Grants For Cultural Arts Live Events Theaters

Recognizing that most venues offering in-person cultural activities have been shuttered throughout the pandemic, Congress allocated $15 billion in grants for certain live events, movie theaters, museums and other cultural providers.

Eligibility:

Live venue operators or promoters, theatrical producers, live performing arts organization operators, museum operators, motion picture theater operators, or talent representatives who demonstrate at least at 25% reduction in revenues.

Smaller providers:

$2 billion was set aside for those with 50 full-time employees or fewer, but that set-aside expires after 60 days. So small providers need to act fast!

Harder-hit providers:

In the initial 14-day period, grants will be awarded to eligible entities that have faced 90% or greater revenue loss. This may include large movie chains. In the 14-day period following the initial 14-day period, grants will be awarded to eligible entities that have faced 70% or greater revenue loss. After these two periods, grants shall be awarded to all other eligible entities.

Money to be used for:

Grants to be used for specified expenses such as payroll costs, rent, utilities and personal protective equipment.

Amount:

The amount of grant appears to be up to 45% of your 2019 revenue or 85% of 2019 operating expenses. A first grant can be up to $10 million, and a second grant could be up to 50% of the first grant. In other words, a large movie theater chain could get $15 million in grants.

Who Can Qualify For The Employee Retention Credit

To qualify for the Employee Retention Credit, your business must meet one of the following criteria:

- Have been partially or fully closed because of a government order relating to COVID-19

- You paid employees between March 2020 and September 2021

- Your business qualifies as a recovery startup business

- You had a big loss in your gross receipts

Unfortunately, self-employed individuals cannot get the Employee Retention Credit.

Report Your Experiences And Any Unfair Practices You Encounter To The Attorney General

The Massachusetts Consumer Protection Act protects you from unfair or deceptive business practices. If you have encountered difficulties with landlords, mortgagees, creditors, debt collectors, suppliers, insurers, or other businesses you deal with, we want to know about it. We are also interested in hearing about your general experiences and what you have done to keep your business operational during the shutdown. Please provide us with your information on the Small Business Experience form.

Recommended Reading: How To Find Out If You Get Stimulus Check

Shuttered Venue Arts Program

This program, which is part of the December 2020 stimulus legislation, is expected to begin accepting applications here shortly.

The program targets as much as $15 million in grants for live venue operators or promoters, theatrical producers, live performing arts organization operators, museum operators, motion picture theatre operators, or talent representatives who demonstrate a 25% reduction in revenues with special amounts set aside for organizations with fewer than 50 full-time employees.

Because of implementation delays, the grants are now available even if youre participating in the Paycheck Protection Program, with certain restrictions.

» READ MORE: Whats in the stimulus bill? Heres how you can benefit, from checks to healthcare to tax credits and more.

What Else Should I Be Thinking About

- If you are applying for a PPP loan: If you know you cant meet the requirements needed to get the PPP loan forgiven, evaluate the risk of taking on that debt. Be aware that if you reduce the number of employees after loan origination, you may get a reduced dollar amount in loan forgiveness.

- If youre considering laying off employees: Experts say its always risky to layoff employees, as there are many termination laws and hoops to jump through. The PPP loan program was created to allow businesses to avoid those risks by giving them tools to keep people on their payrolls.

- If you are afraid you will not remain eligible for the loan: Experts say to make your best judgement call about the future. When normal commerce will resumes, will you be able to call employees back quickly and keep them on payroll? How will that cost affect your business?

- Communicate! As you are working through making decisions for your business, be sure to communicate with your employees with as much transparency as possible. Get their opinions, and lead with empathy. Do the same with your customers.

The Chamber has created numerous resources to help businesses find and apply for the funding program that best meets their needs, including a number of how-to guides for federal programs. Plus, every week Chamber leaders are engaging directly with business owners through a variety of virtual events.

Recommended Reading: Do You Have To Claim Stimulus Check On 2022 Taxes

Economic Injury Disaster Loan Program

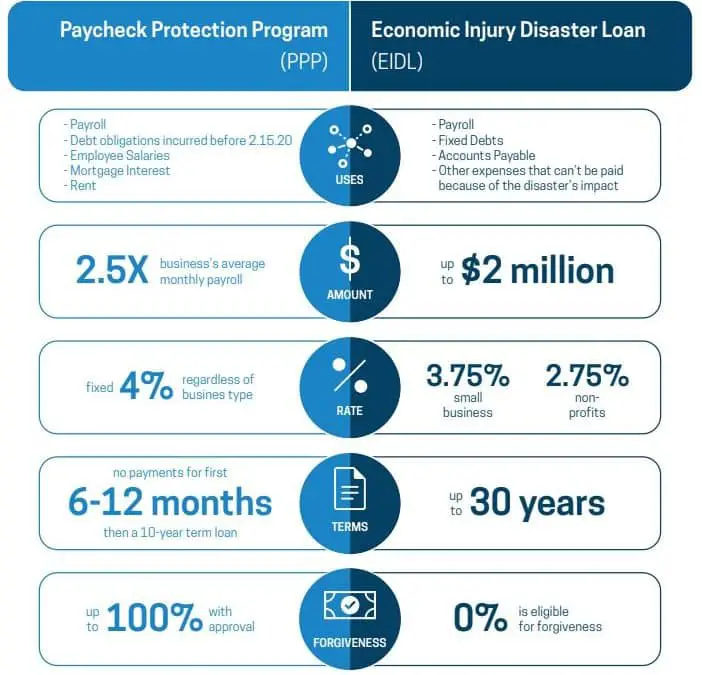

This program offers funds directly through the Small Business Administration to businesses affected by and located in disaster areas impacted by COVID-19. These $2 million loans have a 30-year maturity and interest rates of 3.75% for for-profit companies . You can receive an EIDL loan even if you get a Paycheck Protection Program loan and you can apply for these loans here through Dec. 31.

» READ MORE: Who gets $1,400 and when? Can my stimulus money be garnished for debts?

Families First Coronavirus Response Act Tax Credit

Although employers no longer must provide compensation to employees who with their families have been affected by COVID-19, those that choose to can take advantage of a tax credit on their federal payroll tax returns that reimburses them for these expense. The cost of compensating employees who miss work to get a vaccination shot or who suffer any side effects is now part of the eligible expenses allowed for this calculation. The credit is available through Sept. 30, 2021.

Don’t Miss: How To Apply For Homeowners Stimulus Package

Small Business Relief Fund 20

The City of Boston is committed to helping small businesses during this unprecedented time.

The City of Boston will be replenishing the Small Business Relief Fund 2.0 with $5 million. These funds will help support additional Boston small businesses as they continue their recovery.

The replenishment of the fund will reopen applications for the Small Business Relief Fund, which was initially launched in April 2020, and relaunched in September 2021. The fund will close to new applications on Friday, April 15, 2022, at 5 p.m.

Please note: Duplicate applications will not be considered.

- Get Translation Help with the Fund Application

Please note that the fund is now CLOSED and we will not be accepting any new applications.

Understand Inflation And How It Affects You

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, will be 8.7 percent next year. Here is what that means.

- Budget Surpluses: Up to 20 states are using their excess funds to help taxpayers deal with rising costs. But some economists worry that the payments could fuel inflation.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck next year.

Is there a catch?

Yes, but its not as big as before.

Usually, disaster loans require a personal guarantee of repayment, meaning that the S.B.A. can seize your personal assets like your house, if you own one if you default.

But in response to the pandemic, the S.B.A. is changing that.

It will not require a personal guarantee on loans of less than $200,000. Business assets, like machinery and equipment, can be used to secure loans of up to $500,000, an agency spokeswoman said.

Larger loans will require real estate whether its your businesss or your own if you have it. If you dont, the agency said, it will not turn borrowers away because they lack collateral.

What documents do I need to apply?

When the agency processes your loan, it may request additional material, including federal tax returns and a year-to-date profit-and-loss statement.

When will I get the money?

You May Like: How Many Economic Stimulus Payments Have There Been

Natural Resource Sales Assistance Program

In addition to the billions of dollars spent purchasing goods and services, the federal government also sells large amounts of natural resources and surplus property. The SBA Natural Resource Sales Assistance Program sets aside a percentage of these goods for bidding by small businesses only. In addition, federal agencies sometimes divide surplus materials into smaller parcels, making it easier for small businesses to purchase. The five categories are:

- Timber and related forest products.

- Strategic materials.

- Leases involving rights to minerals, coil, oil and gas.

- Surplus real and personal property.

The program also provides training for small businesses on government sales and leasing.

Emergency Economic Injury Grants

The bill creates a new $10 billion grant program, leveraging SBAs Office of Disaster Assistance infrastructure, to provide small businesses with quick, much needed capital.

Small businesses, cooperative, ESOPS, private non-profits, independent contractors and the self-employed are eligible to receive up to $10,000 to cover immediate payroll, mortgage, rent, and other operating expenses while they wait for additional relief to be processed.

Who is eligible?

Independent contractors, the self-employed, private non-profits, and small businesses and medium sized businesses with up to 500 employees, including startups, cooperatives, and ESOPs.

What is a private non-profit?

Private non-profits include churches and private universities.

Churches are eligible?

Yes, but limited to business activities. The SBA will make the final determination which activities, like running a thrift shop, are eligible for a grant.

How quickly will grants be made?

The legislation requires SBA to disburse the $10,000 grants within 3 days of verifying the businesss eligibility.

Are grant recipients eligible for other SBA programs?

Yes, businesses remain eligible for the paycheck protection program, disaster loans, and regular SBA-back loans.

You May Like: Amount Of 3rd Stimulus Check

How To Access Stimulus Funding For Your Small Business

FAQs on the SBA’s Payroll Protection Program for small businesses impacted by the coronavirus.

In March Congress passed the $2 trillion-dollar Coronavirus Aid, Relief, and Economic Security Act, a stimulus package that includes several programs aimed at small businesses impacted by the COVID-19 outbreak.

Demand for the popular Paycheck Protection Program has been massive since the application window opened on April 3. The original $349 billion allocated for the PPP ran out in mid-April. On April 24, Congress passed legislation to replenish funds for small business loan programs.

What’s New:The newest legislaition will allocate another $310 billion to the PPP and an additional $10 billion to the Economic Injury Disaster Loan grant program. The bill also includes $60 billion for other economic disaster loans for small businesses, with half of that amount reserved for community financial institutions and smaller banks and credit unions.

Wondering what new programs you should apply for? Unsure how to apply? Read on.

What Is The Coronavirus Stimulus Package

The CARES Act was signed into law at the end of March. The Act contains several provisions that provide help for small businesses, individuals, big businesses, and more. Altogether, the economic stimulus package provides some $2 trillion in aid from the federal government.

Many of the programs described in the CARES Act are beginning to go into effect. Our guide will break down the provisions that matter the most to businesses like yours.

- : More parts of the CARES Act

You May Like: Direct Express Stimulus Check Deposit Date 2021

Community Development Financial Institutions Fund

The CDFI Fund promotes economic revitalization and community development in low-income communities through investment in and assistance to mission-driven lenders known as Community Development Financial Institutions and other community development organizations. The CDFI Fund accomplishes this goal through the Community Development Financial Institutions Program, the New Markets Tax Credit Program, the CDFI Bond Guarantee Program, the Bank Enterprise Award Program and the Native American CDFI Assistance Program.

Small Business Lending Fund

The Small Business Lending Fund provided capital to qualified community banks and community development loan funds to encourage these institutions and Main Street businesses to work together to promote economic growth and create new jobs. Through the SBLF program, Treasury invested over $4.0 billion in 332 institutions, structured to incentivize increased small business lending.

You May Like: When Did The Government Give Stimulus Checks

Grants Changes For Economic Injury Disaster Loan

When EIDL grants were passed by Congress, they allowed for a $10,000 “Advance” to be treated as a grant, not a loan. The SBA unilaterally scaled back that grant to only be $1,000 for each employee, counteracting congressional intent. This addresses that issue.

Businesses in low-income communities that received an EIDL can get a grant equal to the difference of what they received and $10,000.

Eligible businesses in low-income communities that did not get EIDL/Advance grants because funds had run out can now get $10,000.

Also, if you previously received both an EIDL Advance grant and a PPP loan, you had to deduct the advance from your PPP forgiveness amount. You now no longer have to deduct that amount from forgiveness.

Sba Express Bridge Loans

Businesses that already have a relationship with an SBA lender may be eligible for Express Bridge Loans. These loans are for up to $25,000 with a fast turnaround time, and can be repaid with proceeds from Economic Injury Disaster Loans. They help businesses while they wait for other funding to come through. If you already have a relationship with an SBA lender, contact the lender to find out their process to apply for Express Bridge loans.

Read Also: How To Find Out What Stimulus Checks I Received

Who Can Qualify For Ppp Loans

The requirements to get a PPP loan were simple:

Thats it. There was no credit check, no collateral requirementsnone of the criteria usually used by lenders.

Note that pretty much all types of small businesses could get PPP loans. In addition to your typical small business, the following groups could qualify:

These small-business loans had a 1% interest rate . They also had a two-year maturity term.

All PPP loans had deferred payments for the first six months. Youd still accrue interest on the loan during that time, but you wouldn’t have had to make any payments.

Unlike other SBA loans, PPP loans had no fees. And these loans did not require collateral or a personal guarantee .

Work Opportunity Tax Credit

Extended through 2025, this income tax can be as much as $9,600 per new employee when the employee meets certain criteria, such as being released from prison, getting off welfare or returning to work after being unemployed for more than six months. Some employers I know are using this tax credit to fund hiring bonuses for new employees.

You May Like: I Didn’t Get The 1400 Stimulus Check

Past Pandemic Relief Programs

Small Business CARES Relief Grants

Application period: December 7, 2020 December 18, 2020

The Small Business CARES Relief Grants were authorized by the State of New Mexico in the November 2020 Special Session and were funded by $100 million in Federal CARES stimulus funds.

NMFA received 14,136 grant applications from New Mexico businesses totaling $156 million in funding requests. Grants were awarded to 6,743 businesses throughout New Mexico, with 60% of the funds provided to businesses in urban areas and 40% of the funds to businesses in rural areas of the state. The businesses receiving grants include restaurants, hotels, retail stores, nonprofit organizations, manufacturing companies, accountants, and many more in communities large and small throughout New Mexico. The smallest grant was $2,000 and the largest grant was $50,000. The average grant size was $15,000.

Small Business Recovery Loan Fund 2020

Application period: August 5, 2020 December 31, 2020

Enacted by the New Mexico Legislature during the June 2020 Special Session and signed into law by Governor Michelle Lujan Grisham, this program allocated funds to provide loans to businesses that experienced financial hardship due to the public health order resulting from the COVID-19 pandemic.

Number of businesses with approved loans: 890 Number of NM counties represented: 26 Number of NM cities and towns represented: 73

Total loan amount: $40,545,955

Assistance For Small Businesses

The COVID-19 public health crisis and resulting economic crisis have created a variety of challenges for small, micro, and solo businesses in communities across the country. The Treasury Department is providing critical assistance to small businesses across the country, facilitating the urgent deployment of capital and support to help these organizations not just persevere, but recover on solid footing.

Recommended Reading: When Did The First Stimulus Check Come Out

Shuttered Venue Operators Grants

Congress created the Shuttered Venue Operators grant program in December 2020 to help live venues that were harmed by COVID-19 restrictions. The SVO grant program will distribute $16 billion in funds to live venue operators, including eligible movie theaters, concert spaces, museums and performing arts organizations.

A significant change in the SVO grants occurred in March 2021, with the ARPA revising eligible venues. As of this writing, venues can receive first and second-draw PPP loans and still apply for SVO grants, but grant amounts will be reduced by the value of their PPP loans.

These grants are administered directly by the SBA, and the application portal is open. Notably, interested applicants should , obtain a D-U-N-S number, and immediately if they want to apply quickly.

The application portal for SVO grants is now open. Applicants can continue to register for an application portal account.

Read more about the SVO grants here.

What Small Business Relief Is In The New Stimulus

Small businesses will get billions of dollars in funding and aid under President Biden’s $1.9 trillion relief package.

The $1.9 trillion relief package signed by President Biden March 11 includes several provisions to help small businesses outlast the prolonged economic downturn.

The American Rescue Plan Act, which gained key Senate approval after tweaking unemployment benefits and removing the contested federal minimum wage hike, kick starts another round of government aid a full year into the pandemic and secures Joe Biden’s first major legislative victory as president.

Business management consultant Marco Robert welcomes the support as many of his customers have struggled to survive and cover expenses amid the pandemic.

Many small businesses had to fold up due to taxes, others couldn’t foot the bills due to the lockdown and even when they tried online, they lost customers,” says the founder of Tumiza Strategy Consulting LLC in San Mateo, Calif.

The Silicon Valley consultancy in December received $2,500 from the Paycheck Protection Program, which helped offset payroll costs for his staff of more than 25.

Also Check: Track My Golden State Stimulus 2