Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Q How Will I Get My Third Stimulus Check If Im An American Living Overseas

A. There are two ways overseas Americans can get their third stimulus payment: Direct deposit or through the mail.

You should get your check via direct deposit if you received your latest tax refund through direct deposit or if the IRS has your direct deposit info from the last round of stimulus checks and you havent filed yet this year.

You need to have an account with a U.S. bank in order to get direct deposit.

We recommend you update your address if you:

- Dont know what address is on file

- Have moved to a different address

- Want your check sent somewhere other than the address they have on file

In addition to Form 8822, Change of Address, you may be able to update your address via phone, through a written statement, or on your tax return. You can see the IRS most up-to-date address change info on the IRS website.

Q. What happens if I live abroad and my direct deposit payment is returned by my U.S. financial institution?

A. Once your payment is returned, the IRS will issue your payment by mail as a check or U.S. Treasury-issued debit card. Typically, IRS will reissue the payment by mail within two weeks. Once the payment is reissued, the IRS Get My Payment tool will update to reflect your payment status.

Q. What if my third stimulus check was for the wrong amount?

A. If you didnt receive the full amount of the third payment you were owed , there are two times when you may receive additional stimulus money:

Recommended Reading: Will Ssi Get Their 3rd Stimulus Check Tomorrow

What If I Dont Receive A Third Stimulus Check

Those who dont file tax returns, including those who earn little income and recent college graduates, may have to wait until they file a tax return in April 2022 to get their stimulus rebate if they didnt file a tax return for 2020 taxes or submit non-filer information to the IRS last year. Married couples with incomes below $24,400 and individuals with incomes under $12,200 fall into this category.

The IRS is still updating its Get My Payment tool with new payment information. Once its loaded with up-to-date information, individuals can check when their stimulus payment went out. If you have any issue with getting your second or third payment, see our article on what to do if you havent received your stimulus check.

Filing a tax return for 2020. If you dont receive government benefits, and you didnt file a tax return for 2019 or 2020 taxes or submit non-filer information to the IRS by November 21, 2020, you may not automatically get a third stimulus check. You might need to wait to file a tax return for the 2021 tax year and request a Recovery Rebate Credit. You will fill in the amount you are owed on line 30 of IRS Form 1040 .

Recommended Reading: I Haven’t Received My Second Stimulus Check

Two More Irs Child Tax Credit Payments Are Coming This Year What To Know

Four payments have been sent this year. Heres the latest on missing checks and how to cancel future payments.

The IRS is planning to issue three more monthly payments this year.

Millions of eligible parents have received four child tax credit payments so far. But the monthly checks are coming to an end soon, with only two remaining this year. The other half of the money will come during tax time next year. With the final checks coming soon, some parents are still waiting for payments from prior months and others are receiving adjusted amounts if they didnt receive checks earlier this year.

In addition to that, the IRS has faced several problems with payments along the way, including glitches and delayed changes to the IRS Update Portal. Parents still cant update outdated IRS information, like income and number of dependents, as the tax agency hasnt made this feature available yet. But there is still time to unenroll from child tax credit checks if your family has a complicated tax situation that may lead to repayment, or youd prefer to get the rest of the credit next year. The next opt-out deadline is Nov. 1.

Well explain how the advance money will impact your taxes next year and what you should do now. If youre still waiting for payments from previous months, it might be time to file an IRS payment trace. You can also use CNETs calculator to see how much money your family should be receiving. We update this story regularly.

Is There A Deadline To Get The Economic Impact Payment

The IRS must receive peoples information by November 21, 2020 to issue payments this year. For many people, this means completing an online form. See question 7 on how to get payments for more information.

If someone is required to file a tax return AND owes taxes, they must file and pay the amount owed by July 15 to avoid late fees. If more time is needed to file taxes, a person can get an extension until October 15, 2020, but they will need to pay the tax owed by July 15 to avoid penalties.

If people receive Social Security, Social Security Disability Insurance , or Supplemental Security Insurance OR are a railroad retiree or Veterans Affairs beneficiary, they must send information to the IRS to get their additional stimulus payment for qualifying children this year. They should use the IRS Non-filer tool to add the names and Social Security Numbers for their dependents. Learn more about qualifying dependents here.

If they miss these deadlines, they will be able to get their payment in 2021 by filing a 2020 tax return.

Don’t Miss: How To Apply For Homeowners Stimulus Check

How Will Stimulus Payments Affect Taxes

As part of economic legislation aimed at mitigating the impact of the coronavirus, millions of individuals and families were eligible to receive stimulus payments, also referred to as economic impact payments by the Internal Revenue Service. The federal government sent out two stimulus payments in 2020, and one in 2021. Many people wonder if those payments are taxable or otherwise affect their taxes.

What If Someone Doesnt Have A Bank Account To Receive An Economic Impact Payment Through Direct Deposit

Direct deposit is the quickest and safest way to get payments. If someone doesnt have a bank account, they can use a prepaid debit card, open a new bank account, use a payment app like CashApp, Venmo, or PayPal, or get a paper check in the mail.

If someone used a bank account on their most recent tax return that is no longer active, the IRS may attempt to deliver the payment using this information before the person can update their information through the portal. The person can notify the bank however, the bank will most likely return the funds to the IRS. Depending on the timing, the IRS will likely distribute the payment as a paper check.

Prepaid Debit Cards

A prepaid debit card allows someone to receive their payment through direct deposit. People will want to get a card before filing taxes and may need to contact the company directly to obtain the account and routing numbers needed for direct deposit. Some free tax filing sites may offer prepaid debit cards along with select tax software companies that are part of IRS Free File. Additionally, commercial tax preparation companies such as H& R Block and TaxSlayer offer options to get a prepaid card during the tax filing process. These cards tend to have higher fees.

Bank Accounts

People should not provide the bank account information for someone else. Different names on the tax return and bank account will trigger a reject of the deposit, causing the IRS to send a check which will delay the delivery of the payment.

You May Like: How To Find Out If I Received Stimulus Check

How Will People Get Their Payment If They Filed Taxes With A Refund Anticipation Check Or Refund Anticipation Loan

The IRS will attempt to deliver the payment to the account information provided on the tax return. Some RALs and RACs are issued through debit cards. If the card is still active, the person will receive the payment on the card. If the account or card is no longer active, the deposit will be rejected, and the IRS will send a paper check to the address on the tax return. A person can check Get My Paymentfor updates on their payment delivery. If the payment has been directly deposited into an account that they dont recognize or dont have access to, they should contact the tax preparer who filed the return. If they are unable to reach them, contact your local Low Income Tax Clinic or Taxpayer Advocate Service office for help.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Recommended Reading: Is The Fourth Stimulus Check Coming

Read Also: New York Stimulus Check 4th

Will I Have To Pay Back 2021 Stimulus

Asked by: Elsie Walter DDS

You can also view what payment you were eligible for using the IRS online account. 7. You don’t have to pay back money you received in 2021. It’s important to note that you won’t owe money if you would have qualified for a smaller payment based on your 2021 income or family situation.

Returning An Economic Impact Payment

COVID Tax Tip 2020-73, June 18, 2020

Millions of eligible individuals have already received their Economic Impact Payment. Some people, including those who received a payment for a deceased individual, may be unsure whether they should return a payment.

Here is additional information about returning an Economic Impact Payment.

Don’t Miss: I Havent Received My Stimulus Check

How Will The Us Pay For $2 Trillion Coronavirus Stimulus Package

President Donald Trump on Friday afternoon signed a $2 trillion stimulus deal aimed at softening the economic impact of the . That’s a whole lot of money, especially if you’re among the 83% of Americans who told Peterson Foundation pollsters last year that politicians should try to lower the U.S. debt.

Yet a growing number of economists and other experts think that, at least for now, the nation’s debt isn’t a problem. Even the Peterson Foundation, which has long argued for paying down public debt, recently came out in favor of federal stimulus spending to fight the coronavirus recession. So, too, has Kenneth Rogoff, the Harvard economist who in 2009 co-wrote a seminal history of financial collapses that warned about the risks spiraling national debt.

“We are in a war,” Rogoff told CBS MoneyWatch this week. “The whole point of not relying on debt excessively in normal times is precisely to be able to use debt massively and without hesitation in situations like this.”

Here’s what you should know about where the stimulus money will come from and whether America can afford it.

Q: Will the U.S. Treasury Department have to print $2 trillion in dollar bills to pay for the stimulus?

Q: So where does the Fed get its money from?

Q: What will the national debt be including the $2 trillion stimulus?

Q: Is there any good news here?

When Returning A Direct Deposit Or A Paper Check That Was Cashed Or Deposited Taxpayers Should:

- Mail a personal check, money order, etc., to the appropriate IRS location.

- Make the check or money order payable to U.S. Treasury and write 2020 EIP, and the taxpayer identification number, Social Security number or individual taxpayer identification number of the person whose name is on the check.

- Include a brief explanation of why they are returning the Economic Impact Payment.

Taxpayers should visit Economic Impact Payment Information Center on IRS.gov for information on how to return or request a replacement EIP debt card.

Don’t Miss: How Do I Know If I Got The Third Stimulus

You Have Received A Check From Someone Who Died

It is likely that if a family member died in 2019, the IRS was not informed and was sent a support check so that someone else mistakenly benefited.

Under this circumstance, the family member may be required to repay the money.

According to the IRS, anyone who lost a loved one prior to 2020 may also be contacted to pay any unpaid taxes.

How Can I See If I Overpaid Taxes On Unemployment Benefits In 2020

The best way to check your tax return from 2020 is by using an online IRS account. It takes a few minutes to register, but after you’re set up, you can access all sorts of useful information, like your current adjusted gross income, your payment history and transcripts of your old tax returns, including 2020.

After you receive your 2020 tax transcript, check Form 1040 Schedule 1 Line 8 to see if you included the unemployment compensation exclusion. If you received jobless benefits and didn’t enter an exclusion, use the “Unemployment Compensation Exclusion Worksheet” in the instructions for the 2020 version of Schedule 1 to calculate the amount.

If you received unemployment income in 2020 and did not claim the exclusion even though you were eligible, you could get additional tax refund money from the IRS by filing an amended return.

If you didn’t receive any jobless benefits in 2020 or included the exclusion in your tax return for that year, you’re not eligible for any additional refund related to unemployment.

Recommended Reading: When Did The Second Stimulus Checks Go Out

Am I Eligible For The Recovery Rebate Tax Credit On My 2021 Return

The third stimulus check was an advance payment for the 2021 tax credit in response to COVID-19. If you received the full amount you are eligible for, you wont receive the new Recovery Rebate Credit when you file your tax return in 2022. But if you received less than you are eligible for, you can claim the tax credit.

For more information about this credit, read The 2021 Recovery Rebate Credit.

If You Never Cashed Or Deposited The Paper Check You Got Heres What The Irs Wants You To Do

If any of the above situations pertain to you, you may need to send your stimulus check back. Heres how to do it for each scenario, per the IRS.

1. Write VOID in the endorsement section on the back of the check.

2. Do not bend, paper clip or staple the check.

3. On a separate piece of paper, let the IRS know why youre sending the check back.

4. Mail the check to the appropriate IRS location it varies depending on which state you live in.

Dont Miss: When To Expect Stimulus Checks

Don’t Miss: Will Ssi Get Their Stimulus Check Tomorrow 2021

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Was I Eligible To Get A Stimulus Check

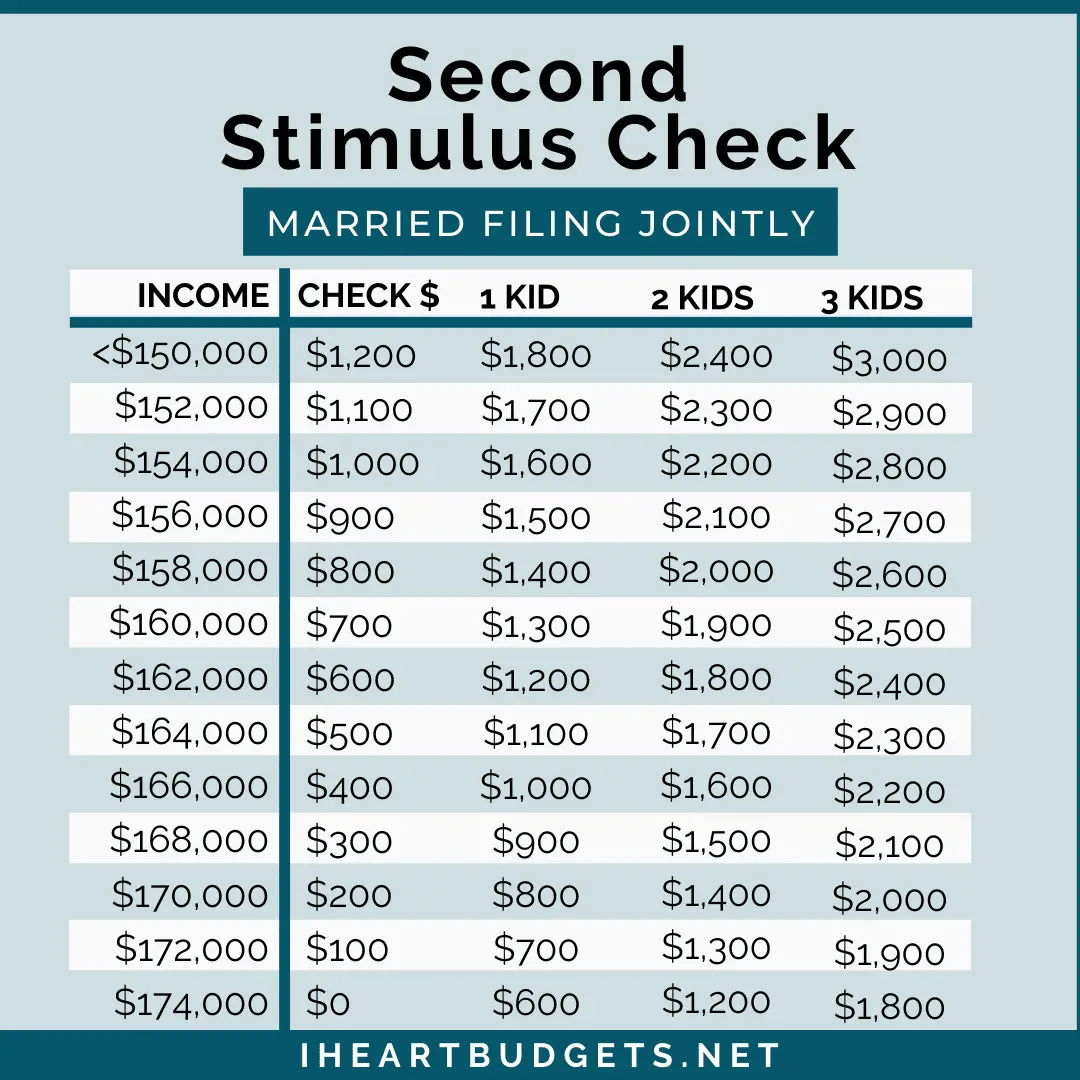

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Read Also: Where Do I Cash My Stimulus Check