Who Is Eligible For The Recovery Rebate Credit 2021

Single filers who had incomes between $75,000 and $80,000 in 2020 but had lower incomes in 2021 married couples who filed a joint return and had incomes between $150,000 and $160,000 in 2020 but had lower incomes in 2021 and head of household filers who had incomes between $112,500 and $120,000 in 2020 but had lower …

The Irs Is Sending Out Another Round Of Stimulus Payments Here’s What You Need To Know About The Third Stimulus Check With Your Name On It

The IRS started sending third stimulus check payments in batches shortly after President Biden signed the American Rescue Plan Act on March 11. And, so far, the tax agency has sent over 150 million payments. But many Americans especially those who haven’t received a check yet still have a lot of questions about the third-round stimulus checks. At the top of the list: How much will I get? And when will I get it?

Fortunately, we have answers to these and other frequently asked questions about your third stimulus check. We also have a nifty Third Stimulus Check Calculator that tells you how much money you should get . Read on to get the answers you need to the questions you have. Once you know more about your third stimulus check, you can start figuring out how you can use the money to your advantage.

Question: How many third-round stimulus checks will I get?

Answer: As with the first two round of checks, the legislation authorizing the third round of payments only calls for one payment. This is not a “recurring” payment situation.

Some married couples could also get two payments. If a joint tax return is filed, a married couple could get two separate third stimulus payments. Half may come as a direct deposit and the other half will be mailed to the address the IRS has on file. Each spouse should check the IRS’s “Get My Payment” tool separately using their own Social Security number to see the status of their payments.

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

Generally, anyone who is a U.S. citizen or U.S. resident alien is eligible. You will get the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer, have a valid Social Security number , and your AGI on your tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing status, such as single filers and married people filing separate returns.

Payments will be phased out or reduced above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using any other filing status, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 , and $160,000 will get no payment based on the law.

Also Check: Stimulus Check For Social Security Recipients 2021

What Is The Earned Income Tax Credit

The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit, which has been available for decades and is aimed at helping low-income workers. Prior to the legislation, childless workers between 25 to 64 could only get up to $538, but the pandemic law boosted that to $1,502.

The law also increased the amount that can be claimed by working families with children, increasing it to as high as $6,728 for parents with three children.

Most people can claim the EITC if they earn under $21,430 for single taxpayers or $27,380 for married people filing jointly.

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Dont Miss: Who Receives Third Stimulus Checks

Read Also: How Many Stimulus Checks Did I Get In 2021

How Many Stimulus Checks Did Americans Get

In total, Americans received three stimulus checks since 2020.

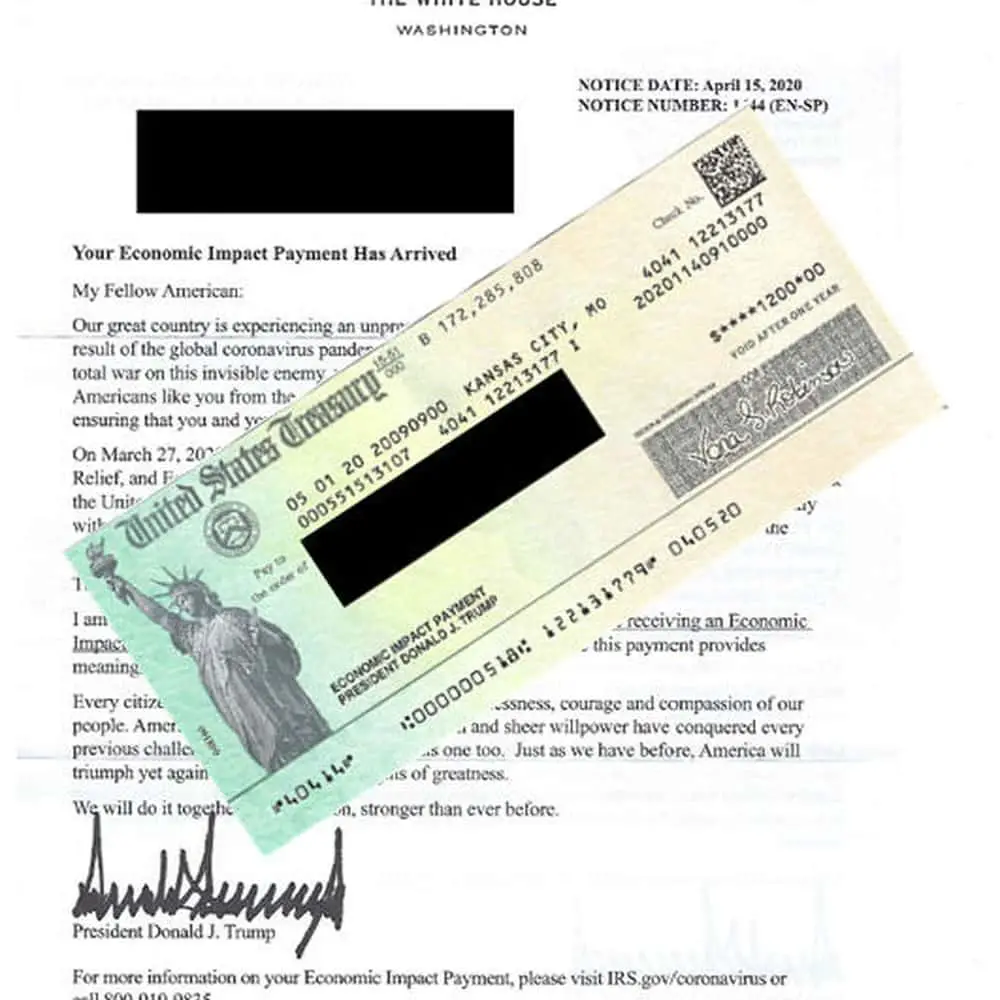

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

Also Check: Irs Stimulus Check Sign Up

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Don’t Miss: Congress’s Mortgage Stimulus Program For The Middle Class

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Also Check: Do You Pay Taxes On Stimulus Checks 2021

St Round Of Stimulus Checks: April 2020

It was specified in the CAREs Act that qualified tax-paying adults would get a check of up to $1,200 and their dependent children under the age of 16 would receive checks of up to $500 as part of a stimulus package .

Those earning less than $75,000 were eligible for the payments, which were provided to those earning up to $99,000 . Individuals received their first stimulus payments on April 11 and 12, either by direct deposit into their bank accounts, paper checks mailed to them, or the Economic Impact Payment Card, a prepaid debit card delivered to them in late May or early June of last year.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Don’t Miss: Ssi Get Stimulus Check 2022

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

Also Check: How To Check On Stimulus Payment For Non Filers

Stimulus Relief Checks: Whos Getting More Money This Fall

Gas prices and inflation as a whole have come down somewhat in recent weeks. However, prices are still much higher than they were a year ago, and that is leaving Americans feeling short-changed.

Student Loan Forgiveness:

The federal government has not indicated that another stimulus check is on the way, so some states are taking matters into their own hands. As usual, each state has its own approach, with some offering tax rebates while others are simply cutting checks. A handful of states have stimulus relief checks or rebates on the way this fall. Find out if your state is on the list as well as some important dates to keep in mind.

You May Like: Amount Of Third Stimulus Check

Who Gets The Next Stimulus Check 2021

The full payment is available to single tax filers with income under $75,000 and married joint filers with an income under $150,000. Payments phase out once income exceeds these thresholds, and single filers with an income above $80,000 or married joint filers with an income above $160,000 aren’t eligible.

Don’t Miss: When Did We Get Stimulus Checks In 2021

Missed The Deadline To Claim Your Child Tax Credit Or Stimulus Money What To Know

If you didn’t claim your child tax credit money or third stimulus check by last night’s cutoff, we’ll explain what you need to do.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The deadline for claiming your missing stimulus or child tax credit payments this year has passed — but that doesn’t mean you’ll never get that money. While the IRS Free File form is indeed closed, you can still claim any money owed to you when you file your taxes in 2023.

Some 9 million people who haven’t received their payments never filed a tax return this year, either because they’re not required to file or because they need more time. The IRS used tax returns to determine eligibility for both of these payments.

Keep reading to find out what you can do to receive any stimulus payments or child tax credit money owed to you. For more, see if your state is mailing out stimulus checks this month.

How Much Does The Third Stimulus Check Pay

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by Congress in December 2020, and adding up to $2,000.

Congress passed the coronavirus relief plan with targeted income limits for maximum stimulus payments to individual taxpayers earning under $75,000 and joint filers making up to $150,000. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples.

Eligibility for the third stimulus checks is based on your tax filing status. For more information on who qualifies for a third stimulus check, our tables below will help you calculate different payment options.

Recommended Reading: Telephone Number For Stimulus Check

Impact Of The Coronavirus Stimulus Checks On The Economy

The emergence of the COVID-19 virus early in 2020 had a huge impact on this countrys economy, with federal and state agencies, as well as many private companies from different sectors, forced to stop their operations in order to preserve the health of their workforce and to prevent the spread of the virus. As a result, the unemployment rate suffered a substantial increase, reaching 14.7% in April 2020, the highest rate observed since data collection began in 1948. The high unemployment rate disproportionately impacted the nations communities of color and low-wage workers. Many households, mainly those with children, were unable to pay for their basic needs: food, housing, utilities, and transportation.

The second stimulus package, The Coronavirus Response and Relief Supplemental Appropriations Act of 2021, was signed by former President Donald J. Trump on December 27, 2020. It was a $900 billion package that included disbursements of up to $600 per household plus an additional $600 for dependent children ages 16 or under. As in the previous stimulus package, those individuals who earned up to $75,000 in 2019 received the full stimulus check, while a gradually smaller figure was provided to those with higher annual incomes, up to a maximum of $87,000.

Table 1. U.S. Households Spending Priorities with Coronavirus Stimulus Money

| Stimulus Program |

|---|

Dont Miss: New York Stimulus Check 4