What Happens If You File Taxes Late

Generally speaking, the earlier you can file your return, the better.

In the event you file taxes late, the IRS starts by sending you a summons. If you earned enough income from a W-2 job or from self-employment during the tax year, generally, you should receive a W-2 or 1099 form reporting your income. Even if you dont report income on your tax return, you must remember that your employer or client might have.

The summons comes via mail and the IRS collection process begins, meaning the IRS has a reasonable belief that you do owe taxes. You’re legally required to meet with the IRS for you to determine your tax liability.

Irs Letter 6475 Notice 1444

Youll need to know the total amount of your third stimulus check payment and any plus up payments actually paid to claim the recovery rebate tax credit on your 2021 tax return. You can get this information from a few different sources. First, you should have received Notice 1444-C from the IRS shortly after receiving your third stimulus payment. If you received a joint payment with your spouse, the notice shows the total amount of the payment. If youre married but file separate 2021 tax returns, each spouse must enter half of the payment amount shown on Notice 1444-C. People who received a plus-up payment should have received a separate Notice 1444-C after your payment was sent. Save Notice 1444-C with your other tax records.

The IRS is also mailed Letter 6475 in January. This letter confirms the total amount of the third stimulus check and any plus-up payments you received for the 2021 tax year. Again, if you received a joint payment with your spouse, the letter shows the total amount of payments. If you file separate 2021 tax returns, each spouse must enter half of the amount shown on Letter 6475. Save this letter, too.

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Read Also: Is There Going To Be Another Stimulus Check In 2022

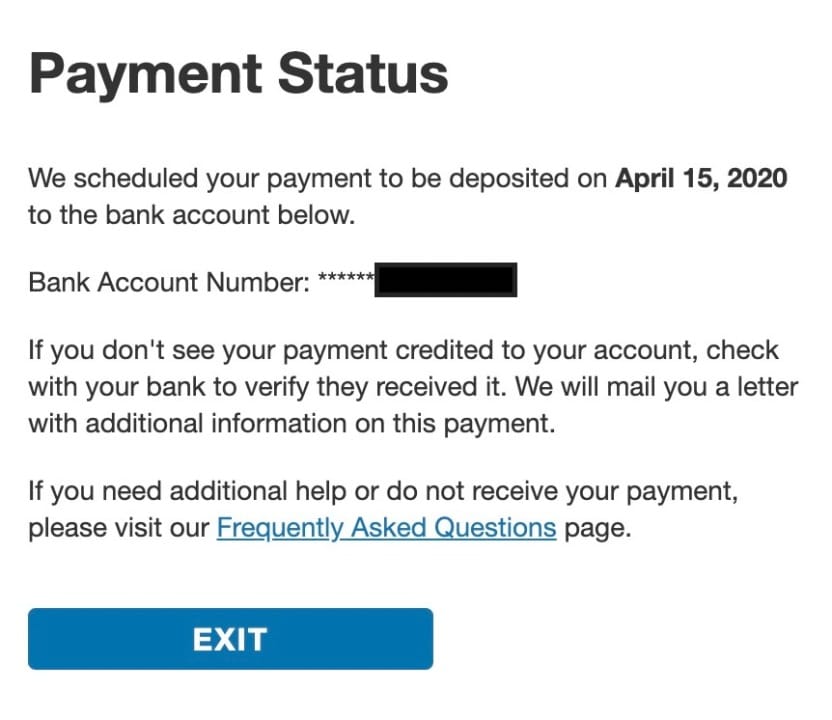

Filing Electronically And Choosing Direct Deposit Is The Fastest Way To Get Your Refund And Stimulus Payments

If I could give you one important piece of advice for filing your taxes, it would be to file electronically and choose direct deposit for your refund. The best way to file a complete and accurate return is to file electronically. The tax software asks questions about your income, credits and deductions and will help figure your Recovery Rebate Credit. If you want your refund as soon as possible, filing electronically and having your refund sent via direct deposit is the fastest and safest way to receive your money.

If you dont have a bank account, visit the FDIC website or the National Credit Union Association using their for information on where to find a bank or credit union that can open an account online and how to choose the right account for you. If you are a veteran, see the Veterans Benefits Banking Program for access to financial services at participating banks.

So, if you havent filed taxes recently because you thought you didnt have to, I hope Ive given you a closer look into why it might be a great idea to file in 2020. Its something that can be done electronically using a smartphone. Plus, with our helpful online resources and free filing assistance for certain taxpayers, its easier than ever to file electronically and see if youre due a refund. If youve already filed, thank you. Tell your friends and family so they dont lose the money theyre entitled to visit the filing information section of IRS.gov today!

What Happens If You Pay Taxes Late

If you filed a tax return on time but didn’t pay any owed taxes when they were due, the IRS will likely assess a penalty on you. Youll also learn of this penalty through the mail.

The penalty for failing to pay taxes on time is based on how long your overdue taxes remain unpaid. Failing to pay is a lot less expensive than paying the penalty for failing to file: 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid. The IRS wont levy a penalty of more than 25% of your unpaid taxes.

If you incur both penalties in the same month, the IRS will reduce the Failure to File Penalty by the amount of the Failure to Pay Penalty. For example, if you didn’t file a return and pay your taxes for an entire month, the 5% Failure to File Penalty would be reduced by 0.5% and only a 4.5% net penalty would apply.

The IRS gets a bit more lenient if you missed your tax payment but filed your individual tax return and have an approved payment plan in place. In this case, the Failure to Pay Penalty is reduced to 0.25% per month during your approved payment plan.

However, if you still choose not to pay your taxes within 10 days of receiving a notice from the IRS with an intent to levy taxes against you, the Failure to Pay Penalty becomes 1% per month or partial month.

The IRS applies full monthly charges on these penalties, even if you pay your taxes in full before the month ends.

Read Also: Check On Status Of Stimulus Check

Will I Still Need To File State Taxes By April 15

Yes. The extended deadline is only for federal income taxes. It doesnt affect a states income tax deadline. But last year, states also eventually pushed back their deadlines after Tax Day 2020 was extended to July 15 due to the pandemic.

Earlier this month, Maryland pushed its state income tax filing deadline to July 15, according to Comptroller Peter Franchot.

Its important that taxpayers check their state to see if they are moving their deadline.

How Much Will My Check Be For

The MCTR has been set up in three tiers based on the adjusted gross income on your 2020 California state tax return.

- Single taxpayers who earned less than $75,000 and couples who filed jointly and made less than $150,000 will receive $350 per taxpayer and another flat $350 if they have any dependents. A married couple with children, therefore, could receive as much as $1,050. This is the largest bracket, KCRA reported, representing more than 80% of beneficiaries.

- Individual filers who made between $75,000 and $125,000 — and couples who earned between $150,000 and $250,000 — will receive $250 per taxpayer, plus another $250 if they have any dependents. A family with any children could receive $750.

- Individual filers who earned between $125,000 and $250,000 and couples who earned between $250,000 and $500,000 would receive $200 each. A family with children in this bracket could receive a maximum of $600.

Don’t Miss: Irs.gov Stimulus Check 4th Round

What Happens If You Dont File Taxes And You Dont Owe Money

You might think that because you dont owe any money to the IRS that you dont need to file a return. However, owing tax versus facing a filing requirement, are two separate situations in the eyes of the IRS.

The IRS maintains restrictive guidelines for determining who needs to file a return. Because of that, it could mean that even if you don’t owe the IRS money, you may still need to file a return anyway. The restrictions used by the IRS are based on the amount and type of income you receive and whether your income will fall below the standard deduction applicable to your filing status.

More often than not, youre better off filing a return, even if you dont need to. That way, you wont run afoul of any IRS filing requirements, letting you avoid the penalties, interest and other consequences that come with not filing or paying your taxes on time.

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

You May Like: Are Refinance Fees Tax Deductible

You May Like: When Did The Third Stimulus Check Go Out

Governors And State Snap Medicaid Agencies Have Key Role

Governors and state agencies that administer SNAP and Medicaid can play a central role in raising awareness about the payments and connecting non-filers with assistance in getting them. Governors can direct agencies to use available resources to identify individuals eligible for the payments and provide support to help this vulnerable group apply. They also can use their leadership positions to educate the public and organize statewide outreach efforts governors have led many past outreach efforts, such as campaigns to promote federal tax refunds, childrens health care coverage, and immunization campaigns. Governors can drive such efforts through their chief-executive authority, their convening power, and by leveraging their ability to drive significant earned and unearned media interest . In states that administer SNAP and/or Medicaid at the county level, county leaders can play a similar role.

State agencies administering SNAP and Medicaid also can help identify people eligible for the payments and educate them about their eligibility and how to claim the funds. Though many of these agencies face overwhelming workloads now, incorporating this outreach into their regular activities would yield a high impact at relatively low cost. These agencies have daily contact with program participants by phone, in person, or in writing.

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes.

This year, Americans were only required to file taxes if they earned $24,800 as a married couple, $18,650 as a Head of Household, or $12,400 as a single filer. If you had total income in 2020 below those levels, you can sign up to receive monthly Child Tax Credit payments using simple tool for non-filers developed by the non-profit Code for America.

If you believe that your income in 2020 means you were required to file taxes, its not too late. In addition to missing out on monthly Child Tax Credit payments in 2021, a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed. For help filing a past due return, visit the IRS website.

Recommended Reading: Amending Taxes For Stimulus Check

What About Those Debit Cards

Watch the mail carefully! Last time, some taxpayers werent expecting them and accidentally tossed them in the trash.

If Treasury sends you a debit card, it will be issued by Treasurys financial agent, MetaBank®, N.A. The card will be sent in a white envelope with the U.S. Department of the Treasury seal. The card has the Visa V name on the front of the Card and the issuing bank, MetaBank®, N.A. on the back of the card.

Information included with the card will explain that this is your Economic Impact Payment or stimulus payment. More information about these cards is available at EIPcard.com.

Will I Owe Taxes On Stimulus Checks

No, stimulus checks arent considered income by the IRS. They are prepaid tax credits for your 2020 tax return, authorized by two relief bills passed last year that aimed at stabilizing the struggling U.S. economy in the wake of the pandemic. Because the stimulus payments arent considered income by the tax agency, it wont impact your refund by increasing your adjusted gross income or putting you in a higher tax bracket, for instance.

When it comes to getting paperwork ready, youll want to dig up the IRS Notice 1444 for the stimulus payment amount you were issued in 2020. And the second round of payments would be outlined in Notice 1444-B.

Jessica Menton and Aimee Picchi

Follow Jessica on Twitter and Aimee

Recommended Reading: How Does Taxes Work With Doordash

Recommended Reading: Irs Says I Got Stimulus But I Didn’t

Stimulus Faqwhy Have Stimulus Payments Been Delayed For People Who Receive Social Security Or Va Benefits

UPDATE: The IRS just announced on March 30 that payments to federal beneficiaries should be disbursed later this week. If you receive Social Security, disability, or VA benefits, you should receive your third stimulus payment the same way you receive your benefits. Direct Deposit recipients should receive payments within the next few days. If you receive your benefits by mail, it may take a few weeks.

On March 22, members of Congress wrote to the heads of the Internal Revenue Service and Social Security Administration to express concern over stimulus payment delays to beneficiaries. These delays extend to anyone who is set to receive their stimulus payment the same way they receive federal benefits. This includes Veterans who receive benefits through the U.S. Department of Veterans Affairs and Railroad Retirement Board Beneficiaries.

According to the American Rescue Plan Act, people who receive benefits through the SSA and VA should receive their third stimulus with no additional action needed. Benefits recipients would receive their third stimulus in the same way they receive their benefits.

However, payments for these groups have not started to go out thus far. Whats more, you will not be able to get information on the status through the IRS Get My Payment tool. And unfortunately, while the members of Congress asked for an update by Friday, March 26, no updates have been provided to the public as of yet.Why are stimulus checks tied to filing taxes?

You Can Still Get Your Payments But It May Require Filing Taxes This Year

Millions of Americans have already received their third stimulus payment. However, millions more are wondering how to get their payment, particularly those who dont file taxes. The good news is that you may still be eligible to receive the paymentyou can also claim the other two if you havent received them already. The bad news is that you may need to file a 2020 tax return even if you dont traditionally file.

This FAQ can help you understand how the system works and what you can do to claim any stimulus that you may be eligible to receive.

Read Also: How.many Stimulus Checks In 2021

Fill Out Filing Status Claim Dependents And Provide Banking Information

For STEP 1. Fill Out Your Tax Forms, there is required and optional information to complete. Skip the optional fields if they do not apply to you.

Required:

- First name, middle initial, and last name

- Social Security Number or Individual Identification Number

- Dependents in 2020: First and last name, SSN, relationship to you. Check the box if they qualify for the CTC.

Note: these fields are required for both you and your spouse if you are married filing jointly. If you have a new qualifying child in 2021, you will be able to provide their information in a separate tool this summer.

Optional info:

- Check the box if you or your spouse can be claimed by someone else as a dependent

- Recovery Rebate Credit amount: If you didnt get the full first or second stimulus check, you can enter the amount you are owed

- Bank account routing info: If you leave this blank, your payments will be mailed.

- Identity Protection PIN: only include if the IRS provided you a number because youve experienced identity theft.

After entering all the information that relates to you, click Continue to Step 2.

If you didnt receive your full first or second stimulus check, you can enter your Recovery Rebate Credit amount to get your money. Be sure you know the exact amount you received. If you dont enter the right amount, your CTC and stimulus checks may be delayed.

Heres how you calculate how much you are owed.

First stimulus check: $1,200 OR $2,400 + $500 per dependent

What To Do If You Cant Pay Your Taxes Right Now

If moneys tight and you cant afford to pay your taxes right now, the IRS offers payment options to spread out the time required to pay your taxes. You can set up a payment plan directly through the IRS website using their Online Payment Agreement tool.

To qualify, your specific tax situation will determine which payment options you can use. The available options include full payment, a short-term payment plan lasting 180 days or less or a long-term payment plan or installment agreement that requires you to make monthly payments.

If you choose to pay upfront through the IRS Direct Pay portal, you wont pay a setup fee nor will you need to pay future penalties or interest added to your balance. Under the short-term payment plan, you also wont encounter a setup fee, but you’ll need to pay accrued penalties and interest until the balance is paid in full.

If you elect to apply for a long-term payment plan through automatic withdrawals from your checking account, you’ll pay $31 and, like the short-term payment plan, you’ll pay accrued penalties and interest until the balance is paid in full.

If you opt for non-direct debit, you’ll face a $130 installment agreement setup fee. If you need to revise an existing payment plan or reinstate after a default, youll be charged a $10 fee.

Also Check: Set Up Direct Deposit For Stimulus Check