Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment was possible due to a budget surplus. Couples filing jointly received $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

If youre eligible but didnt receive a rebate yet, you can apply online starting November 1. The application period will only last 30 days and will close on November 30, 2022.

Applicants must provide their Social Security number, active Delaware drivers license that was issued before December 31, 2021 and a valid Delaware residential mailing address. Payments will be sent out to qualifying applicants after the application period closes and all applications are reviewed.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

Will The Stimulus Affect My Taxes For This Year Or Next Year

None of the three stimulus checks are considered income, and therefore arent taxable. They wont reduce your refund or increase what you owe when you file your taxes this year, or next. They also wont affect your eligibility for any federal government assistance or benefits.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

You May Like: Gas Stimulus Checks 2022 Ohio

Has Anyone Received The Stimulus Check Yet

They actually started depositing the funds into some accounts over the weekend. Other banks, including Wells Fargo and Chase, have said that customers may start seeing the funds in their accounts on Wednesday. Most Americans, however, wont get payment right away as the IRS anticipates continued disbursements during the next several weeks, according to the Associated Press.

RELATED: Wheres my stimulus check? Chase, Wells Fargo expect midweek deposit

Don’t Miss: How Do I Get The 3rd Stimulus Check

When Do Stimulus Checks Begin Distribution

According to the IRS, distribution began December 29th via direct deposit followed by a paper check on December 30, 2020. Youll receive the direct payment to whichever bank account youve supplied the IRS with on the Get My Payment tool or from your 2019 or 2020 filing

If you havent received your payment yet and want to check the status check of your Economic Impact Payment click here.

How Do I Claim These Benefits

The IRS is urging people who believe they are eligible for the tax credits but havent filed a tax return to go ahead and file a return with the tax agency, even if they havent yet received a letter from the IRS. But the deadline for filing a return to claim these benefits is Thursday, November 17.

The IRS reminds people that theres no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline, the IRS said.

There are a few ways people can claim the benefits:

- File a return with Free File before November 17, 2022. Free File is available to people who earn less than $73,000.

- File a simplified 2021 tax return through GetCTC before November 15, 2022.

The IRS said it urges people to file their tax form electronically and to choose direct deposit in order to get their tax credits as soon as possible.

Recommended Reading: Never Received My Third Stimulus Check

Do I Have To File 2020 Taxes To Get The Third Stimulus Check

No. The Treasury can use 2019 or 2020 tax returns to determine your payment.

It will also send payments to people who dont file taxes, but who either used the IRS nonfilers tool last year to submit information or receive federal benefits such as Social Security retirement or disability and Supplemental Security Income.

However, if you qualify for more money based on your 2020 income or need to claim additional dependents, you will need to file a 2020 tax return so the IRS can top off your payment.

Also Check: When Was The Third Stimulus Check Sent Out In 2021

Checks Started Arriving On October 7

Funds began arriving on Friday, Vigliotti noted, with people receiving either a debit card in the mail or a direct deposit to their bank account.

But it could take a few days or weeks for the money to arrive. Still, about 90% of people who receive direct deposits will get their payments by the end of October, according to the California Franchise Tax Board.

On social media, some people said they had received their checks via direct deposit on Friday, while others said they were still waiting.

Don’t Miss: Third Round Of Stimulus Check

How You Can Expect To Receive Your Stimulus Payment

The most important thing to remember if youre an adult dependent looking for a stimulus payment: You wont be individually receiving these stimulus payments. Rather, theyll be incorporated in the lump sum that your parent or guardian receives.

The IRS and Treasury Department are delivering stimulus checks through three main methods: direct deposit, as well as mailed physical check or a prepaid debit card. If your household has a bank account and routing number on file with the IRS, the payment will most likely hit your familys bank account, the fastest method of delivery. New to this round, the Treasury Department is also working across government agencies to access any bank accounts that might have been on file for other federal payments, potentially speeding up the delivery process.

Mailed checks or debit cards will likely take longer, potentially adding weeks to the process. Be sure to keep a watchful eye out for any letters or notices that come from the IRS or Treasury Department and hold onto any documents referring to your stimulus payment.

The IRS started delivering the third stimulus check round on March 12 and has now delivered roughly four-fifths of all payments, according to a . The IRS will continue delivering paper checks and debit cards on a weekly basis, a process that started officially on March 19.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Read Also: When Are The Next Stimulus Checks Going Out

Some Californians Got An Extra $300 Thanks To Stimulus Program

Officials in Santa Ana, California, hand-delivered $300 Visa debit cards earlier this month as part of the citys stimulus program. Those payments went to the citys poorest residents. The city spent $6 million on the cards.

Those low-income families are the ones who were most hard hit, Santa Ana Mayor Vincente Sarmiento told the Orange County Register. This is pretty incredible, and we are blessed, because not many communities that have the need that we have, are able to do this for the residents. I dont think Ive ever seen this in my 14 years on the council, that we can directly impact households and peoples lives this way.

Santa Ana put no restrictions on how the recipients spent the money. But Sarmiento hopes theyll use the money at local businesses.

It will be like a double injection of stimulus to households, but also those businesses that are going to see those cards being redeemed, he said.

Dont Miss: Stimulus Check Based On Taxable Income

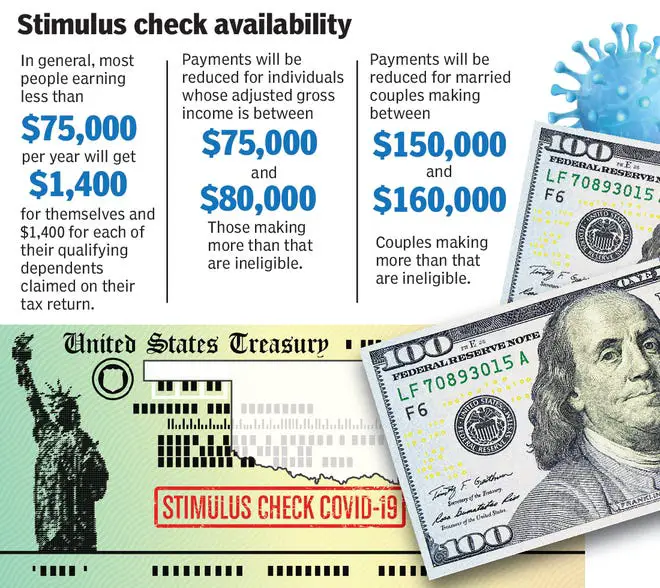

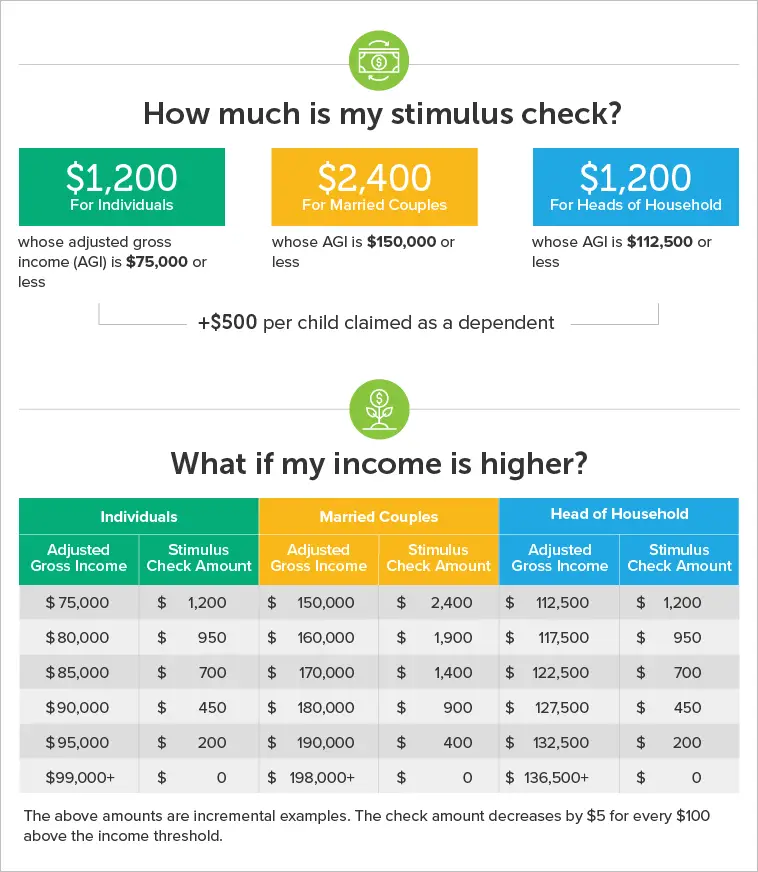

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

Also Check: How Many Economic Stimulus Payments Have There Been

Where Can I Find My Routing Number And Account Number For Direct Deposit

The routing number for Lake Trust Credit Union is 272078268. You can find your account number several ways:

- Find it on your monthly statement.

- Log into Online Banking or Mobile Banking, click on the account you want the deposit to go into, then click on “Account Details” or “Details” to show your account number.

- If you have printed checks, you can find your checking account number at the bottom of the check immediately after the routing number.

What Is A Plus

A plus-up supplemental payment is a new or larger payment you may be eligible to get if you recently submitted your 2020 tax return and your income or number of dependents changed.

For example, if you received a partial third stimulus payment based on your 2019 income, but your income declined in 2020, you may receive another payment to make up the difference between the two amounts. Your original third stimulus payment and your plus-up payment together will equal the amount youre eligible to receive based on your 2020 tax return.

On April 1, the IRS announced that new payment batches include supplemental payments for these people. As of late June 9, more than 8 million plus-up payments have been issued.

Also Check: Are We Getting A Third Stimulus Check

Recommended Reading: When Is The Latest Stimulus Check Coming

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Are 4th Stimulus Checks Really Happening

They arebut theyre not coming from the federal government like the last three stimulus checks did. This time, it all depends on what state you live in. Thats right, these fourth stimulus checks are being given out to some folks at the state and city levels now.

Back when the American Rescue Plan rolled out, all 50 states as a whole were given $195 billion to help fund their own economic recovery closer to home.1 Thats a lot of dough. But heres the catchthey dont have forever to spend that money. The states have to figure out what to spend the money on by the end of 2024, and then they have until the end of 2026 to use up all that cash.2 Those deadlines might sound super far away, but the clock is ticking here.

Recommended Reading: How Much Are All The Stimulus Checks

Can I Deposit My Check Through The Mail

Yes, you can mail your EIP check to us and well deposit it to your account. Please mail your check to: Lake Trust Credit Union, 4605 South Old US Highway 23, Brighton MI 48114.

Please endorse the check before mailing, provide your account number, and identify which account you want funds to be deposited into .

Receiving & Using Your Debit Card

Some taxpayers will receive their payment on a debit card.

FTB has partnered with Money Network to provide payments distributed by debit card.

Refer to the How you’ll receive your payment section for information on how debit cards will be distributed.

Visit the Money Network FAQ page for details on making purchases, withdrawals, and transfers with your debit card payment.

Note the return address of the envelope is Omaha, NE.

Recommended Reading: Irs Stimulus Payments Phone Number

How Much Money Will I Receive

Payments for eligible couples who file jointly may range from $400 to $1,050.

Qualifying individuals may receive $200 to $700.

The amount of the checks depends on two factors: income and number of dependents.

The most generous amount $1,050 goes to married couples who file jointly with $150,000 or less in income and a dependent. A couple in that income category will receive $700 if they have no dependents.

Individual taxpayers with $75,000 or less in income may receive $700 if they have a dependent and $350 if they do not.

The payments are gradually phased out for those with up to $500,000 in income, for married couples, and $250,000, for individuals. California residents with incomes above those thresholds will not receive a stimulus payment.

The income is based on your California adjusted gross income, which can be found on line 17 of the 2020 Form 540 or line 16 of the 2020 Form 540 2EZ.

An online tool can help estimate your payment amount.

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Read Also: When Should I Get My Stimulus Check

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Who Qualifies For A $1400 Direct Payment

Unlike previous rounds of payments, eligibility for the new $1,400 checks may be determined based on either 2019 or 2020 tax returns, depending on whether youve filed yet for 2020 and whether the IRS has processed your return. In general, the federal government will use the most recent income information it has on file to determine eligibility.

Heres whos eligible for a payment:

Support more journalism like this

Don’t Miss: I Didn’t Receive My 3rd Stimulus Check

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple payments to state taxpayers.

Low-income New Mexico residents could apply for relief payments of at least $400 starting on September 26. The application deadline was October 7, 2022.

The low-income relief payments are part of a $20 million line item in the state budget for economic relief efforts. Application approvals are limited to the budget allotment and the lowest-income families will be paid first.

Another payment, in the form of a refundable income tax rebate, was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

If you dont typically file a state income tax return but do so for 2021 by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Read more: New Mexico Families Receive Rebates Of Up To $1,500 In 2022

Im On Social Security And Havent Gotten My Payment Yet Why

The first batch of payments to Social Security recipientsmore than 19 million payments made to beneficiaries who didnt file 2019 or 2020 tax returns and did not use the non-filers tool last yearwent out on April 7.

Payments were delayed while Social Security and the IRS worked out the details of transferring beneficiary data to the IRS, which is handling payment processing.

If you used the non-filers tool to get a stimulus payment in 2020, your payment may have already been issued.

Recommended Reading: How Much Was All 3 Stimulus Checks