What If Im A Us Citizen Who Lives Abroad

American citizens who live in another country are eligible for a stimulus payment. Unfortunately, the IRS online tools do not support foreign address or non-US banks, so some expats are experiencing delays in receiving their payment by direct deposit, the fastest delivery method.

If you qualify for a payment but the IRS does not have your bank account information from a previous tax return or you use a non-US bank youll be sent a paper check or prepaid debit card to your last known address.

Why Might I Still Be Eligible For More Stimulus Money

The EIPs were based on taxpayers 2019 or even their 2018 income-tax filing, which means if their economic situation changed in 2020 for the worse, they might not have gotten the full amount due. You may be eligible to claim the Recovery Rebate Credit when you file your 2020 tax return, which you can find on Line 30 of the 1040 and 1040-SR forms.

On the contrary, if your economic situation improved during 2020 making you ineligible for the $1200 and $600 stimulus checks you neednt worry. There was no provision in the law for those who received a direct payment to pay back all or part of the payment if they no longer qualify for that amount or would qualify for a lesser amount.

What If Dont Normally File A Tax Return

The IRS said this third round of stimulus will be based on tax year 2019 or 2020 information, or information obtained by the Social Security Administration and Veterans Affairs Administration. If you are a non-filer who also does not receive a SSA or VA benefit, then use the Non-filer Sign-up tool, described below.

The IRS recently launched a new Non-filer Sign-up tool on its website. Although this non-filer portal is labeled as for non-filers claiming advance payments of the child tax credit, it is also available for others, including single individuals and people experiencing homelessness. It will allow individuals to provide their information to the IRS so that they can receive any of the three Economic Impact Payments , also known as stimulus payments, that they may be missing. If an individual did not get the full amounts of the EIPs, they may use this tool if they:

- Are not required to file a 2020 tax return, didnt file a 2020 tax return, and dont plan to, and

- Want to claim the 2020 Recovery Rebate Credit and get their third EIP.

The new Non-filer Sign-up tool is for people who did not file a tax return for 2019 or 2020, and who did not use the IRS Non-filers tool last year to register for Economic Impact Payments.

Read Also: Is There Another Stimulus Check Coming In 2021

Stimulus Check: How Much Money Will You Get And When

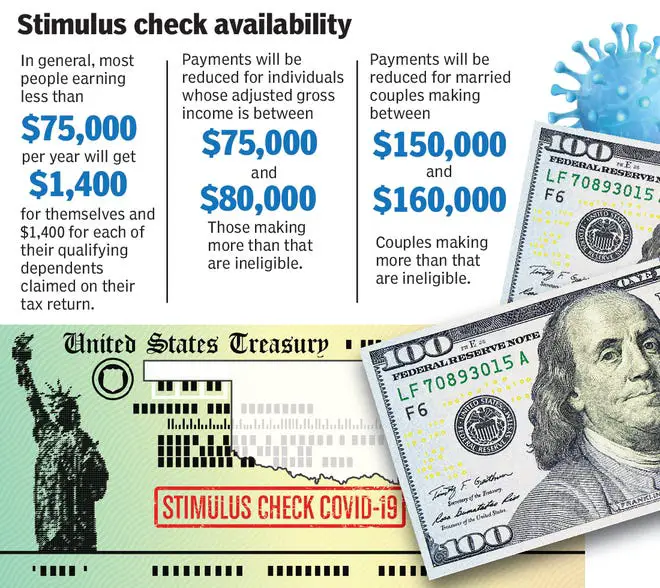

The $2 trillion economic stimulus bill includes help for American families who are hurting financially due to the economic impact of the coronavirus. Most adults will receive $1,200 checks, plus $500 for each of their children. The massive relief package will funnel $290 billion in direct payments to individuals and families. Households are expected to get a check within weeks or months. That could provide a lifeline for the millions of Americans who have already been laid off or seen their income plunge as people hole up to avoid infection.

“Low- and middle-income households would receive about 68 percent of the payments,” noted Tax Policy Center senior fellow Howard Gleckman in a blog post. Here’s what to know about how the payments will work.

California: Up To $1050 Rebate

Californias new budget includes payments of $350 for individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Californians can expect to receive payments between October 2022 and January 2023 via direct deposit and debit cards.

Read more: California Families To Receive Stimulus Checks Up To $1,050

Don’t Miss: How Much In Total Were The Stimulus Checks

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until Nearly 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until nearly 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

What About Timing Of The Checks

Before Mr. Trump’s pushback, Treasury Secretary Steven Mnuchin had predicted on December 21 that Americans could start receiving the funds as soon as the week of December 28.

Despite the president’s delay in signing the bill, Mnuchin on December 29 tweeted that stimulus checks could begin arriving in bank accounts “as early as tonight.”

.@USTreasury has delivered a payment file to the @FederalReserve for Americans Economic Impact Payments. These payments may begin to arrive in some accounts by direct deposit as early as tonight and will continue into next week

Steven Mnuchin

Mnuchin said that paper checks will begin to be mailed on December 30, and that people will be able to check their payment status at the IRS’ “Get My Payment” portal later this week. He didn’t specify how many checks will be initially distributed.

As of January 1, the IRS site says its “Get My Payment” portal isn’t currently open, but that it “continues to monitor and prepare for new legislation related to Economic Impact Payments,” which is the term the IRS uses for stimulus checks.

Don’t Miss: 3rd Stimulus Check 2021 Amount

Here’s How Much Stimulus Money The Average American Has Received

by Lyle Daly | Published on Aug. 16, 2021

Image source: Getty Images

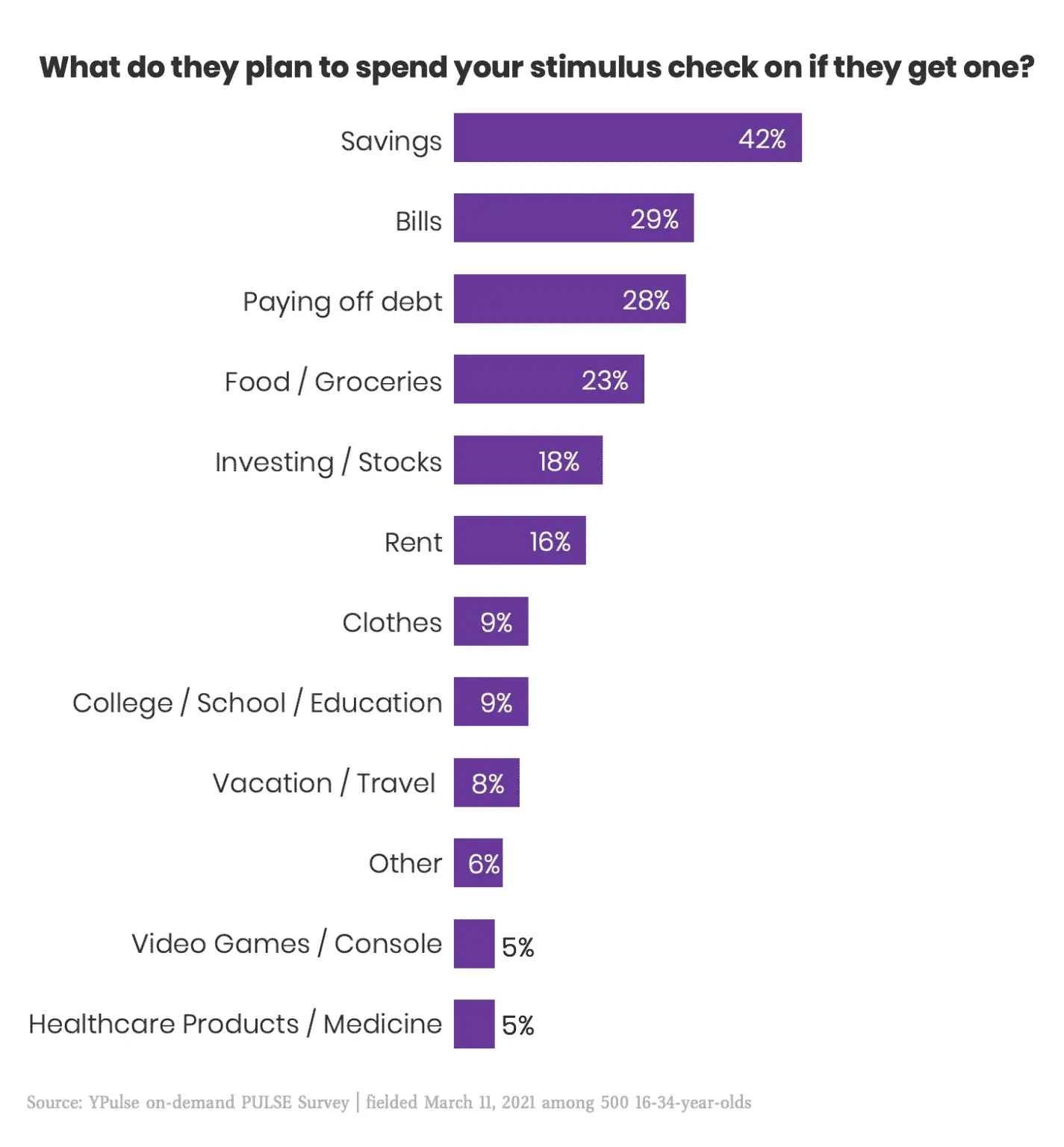

Americans at almost every income level have collected sizable stimulus funds.

Since the beginning of the COVID-19 pandemic, the U.S. government has offered different types of stimulus money, including checks and tax credits.

But how much stimulus money has the average American received so far? We know the answer thanks to research from the Institute on Tax and Economic Policy. According to that data, most Americans got over $3,000 in federal funds, and lower-income Americans benefited the most.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

You May Like: Who Is Eligible For Stimulus Checks 2021

Stimulus Update: Inflation Stimulus Check

12 Min Read | Aug 29, 2022

Social distancing, remote learning, stimulus paymentsthe COVID-19 pandemic introduced us all to lots of new concepts.

And while the 6-foot rule has gone out the window , stimulus checks have hung around. But instead of a stimulus for pandemic relief, state politicians are now cutting stimulus checks to help ease the pain of record-high inflation and gas prices. And theres even talk of a federal inflation stimulus check.

So, is more stimulus money coming your way? Lets take a look.

Will Children Get A $500 Check

Yes. Taxpayers with dependent children will receive a $500 payment for each child, which isn’t determined by income. In other words, taxpayers will get a $500 payment for each of their children, regardless of how high their income is.

There is a catch on children, however: only kids who haven’t yet turned 17 are eligible.

Don’t Miss: Was There Any Stimulus Checks In 2021

Millions Of People May Still Be Eligible For Covid

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower-incomes, limited internet access, or experiencing homelessness. Based on IRS and Treasury data, there could be between 9-10 million eligible individuals who have not yet received those payments.

Relief might be in sight for more families and individuals. Individuals with little or no income, and therefore not required to pay taxes, have until to complete a simplified tax return to get their payments. Taxpayers who missed the April 15 deadline have until . These IRS pages, irs.gov/coronavirus/EIP and ChildTaxCredit.gov, have more information on how to complete and submit a tax return.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals, including the Child Tax Credit and next steps for people who may still be eligible to receive theirs.

Who can get a COVID-19 stimulus payment or a Child Tax Credit?

From April 2020 to December 2021, the federal government made direct COVID-19 stimulus payments to individuals totaling $931 billion. Congress authorized three rounds of payments that benefited an estimated 165 million eligible Americans. Generally, U.S. citizens with income below $75,000 or married couples with an income below $150,000 were eligible for all three payments and the full amount of each payment.

What more can Treasury and IRS do to get the word out about how eligible individuals can get their payments?

How Many Stimulus Checks Have There Been

If youre like most people, everything thats happened since March 2020 is a blurincluding how many stimulus checks there were and when the checks went out. Heres a quick reminder.

First stimulus check: March 2020 $1,200

Second stimulus check: December 2020 to January 2021 $600

Third stimulus check: March 2021 $1,4004

Don’t Miss: When Are We Receiving Stimulus Checks

First Round Of Economic Stimulus Checks: April 2020

The CAREs Act included a provision for a round of stimulus payments eligible tax-paying adults received a check of up to $1,200 while eligible dependents under 16 years of age received $500 each .

The payments were made to everyone earning under the income limits, which were set at Adjusted Gross Income of $75,000 with the stimulus check value reducing in a tapered fashion up to a maximum of $99,000 . The very first stimulus checks were paid into peoples bank accounts over the weekend of the 11 and 12 of April, either via direct deposit into individuals bank accounts, paper checks sent through the post or in some cases, through a prepaid debit card, the Economic Impact Payment Card which were sent out in late May/early June last year.

Will There Be More Stimulus Checks

Over 2.15 million people have signed an online petition started by restaurant owner Stephanie Bonin calling for a fourth stimulus check.

There has been no word on if Congress is planning on passing a fourth check.

In a meeting earlier this week, White House press secretary Jen Psaki was asked whether the Biden administration would support a fourth stimulus check.

Well see what members of Congress propose, but those are not free, Psaki said.

Dont Miss: How To Get My Stimulus

Read Also: Were There Any Stimulus Checks In 2021

Can My Bank Take My Stimulus Check

It may. While the CARES Act does not allow your stimulus payment to be garnished for federal or state debts , it doesnt explicitly prohibit private debt collection.

If you are receiving your payment through direct deposit, it can legally be seized by your bank to pay offset a negative account balance caused by things like delinquent debt or overdraft charges, according to a report from the Prospects David Dayen.

While the New York Times reported that some people banking with credit unions have had their stimulus payments taken, it also said the four biggest US banks JPMorgan Chase, Wells Fargo, Citi Bank, and Bank of America are pausing their collections on negative account balances to give customers access to the stimulus.

Heres some advice on what to do if your bank takes your stimulus payment.

You May Like: Havent Got My Stimulus

$600 For Each Dependent Child

Aside from the smaller stimulus checks for adults, the other major change under the bill passed by Congress is the amount provided for dependent children: $600 for each child, up from $500 in the CARES Act.

However, the bill states the $600 would be directed toward each dependent child under age 17, which means that adults who are nevertheless claimed as dependents such as college students and older high school studentswouldn’t qualify for the checks.

Adult dependents, such as seniors who are claimed as dependents on their adult children’s tax returns, also wouldn’t qualify for the checks. Excluding college students and other adult dependents was a matter of debate with the first round of checks, with some families arguing that older dependents should also qualify for the payments.

A family of two parents with two child dependents could receive up to $2,400 under the provision, lawmakers said.

Also Check: Who Sends The Stimulus Checks

Stimulus Check 1 And 2

If you did not receive your first or second stimulus check, you will need to file a 2020 tax return to obtain it. The IRS is accepting returns for the 2020 tax year so you can submit your forms as soon as you are able.

When you submit your 2020 tax return, you will be able to claim unpaid funds from your first and second stimulus check through the “Recovery Rebate Credit.” You can claim this credit if you did not receive any stimulus money at all. If you received the incorrect amount, you can claim a partial credit and get any additional funds you’re owed.

It’s possible to claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Unfortunately, since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return. This means individuals who ordinarily wouldn’t submit one will have to this year to get their funds.

E-filing your 2020 return and requesting a refund via direct deposit is the fastest way to claim any unpaid stimulus funds. You can file your return electronically for free if your income is under $72,000. The IRS has instructions on how to do that on its Free File website.

Second Round Of Checks Up For Debate

Lawmakers are currently debating on a second round of stimulus checks.

Many Democrats have said that the first round of checks is not nearly enough for Americans, as businesses have been forced to close and people have had hours cut at work, been furloughed or lost their jobs entirely.

Over 50 Democratic lawmakers signed a letter in April encouraging monthly direct payments as part of a fourth coronavirus response bill, The Hill reported.

Reps. Alexandria Ocasio-Cortez of New York, Sen. Kamala Harris of California, Rep. Rashida Tlaib of Michigan and Rep. Ilhan Omar of Minnesota were among those supporting the monthly payments.

Republicans, however, have been less keen about a second round of checks and pushed for the economy to open instead.

The real stimulus thats going to change the trajectory that were on is going to be the economy, not government checks, Republican Sen. Lindsey Graham said during a virtual town hall.

So I doubt there will be another payment, he added.

Read Also: Will You Get A Stimulus Check

Recommended Reading: Is The Fourth Stimulus Check Coming

How Do You Get One

The payment will occur automatically by check or direct deposit for many eligible people. This includes people who filed a tax return for 2018 or 2019, and those who did not file tax returns but receive railroad pensions or Social Security retirement, disability, or survivor benefits. Payments began in April 2020 and are continuing to be made.

Some people who are not required to file tax returns are eligible but need to provide their information to the IRS to receive a payment. This includes non-filing individuals with gross incomes below $12,000, married couples with gross incomes below $24,000, certain veterans, and some people with disabilities. To provide information to the IRS to receive a payment, visit www.irs.gov/coronavirus/non-filers-enter-payment-info-here.

People who received a tax refund for 2018 or 2019 by direct deposit will have payments directly deposited into their accounts. People who did not receive a tax refund or received their refund by check will receive their payment by check. However, people set to receive payment by check can provide their bank account information to the IRS to get their payment by direct deposit. Visit www.irs.gov/coronavirus/get-my-paymentto do so.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Read Also: Sign Up For Fourth Stimulus Check