Why Your Stimulus Check May Be Missing

Although the stimulus payments have provided some much-needed relief, the delivery process has not been without its flaws. In some cases, payments have been deposited into old, inactive bank accounts or checks mailed to the wrong address other individuals have received a payment for themselves, but not for their dependents and folks who dont typically file taxes may have slipped through the cracks entirelyparticularly those who missed the deadline to use the IRS non-filers tool to claim payment. Bottom line: There are a whole host of reasons why your Economic Impact Payment might have missed the mark, or just gone missing. Whatever the case may be, theres a fairly straightforward solution, and it comes down to filing your 2020 taxes.

Golden State Stimulus Taxation

While individual states that offered stimulus checks may have different rules, the California Franchise Tax Board confirms on its website that the Golden State Stimulus payments are not subjected to state tax.

As with the federal stimulus payments, the Golden State Stimulus cannot be claimed as income.

Therefore, it cannot be claimed on an income tax return.

Increase In The Amount Of The Maximum Child Tax Credit For 2021

One significant change to the Child Tax Credit, effective in 2021, is an increase in the maximum amount of credit available per child. In general, the new IRC Section 24 increases the maximum amount of the credit to $3,000 per qualifying child for 2021. And even better, the enhanced maximum credit is further increased to $3,600 per qualifying child under the age of six .

Nerd Note:

While the increase in the maximum credit from $2,000 to $3,000/$3,600 per qualifying child is substantial in and of itself, it is even more significant considering the maximum credit per child was doubled only recently, beginning in 2018, from $1,000 to $2,000 per qualifying child, via the Tax Cuts and Jobs Act.

Example 5: Tony and Pepper are married taxpayers with two children, ages eight and four. Therefore, they are eligible for a maximum Child Tax Credit of $3,000 + $3,600 = $6,600 in 2021.

Tony and Pepper have $140,000 of AGI in 2021, which is less than the credit threshold established for joint filers.

Accordingly, they will receive the full $6,600 amount as a Child Tax Credit for 2021.

Not all clients with children age 17 and under will qualify to receive these enhanced 2021 Child Tax Credit amounts, though. Thats because the increased Child Tax Credit amounts authorized by the American Rescue Plan are subject to phaseout ranges at significantly lower income amounts than the standard Child Tax Credit.

- Joint Filers: $150,000

Read Also: How Do I Get The 3rd Stimulus Check

Don’t Miss: Are Getting Another Stimulus Check

What Happens If I Received A Partial Payment Or Did Not Receive My Stimulus Check Before I File My Taxes

If you were eligible, but received a partial payment or did not receive a stimulus check for the first and second stimulus payments, you can only claim it as a recovery rebate credit by filing your 2020 tax return or amending a previously filed 2020 tax return. TurboTax will ask simple questions to see if you received your stimulus checks and how much you received in order to see if youre eligible for the Recovery Rebate Credit.

The third stimulus payments under theAmerican Rescue Plan were issued during 2021 after the relief bill was signed into law on March 11, 2021. If you do not receive your third stimulus payment or you only received a partial payment, you will be able to claim more in the form of a recovery rebate credit when you file your tax year 2021 taxes.

What Can I Do If The Amount Of My Stimulus Payment Is Wrong

If you didnt get the additional $500 for your children or didnt get the full payment amount that you expected based on your eligibility, you can get the additional amount by filing a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you receive Social Security, Social Security Disability Insurance , or Supplemental Security Insurance OR are a railroad retiree or Veterans Affairs beneficiary, and didnt get the first stimulus check or the full amount you are eligible for, you will also have to file a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Read Also: Stimulus Checks Gas Prices 2022

Find Out If Your State Still Owes You A Tax Rebate Or Stimulus Check

South Carolina is mailing out refunds through the end of the year, and California won’t finish until January 2023.

Many states are still issuing tax refunds and stimulus checks as residents cope with ongoing inflation. Massachusetts only began returning $3 billion in surplus tax revenue in November. The Massachusetts payments, equal to about 14% of an individual’s 2021 state tax liability, are expected to continue to be issued at least through about Dec 15.

South Carolina will continue issuing for up to $800 through the end of the year, and residents of California, Colorado, Massachusetts and Hawaii are also still receiving their payments

Your state could be sending out a rebate or stimulus check, too. See if you qualify and how much you could be owed. For more ontax credits, see if you qualify for additional stimulus or child tax credit money.

File Electronically And Choose Direct Deposit

The amount of the 2021 Recovery Rebate Credit will reduce the amount of tax owed for 2021, or, if its more than the tax owed, it will be included as part of the individuals 2021 tax refund. Individuals will receive their 2021 Recovery Rebate Credit included in their refund after the 2021 tax return is processed. The 2021 Recovery Rebate Credit will not be issued separately from the tax refund.

To avoid processing delays, the IRS urges people to file a complete and accurate tax return. Filing electronically allows tax software to figure credits and deductions, including the 2021 Recovery Rebate Credit. The 2021 Recovery Rebate Credit Worksheet on Form 1040 and Form 1040-SR instructions can also help.

The fastest and most secure way for eligible individuals to get their 2021 tax refund that will include their allowable 2021 Recovery Rebate Credit is by filing electronically and choosing direct deposit.

Anyone with income of $73,000 or less, including those who dont have a tax return filing requirement, can file their federal tax return electronically for free through the IRS Free File program. The fastest and most secure way to get a tax refund is to file electronically and have it direct deposited contactless and free into the individuals financial account. Bank accounts, many prepaid debit cards, and several mobile apps can be used for direct deposit when taxpayers provide a routing and account number.

Also Check: Stimulus Check For Ssi And Ssdi

Who Is Eligible For A Third Stimulus Check

Some people may or may not be eligible for receiving a stimulus check. Among people that can expect this check include:

- Individuals with an $80,000 AGI or less

- Head of household with a $120,000 AGI or less

- Couples filing jointly with a $150,000 AGI or less

- Dependents of every age, if the guardian qualifies

- Families with mixed US citizenship

- US citizens who live abroad

- Citizens living on US territories

- Incarcerated people

- Non-citizens that pay taxes

Most people living in the US can indeed be expected to receive a stimulus check, provided they have US citizenship, have a visa, or at least pay U.S. taxes. With that in mind, certain categories are disqualified from receiving a stimulus check and this will precisely help you determine whether you are eligible for receiving it as well or not.

Eligibility is based on your adjusted gross income, and the amount of money that you receive will be calculated on the same basis.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Read Also: Second And Third Stimulus Checks

Q How Will I Get My Third Stimulus Check If Im An American Living Overseas

A. There are two ways overseas Americans can get their third stimulus payment: Direct deposit or through the mail.

You should get your check via direct deposit if you received your latest tax refund through direct deposit or if the IRS has your direct deposit info from the last round of stimulus checks and you havent filed yet this year.

You need to have an account with a U.S. bank in order to get direct deposit.

We recommend you update your address if you:

- Dont know what address is on file

- Have moved to a different address

- Want your check sent somewhere other than the address they have on file

In addition to Form 8822, Change of Address, you may be able to update your address via phone, through a written statement, or on your tax return. You can see the IRS most up-to-date address change info on the IRS website.

Q. What happens if I live abroad and my direct deposit payment is returned by my U.S. financial institution?

A. Once your payment is returned, the IRS will issue your payment by mail as a check or U.S. Treasury-issued debit card. Typically, IRS will reissue the payment by mail within two weeks. Once the payment is reissued, the IRS Get My Payment tool will update to reflect your payment status.

Q. What if my third stimulus check was for the wrong amount?

A. If you didnt receive the full amount of the third payment you were owed , there are two times when you may receive additional stimulus money:

Use The Recovery Rebate Credit Worksheet To Calculate How Much You Are Due

by John Waggoner, AARP, January 13, 2021

En español | The Internal Revenue Service issued about 160 million stimulus checks to eligible Americans for the first round of economic impact payments that began in April. Millions more payments, dubbed EIP 2, started going out in late December for the second round of stimulus. Nevertheless, some people never got their first-round stimulus checks, while others didnt receive the full amount to which they were entitled. The same will be true for the second round of stimulus payments.

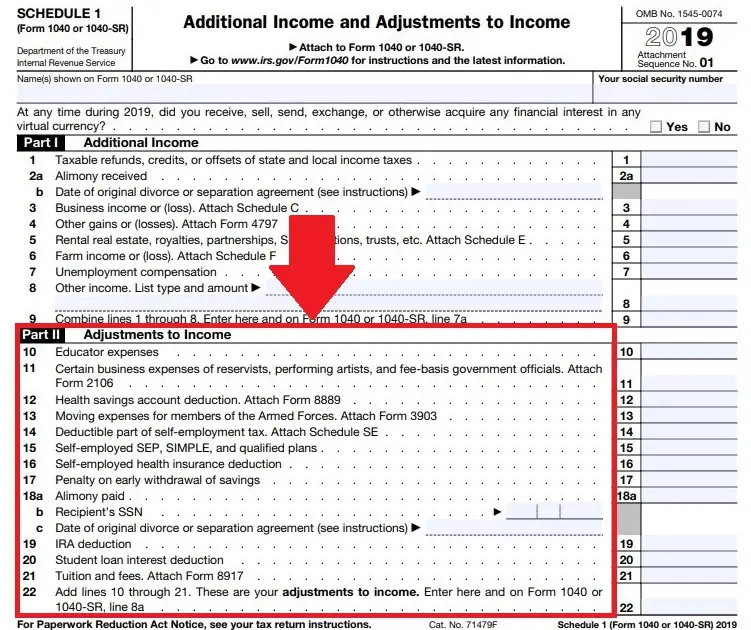

If you didnt receive money from the first or second round of stimulus payments or you didnt get the full amount you should have dont give up. Youll need to file the standard 1040 federal tax return form, or the 1040-SR tax return for people 65 or older, to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund.

Also Check: Wa State 4th Stimulus Check

What If Your 2020 Taxes Make It So The Stimulus Checks You Already Got Were Too Big

EIP 1 and EIP 2 were based on the adjusted gross income reported on your 2018 and 2019 tax returns. As mentioned above, they had income limits over which stimulus checks decreased and eventually phased out.

If your income from 2018/2019 changed in 2020 and based on that income level, you dont qualify for the aid you already got dont worry. The IRS has said its not clawing back excess funds from people whose stimulus checks were too big. Its more concerned with taxpayers whose stimulus checks were too small.

If you got paid too much money, you do not have to pay that back, Pickering says. Thats something that should make people feel really relieved.

Recommended Reading: Are There Any Stimulus Checks Coming

When Can We Expect The Next Stimulus Check

The third stimulus check passed through a process called budget reconciliation, which allowed Democrats to push the legislation through with a simple majority vote in the Senate. The bill did not get any Republican support.

There is a limit on the number of times reconciliation can be used. Democrats are now focused on other priorities and Republicans have made it clear theyre not interested in providing additional COVID relief. As such, its unlikely a fourth stimulus check will be authorized. This is especially true as states ease lockdowns and vaccinations ramp up.

Also Check: How To Get The Stimulus Check

Recommended Reading: Didn’t Receive 2nd Stimulus Check

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15, you can still claim the full credit of up to $3,600 per child by filing a tax return next year.

If You Didnt Get A Third Stimulus Check Last Year Or You Didnt Get The Full Amount You May Be Able To Cash In When You File Your Tax Return This Year

It was more than a year ago that a third round of stimulus checks was announced. Remember how excited you were to hear the news? An extra $1,400 in your pocket, plus $1,400 more for each dependent, was a big deal and made a huge difference for millions of Americans. But the excitement eventually turned to frustration and disappointment for people who didnt get a payment or didnt get the full amount. If thats you, theres some good news. You may still be able to claim the third stimulus check money you deservebut you have to act now, because you need to file a 2021 tax return to get paid.

Some people were left high and dry because they simply werent eligible for a third stimulus check. However, others were left out or given less than they were entitled to for various other reasons that wont prevent them from getting paid this year. For example, if you didnt get a third stimulus check because you didnt file a 2019 or 2020 tax return, you can still claim a payment when you file a 2021 tax return. If you had a baby in 2021, you can get the extra $1,400-per-dependent for the child that was missing from last years third stimulus check payment. You could also be entitled to stimulus check money when you file your 2021 tax return if you experienced other recent changes to your family or financial situation .

Read Also: Irs Find My Stimulus Check

Undelivered Federal Tax Refund Checks

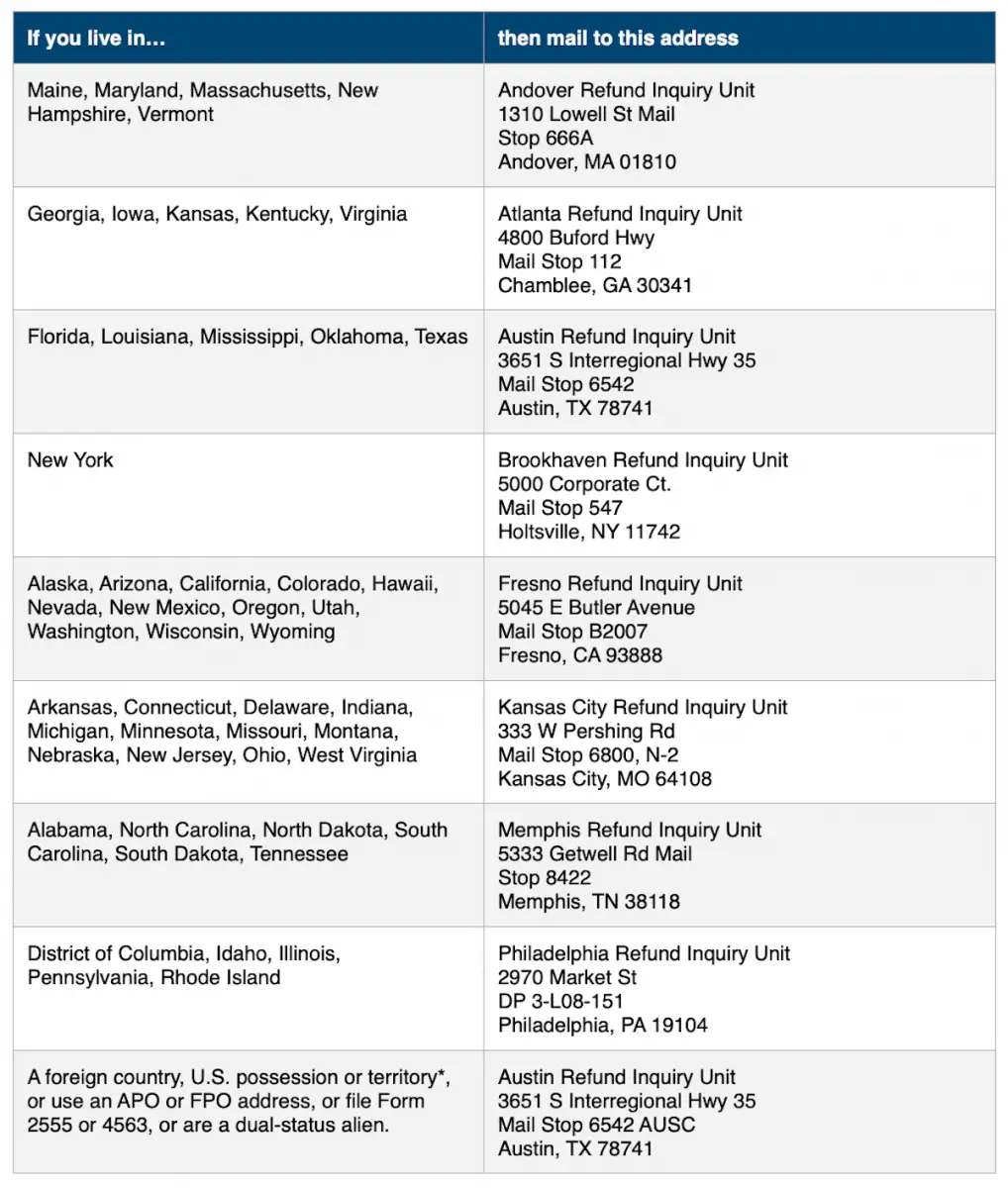

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

What Does Irs Letter 6475 Look Like

These letters started going out in late January and say, Your Third Economic Impact Payment in bold lettering at the top. You can also find the terms Letter 6475 on the bottom at the very righthand corner.

Earlier in the program, the IRS sent out a Notice 1444-C that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, you might have more than one notice. Letter 6475 gives you a total dollar amount.

Recommended Reading: Tax Deductible Home Improvements

Recommended Reading: Is There Stimulus Check Coming

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Didnt Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, well also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Read Also: Who To Contact About Stimulus Check Not Received