I Got Divorced In 2020 How Will I Get My Money

Since this round of stimulus payments will be delivered the same way your CARES Act payment was delivered, you may need to communicate with your former spouse to ensure your payment was receivedâand you can divide the single payment between you.

Check the Get My Payment Portal for the status of the payment youâre expecting. If you canât communicate with your former spouse or they have moved away, you may need to claim your recovery rebate on your taxes in lieu of a stimulus payment now. Speak with a tax professional about your options.

If I Owe Back Child Support Will I Still Get A Payment

Yes. If you owe back child support, your stimulus payment cannot be garnished to pay that debt. The same is true if you owe federal or state debts: your stimulus payment cannot be garnished. Your payment wonât be levied by the IRS, either.

This is different from the CARES Act, which specified that if you owed back child support, your stimulus payment would be garnished.

What If The Irs Sent The Check To A Closed Account

Because people can’t update their bank account information on the “Get My Payment” site, there’s concern that some checks might be sent to accounts that were recently closed. If that’s the case, the IRS says you’ll have to wait until you file your 2020 tax returns.

The stimulus checks are actually a tax rebate that can be applied to your annual tax returns but that means people may be waiting weeks or even months for their stimulus money to show up through their tax refund.

Don’t Miss: How Do I Get Another Stimulus Check

Alert: Highest Cash Back Card Weve Seen Now Has 0% Intro Apr Until Nearly 2024

If youre using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until nearly 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Why Cant I Claim My Second Stimulus Check Now

With the first round of stimulus checks, qualified individuals who were waiting for their payment could request their money right away through an IRS portal. One commonly asked question is why this isnt the case this time around.

With the first stimulus check, the Treasury Department and IRS sent payments automatically to taxpayers for whom bank account information was on file and created an online portal that allowed everyone else to register for and receive the payment. People could still claim and receive their initial $1,200 stimulus check months after most of the payments had been given out.

Theres a good reason the government decided to do this. At the time the first stimulus check was granted as part of the CARES Act, the majority of Americans had already filed their tax returns, so there wasnt any other mechanism in place to get deserving U.S. residents their money.

With the second stimulus check, it just so happens that 2020 tax season is right around the corner. In fact, the IRS recently announced that tax season will start on Feb. 12, so the best course of action if youre entitled to a second stimulus payment but didnt get it would be to file your 2020 tax return as soon as possible on or after that date making sure to claim your Recovery Rebate Credit, of course.

Don’t Miss: Was There Any Stimulus Checks In 2021

Eligibility For A ‘plus

You can estimate how much money the IRS owes your household for the third stimulus check. Just make sure to triple-check that you meet the qualifications, including the income limits.

Because of the overlap with tax season 2020, many people may receive some, but not all, of their allotted amount. If your income changed in 2020, in some cases, the IRS may owe you more money than you received if the income figure used to calculate your payment from your tax returns in 2018 or 2019 is less in 2020. Likewise, if you now have a new dependent, such as a new baby, you may be owed more money.

The IRS is automatically sending “plus-up payments” to make up the difference. If you don’t get one, you may need to claim the missing money another way later in 2021 or even in 2022, since tax season is officially over now.

What If The Irs Deposited Your Money Into The Wrong Bank Account Or A Closed Bank Account

Other 13News viewers say the “Get My Payment” portal shows the IRS tried to deposit their money into the wrong account or an account that was closed.

The IRS advises, If you dont recognize the bank account number displayed in the Get My Payment tool it does not mean your deposit was made to the wrong account that there is a fraud. If you do not recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products. You do not need to complete Form 14039, Identity Theft Affidavit.

At the same time, the IRS has acknowledged it improperly sent millions of EIP stimulus deposits to the wrong bank accounts that were set up through TurboTax, Jackson Hewitt and H& R Block.

Earlier this month, the agency said the IRS and tax industry partners are taking steps to redirect stimulus payments to the correct account for those affected. The IRS also advised, If Get My Payment shows bank account information you dont recognize, watch your bank account and mail for a payment. Were automatically reissuing stimulus payments as a direct deposit or as a mailed check or debit card.

Its not clear how long it will take to redirect millions of stimulus payments, but the IRS and private tax services suggested the error would be corrected quickly, so most of the impacted payments should have been deposited into the correct bank accounts by now.

Recommended Reading: Track My Second Stimulus Check

Missed The Deadline To Claim Your Child Tax Credit Or Stimulus Money What To Know

If you didn’t claim your child tax credit money or third stimulus check by last night’s cutoff, we’ll explain what you need to do.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The deadline for claiming your missing stimulus or child tax credit payments this year has passed — but that doesn’t mean you’ll never get that money. While the IRS Free File form is indeed closed, you can still claim any money owed to you when you file your taxes in 2023.

Some 9 million people who haven’t received their payments never filed a tax return this year, either because they’re not required to file or because they need more time. The IRS used tax returns to determine eligibility for both of these payments.

Keep reading to find out what you can do to receive any stimulus payments or child tax credit money owed to you. For more, see if your state is mailing out stimulus checks this month.

Is There A$ 1 400 Stimulus Check Coming

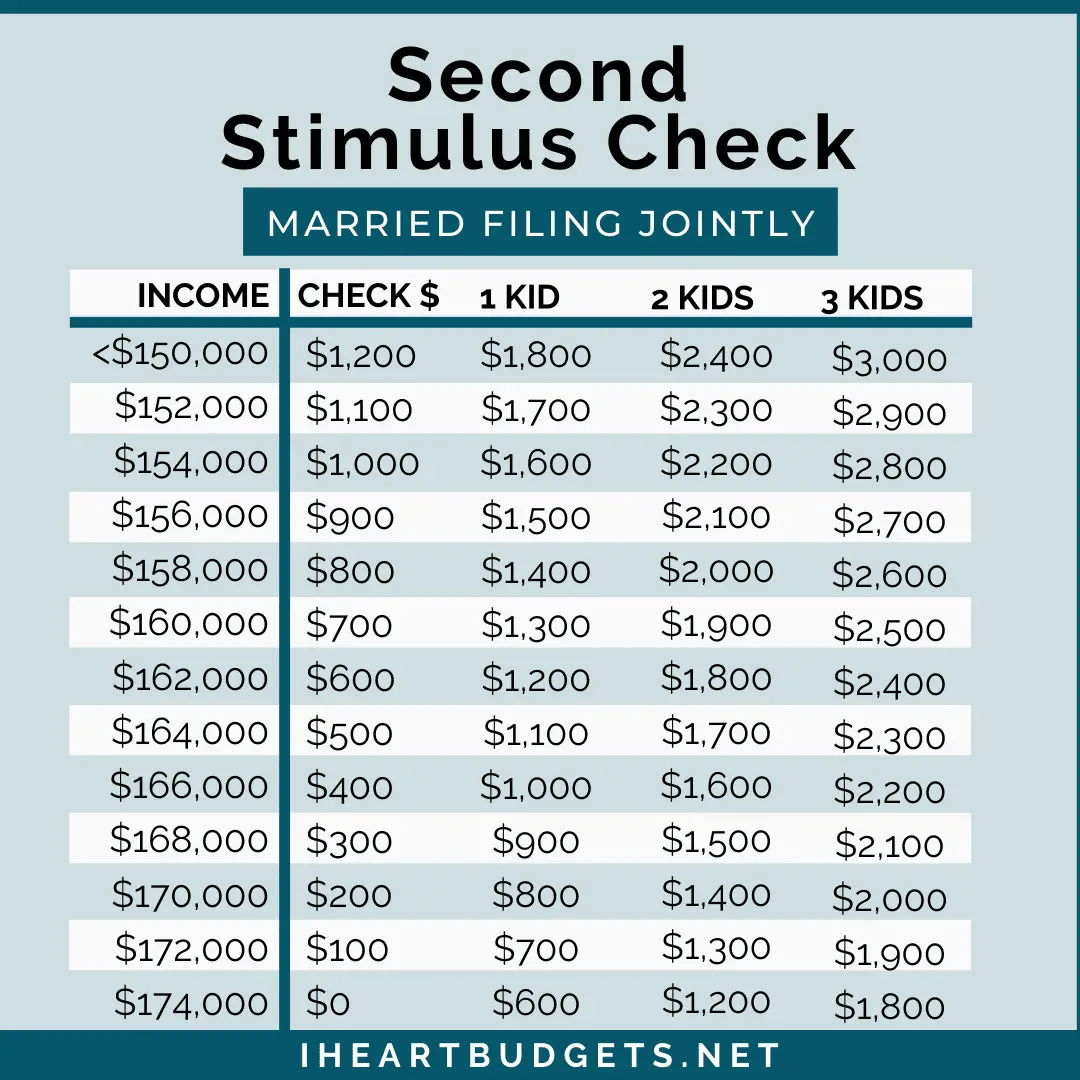

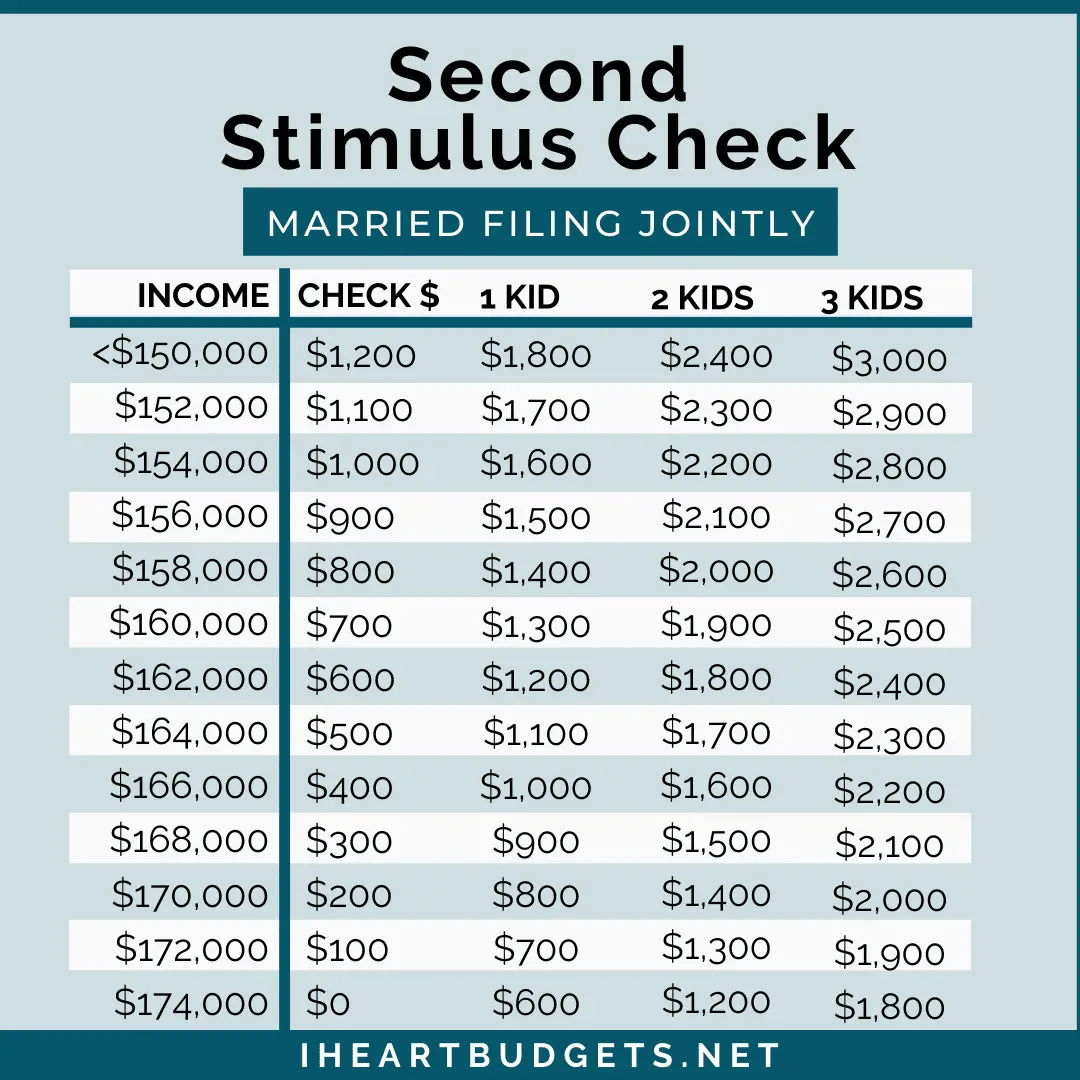

The best way to track this third stimulus payment is still via the âGet My Paymentâ portal on the IRS.gov website. The $1,400 stimulus payments are a part of $1.9 trillion package. Single filers earning up to $75,000 are eligible for $1,400, while couples filing jointly earning up to $150,000 can get $2,800.

Read Also: Do You Pay Taxes On Stimulus Checks 2021

How A Life Change Affects Your Stimulus Check/payment Eligibility

With the third stimulus check dispersal under way, millions have already received their third stimulus payments. But the more Americans get their checks, the more questions arise specifically about how life changes affect your stimulus payment.

The first, second and now third economic impact payment or stimulus payments can be paid in advance. Your eligibility and amount is based off your most recently filed tax return but what if that information is incorrect?

For example, what if you havent filed taxes yet but got married in July 2020? Or had a baby? What if youre dealing with the aftermath of a divorce or the recent death of a loved one? What if you already received your first and second stimulus checks, but it was for the wrong amount? What if you graduated from college in 2020 and arent a dependent anymore?

For the first and second stimulus payments, if your situation changed, youll claim the rest youre owed through the Recovery Rebate credit on your 2020 return. For the third , youll wait to claim the credit on your 2021 tax return.

The IRS understood the need to get stimulus payments out quickly. As a result, some taxpayers have found differences in the amount they should have received due to tax filing changes and income changes.

Below, well clear things up about who is eligible for a stimulus checks, payment, and the credit and how life changes affect your eligibility.

Read Also: How Many Economic Stimulus Payments Have There Been

What If My Bank Account Information Changed How Will I Get My Second Stimulus Check

Unfortunately, if your second stimulus check is sent to an account that is closed or no longer active, the IRS will not reissue the payment to you by mail. Instead, if you are eligible to get a payment, you can claim the stimulus check on your 2020 tax return as the Recovery Rebate Credit or use GetCTC.org if you dont have a filing requirement.

Also Check: When Did I Receive My Stimulus Check

Stimulus Checks Could Be Seized To Cover Past Due Debt

If you owe child support or other debts, your first check was seized to cover those debts. The third check is subject to being taken by private debt collectors, but not the state or federal government. The same goes for the second payment, too, if you’re claiming missing money in a recovery rebate credit. You may receive a notice from the Bureau of the Fiscal Service or your bank if either of these scenarios happens.

In the case of the third check, we recommend calling your bank to confirm the garnishment request from creditors and ask for details about how long you have to file a request with a local court to stop the garnishment. If you think money has already been mistakenly seized from the first two checks, you can file a recovery rebate credit as part of your 2020 tax return — but only if you filed a tax extension.

You can track down your stimulus payment without picking up the phone.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

You May Like: Get My Stimulus Payment 1400

Don’t Miss: Social Security Stimulus Checks Update

What If I Need To Change My Bank Account Information Since I Filed

The Get My Payment tool doesnt allow people to change their bank account information already on file with the IRS, in order to help protect against potential fraud, the IRS website says. The Get My Payment tool also does not allow people to update their direct deposit information once their Economic Impact Payment has been scheduled for delivery.

However, people who did not use direct deposit on their last tax return to receive a refund, or when their direct deposit information was inaccurate and resulted in a refund check, will be able to provide that information and speed their payment with a deposit into their bank account, the IRS website says.

If the bank account you used on your tax return has since been closed, the IRS says the bank will reject the deposit and you will be issued your payment to the address we have on file for you.

If you split your tax refund between multiple accounts, the IRS will send your stimulus payment to the first account you listed on Form 888. If your direct deposit is rejected, your payment will be mailed to the address we have on file for you, the IRS says.

If youve had to make an electronic payment to the IRS in the past which includes Direct Debit Installment Agreements the IRS will not use that account information to send your stimulus payment. Instead, the IRS says you must fill out your direct deposit information through the Get My Payment app or wait for your payment to come in the mail.

Is Congress Talking About A Fourth Stimulus Check

There are no signs that lawmakers in Washington, D.C. are in serious discussions about a fourth direct payment stimulus check. While there have been calls by the public and from some lawmakers for recurring payments, there has been practically nothing in terms of action.

Emails and phone calls to the White House, Sen. Bernie Sanders, I-Vt., who is chair of the Senate Budget Committee, and Rep. John Yarmuth, D-Ky., chair of the House Budget Committee, asking if such payments are under discussion were not returned.

One pandemic-related stimulus that is being considered for an extension is the monthly advance child tax credit. It raised the previous tax credit from $2,000 at tax time to $3,000-$3,600 with the option of monthly payments. A one-year extension is part of the Build Back Better bill that passed the House. But Sen. Joe Manchin, D-W.V., announced Sunday he would not vote for it. With no Republicans on board, passage of the bill is doomed unless an alternative is found.

A group of Democrats sent a letter to Biden in back in May , but the letter did not get into specifics and nothing else came of it.

A change.org petition started by Denver restaurant owner Stephanie Bonin in 2020 called on Congress to pass regular checks of $2,000 for adults and $1,000 for kids for the duration of the pandemic crisis.

As of late December, the petition has reached nearly 3 million signatures.

Dont Miss: Irs Phone For Stimulus Checks

Don’t Miss: News On 4th Stimulus Checks

Check The Get My Payment Tool

The IRS website has been uploading data for your third stimulus payment into a tool on its website called Get My Payment. If your information has been updated, you’ll be able to see the date you can expect to receive your stimulus payment, or the date it was deposited or mailed. You should also be able to see whether your money was direct deposited or whether you’ll be receiving the payment by mail.

Many people are seeing a message that says either the IRS doesn’t have enough information yet or you aren’t eligible for the payment. This message doesn’t necessarily mean you aren’t eligible for the payment. This information may be updated this coming weekend.

Here are some of the issues people are seeing, either with their actual deposit or with the Get My Payment tool.

H& R Block Turbotax Problems

Intuits TurboTax on Tuesday also tweeted that some customers were having problems receiving their stimulus checks. The IRS announced yesterday that due to the speed at which they issued this second round of payments, they sent some payments to an account that may be closed or no longer active, the tax-prep service said.

The IRS said checks sent to closed or inactive accounts cant by law be held by the financial institutions and redirected to consumers. Instead the funds will be returned to the IRS, and people who didnt receive a check must wait until they file their 2020 tax returns to get the stimulus money in a refund. Because of that, its likely that those customers will face a delay.

Some customers responded on social media that they had panicked after failing to receive their funds as expected, with some expressing concern they had been a victim of fraud.

Meanwhile, the IRS said on Monday that the direct deposits could take several days to post to individual accounts after the official payment day of January 4. It added that some people may see their stimulus checks listed as pending or as provisional payments in their accounts.

Heres what to know about tracking your payment.

You May Like: When Did The 1st Stimulus Checks Go Out

Filed A Tax Return But Still Didn’t Receive Your Money Here’s What The Issue Could Be

If you filed your taxes this year but still haven’t received your stimulus check or child tax credit money that you’re eligible for, there are some other things that could be holding it up.

- You don’t have a bank account set up.

- It was your first time filing.

- You have a mixed-status household.

- You haven’t updated your address with the IRS or USPS.

- You’re experiencing homelessness.

- You have limited or no internet access.

If none of these reasons apply to you, it may be time to file a payment trace with the IRS either by calling 800-919-9835 or mailing in Form 3911.