments arent taxable they are a gift from the government. There is no need to claim stimulus checks since stimulus payments arent considered part of your income. That also means that the additional payments dont affect your income tax bracket, so its essentially free money.

Everyone should have received two stimulus payments in 2020a payment of $1,200 per adult and then a second payment of $600 per adult. To be eligible for the 2020 stimulus checks you needed to earn less than $75.000 per year if you are single or less than $150,000 per year if you are married and file a joint tax return.

Government stimulus payments are considered an advance payment of a tax credit, and tax credits arent taxable income. Since stimulus money is considered a tax credit, you may even qualify to get money back. If you pay taxes and arent considered a dependent on someone elses income tax, then you are eligible to claim the tax credit.

There is a distinct difference between a tax deduction and a tax credit. A tax deduction is an expense that you can subtract from your taxable income. Once you calculate your total income, you subtract any deductions and that amount becomes your taxable income. A tax credit, on the other hand, is taken after you calculate your taxable income, so it is a dollar-for-dollar reduction in your tax bill.

Who Is Eligible For The 2020 Recovery Rebate Credit

Qualifying for the initial advance payments was based on the information that the government had at the time of distributing the payments. This could have been from your 2019 tax return or your 2018 tax return if you had not already filed a 2019 return by the time the money was issued. If you are attempting to claim part or all of the credit on your 2020 tax return, the credit will be based on your 2020 tax information.

In order to qualify for any of the credit on your 2020 tax return, you:

- Must be a U.S. citizen or U.S. resident alien in 2020

- Cannot have been a dependent of another taxpayer in 2020

- Must have a Social Security number that is valid for employment before the 2020 tax return due date

- Did not receive the full amount of the credit through an Economic Impact Payment

This includes someone who was born or died in 2020.

In some rare cases, a married couple filing a joint return may qualify for a full credit even if only one spouse has a valid Social Security number. On the other hand, nonresident aliens, estates, and trusts don’t qualify for the credit.

After meeting the qualification requirements above, the taxpayer’s adjusted gross income must fall within the limits to receive the credit based on their situation. Other eligible taxpayers may include those who:

You May Like: Third Stimulus Checks Tax Return

What If I Wait Until The April 15 Deadline To File My Taxes

April 15 is the due date for all 2020 tax returns, but filing your taxes sooner will not only potentially speed up delivery for any tax refund you might collect, it will also position you to get any missing stimulus money weeks or even months faster. We made a handy comparison chart here that looks at the timing.

What To Do If You Missed The Deadline To Claim Your Money

If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, donât worry. You can still claim that money when you file your taxes in 2023 â you just wonât receive it this year.

The final cutoff day for claiming the money will be on Tax Day in 2025, but we recommend filing as soon as possible.

You May Like: How To Check If You Received 3rd Stimulus Check

Recommended Reading: Va Stimulus Checks Deposit Date 2021

What To Do With Your Stimulus Money

You should have received government stimulus money either as a check, in the form of a debit card, or deposited directly to your bank account by the Department of the Treasury. That extra cash was undoubtedly welcome if you have been struggling to pay your bills during the pandemic. If you do need help with your finances during the COVID-19 crisis, remember that iQ Credit Union is always available to offer a helping hand.

One of the advantages of belonging to a credit union is that you become a member of a collaborative. Our mission is to help members with their financial needs, especially when times are hard. If you have unexpected expenses or are facing unexpected financial challenges because of the pandemic, iQ can help. For example, we are offering members the option to skip loan payments without incurring fees. We also are offering emergency relief loans, mortgage payment deferments, and assistance with government loans.

We are here to help you make the most of your money. If the pandemic has turned your finances upside down, it may be time to revisit your household budget. Our budgeting checklist is a useful tool to help you assess your finances. And remember that the financial professionals at iQ Credit Union are always available to help.

How Do I Claim The Recovery Rebate Credit In Turbotax

Third stimulus payments were made beginning in March 2021. If you received the full amount of the third stimulus payment in 2021 , you wont get any additional Recovery Rebate Credit on your 2021 return since youve already received the full amount of the credit as a stimulus payment.

If you didnt receive the full amount of your third stimulus payment, well help you claim the Recovery Rebate Credit when you file your 2021 taxes or your 2021 amended return and make sure you get the money you qualify for by double-checking the amount you received.

First, find the exact amount you received for the third stimulus payment.

- On your IRS Letter 6475, or

- By visiting the IRS View Your Account Information page and creating or accessing your account, or

- In your bank statements. You might be able to search your online statements for deposits made by the IRS or US Treasury

When you have it ready, enter all of your federal return information as you would normally.

Related Information:

Also Check: Irs Sign Up For Stimulus

Where Is My Third Stimulus Check

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page. IRS EIP Notices: We mailed these notices to the address we have on file.

Hint: Filing Electronically Could Make Your Life A Lot Easier

Even if you normally submit a paper tax return, it pays to file your 2020 taxes electronically. Not only will it be easier to calculate the Recovery Rebate Credit, but it could help you avoid other mistakes. Plus, if you’re due a refund from the Recovery Rebate Credit, you’ll get it a lot faster with an electronic return.

Don’t Miss: Is There Any New Stimulus Checks Coming

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

Timing Of Third Stimulus Checks

Question: When will I get my third stimulus check?

Answer: Millions of Americans have already received their third stimulus check. And the IRS will be sending out more over the next several weeks. So, if you havent received your payment yet , it should arrive relatively soon.

How long it will take to send all payments is not known yet. The IRS has a lot on its plate right now. Were in the middle of tax return filing season, so the IRS is already busy processing tax returns. The tax agency also has to send refunds for people who reported unemployment compensation on their 2020 return and come up with a way to send periodic child tax credit payments later this year. All of this could very well slow down the processing and delivery of third-round stimulus checks.

If the IRS already has your bank account information either from a recent tax payment that you made, a tax refund it sent you, or some other source then expect to get your third stimulus check faster. Thats because the IRS will be able to directly deposit the payment into your bank account. The IRS can also make a third stimulus payment to a Direct Express debit card account, a U.S. Debit Card account, or other Treasury-sponsored account. Otherwise, youll get a paper check in the mail.

If you already have a prepaid debit card from the IRS , youll get a new card if the IRS decides to send your third stimulus payment to you in that form.

Also Check: Is There Another Stimulus Check Coming Out Soon