What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

When Will You Receive Your Stimulus Payment After You File For A Recovery Rebate Credit

The IRS started processing 2020 tax returns on Feb. 12 but extended the tax deadline to May 17 and focused on sending stimulus checks instead. If you filed for a Recovery Rebate Credit as part of a 2020 tax form and submitted it in February or early March, you can check the status of your tax return and refund to see if it’s been processed. It isn’t certain what the IRS’ revised timeline is for processing tax returns submitted in mid-March and beyond.

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Also Check: Are We Getting Another Stimulus Pay

Recommended Reading: Do We Supposed To Get Another Stimulus Check

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

How To Claim Your Missing $600 Or $1200 Payments

The stimulus checks are generally advance payments of a tax credit.

The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first $1,200 stimulus check or the second $600 payment if that money is due to you line 30 of Forms 1040 or 1040-SR.

On that part of the return, filers can start with the amount of stimulus money they already received and calculate any more funds which they are due. That can be done either through a worksheet provided with the tax form or through tax preparation software.

Once the IRS receives the return, the tax agency will also tally your recovery rebate credit, which means it may correct the amount you claim.

If there is a discrepancy, that could lead to a “slight delay” in processing the return, according to the tax agency.

However, for people who still do not understand why they received less money than they thought they were due, or no money at all, the process could help resolve the confusion.

The IRS will mail letters to filers in this situation to explain what prompted the correction.

Some reasons why the IRS might correct the credit amount include not providing a valid Social Security number or if you were claimed as a dependent on a 2020 tax return. If a dependent was age 17 or over as of Jan. 1, 2020, they will not be eligible for either of the first two checks.

Math errors in the rebate calculations could also prompt a correction.

Recommended Reading: Federal Stimulus Pays Off Mortgage

$300 Check Due To Be Refunded To Taxpayers Today & Direct Payment Tomorrow

Filers cannot be claimed as a dependent of another taxpayer and have an adjusted gross income of $75,000 or less if single.

If you’re head of the household you must have an income of $112,250 or less, $150,000 or less if married filing a joint return.

Reduced payments are available for those who earn more than the above amounts but still earn less than $99,000 per year or less for individuals.

If you’re the head of the household, you must have an income of $136,500 per year or less and $198,000 per year or less for married filing jointly.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money.

You May Like: Who Will Get Stimulus Checks

Will Tax Refunds Be Delayed Longer For Americans As The Irs Tries To Implement Tax Code Changes In The Midst Of Tax Season

Roughly 7.6 million returns havent been processed yet so far this tax season, according to IRS filing statistics through the week ended March 12. That’s nearly three times the number in the same period last year, when 2.7 million faced delayed processing.

Experts say that most Americans shouldnt expect a major delay in their refunds.

IRS has said there are no delays in tax refunds, unless tax returns trigger a closer look with information that warrants additional consideration as with significant changes from prior returns on information different than on IRS systems, says Steber.

Still, some Americans who made sure to file electronically on Feb. 12 when tax season kicked off contacted USA TODAY this month and said they were still waiting for the IRS to process their returns.

The IRS has said that the typical turnaround time for refunds is 21 days.

Some tax professionals are worried that millions of filers could face significant processing delays, especially those who already filed their taxes if they end up having to file an amended return to take advantage of new tax breaks on unemployment and dependent children from the latest relief package passed last week.

If I Sign Up For The Child Tax Credit Will It Affect My Other Government Benefits

No. Receiving Child Tax Credit payments will not change the amount you receive in other Federal benefits like unemployment insurance, Medicaid, SNAP, SSI, TANF, WIC, Section 8, SSDI or Public Housing. The Child Tax Credit is not considered income for any family. So, these programs do not view tax credits as income.

You May Like: When Was The 3rd Stimulus Payment Issued

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Stimulus Check Irs Phone Number: Where To Call

The IRS Economic Impact Payment phone number is 800-919-9835. You can call to speak with a live representative about your stimulus check.

Be prepared to sit on hold, though. If the automated responses cant answer your questions and youd like to talk to a live operator, you may join a long waiting list. Some people say they havent even been able to get through.

Thats why the IRS recommends using its dedicated stimulus check portal for fast assistance. It also reminds those who are eligible for a stimulus check but arent required to file a tax return to use the Non-Filers tool to register for their payment.

Looking for more information about stimulus checks? Check out our stimulus check FAQ page for answers to common payment questions.

Read Also: How To Change Your Bank Account For Stimulus Check

You May Like: H& r Block Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Irs Get My Payment: How To Use The Online Tracker Tool

To get an update on your third stimulus check using Get My Payment, enter your Social Security number, date of birth, street address and ZIP or postal code. The tool will display a message with information about your payment. You can see things like whether your money was sent or is scheduled to be sent, the payment method and the date your stimulus money was issued. The tool may also say it cant yet determine your status see more below about error messages.

You May Like: How To Get Unclaimed Stimulus Checks

Who May Be Eligible To Receive More Stimulus Money

- Parents of a baby born in 2021 who claim the child as a dependent on their 2021 tax return

- Families who added a dependent, such as a parent, grandchild or foster child, on their 2021 tax return who was not listed as a dependent on their 2020 return

- Single filers who had incomes above $80,000 in 2020 but less than that in 2021 married couples who filed a joint return who earned more than $160,000 in 2020 but made less money in 2021 and head-of-household filers with incomes above $120,000 in 2020 but less than that in 2021

- Single filers who had incomes of between $75,000 and $80,000 in 2020 but earned less in 2021 married couples who file jointly who had incomes of between $150,000 and $160,000 in 2020 but less than that in 2021 and heads of household who had incomes of between $112,500 and $120,000 in 2020 but made less money in 2021

Even if you didnt qualify for the first and second round of stimulus payments in 2020, if you had a tough time financially in 2021 and your income is lower , you will get the credit on your 2021 return, Steber says.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Also Check: Telephone Number For Stimulus Check

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Who Is Getting The Letters

The IRS said the 9 million people, who were identified by the Treasury’s Office of Tax Analysis, are those who aren’t required to file taxes because they have very low incomes. Single taxpayers under 65 typically don’t have to file a tax return if they earn less than $12,550 a year, for instance, while that goes up to $14,250 for single people over 65.

Don’t Miss: Apply For Stimulus Check Online

State And City Stimulus Checks

Congress has yet to agree on a fourth federal stimulus check, leaving many states to come up with their own programs to help eligible residents.

In California, the Golden State Stimulus II program offers residents over $568million in extra funding through the end of the year.

The program is for residents who have been financially impacted as a result of the pandemic.

Over half a million residents received $285 checks in Maine. In Maryland, qualifying residents can receive a check worth between $300 to $500.

Read Also: Is 2021 Stimulus Check Taxable

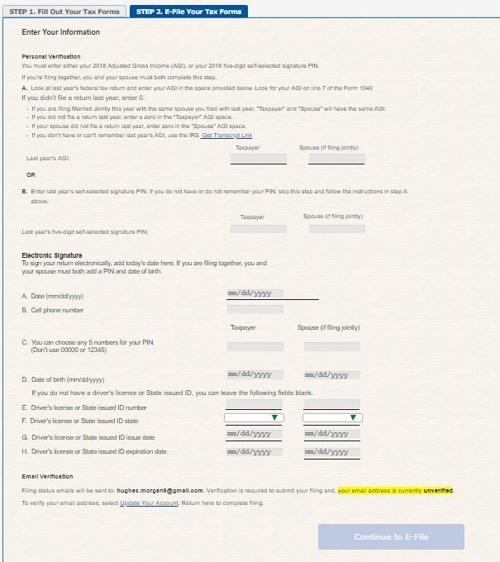

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

You May Like: State Of Maine Stimulus Check

Who Will Be Eligible For A Stimulus Check

Stimulus check in this pandemic situation is worth ensuring a better life indeed. When you were dependent on someones else tax return, you may be lucky to get this stimulus check as well. The IRS is explaining a five-part test to make sure they are eligible to get this stimulus check.

- The adult children need to be older than age 17 and younger than 19 to make sure they are considered adult-dependent from a tax perspective.

- The Taxpayer must claim the adult children as a dependent when they were students at least for 5 months last year and under the age of 24.

- You were not claimed as dependent on other peoples tax returns for the year 2020.

- There are income limit criteria for filing a tax return even if you have low income.

How To Claim The Credit

The first stimulus check was worth up to $1,200 per eligible individual plus $500 per eligible child, while the second was worth up to $600 per eligible individual and dependent. Generally, individuals with adjusted gross income up to $75,000, heads of households earning up to $112,500 and married couples filing jointly earning up to $150,000 qualified for full payments. The amount of the checks then phased out above those income levels.

The value of the checks were based on taxpayers’ 2019 returns at first to streamline sending them out. But those who had a child or lost income in 2020 relative to 2019 likely qualified for more money than they received based on their 2019 tax return.

Eligible individuals can claim the credit on line 30 of Form 1040 or Form 1040-SR. Tax software should allow users to claim the stimulus check funds, but you will need to know how much you already received from the IRS. This can be found via bank statements for the deposit amount, or via your IRS online account.

Those eligible for more will not receive a separate check it will be part of their tax refund, or will reduce the amount of tax owed to the IRS.

Additionally, low-income individuals who don’t normally file were also eligible for the stimulus checks, but needed to give their bank account information or address to the IRS in order to receive them. To do so now, you can file a simplified return or use the IRS’s Child Tax Credit Non-filer Sign-up tool .

Also Check: New York Stimulus Check 4