You Received An Extra Check

So many checks have been sent, its possible that a percentage of individuals received more than one payment for the same round. If you were eligible for stimulus funds but received more than one check during the first, second, or third round, dont be surprised if the IRS asks you to return those extra funds.

How Are Social Security Payment Dates Determined

The Social Security Administration sends out payments on three different Wednesdays of each month — the second, third and fourth. On which Wednesday you receive your money depends on your birth date. Payments for SSI recipients generally arrive on the first of each month . We’ll break it down.

- If your birthday falls between the 1st and 10th of the month, your payment will be sent out on the second Wednesday of the month.

- If your birthday falls between the 11th and 20th of the month, your payment will be sent out on the third Wednesday of the month.

- If your birthday falls between the 21st and 31st of the month, your payment will be sent out on the fourth Wednesday of the month.

Your payment date depends on your birthday and when you started receiving benefits.

How Do I Find My Stimulus Money What To Do About A Missing $1400 Check

Your third stimulus payment could be delayed for a variety of reasons. We’ll help you track down your IRS payment.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET, where he leads How-To coverage. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

To date, the IRS has made 169 million payments for the third round of stimulus checks for $1,400. The agency continues to send weekly batches of payments, so there is still time if you are waiting for your money. However, there could actually be an issue with your payment and the IRS doesn’t want you to call them with problems related to a missing check.

Reasons for a delay could include a lag in mail delivery , if the IRS has incorrect direct deposit information for you or if the agency suspects identity theft. There might be other problems if you’re a recipient of SSI, SSDI or veterans benefits. Or maybe you received a letter from the IRS saying that your $1,400 payment was sent, but the check never arrived. Then what?

Recommended Reading: When Are We Receiving Stimulus Checks

Where Is My Third Stimulus Check

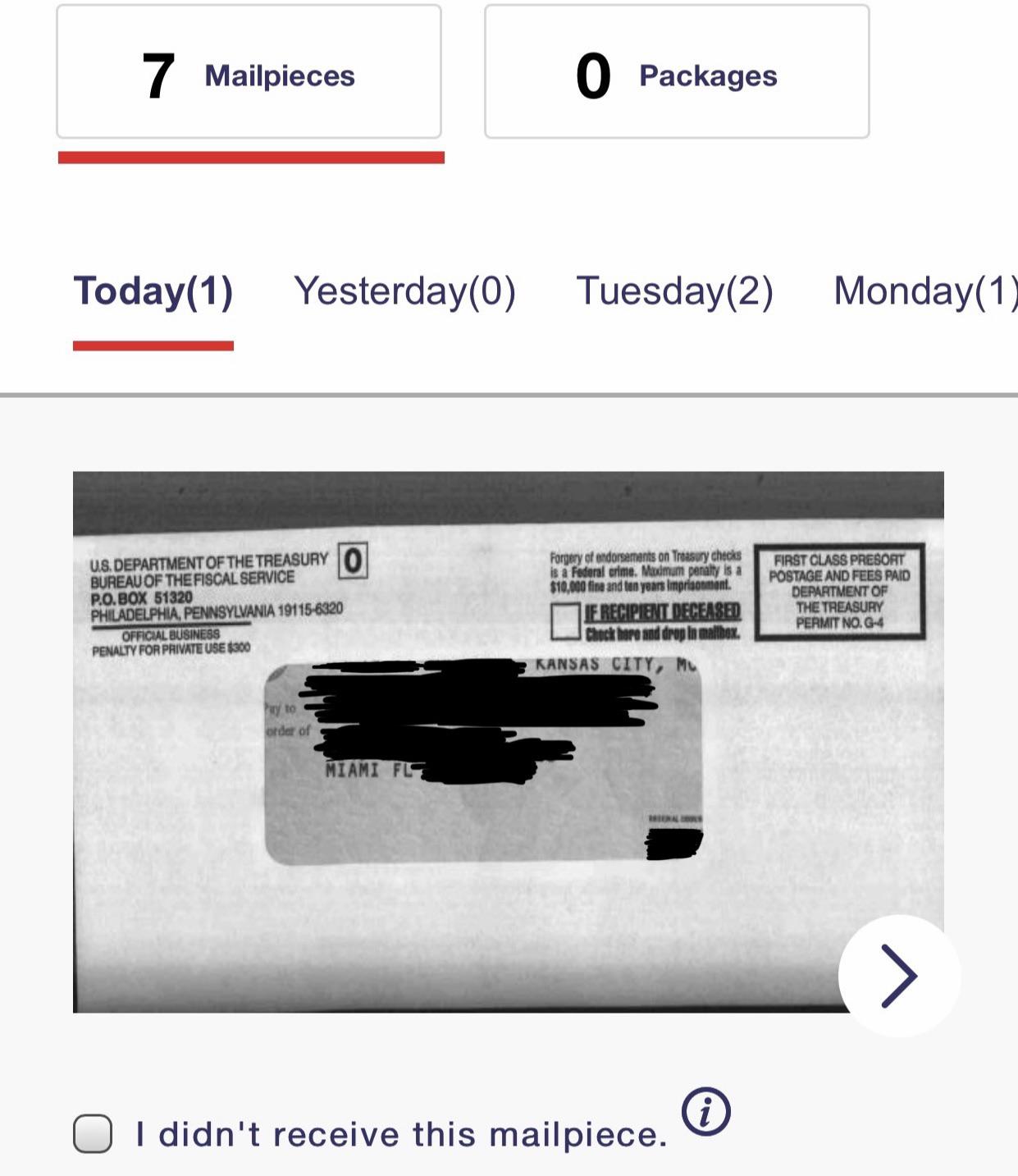

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

If Your First Or Second Stimulus Check Never Arrived You Can Claim A Rebate When You File Your Taxes

If you were eligible for a first or second stimulus check but still havent received a direct deposit, check or prepaid EIP debit card from the IRS, you may have mistakenly been overlooked, or you may have a problem that you need to resolve. Certain groups who were eligible for that first payment, such as some older adults, retirees, SSDI recipients, noncitizens and those who are incarcerated, can file a claim for payment.

Even if you dont typically file taxes, youll have to submit a 2020 tax return using a 2020 Form 1040 or 1040SR to claim your money. This credit would either increase the amount of your tax refund or lower the amount of the tax you need to pay by the amount of stimulus money youre still owed.

Again, just be aware that if you do file for a Recovery Rebate Credit and owe any back taxes, the IRS may garnish that money to pay those debts.

If you got a letter from the IRS confirming either your first or second payment, but never actually got the money, you can try filing a Payment Trace through the IRS to track it down.

If you owe child support, all or part of your stimulus check could be used to cover the expense.

You May Like: When Are Stimulus Checks Coming

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

Recommended Reading: Why I Didn’t Get My Stimulus Check

More $1400 Payments Go Out Automatically After Aarp Urges Irs Ssa To Prioritize Federal Beneficiaries

| The IRS has sent a wave of pandemic stimulus checks to government retirees who normally dont file federal income taxes. Now the agency is sending payments to Veterans Affairs beneficiaries who dont normally file taxes. But the Social Security Administration says if you are a beneficiary and havent gotten your stimulus check, you need to file a 2020 tax return now to get any stimulus payments due to you.

To date, the IRS has delivered 164 million stimulus payments worth about $386 billion during the coronavirus relief mandated by the American Rescue Plan Act, which President Joe Biden signed on March 11.

Many low-income beneficiaries including recipients of Social Security retirement and disability benefits, as well as recipients of SSI benefits administered by the Social Security Administration arent required to file tax returns, and some of those payments were delayed. The IRS said it was waiting for updated information from the SSA on bank accounts and addresses of federal beneficiaries to ensure the stimulus payments reach eligible individuals.

AARP has pushed the IRS and the SSA to move more swiftly to get those checks to individuals who dont file federal income taxes.

On March 25 the SSA gave the IRS the updated information required to begin delivering stimulus checks to some 30 million federal beneficiaries still awaiting payments, Saul said.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

How Do I Check The Status Of My Stimulus Payment

But waiting on your stimulus check can be an anxiety-ridden process, especially at a time when nearly 10 million Americans are out of work. Use the Treasury Departments tracker:

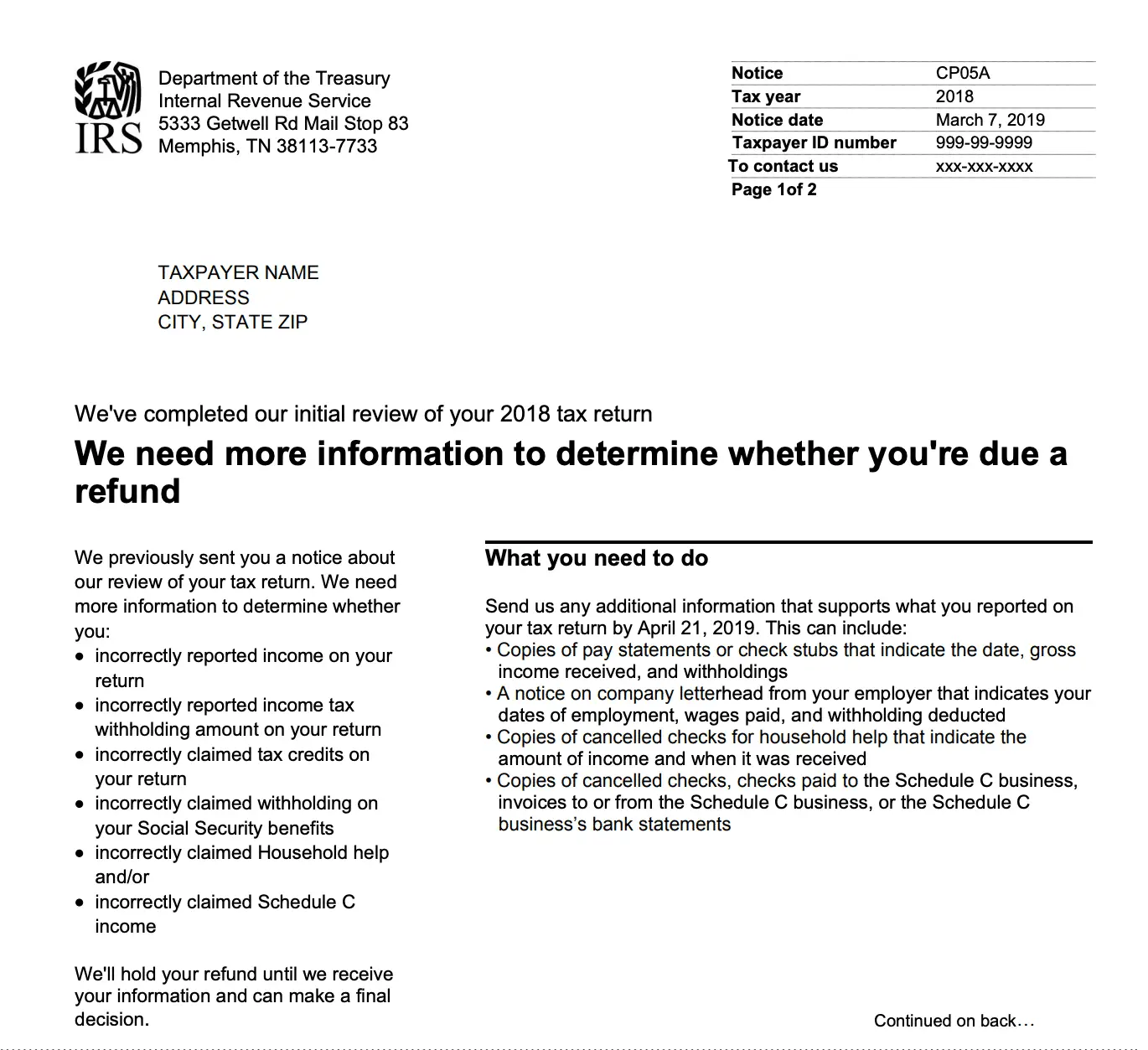

If youre seeing a payment status not available error message on the platform, the IRS says one of the following issues might be occurring:

The platform is typically updated overnight, meaning you wont see a new message if youre checking for updates more regularly than once a day.

Recommended Reading: Where Can I Cash Stimulus Check

Contribute To A Traditional Ira

If your AGI is a bit too high, contributing to a traditional individual retirement account might be the key to getting a third stimulus checkâif you donât have a retirement plan like a 401 through your job.

You can contribute up to $6,000, or $7,000 if youâre 50 or older, to a traditional IRA before April 15, 2020. If you donât have a retirement plan through work, you can deduct the full amount of your contributions from your taxable income.

If youâre single and took home $81,000 in gross income in 2020, contributing $6,000 to a traditional IRA would lower your AGI to $75,000 and earn you a full stimulus check.

As an added bonus, if your spouse didnât earn income in 2020, they can still contribute to a spousal IRA, which could allow you to deduct up to another $6,000 , depending on your income level.

⢠Potential Income Reduction Amount: $6,000 to $14,000, depending on marital status, age, income level and access to workplace retirement plan.

⢠If youâre self-employed, check out a notes Julie Welch, managing partner and director of taxation at Meara Welch Browne, P.C. This could let you deduct up to $57,000 of your income in 2020 and allows you to contribute up until April 15, 2021, as well.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: I Never Got Any Of The Stimulus Checks

Other Payments You Can Claim Using The Tool

Additionally, by visiting GetCTC.org, you can claim the Child Tax Credit and Earned Income Tax Credit along with the third stimulus check.

To file for Child Tax Credit, you may e-file online.

To receive your payment, users must answer the questions provided truthfully and accurately.

Filling out the form only takes 15 minutes to complete.

If you would like to claim additional money with EITC, you may contact your employer for your W-2.

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

You May Like: Who Is Eligible For 4th Stimulus Check

How Much Does The Third Stimulus Check Pay

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by Congress in December 2020, and adding up to $2,000.

Congress passed the coronavirus relief plan with targeted income limits for maximum stimulus payments to individual taxpayers earning under $75,000 and joint filers making up to $150,000. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples.

Eligibility for the third stimulus checks is based on your tax filing status. For more information on who qualifies for a third stimulus check, our tables below will help you calculate different payment options.

Also Check: How Many Stimulus Checks Were There In 2020

People Who Dont File A Tax Return

Question: What if I dont file a 2019 or 2020 tax return?

Answer: Some people dont file a tax return because their income doesnt reach the filing requirement threshold. If thats the case, the IRS will send a third stimulus check based on whatever information, if any, is available to it. That information potentially could come from the Social Security Administration, Railroad Retirement Board, or Veterans Administration if youre currently receiving benefits from one of those federal agencies. If thats the case, youll generally receive your third stimulus payment the same way that you get your regular benefits. If you supplied the IRS information last year through its online Non-Filers tool or by submitting a special simplified tax return, the tax agency can use that information, too.

Some people who receive a third stimulus check based on information from the SSA, RRB, or VA may still want to file a 2020 tax return even if they arent required to file to get an additional payment for a spouse or dependent.

Read Also: How To Qualify For A Stimulus Check

Also Check: Any Stimulus Checks In 2022

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Who Is Not Eligible For The Recovery Rebate Credit

If you received your full amount in advance through the third stimulus payment, you would not qualify for any more money when you filed the return and you do not claim the Recovery Rebate Credit. Filing incorrectly for the credit could also delay your tax refund.

Also Check: When Will I Get My Stimulus

Read Also: Didn’t Receive 2nd Stimulus Check

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.