Social Security Cash Up To $1800 To Land In Millions Of Bank Accounts In Days

The proposal came after it was heard from many seniors who shared their hardships in the aftermath of the pandemic.

Shannon Benton with the Senior Citizens League told The Sun: “We have received hundreds of emails from people concerned about making ends meet.

“The high cost of living adjustment, for many, just exacerbated their financial woes by bumping their income above program limits to qualify for medicare savings programs and extra help.”

The Senior Citizens League isn’t the only one that is trying to get Congress’s attention.

How Have Americans Spent Their Stimulus Checks

There have been threecount themthree wide-reaching stimulus checks from the government since the pandemic hit. And now that a good chunk of time has gone by since they dished out the first one, were starting to see how people spent that money. Our State of Personal Finance study found that of those who got a stimulus check:

- 41% used it to pay for necessities like food and bills

- 38% saved the money

- 11% spent it on things not considered necessities

- 5% invested the money

And on top of that, heres some good news: Data from the Census Bureau shows that food shortages went down by 40% and financial instability shrank by 45% after the last two stimulus checks.25 Thats a big deal. But the question here isif people are in a better spot now, will they be more likely to manage their money to make sure things stay that way?

Stimulus Checks: Direct Payments To Individuals During The Covid

GAO-22-106044

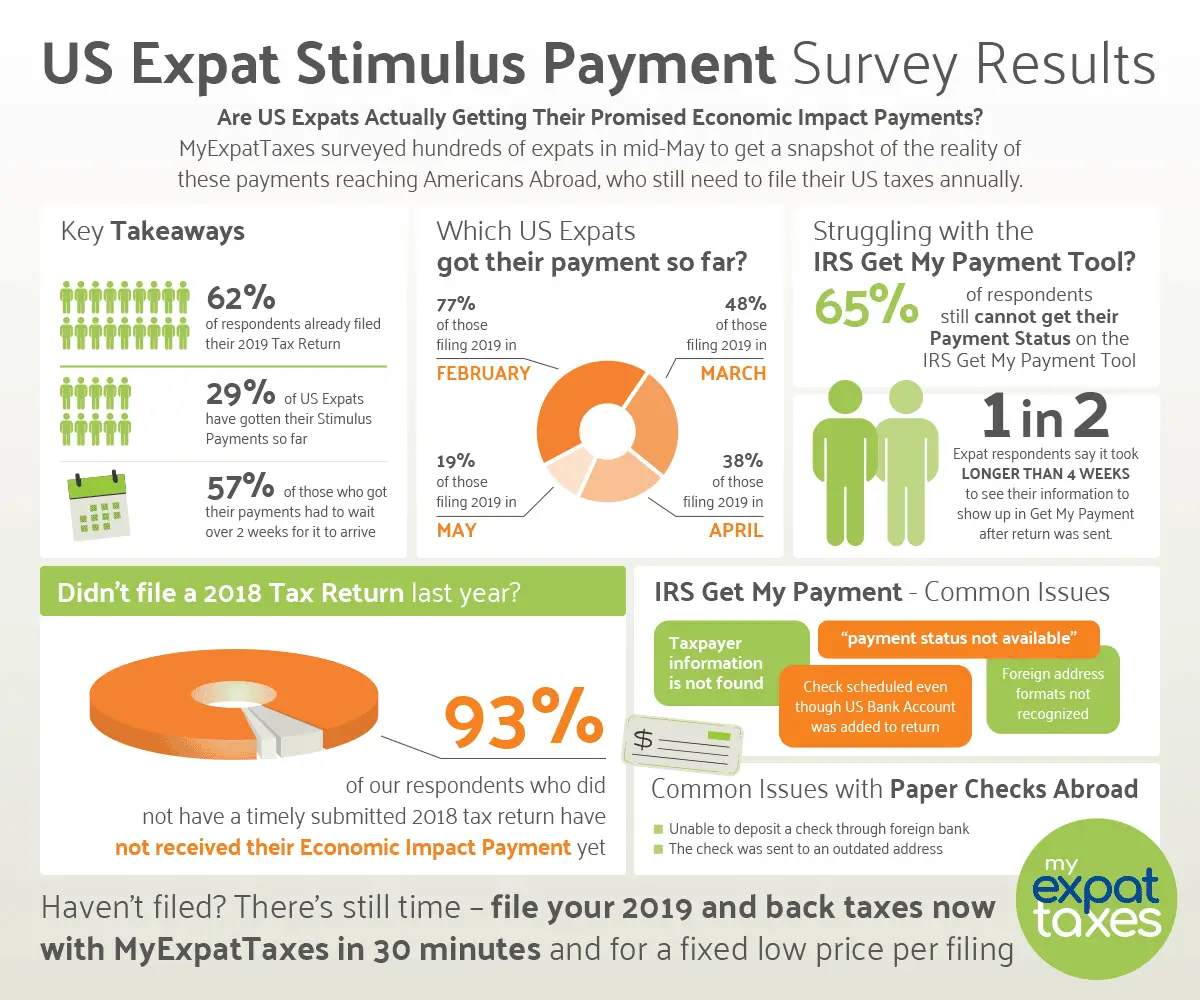

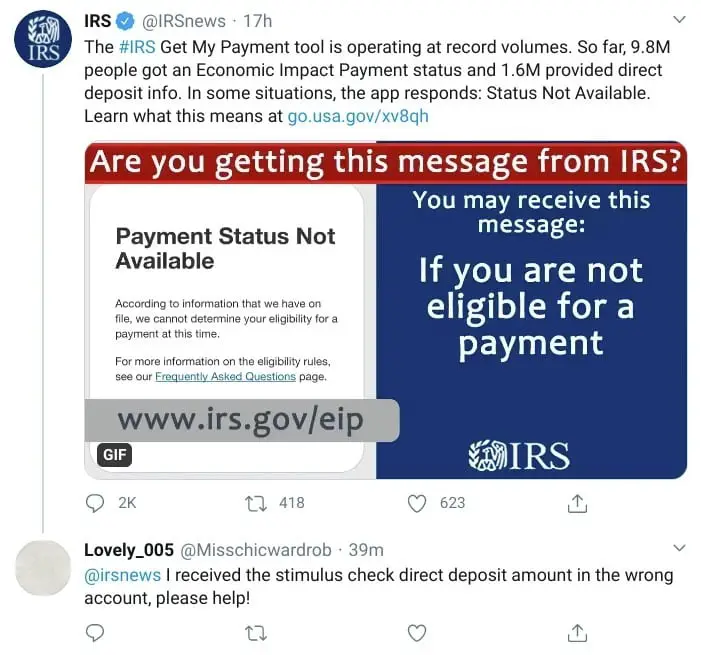

The federal government made direct payments to individuals totaling $931 billion to help with COVID-19. However, it was challenging for the IRS and Treasury to get payments to some people.

We found that nonfilers , first-time filers, mixed immigrant status families, and those experiencing homelessness were among those likely to have trouble receiving these payments in a timely manner.

We recommended that Treasury and the IRS tailor their outreach efforts to educate such people about their eligibility for these payments.

In 2020 and 2021, IRS and Treasury issued $931 billion in direct payments to individuals to ease financial stress due to the COVID-19 pandemic. However, some eligible Americans never received payments. We made recommendations to strengthen Treasury and IRSs outreach and communications efforts for the billions of dollars in similar tax credits IRS administers, such as the Earned Income Tax Credit.

Don’t Miss: New Home Purchase Stimulus Program

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

The Second Round Of Stimulus Checks

The second round of stimulus payments were authorized on December 27, 2020 as part of the Consolidated Appropriations Act, 2021. Those payments typically totaled $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child. The payments began phasing out at the same income levels as the current payments, but the maximum income levels to receive a payment were slightly higher. Taxpayers were ineligible for any payment, unless they had a qualifying child, above the following income levels:

- $87,000 for single taxpayers

- $124,500 for taxpayers filing as head of household

- $174,000 for married couples filing jointly

As of March 5, 2021, about $135 billion of the second round of payments have been sent out overall, such payments are expected to cost a total of $164 billion according to the Congressional Budget Office.

Recommended Reading: Is 2021 Stimulus Check Taxable

A Breakdown Of The Fiscal And Monetary Responses To The Pandemic

The COVID-19 pandemic, now in its third year, has tremendously impacted the U.S. and global economies. The U.S. government responded to the crisis when it enacted a number of policies to provide fiscal stimulus to the economy and relief to those affected by this global disaster. The Federal Reserve also took a series of substantial monetary stimulus measures to complement the fiscal stimulus.

In this article, we divided stimulus and relief efforts into monetary policy, made by the Fed, and fiscal policy, made by Congress and the Trump and Biden presidential administrations. Although the pandemic persists, many of these programs have since been discontinued.

When Can We Expect The Next Stimulus Check

The third stimulus check passed through a process called “budget reconciliation,” which allowed Democrats to push the legislation through with a simple majority vote in the Senate. The bill did not get any Republican support.

There is a limit on the number of times reconciliation can be used. Democrats are now focused on other priorities and Republicans have made it clear they’re not interested in providing additional COVID relief. As such, it’s unlikely a fourth stimulus check will be authorized. This is especially true as states ease lockdowns and vaccinations ramp up.

Also Check: What Was The 2021 Stimulus Check

Stimulus Checks: Is Your State Giving Out Money This Year

The federal government is no longer sending out stimulus money, but some states have stepped up to send residents a fourth stimulus check in 2022. Four states are currently preparing more stimulus payments and while everyone may not be eligible, these payments stand to benefit 87 million residents in total, Marca reported.

Social Security Trend: Stimulus Money Allowed Seniors To Retire Early and Receive Full Benefits

A 4th Stimulus Check Is Happeningif You Live In These States

10 Min Read | Jul 14, 2022

It seems like every time a stimulus check goes out, theres a five-second pause before someone starts asking, So . . . will there be another stimulus? . If youre one of those people who has been wondering if a fourth stimulus will happen, weve got your answer: Yes . . . kind of. Its true, a fourth stimulus check is happeningbut only if you live in certain states in America.

Right now, you might be thinking, Wait. What? Really?

Yep, its for real. Lets dig into this topic layer by layer and coast to coast.

Also Check: Are There Any Stimulus Checks Coming

Stimulus And Relief Package 1

The first relief package, the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020, nicknamed Phase One, was signed into law on March 6, 2020, by then-President Trump. It allocated $8.3 billion to do the following:

- Fund research for a vaccine

- Give money to state and local governments to fight the spread of the virus

- Allocate money to help with efforts to stop the spread of the virus overseas

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Recommended Reading: When Should I Get My Stimulus Check

The Stimulus Became Political

Part of the problem is that the last rounds of stimulus the checks that went out in December 2020 and March 2021 may actually have been too big. But the decision to send an extra $2,000 to most Americans wasnt backed by evidence or economic calculations. It was shaped by politics.

Though the CARES Act passed on a near-unanimous, bipartisan basis in March 2020, when former President Donald Trump was in office, a much different story played out in the transition from his administration to now-President Bidens. Toward the end of 2020, Trump pushed for additional $2,000 payments, which House Democrats supported and later passed, but that effort was blocked by Republicans in the Senate who were alarmed by the price tag. Ultimately, direct payments of just $600 were greenlit despite broad-based support for the bigger checks among voters of both parties.

But Democrats, with control of the Senate hanging in the balance, decided to campaign for larger stimulus checks in the run-up to the Georgia run-off elections. Its impossible to know whether support for the checks gave now- Sens. Raphael Warnock and Jon Ossoff their respective edges, but Democrats did end up winning both seats and passing the American Rescue Plan two months later, which included $1,400 checks to meet the desired $2,000 target.

Instead of helping Biden and his party, then, the stimulus could end up hurting them in the 2022 midterm elections.

Minnesota: $750 Payments For Frontline Workers

Some frontline workers could receive a one-time payment of $750, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021, and were not eligible for remote work. Workers with direct Covid-19 patient-care responsibilities must have had an annual income of less than $175,000 between Dec. 2019 and Jan. 2022 workers without direct patient-care responsibilities must have had an income of less than $85,000 annually for the same period. Applications for the payment are now closed.

Walz recently proposed using the states $7 billion budget surplus to fund a generous relief package, proposing that Minnesotans receive tax rebate checks of $1,000 per person. Doing so would require action from the state legislature.

Recommended Reading: Update On 4th Stimulus Check For Ssi

Republican Talking Point Omits Key Details About Stimulus Payments To Inmates

Posted on September 19, 2022

Some congressional Democrats voted for COVID-19 relief bills that resulted in stimulus checks being sent to inmates but so did some congressional Republicans.

Boston Marathon bomber Dzhokhar Tsarnaev was one of the prisoners eligible for a $1,400 stimulus check but he didnt get to keep it, because a federal court ruled that the payment could be seized to pay Tsarnaevs criminal fines and for restitution to his victims.

But those two facts that Republicans voted for previous stimulus checks and Tsarnaev didnt keep his check were omitted from Republican attacks on a number of Democrats who voted for the American Rescue Plan Act of 2021.

That law like two previous COVID-19 relief bills that were enacted in 2020 with overwhelming bipartisan support did not block inmates from receiving economic impact payments intended to help individuals and families during the pandemic.

For example, in Florida, a TV ad from Sen. Marco Rubios reelection campaign says that Rep. Val Demings, his Democratic challenger, joined Pelosi to give a billion in stimulus checks to convicted criminals and illegal immigrants.

Similarly, a Senate Leadership Fundad attacking Democratic Sen. Raphael Warnock in Georgia says, Warnocks at the center of even more liberal spending that allowed COVID relief checks to go to convicted criminals in prison like the Boston Marathon bomber, a Michigan sex abuser, and thousands of murderers and drug dealers.

State And Local Aid $745 Billion

Non-public

$0.4 bil.

At the outset of the pandemic, governments used the funds largely to cover virus-related costs.

As the months dragged on, they found themselves covering unexpected shortfalls created by the pandemic, including lost revenue from parking garages and museums where attendance dropped off. They also funded longstanding priorities like upgrading sewer systems and other infrastructure projects.

K-12 schools used early funds to transition to remote learning, and they received $122 billion from the American Rescue Plan that was intended to help them pay salaries, facilitate vaccinations and upgrade buildings and ventilation systems to reduce the viruss spread. At least 20 percent must be spent on helping students recover academically from the pandemic.

While not all of the state and local aid has been spent, the scope of the funding has been expansive:

Utah set aside $100 million for water conservation as it faces historic drought conditions.

Texas has designated $100 million to maintain the Bob Bullock Texas State History Museum in Austin.

The San Antonio Independent School District in Texas plans to spend $9.4 million on increasing staff compensation, giving all permanent full-time employees a 2 percent pay raise and lifting minimum wages to $16 an hour, from $15.

Alabama approved $400 million to help fund 4,000-bed prisons.

Summerville, S.C., allocated more than $1.3 million for premium pay for essential workers.

What was the impact?

Read Also: How To Know If You’re Eligible For Stimulus Check

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Great Recession Of 2008

In 2007, as a result of financial deregulation and banks engaging in hedge fund trading, the U.S. Economy began to falter. Housing prices started falling as supply outpaced demand. Homeowners couldnt afford payments on their houses, but also couldnt sell their homes. Eventually, banks stopped lending to each other when the values of the derivatives crumbled, leading to the Financial crisis known as the Great Recession. In response, President George W. Bush signed the Economic Stimulus Act in 2008 to alleviate the effects and stave off the recession. The act consisted of $152 billion that included a $600 tax rebate to low- and middle-class households.

When President Barack Obama entered office, he signed the American Recovery and Reinvestment Act of 2009 on February 17, 2009 in response to the Great Recession. The law aimed to save existing jobs, create new jobs, invest in infrastructure, education, health, renewable energy, and provide temporary relief programs for those most affected.

The ARRA stimulus package boosted the economy immediately, and additional legislation known as the Dodd-Frank Act instilled confidence in American consumers, helping to prevent further economic collapse.

Also Check: Stimulus Checks Status Phone Number

Covid + Credit: 4 Things To Know About Stimulus Checks & The Cares Act

Reading Time: 7 minutes

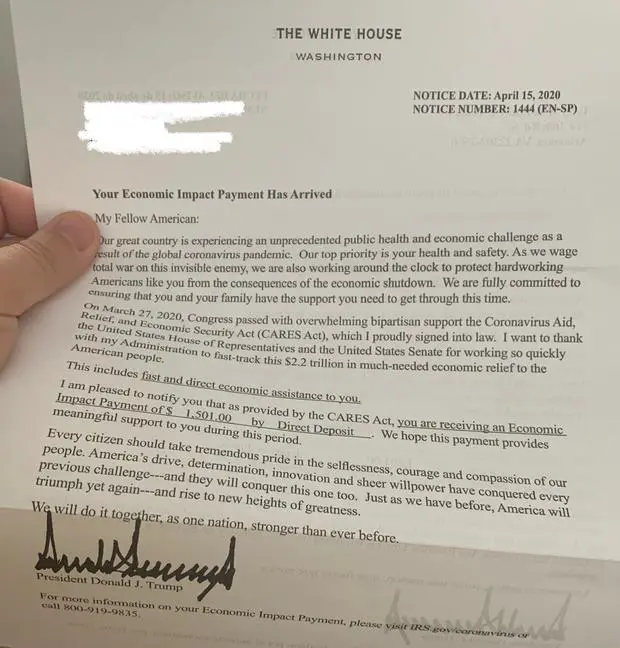

The $2 trillion Coronavirus Aid, Relief, and Economic Security Act, approved in late March by Congress, provides relief across the economic spectrum provided you can understand every opportunity the massive piece of legislation offers. With news during the Coronavirus/Covid-19 pandemic breaking at a rapid pace, it can be hard to decipher the legislative efforts aimed at helping you. Were here to guide you through that process. Here are four things to know about the CARES Act.

Fresh Stimulus Checks Could Be Bad News

A fourth stimulation check would be unwelcome for one simple reason. The federal government only grants stimulus funds when it believes it is vital to stimulate the economy or assist citizens in dealing with a financial crisis.

To get another stimulus payment, the country would need to be in a serious recession or the COVID-19 pandemic would need to worsen, maybe due to a more virulent strain that the vaccines were ineffective against. Nobody wants these things to happen even if it means sending out another payment.

Although you should not expect a fourth check from the federal government owing to the implications for the country, things are different when it comes to financial assistance from your state.

As a result, many local governments have ended up with a budget surplus. Some of this money is being distributed to people in the form of various sorts of stimulus checks in a number of states. The issuing of these payments isn’t directly tied to any financial crises since the government is only dispersing extra monies.

So, if you want another stimulus payout this year, your best bet is for it to come from your state. By visiting the website of your local Department of Revenue, you can find out if the location where you live is one of those accepting payments, The Motley Fool via MSN reported.

Don’t Miss: Why Have I Not Received My 3rd Stimulus Check

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

What Covid Relief Is Still Available

Among the assistance still available are rent assistance and tax breaks on student loans that were forgiven. Check with your state to see what local programs are available. For example, while the federal eviction moratorium has ended, a few states still have eviction bans in place. Others have allocated funds to help small businesses.

Read Also: How Do I Apply For The 4th Stimulus Check