How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

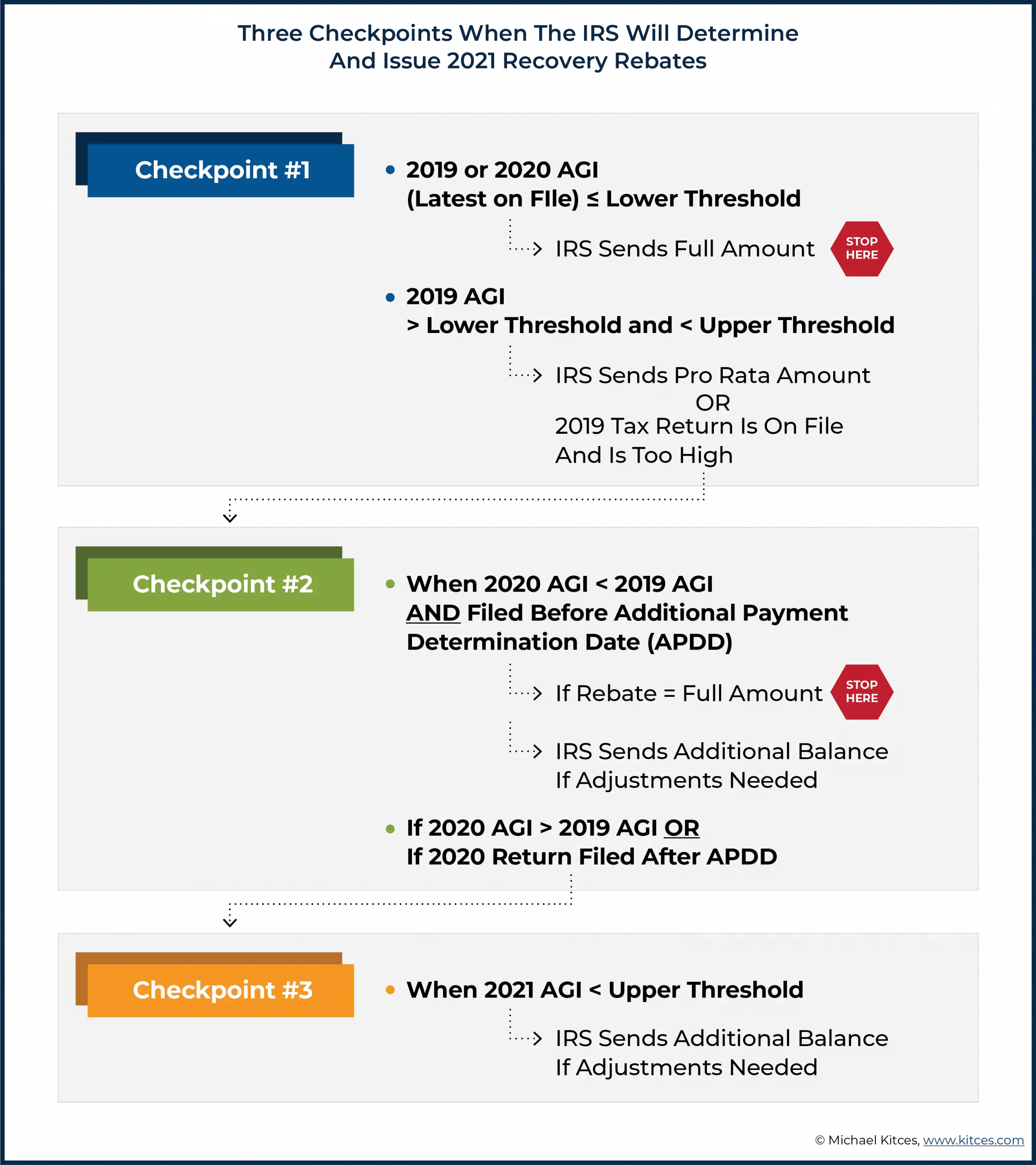

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Powell Calls For Review Of Fed Ethics Rules

It came to light earlier this year that senior policymakers at the Fed made several personal multi-million dollar transactions last year. The trades came at a time when the Central Bank was deciding stimulus measures and fiscal policy to rescue the US economy.

The Fed insists that its rules are more stringent than those for Congress, but the review is necessary becausetrust of the American people is essential.

Who Qualifies For $1400 Per

On the official White House government website, there is a section which details who is eligible to receive checks worth $1,400 per person as a result of the American Rescue Plan.

“Single people making less than $75,000, heads of household making less than $112,500, and married couples filing jointly making less than $150,000 qualify for stimulus checks, while people making up to $80,000 will receive partial payments,” the website explains.

It also adds that people with dependents can receive $1,400 per person and that this can include college students and seniors.

Also Check: Have Not Received Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Which States Saw Increases In The Number Of Unemployed People From July To August

While at the national level the number of unemployed workers fell from 9,176,368 in July to 9,011,277 in August, some states experienced increases.

Many experts believe this is due to a combination of factors including the surge in covid-19 cases caused by the Delta variant and the impacts of severe natural disasters like Hurricane Ida.

Increases

10. Vermont

Don’t Miss: Irs 3rd Stimulus Check 2021

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

What Are The Chances Of States Sending Out Aid In 2023

While there is always the possibility of states sending aid in 2023, the economic climate of the U.S. might not leave many inclined to continue offering relief. The fear is that another round of stimulus checks would further inflation and set the economy back.

That being said, the chances of states offering some relief are not impossible. In fact, some states are obligated to disperse any excess funds with residents instead of reinvesting them into the economy. While it is too early to determine whether states will have excess funds next year, residents of the states with this requirement in place might be able to enjoy some financial relief in the new year.

Read Also: Do You Pay Taxes On Stimulus Checks 2021

Does The American Rescue Plan Provide Additional Unemployment Benefits

Continuing the expanded unemployment aid established by the CARES Act and the Covid-19 Economic Relief Bill, this new pandemic relief legislation extends unemployment benefits through early September 2021. Those filing for unemployment benefits will remain eligible for $300 in aid per week on top of normal payments. The additional benefits are automatic, and recipients need only to continue filing biweekly claims with their state unemployment insurance agency.

The act also includes a new benefit for unemployed Americans in the form of a significant tax break. Individuals who collected unemployment during the 2020 tax year may waive federal income taxes on up to $10,200 of that money , provided they earned less than $150,000 in 2020.

Q How Much Will My Third Stimulus Check Be For

A. Your third stimulus check depends on your 2020 or 2019 income .

| Qualifying group | |

| An AGI of $150,500 or less | An AGI $160,000 or more |

| Dependents of all ages: $1,400 | $1,400 apiece, no cap but only if caretakers make under the above limits |

| * This framework by the IRS was designed for taxpayers who are living and working in the U.S., so expats should ensure theyre looking at their AGI and not their gross income when determining their eligibility, especially if theyre claiming the foreign earned income exclusion. |

Additional Payments: If your third stimulus payment is based on their 2019 return and your 2020 return makes you eligible for a larger payment, the IRS will redetermine your eligibility and issue a supplementary payment later this summer.

You can estimate your own payment amount with H& R Blocks Stimulus Check Calculator.

Q. Will I have to pay back my stimulus check?

A. No, you will not have to pay back any amount of your Recovery Rebate Credit, even if you experience a pay hike in 2021.

Q. Will this round of stimulus checks affect my tax return this year?

Q. Will I owe tax on this third stimulus check in 2022 or have to pay it back?

A. No, the third stimulus payment is considered a 2021 tax credit , not income, so you will not need to pay taxes on it or pay it back.

Q. Do I need to sign up for the third stimulus check it or sign off on it?

Q. If I live abroad, when will I get my third stimulus check if I qualify?

Read Also: When Are We Getting The Next Stimulus Check

Commercial Paper Funding Facility

On March 17, 2020, the Fed established the Commercial Paper Funding Facility , which purchased short-term debt known as commercial paper to ensure that those markets stayed liquid.

On March 23, 2020, the Fed broadened the variety of commercial paper that it would buy to lower the pricing of the debt. This was actually a relaunch of a program that ran during the Great Recession, when many businesses were hurt as liquidity in the commercial paper markets dried up.

While it had no set limit on the amount it purchased, the CPFF stopped purchasing debt on March 31, 2021, and the SPV continued to be funded until its assets matured. The Treasury Department made a $10 billion equity investment in the CPFF from its exchange stabilization fund .

Third Stimulus Payments For Individuals And Joint Taxpayers

Those eligible will get up to $1,400 in stimulus payments for each taxpayer in their family plus an additional $1,400 per dependent. This means a family with two children could receive $5,600.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

Although you may want to file your 2020 return now in order to provide your most recent information to the IRS, including bank account information, you dont need to do anything to get your stimulus check. The IRS will determine eligibility based on your last tax return, either 2019 or 2020, and will likely send your payment to the bank account where your tax refund was deposited.

For your 2021 tax return, the IRS will send a Letter 6475 with your total amount of 2021 stimulus payment. This letter only applies to the third stimulus payment received in 2021.This letter has all the info you need to report the correct amount of the third stimulus you received and understand if you are eligible for additional stimulus dollars and how much. If you didnt get the full stimulus amount you were eligible for then you may be able to claim those dollars through theRecovery Rebate Crediton your tax return.

Read Also: Stimulus Checks For Seniors On Social Security

Expanded Unemployment And Retroactive Tax Relief

Unemployment payments will increase by $300 per week and the benefits will be extended through September 6, 2021.

The bill extends the Pandemic Unemployment Assistance , which expands unemployment to those who are not usually eligible for regular unemployment insurance benefits. This means that self-employed, freelancers and side giggers will continue to be eligible for unemployment benefits.

The bill also makes the first $10,200 of unemployment income tax-free for households with income less than $150,000. This provision would be retroactive to tax year 2020 .

Q What Does The Third Stimulus Check Mean For Us Citizens Living Abroad

A. The third stimulus check is part of the 2021 American Rescue Plan Act , a Coronavirus government relief package designed to provide further economic assistance to Americans struggling with the economic impacts of COVID-19. The relief package includes direct $1,400 payments to each eligible individual, plus $1,400 per dependent, including dependents over 17. These payments are technically an advance payment of a 2021 tax credit.

The biggest differences between the third stimulus checks for expats and the other two are the phaseout thresholds and addition of payments for dependents of all ages.

Q. Do expats qualify for the third stimulus check?

A. Yes, expats qualify for the third stimulus check. You qualify if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

| Expat Group | |

| Non-U.S. citizens residing within the U.S. are not included | |

| Expat dependents | Expat dependents with SSNs qualify for stimulus payments if their caretakers qualify under the income limits and at least one caretaker has an SSN |

Q. Im retired overseas and dont file a tax return do I qualify for the third stimulus check?

Q. What if I dont have an SSN but filed a U.S. return. Do I get to take advantage of the third stimulus check?

A. Probably not. To receive a third stimulus check, you generally must have a social security number .

Don’t Miss: How To Claim Stimulus Check On 2020 Tax Return

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Stimulus Check 3 Release Date And Updates On Your Money

The 3rd stimulus check, a part of the American Rescue Plan Act of 2021, was signed into law by President Joe Biden this week. Today were taking a digital peek at the requirements for individuals aiming to receive money from the government, who will be eligible, and when this is all going down posted on the IRS website, money sent to accounts, and so forth. As of March 10, 2021, the IRS was reviewing implementation plans for the American Rescue Plan Act of 2021 that was recently passed by Congress.

An update posted by the IRS on the 10th suggested that Additional information about a new round of Economic Impact Payments and other details will be made available on IRS.gov as soon as the legislation was signed by the President. Since then, President Joe Biden signed said legislation, meaning were right on the brink of seeing the IRS post said detailed information for the public.

At the same time, we already have access to the legislation in its original form, so were able to translate the most important bits for you before the IRS makes their own guide.

Also Check: When Is The Next Stimulus Check Coming 2021

Don’t Miss: When Was The Third Round Of Stimulus Checks

Stimulus And Relief Package 35

A supplementary stimulus package, nicknamed Phase 3.5, was signed into law on April 24, 2020. It appropriated $484 billion, mostly to replenish the PPP and the EIDL, and contained additional funding for hospitals and COVID-19 testing.

Another supplementary measure, the Paycheck Protection Program Flexibility Act of 2020, which modified the PPP, was signed into law on June 5, 2020. It made the following changes to the program:

- It allowed businesses 24 weeks to spend the money, up from the initial eight-week period

- It lowered the requirements for loan forgiveness. Businesses now had to spend only 60% of their PPP funds on payroll, instead of the 75% previously required.

- The payment deferment period was extended from six months to when the borrower finds out the amount of their loan forgiveness

- It allowed businesses that received PPP loans to delay paying payroll taxes

- It allowed businesses loan forgiveness if they didnât rehire workers who refused good-faith offers of reemployment or were unable to restore operations to levels before the COVID-19 pandemic

- It gave businesses until the end of 2020 to restore their payrolls to precrisis levels

- It increased the loan maturity of PPP loans taken out after June 5, 2020, to five years

- It extended the time that borrowers have to pay back unforgiven parts of the loan

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Recommended Reading: Amount Of All Stimulus Checks

*please Note: This Article Was Written In 2021 And May No Longer Be Up To Date Click Here For Updates On Filing Your 2021 Federal Income Tax Return Including Stimulus Payments

Since the American Rescue Plan was signed into law in March 2021, the IRS has been working to implement provisions of the law and provide guidance to make sure taxpayers can receive Economic Impact Payments and take advantage of new tax credits during this current tax season.

Below are frequently asked questions about the American Rescue Plan will impact this tax season and when people can expect to receive their stimulus checks:

The American Rescue Plan Passed Now What

HOW WORKING AMERICANS WILL RECEIVE THEIR DIRECT PAYMENTS

The House and Senate have passed the American Rescue Plan and President Biden looks forward to signing it into law this week.

The Treasury and IRS are working to ensure that we will be able to start getting payments out this month. And the IRS and Bureau of the Fiscal Service are building on lessons learned from previous rounds of payments to increase the number of households that will get electronic payments, which are substantially faster than checks.

Heres an overview of what the American people need to know about the direct payments in the American Rescue Plan:

- For households who have already filed their income tax return for 2020, the IRS will use that information to determine eligibility and size of payments.

- For households that havent yet filed for 2020, the IRS will review records from 2019 to determine eligibility and size of payment. That includes those who used the non-filer portal for previous rounds of payments.

- For tax returns with direct deposit or bank account information, the IRS will be able to send money electronically. For those households for which Treasury cannot determine a bank account, paper checks or debit cards will be sent.

Heres an example of what direct payments passed in the American Rescue Plan mean for a typical family of four with parents making $75,000 a year combined, and with kids in school aged 8 and 5:

American Rescue Plan

You May Like: I Haven’t Received Any Stimulus Check Yet