Pros And Cons Of Refinancing

Like with any loan, there are some pros and cons when it comes to an FHA cash-out refinance. This type of loan may benefit some, but it could be the wrong option for others.

Pros:

- Using an FHA cash-out refinance, your home equity can be turned into cash that can be used to put you in a competitive financial position.

- An FHA cash-out refinance is a great option if you plan to reinvest it into your home by doing renovations or making improvements.

- It can be a great way to consolidate your high-interest debts, such as credit card debt, student debt, or car loans.

- Since FHA cash-out refinance requirements are more lenient than those of conventional loans, FHA loans are more accessible, especially to those with low credit. The official minimum credit score to qualify for an FHA cash-out refinance is 500. However, be aware that lenders may look for a higher credit score. These loans also provide a higher maximum LTV than conventional loans.

- FHA loans are assumable, meaning that they can be transferred from an existing owner to another buyer after evaluation by the lender.

Cons:

How To Refinance Second Mortgages

Refinancing a second mortgage requires almost the same steps as refinancing the first mortgage. In most cases, youll have to wait at least 12 months from when you were approved for the second mortgage before refinancing it. Most lenders also require you to have at least 20% equity in your home. If you plan to refinance with a different lender, you may want to check with the lender who holds your second mortgage before pursuing refinancing.

It may be slightly more difficult to find a lender, as refinancing second mortgages carries more risk for the lender. If for any reason your house is foreclosed, the second lender only gets whats left over after the first lender is paid off. Nonetheless, if you have good credit, a stable income, and youve made your mortgage payments on time, you should be able to find a lender willing to help you refinance your second mortgage.

Before considering refinancing any mortgage, you should do your research, speak with your financial advisor, and calculate whether youll benefit financially by refinancing. Depending on the fees, the cost of refinancing a second mortgage may outweigh the benefits.

Once youve decided that refinancing your second mortgage is the right choice, figure out if you would qualify for favorable interest rates by checking your credit score and assessing your financial situation. Your lender may look at your other debts, so determine your debt-to-income ratio.

The Homeowner Assistance Fund

The Homeowner Assistance Fund was established under President Bidens American Rescue Plan to assist homeowners struggling with their housing payments due to Covid.

HAF was funded with close to $10 billion in financial support to help families weather these challenges and remain in their homes. According to the Treasury press release, aid money will be prioritized for homeowners with pending foreclosures and those with immediate threats to housing stability.

Those who receive assistance through the Homeowner Assistance Fund can use the money for mortgage payments as well as other housing-related bills like homeowners insurance and utilities.

HAF funds are allocated state by state, and its up to state administrators to distribute the funds to individual homeowners who qualify for aid. If you think you might benefit from the Homeowner Assistance Fund, reach out to your loan servicer to talk about whether youre eligible.

You can also use this lookup tool from the Consumer Financial Protection Bureau to find active mortgage relief programs in your area.

Don’t Miss: Were There Stimulus Checks In 2021

Refinance To Lower Your Payments

Refinancing can offer homeowners relief by reducing their monthly payments. Most of the time, a refinance will lower your interest rate and extend your loan term both of which result in a more affordable monthly mortgage payment. Borrowers who cant lower their rate may still save money by spreading their remaining loan balance over a longer loan term.

Thanks to rising home values, even homeowners who made a very small down payment or refinanced recently could be eligible for a refi.

Even if you dont think youd qualify for a refinance, its worth talking to a lender. Many homeowners are eligible but dont know it yet.

Whats more, not everyone needs great credit or perfect finances to qualify for a refinance. Select programs, like the government-backed Streamline Refinance, can help borrowers refinance with little, no, or negative home equity.

Even if you dont think youd qualify for a refinance, its worth talking to a lender. Homeowners might be surprised at the amount of equity they gained as housing prices shot up nationwide. This could put refinancing within reach even if you had no home equity quite recently.

Pros And Cons Of Refinancing Second Mortgages

here are a number of pros and cons to consider when it comes to refinancing second mortgages.

Pros:

- Change your existing loan rate and term: If interest rates have dropped, you may want to consider refinancing to take advantage of new rates.

- Lower monthly payments: Lower interest rates may also mean lower monthly payments on your house.

- Allow you to switch to a fixed interest rate: This is good for those who are at a variable rate and would want a fixed rate due to rising interest rates.

- Consolidate debt: Refinancing your second mortgage will give you access to more funds, depending on your homes equity, that you can then use to consolidate high-interest debt, such as credit card debt or student loans.

Cons:

- Consider the extended life of the loan: If you refinance a second loan, you will usually be prolonging the life of the loan and, therefore, be making payments longer.

- Cost: Refinancing can be costly, as you will need to pay, at minimum, an appraisal fee, as well as closing costs.

Summary

Refinancing a second mortgage may be the right option for you if you are seeking a more favorable interest rate or lower monthly mortgage payments. Refinancing a second mortgage is similar to refinancing a first mortgage you will want to have a good credit score, employment history, and debt-to-income ratio to qualify for the best interest rates.

Talk to an expert before pursuing a second mortgage refinance to ensure that it is the best choice for you.

You May Like: What Were The Three Stimulus Payments

Must Earn A Modest Income Based On Location And Household Size

Eligible home buyers must earn an income thats no more than 60 percent above the median income for the area. For example, in Columbus, Ohio where the median income is $60,000, home buyers who file their taxes as a single-earner may not have a household income of more than $96,000 per year.

Higher income levels are permitted for households with multiple income earners, including married and non-married joint-filers.

Keeping Families In Their Homes

Even as the American economy continues its recovery from the devastating impact of the pandemic, millions of Americans face deep rental debt and fear evictions and the loss of basic housing security. COVID-19 has exacerbated an affordable housing crisis that predated the pandemic and that has exacerbated deep disparities that threaten the strength of an economic recovery that must work for everyone.

To meet this need, the Emergency Rental Assistance program makes funding available to assist households that are unable to pay rent or utilities. Two separate programs have been established: ERA1 provides up to $25 billion under the Consolidated Appropriations Act, 2021, which was enacted on December 27, 2020, and ERA2 provides up to $21.55 billion under the American Rescue Plan Act of 2021, which was enacted on March 11, 2021. The funds are provided directly to states, U.S. territories, local governments, and Indian tribes. Grantees use the funds to provide assistance to eligible households through existing or newly created rental assistance programs.

Read Also: Irs Stimulus Check 3 Calculator

Don’t Miss: Are They Sending Out Stimulus Checks

Mortgage Relief Options From Fannie Mae And Freddie Mac

Homeowners with conforming loans backed by Fannie Mae or Freddie Mac have options for mortgage relief.

If youre experiencing a temporary hardship, its not too late to ask about forbearance. Theres currently no deadline to make an initial forbearance request with your loan servicer.

If you have a conventional loan, theres currently no deadline to make an initial forbearance request with your loan servicer.

In addition, Fannie and Freddie recently came out with expanded refi programs that make it easier and cheaper to lower your interest rate and mortgage payment.

Fannie Maes RefiNow and Freddie Macs Refi Possible are designed for low- to moderate-income homeowners. You might qualify if you make average or below-average income for your area.

These refinance programs have unique benefits that can offer financial relief to homeowners, including:

- Lower mortgage rate and monthly payment

- Reduced closing costs with no appraisal fee

- Easier debt-to-income qualification

These new loan options can offer big savings for homeowners who might not otherwise qualify to refinance.

You can check your areas median income using Fannie Maes lookup tool and Freddie Macs lookup tool.

What Is The Homeowners Assistance Fund

The Homeowners Assistance Fund offers one such benefit. In short, this $10 billion fund stems from the $1.9 trillion stimulus law from earlier this year.

The fund gives state governments power to decide how they want to help homeowners with various expenses. Including those who live in areas with persistent poverty.

Or if those homeowners belong to a group thats historically faced discrimination.

The idea here is that theres a pot of money available to help homeowners struggling with things like mortgage payments as well as taxes, association dues, and other payments associated with homeownership. Even the payment of things like utility bills and insurance costs. The American Rescue Plan provides nearly $10 billion for states, territories, and Tribes to provide relief for our countrys most vulnerable homeowners, a fact sheet from the Treasury Department explains.

This isnt something thats coming directly to you from the federal government, though.

Individual states submit plans for how they want to parcel out funds for the program. Something that New York State became the first to get final approval for this month. In a statement, Gov. Kathy Hochul said her state is distributing almost $539 million to homeowners at the greatest risk of foreclosure or displacement.

Homeowners in Connecticut, meanwhile, could get up to $20,000, and in Illinois up to $30,000.

Recipients have until to make changes reflected on that final check, coming.

Also Check: Is There Another Stimulus Check On Its Way

Stimulus Package For Homeowners 2022

It is important to refinance your mortgage since it can enable you to settle your current mortgage and obtain a new one on a fresh set of terms.

There are many reasons you could want to refinance your mortgage, including changing the type of mortgage and reducing the interest rates that you will be charged.

The government has a mortgage stimulus program that enables you to make refinancing for your mortgage more affordable. The federal stimulus for homeowners is designed to enable a more affordable getting home and the required financing.

To Start Verify Your Mortgage Type

The GSEs, Fannie Mae, and F.M. deal with conventional loans, FHA, VA loans. The Department of Agriculture offers USDA loans. You can see if your mortgage is owned by Freddie Mac or Fannie Mae. The federal government has encouraged all lenders to support mortgage assistance due to hardship brought about by the coronavirus pandemic. If you have a mortgage problem, contact your mortgage lender to check out the details of how much money is going to be taken from your mortgage.

Also Check: How Do I Get The First Stimulus Check

Do You Qualify For A Lower Interest Rate

Refinancing can offer relief from high mortgage payments. By lowering your mortgage interest rate and/or extending your loan term, you can typically reduce your monthly payment and take some pressure off your budget.

To qualify for a refinance, youll need to meet some basic criteria. But these can be very flexible depending on the loan program.

How To Find Out If Your Loan Is Federally Backed

To find out whether your loan is backed by the federal government, making you eligible for the help noted above, here are some actions that you can take:

- Check online. Use loan lookup tools provided by Fannie Mae or Freddie Mac to find out if either of those two government-backed providers owns your mortgage.

- Check the Mortgage Electronic Registration Systems website to find your servicer, if you dont know who it is.

Also Check: How Can I Find Out About My Stimulus Check

What Are Application Requirements

A person who wants to apply for the Florida check stimulus must know about the application requirements, they are explained in quite a simple way. The applicant must be an Orange County resident and COVID-19 must have impacted financially the person. It is vital for a person to provide social security card and ID proof with a photo.

All the documents that are attached along with the application form must signify that there is a decline in the income of a person due to the pandemic. For instance, there are shortened working hours of the person, a decrease in the hourly rate of that individual, or it may be that the employer is not able to pay the salaries of his employees.

Who Qualifies For Homeowner Stimulus

It has to be noted that this scheme corresponds only to people who suffered from hardship following the COVID-19 pandemic, which means that the impact of the virus affected their income after January 21, 2020.

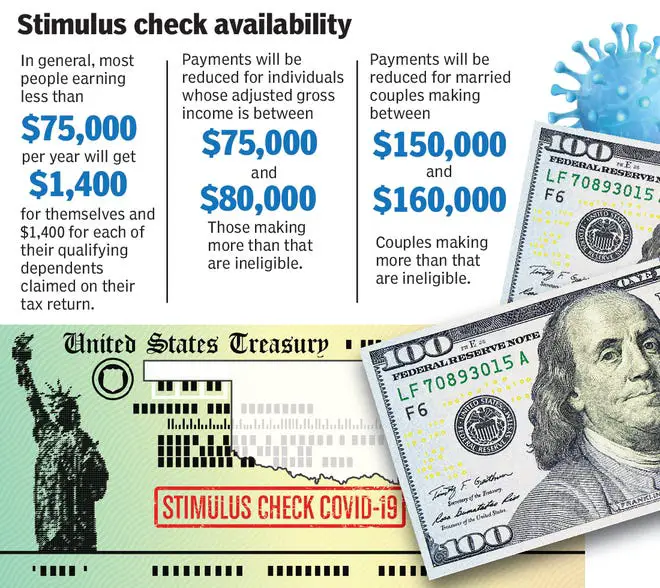

Homeowners are eligible to receive amounts allocated to a HAF participant under the HAF if they experienced a financial hardship after January 21, 2020 and have incomes equal to or less than 150 percent of the area median income or 100 percent of the median income for the United States, whichever is greater, explains the US Treasury.

A HAF participant may provide HAF funds only to a homeowner with respect to qualified expenses related to the dwelling that is such homeowners primary residence. HAF participants must require homeowners to attest that they experienced financial hardship after January 21, 2020. The attestation must describe the nature of the financial hardship .

The US Treasury also stresses that no less than 60 percent of the amount that the fillers will receive must be used for qualified expenses that assist homeowners having incomes equal to or less than 100 percent of the area median income or equal to or less than 100 percent of the median income for the United States, whichever is greater.

In the event you need the help of an expert, it is advisable to speak to a mortgage servicer and ask them to assess your conditions and eligibility.

Recommended Reading: Are We Getting Another Stimulus Checks

Developing And Maximizing The Theme

When it comes to creating a festival or event, one of the most essential elements is the theme, as this is what will both attract attendees and help to create an experience that is unique to the festival or event.

The intent is to consistently communicate the theme in all aspects of the festival or event. It should be incorporated into: the name programming and activities music and entertainment sponsorship food and beverage offerings décor apparel and in the design of marketing and promotional material.

Maximizing the theme should be a fun and creative process. Think outside the box. What activities and programs can be added to your festival or event that are fun and dynamic and appeal to a wider audience or specific audience you are trying to attract?

Where the festival or event takes place is a crucial component of the planning process and directly affects its success. It is important to review the planning requirements and ensure the selected venue or location meets the required needs.

Factors to consider when selecting the location/venue:

To help facilitate budget planning, a Budget Template is available through the Community Festivals and Events Planning Toolkit.

Applying For An Fha Loan

Even though the FHA loan is a stimulus package for homeowners, they dont lend money to people. FHAs main role in getting homeowners the mortgage refinancing that they are looking for is simply getting their mortgage loans insured against default.

To get the insurance on your loan, you will be required to apply for the loan from an FHA-approved lender. As such, it is recommended that you search around first before making the application since this will enable you to get the ideal lender completely insured for the loan.

If you default, the government will take care of the loan on your behalf. For initial homeowners buying a home for the first time, this is an important loan and the best form of financing when they are still unsure of the real estate landscape and what is involved in buying a new home for the first time.

You May Like: Stimulus Checks For California Residents

Is There A Mortgage Relief Program In 2022

With the impact of Covid waning, Congress has wound down much of its Covid-era mortgage stimulus.

Fortunately, there are still mortgage relief programs available to homeowners who need them.

Mortgage relief can come in many forms. Whether you need a lower rate and payment or a break from making payments altogether, there are options. Heres what to do.

In this article

Homeowner Stimulus Checks Are Coming How To Get Your Money From This $10b Fund

As part of the American Rescue Plan stimulus relief bill, $10 billion dollars was included in the Homeowners Assistance Fund providing money to homeowners in assistance with mortgage payments in order to prevent delinquencies, foreclosures and late payments on utilities amongst other things.

The law prioritizes funds for homeowners who have been hardest hit by the pandemic. The Treasury Department states that it uses local and national income indicators to maximize the impact of where the money is distributed.

The HAF provides a minimum of $50 million for each state, the District of Columbia and Puerto Rico and $498 million for Tribes or Tribally-designated housing entities and the Department of Hawaiian Home Lands. $30 million is also available for the territories of Guam, American Samoa, the U.S. Virgin Islands and the Commonwealth of the Northern Mariana Islands.

Homeowners are eligible to receive HAF money if they have experienced financial hardship after January 21, 2020 AND have income equal to or less than 150% of the area median income. This means three times the income limit for very low income families, for the relevant household size, as published by HUD, according to the Treasury Department.

Find: Child Tax Benefits Will Start Hitting Accounts July 15

More From GOBankingRates

Read Also: Can I Still File For My Stimulus Check