Increase The Child Tax Credit Earned

- For those without children, the American Rescue Plan increased the Earned-Income Tax Credit from $543 to $1,502.

- For those with children, the American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and $3,600 for children under the age of six and raised the age limit from 16 to 17.

- The American Rescue Plan also increased and expanded the Child and Dependent Care Tax Credit, making more people eligible and increasing the total credit to $4,000 for one qualifying individual and $8,000 for two or more.

How Likely Is A Fourth Stimulus Check

Don’t hold your breath, according to Wall Street analysts.

For one, the Biden administration has focused on infrastructure spending to spark economic growth, betting that an investment in roads, trains and other direct investments will help get people back to work and spur the ongoing recovery.

Secondly, economists have pointed fingers at relief efforts such as the three rounds of stimulus checks for contributing to inflation. Because Americans had cash in their pockets, they boosted spending on goods such as furniture, cars and electronics. Combine that with the supply-chain crunch, and the result was sharply higher inflation, according to economists.

Without new stimulus efforts on the horizon, it’s likely that inflation could moderate in 2022, according to Brad McMillan, the chief investment officer at Commonwealth Financial Network. “One cause of inflation has been an explosion of demand driven by federal stimulus,” he noted in a December report. “But that stimulus has now ended.”

He added, “Yes, we will continue to face inflation and supply problems, but they are moderating and will keep doing so.”

Will The Us Government Be Sending More Checks

Unfortunately, the answer is no. The current Congress can’t pass a legislation similar to the American Rescue Plan Act until after the election.

According to several reports, there is not enough support to vote a bill that would approve another payment.

The 2022 United States midterm elections will be held on November 8, 2022. According to FiveThirtyEight, the Democrats have a 71 percent chance of keeping control of the Senate, but only 27 percent of doing so with the House.

Read Also: Is 2021 Stimulus Check Taxable

How Are Social Security Payment Dates Determined

The Social Security Administration sends out payments on three different Wednesdays of each month — the second, third and fourth. On which Wednesday you receive your money depends on your birth date. Payments for SSI recipients generally arrive on the first of each month . We’ll break it down.

- If your birthday falls between the 1st and 10th of the month, your payment will be sent out on the second Wednesday of the month.

- If your birthday falls between the 11th and 20th of the month, your payment will be sent out on the third Wednesday of the month.

- If your birthday falls between the 21st and 31st of the month, your payment will be sent out on the fourth Wednesday of the month.

Your payment date depends on your birthday and when you started receiving benefits.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

You May Like: Updates On The 4th Stimulus Check

What Is The Difference Between A Stimulus Check And A Tax Credit

The stimulus check is the same as a tax credit, and it is specifically an advanced refundable tax credit, meaning it is a refund allotted to you and is also sent in advance of the 2020 tax return.3 A refundable tax credit differs from a nonrefundable credit, which only applies to the amount of taxes you owe and is not available as a refund to you otherwise.3

Here’s What Else You Should Know

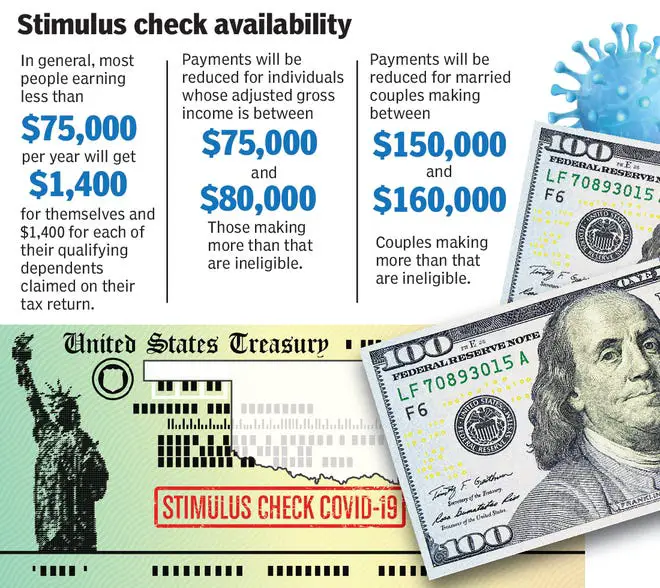

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

Families can also receive $1,400 per dependent, regardless of the dependent’s age.

The Child Tax Credit was also temporarilyextended by Congress to consider more families and increase how much they can receive.

Most families are eligible for $3,000 per child between the ages of six and 17 and $3,600 for each child under six. You can check the IRS’s site to determine if you qualify.

Tax returns can also be completed and submitted through CTC’s site, including the simplified filing tool which was updated on Wednesday.

GAO discovered that people within certain groups may have faced difficulty receiving their payments.

This includes those who:

Read Also: How Much Was The Third Stimulus Check Per Person

Alaska Dividend: 2022 Details

In 2021, the PFD amount was $1,114, and for a short time, it seemed as though Alaskans might receive as much as $5,500 from the state in 2022. When oil prices climbed after Russias invasion of Ukraine, Alaska, a top oil producing state, anticipated a surge in revenue. Whats more, in an election year, some lawmakers apparently felt pressure to follow through on campaign promises to deliver a large dividend.

The Alaska Senate passed a budget that would include a $4,200 PFD and a $1,300 energy relief payment. However, the price tagan estimated $3.6 billionwas too much for a majority of members in the House to stomach.

Instead, the final budget approved by state legislators included $3.4 billion from the Permanent Fund, which was split between dividends to residents and the general fund. It also added a $650 energy relief payment to the 2022 PFD for a total expected payment for individuals of $3,200.

Alaskans have waited seven long years to receive a fair and sizable dividend, and it couldnt have come at a more important time, said Gov. Mike Dunleavy in a press release.

Currently, the annual payment amount is set by legislators, something Dunleavy called an arbitrary political process in his statement. He said a better approach would be to amend the Alaska Constitution to include a funding formula.

What Has Biden Done About Student Loan Debt As President

Well get into whether Biden has the power to cancel massive amounts of student loan debt by his word alone or not. But first, lets take a trip down memory lane and see what the president has done so far when it comes to student loansand how he was able to do it.

Before his latest announcement, Biden had already canceled about $32 billion worth of student loan debt as president.3 Keep in mind, most of this forgiveness was because of already-existing federal policies targeted toward very specific student loan borrowers.

Also Check: Irs Where’s My Stimulus Payment

Whether Youre Getting An Inflation Stimulus Check Or Not You Need A Budget

Heres a crazy ideainstead of hoping for Uncle Sam to swoop in and save the day with an inflation stimulus check, give yourself a raise to tackle inflation. Okay, it might not be as easy as snapping your fingers, but its as easy as making a budget.

Most people feel like they got a raise after making their very first budget! Thats because doing a monthly budget actually puts you in control of your money. And when you tell your money where to go instead of wondering where it went, you feel like you just got a raise. And with this record-breaking inflation were having, that will really come in handy.

The easiest way to make a budget? Our free budgeting app, EveryDollar. Its an awesome stress-free way to make your first budget. And if you live in a state thats cutting an inflation stimulus check, EveryDollar will have your back when it comes to putting that money to work for you too. And lets be realthats a lot more than the government can say.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

Recommended Reading: Recovery Rebate Credit Second Stimulus

Child Tax Credit Stimulus Update

If youll recall from all our child tax credit coverage in 2021, Congress got a bit creative in how it structured the payout of that expanded benefit. Lawmakers essentially sliced it in half. Recipients got the first half up front, in 2021, spread out over six monthly checks.

The second half, however, is still coming later this year.

All of those recipients who got six child tax credit checks in 2021? Theyre also getting that same cumulative amount in the form of a tax credit. One that they can use when they file their federal taxes this year. For millions of Americans, theyll either be taking a $1,500 or $1,800 credit per child. Thats what those six checks added up to .

Minnesota: $488 Payments For Frontline Workers

Some frontline workers received a one-time payment of $488 in October, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020, and June 30, 2021, and werent eligible for remote work.

Workers with direct Covid-19 patient-care responsibilities must have had an adjusted gross income of less than $175,000 between December 2019 and January 2022 workers without direct patient-care responsibilities must have had an adjusted gross income of less than $85,000 annually for the same period. Applications for the payment are now closed.

You May Like: Only Received One Stimulus Check

California: Up To $1050 Rebate

Payments for Californias Middle-Class Tax Refund started hitting bank accounts and mailboxes at the beginning of October, with the most recent batch sent out on October 24. An estimated 23 million Golden State residents are eligible for these payments. To find out if you qualify, you can check the State of Californias Franchise Tax Board website. The Franchise Tax Board expects 90% of payments to be issued in October.

A one-time payment of $350 will go to individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Eligible recipients who received Golden State Stimulus payments by direct deposit should have seen their Middle Class Tax Refund deposited between October 7 and October 25. All remaining direct deposits were slated to occur between October 28 and November 14.

If you received your California stimulus payments by debit card, youll also receive the Middle Class Tax Refund by debit card between October 24 and December 10. Remaining debit card payments will be sent by January 14, 2023.

Read more: California Residents Receive Another Round of Stimulus Payments

Stimulus Payments 2023 Status: Will The States Be Sending More Checks

US citizens may have to wait

The United States government provided citizens with a significant financial boost following the COVID-19 outbreak through a series of stimulus checks.

Although gas and groceries prices are gradually falling, many American families are still struggling and their main question is whether a fourth stimulus check will be coming soon.

Recommended Reading: How Many Federal Stimulus Checks Were Issued In 2021

Covid+credit: When Will I Get My $1200 Stimulus Check

Reading time: 4 minutes

Americans everywhere have been hit hard by the Coronavirus/Covid-19 pandemic, with much of the economy in a holding pattern amid nationwide efforts to curb the spread of the virus. Fortunately for those in need, some short-term economic relief is coming in the form of federal government stimulus checks.

As a part of the record-setting $2 trillion Coronavirus Aid, Relief, and Economic Security Act approved in late March by Congress, most adults will receive a one-time payment of up to $1,200, though the exact amount depends on your income. Adults will receive an additional $500 for every qualifying child age 16 or under, and married couples without children earning below a certain threshold will receive a total of up to $2,400. You do not need to apply to receive a payment.

Now that U.S. government stimulus checks have turned from a dream into a reality, whats the top question on everyones mind? When will I receive my money? The short answer? Its complicated.

Whats More Likely To Happen Instead

But right now, there does not seem to be much appetite for another stimulus check.

However, there has been another push to bring back the enhanced $3,600 federal Child Tax Credit.

When exacted during 2021, millions of American families received monthly payments of up to $300 from July to December.

This helped cut child poverty by 46%, new data from the Census Bureau shows.

However, as a result of failing to extend the boosted credit, its on track to revert to $2,000 for 2022.

In particular, West Virginia Senator Joe Manchin, who fancies himself as a so-called conservative Democrat, has refused to sign onto it because there isnt a work requirement attached.

However, Axios reports that the White House is attempting a hail mary to bring back an enhanced version of the CTC.

In efforts to get Republican support, Democrats might be willing to add corporate tax credits to a package.

Its unclear if this will work or if the size would be $3,600, but the boosted CTC has been a major part of Mr Bidens economic agenda and it could be his last chance to get it if the Democrats lose control of the House or the Senate in the midterms.

Read Also: Is There Another Stimulus Check Coming For Seniors

New $2000 Stimulus Check Coming Soon Nearly Three Million Want It

These days, the expanded child tax creditswhich enable eligible parents to collect $250 or $300 for each child every month through the end of the yearare undoubtedly grabbing most of the headlines.

But that is not to say that demands for a fourth or even a fifth round of stimulus checks are totally dead. Do take note that one of the more passionate calls is being orchestrated by a popular Change.org petition, which recently surged past 2.9 million signatures. With that milestone in hand, it is only fewer than a hundred thousand away from reaching its target.

Continuing Regular Checks

Im calling on Congress to support families with a $2,000 payment for adults and a $1,000 payment for kids immediately, and continuing regular checks for the duration of the crisis. Otherwise, laid-off workers, furloughed workers, the self-employed, and workers dealing with reduced hours will struggle to pay their rent or put food on the table, states the petition, which was launched by a Colorado restaurant owner amid the ongoing coronavirus pandemic.

Our country is still deeply struggling. The recovery hasnt reached many Americansthe true unemployment rate for low-wage workers is estimated at over 20 percent and many people face large debts from last year for things like utilities, rent, and child care. These are all reasons that checks need to be targeted to people who are still struggling and that Congress needs to learn from this past year, it continues.

Seniors Call for Checks

Child Tax Credit: December End

Some families received another form of stimulus aid when the IRS in July deposited the first of six monthly cash payments into bank accounts of parents who qualify for the Child Tax Credit . Families on average received $423 in their first CTC payment, according to an analysis of Census data from the left-leaning advocacy group Economic Security Project.

Eligible families received up to $1,800 in cash through December, with the money parceled out in equal installments over the six months from July through December. The aid was due to the expanded CTC, which is part of President Joe Biden’s American Rescue Plan.

Families who qualify received $300 per month for each child under 6 and $250 for children between 6 to 17 years old. Several families that spoke to CBS MoneyWatch said the extra money would go toward child care, back-to-school supplies and other essentials.

While progressives and some Democrats urged lawmakers to continue the enhanced CTC, it appears stalled at the moment. That means families won’t receive a CTC payment in January or beyond.

Recommended Reading: How To Check Stimulus Payments