How Will The Irs Know Where To Send My Payment

The vast majority of people do not need to take any action. The IRS will calculate and automatically send the economic impact payment to those eligible.

For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the return filed.

Read Also: Get My Stimulus Payment For Non Filers

Biden Hopes To Continue The Expanded Ctc

In another effort to help struggling Americans, President Biden wants to continue the child tax credit payments.

The Biden administration originally proposed extending the payments through 2025, but that proposal was reduced to just one additional year.

CTCs are part of the nearly $2trillion Build Back Better Act which includes a slew of social spending programs and climate practices for the US.

The spending package failed to get the key vote of Democrat Sen. Joe Manchin.

Manchin expressed his concerns over the spending amount and the effects on inflation.

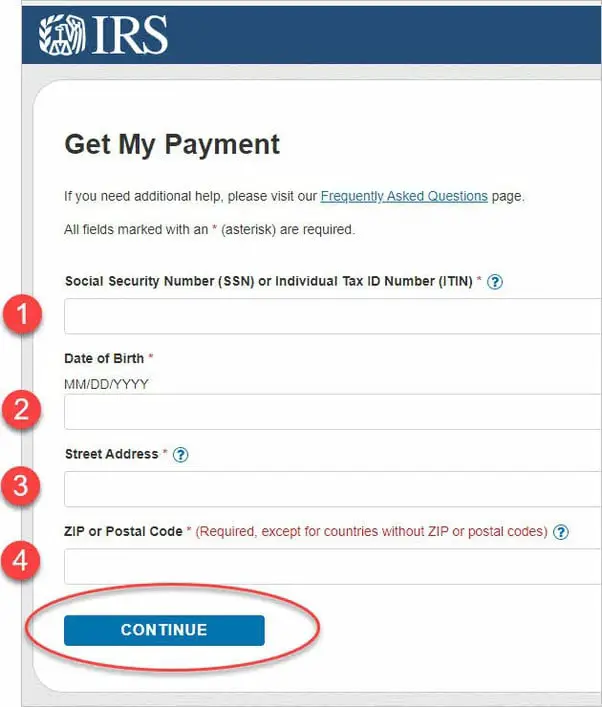

I’m Having Trouble Accessing The Get My Payment Tool

Some people visiting the site may get a “please wait” or error message due to the high volumes coming in. The “please wait” message is a normal part of the site’s operation. We encourage people to check back later. Also, there is a limit to the number of times people can access Get My Payment each day. When people reach the maximum number of accesses, Get My Payment will inform them they will need to check back the following day.

You May Like: Are They Giving Out Stimulus Checks

Where’s The Line For The Stimulus Tax Breaks

This tax season, don’t look for a spot to claim stimulus cash or the recovery rebate credit on a federal income tax return. That credit is gone. Line 30, where the “Recovery rebate credit” was listed on the 2021 return, simply states “Reserved for Future Use” on the 2022 tax return. Leave it blank.

Another tip: The child tax credit won’t be as generous as it was in 2021. Those who got up to $3,600 per dependent for 2021 for the child tax credit will, if eligible, get up to $2,000 for the 2022 tax year.

What If You Didnt Receive Your First Stimulus Check

If you are an eligible individual and you did not receive a stimulus check earlier this year, you will be able to claim it when you file your 2020 taxes in 2021. This is also true if you do not receive your second stimulus check.

If you didnt receive a check, the IRS urges you to review the eligibility criteria when you file your 2020 taxes many people, including recent college graduates, may be eligible to claim it. The stimulus checks will be referred to as the Recovery Rebate Credit on Form 1040 or Form 1040-SR. You can read more about the Form 1040 for 2020 – including where the RRC can be found – here.

Recommended Reading: Senior Citizens 4th Stimulus Check

I’m Eligible For A 2020 Recovery Rebate Credit But Did Not Claim It On My 2020 Tax Return Do I Need To Amend My 2020 Tax Return

Yes. Those who didn’t claim the credit on their 2020 tax return by entering an amount on line 30 of Form 1040 or Form 1040-SR, will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return. The IRS will not calculate the 2020 Recovery Rebate Credit if the taxpayer did not enter any amount on their original 2020 tax return.

Those who need to file an amended return to claim the Recovery Rebate Credit should use the worksheet on page 59 of the 2020 instructions for Form 1040 and 1040-SR to determine the amount of the credit. Enter the amount on the Refundable Credits section of the 1040-X and include “Recovery Rebate Credit” in the Explanation of Changes section.

Those who filed their 2020 return electronically and need to file an amended return may be able to file Form 1040-X electronically.

Taxpayers who did not file their 2020 return electronically will need to submit a paper version of the Form 1040-X and should follow the instructions for preparing and mailing the paper form.

Those filing Form 1040-X electronically or on paper can use the Where’s My Amended Return? online tool to check the status of their amended return.

Child Tax Credit Update Portal

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Well issue the first advance payment on July 15, 2021. For a full schedule of payments, see If Im eligible to receive advance Child Tax Credit payments, when will I start receiving payments?

If you dont have a bank account for direct deposit, see Dont have a bank account?

- Check if youre eligible and/or enrolled for advance payments

- View your bank account and mailing address

- View your payments

Also Check: How To Check Status Of Stimulus Check

What If I Dont File A Tax Return

What if you dont file taxes, or if you make too little money to file taxes? Luckily, you likely still qualify for a stimulus check, and the IRS has a form for that.

If by chance, you make too little money to need to file taxes, you can fill out a non-filers form with the IRS. Filling out this form will help you start the process to receive your stimulus check.

Heres the information youll need if you have to fill out the non-filers form:

- Full name, current mailing address and an email address

- Date of birth and valid Social Security number

- Bank account number, type and routing number, if you have one

- Identity Protection Personal Identification Number you received from the IRS earlier this year if you have one

- Drivers license or state-issued ID, if you have one

- For each qualifying child: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse

Youll also have to create an account with a password for the site. Once youve filled out the form correctly, youll get a notice from the IRS confirming that theyve received it.

Payment Status Not Available: Why

The IRS says that millions of taxpayers have successfully used the new Get My Payment app to track their stimulus checks and, if needed, add their direct deposit information to get payment faster. So why are countless people complaining on social media that they entered their information at the app only to receive a frustrating Payment Status Not Available message?

In some cases, there could be glitches with the Get My Payment app itself that are preventing people from adding direct deposit information or finding out the expected date for their payments to arrive. Among other quirks, the system may give you a Payment Status Not Available Message if you owed $0 in taxes and received no refund on your most recent tax return, the Washington Post reported, because the IRS form gave an error message for people entering 0 in those corresponding spots.

The Get My Payment app went offline during certain late-night hours on Thursday, April 23, through Saturday, April 25, for planned maintenance. On April 26, the IRS announcedsignificant enhancements to the app, though the agency did not specify which glitches had been fixed. We urge people who havent received a payment date yet to visit Get My Payment again for the latest information, IRS Commissioner Chuck Rettig said in a statement. IRS teams worked long hours to deliver Get My Payment in record time, and we will continue to make improvements to help Americans.

Don’t Miss: I Never Got Any Of The Stimulus Checks

Stimulus Checks : State Relief Checks Tax Implications And More Of The Biggest Topics Of 2022

Although the federal government did not issue any economic impact payments aka stimulus checks in 2022, some states took it upon themselves to offer financial relief to eligible residents to offset the effects of inflation and rising gas prices. These inflation relief checks were issued in 17 states in 2022: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Maine, Massachusetts, New Jersey, New Mexico, New York, Pennsylvania, South Carolina and Virginia. Payment amounts ranged from $50 to $1,050 for individuals, depending on the state and income level of the recipient.

See: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

Given the tough economic times, its no surprise GOBankingRates readers looked for information on future stimulus payments they may be receiving, which states are offering inflation relief payments and when they might expect to receive these payments. These topics and more were among our most-read stimulus stories of the year.

Heres a look at the top 10 most-read stimulus stories of 2022.

Recommended Reading: What States Are Getting The Fourth Stimulus Check

People Should Check Get My Payment For Status Of Third Eip And Watch Their Mail

COVID Tax Tip 2021-38, March 29, 2021

The IRS continues to issue the third round of Economic Impact Payments to eligible individuals, with payments being issued as a direct deposit or by mail as a paper check or prepaid EIP debit card. No action is needed by most eligible people to receive a third Economic Impact Payment automatically.

You May Like: Irs Get My Payment 3rd Stimulus Check

What Should I Do

Before you ask for a refund trace

If you asked for a direct deposit refund, double check the bank account information you provided to the IRS to be sure there were no mistakes on your tax return. The IRS assumes no responsibility for errors by you or your preparer. You should also check with your financial institution to make sure the mistake hasnt been at their end.

The Protecting Americans from Tax Hikes Act made the following changes, which became effective for the 2017 filing season, to help prevent revenue loss due to identity theft and refund fraud related to fabricated wages and withholdings:

- The IRS may not issue a credit or refund to you before February 15, if you claim the Earned Income Tax Credit or Additional Child Tax Credit on your tax return.

- This change only affects returns claiming EITC or ACTC filed before February 15.

- The IRS will hold your entire refund, including any part of your refund not associated with the EITC or ACTC.

- Neither TAS, nor the IRS, can release any part of your refund before that date, even if youre experiencing a financial hardship.

When can I ask the IRS to trace my refund?Direct deposit: The IRS generally direct deposits refunds within 21 days after receiving your tax return. If you dont receive your deposit within five days after the 21 days have passed, you can request a refund trace.

Paper check: If you dont receive your refund check within six weeks of mailing your tax return to the IRS, you can request a refund trace.

What Does The Stimulus Check Portal Do

The updated Get My Payment tool lets you:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

For first-round stimulus payments, you could also use the portal to enter or change your bank account information to have your payment directly deposited into your account. However, that feature isnt included in the current tool . The IRS already has bank account information for millions of Americans from recent tax returns, tax payments, the original Get My Payment tool, the non-filers tool used last year, other federal agencies that regularly send out benefit payments , and federal records of recent payments to or from the government. So, the tax agency is generally limiting direct deposit payments to bank accounts that they already have on file. As a result, you cant change your bank information using the Get My Payment tool.

If your payment isnt deposited directly into your bank account, then youll get either a paper check or a debit card in the mail . You could also receive a payment by mail if your bank rejected a direct deposit. This could happen because the bank information was incorrect or the bank account on file with the IRS has since been closed.

Read Also: How Much In Total Were The Stimulus Checks

What Are The Major Tax Refunds This Year

After the first spread of the novel coronavirus in the United States of America, the federal government announced several tax reforms and new financial reliefs.

Nowadays, there are several things that you can track for your tax refund this year. As usual, if you have overpaid your taxes in the year 2021, then you are eligible to receive that money back as a tax refund.

Apart from that, if you are a parent, you could also receive child tax credit money. The government announced that they are going to release 3600 U.S. dollars per child.

You can also expect reimbursements for the money you spent on childcare-related expenses last year. Many people also missed their third stimulus payment, which can also be claimed in your tax refund.

These are the few major tax refunds that you can expect this year. Other than that, if you are eligible for an unemployment insurance claim, then you can also expect that in your tax refund.

What If You Have Changed Your Address Or Bank Account

The IRS will use the data already in its systems to send the new payments:

- If your direct deposit information is on file, you will receive the payment that way.

- If your direct deposit information is not on file, you will receive the payment as a check or debit card in the mail.

Some payments may have been sent to an account that may be closed or no longer active. By law, the financial institution must return the payment to the IRS, they cannot hold and issue the payment to an individual when the account is no longer active.

The IRS cannot change payment information, including bank account or mailing information. If an eligible taxpayer does not get a payment or it is less than expected, it may be claimed on the 2020 tax return as the Recovery Rebate Credit. Remember, Economic Impact Payments are an advance payment of what will be called the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR.

Also Check: Updates On The 4th Stimulus Check

Will We Get Another Federal Stimulus Check

The third payment was probably the last one you will get for the foreseeable future. Democrats passed the third stimulus check through budget reconciliation, which allowed them to pass it with a simple majority vote in the Senate.

There is a limit on the number of times Democrats can use reconciliation and the Republicans have made it clear theyre not going to provide further COVID relief. Therefore, it is unlikely that a fourth stimulus check will be authorized.

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Also Check: When Was The 3rd Stimulus Payment Issued

Check The Status Of Your Third Economic Impact Payment

All Third Economic Impact Payments must be issued by Dec. 31, 2021 in accordance with the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

The IRS mailed Notice 1444-C to people who received a third Economic Impact Payment. You should keep this letter with your tax year 2021 records.

Check when and how your payment was sent with the Get My Payment tool.

What Are All These New Lines For Income

This tax season, filers will spot a new area on the front of the 1040 that spells out several specific lines to list various sources of your income.

But he noted that the front of the 1040 for 2022 now starts with Line 1a for wages that are listed on a W-2 and then lists lines for 8 other sources of income, such as Line 1b for household employee wages not reported on a W-2 form and Line 1c for tip income not reported on Line 1a.

There is no change in what’s considered taxable income. But the new lines give the IRS more information and better clarity on whether you’re reporting all of the income that you should, Luscombe said.

When it comes to household employees, for example, an employer isn’t required to provide a W-2 form to list your wages if they paid you less than $2,400 in 2022. But you’d use Line 1b to enter the total wages you received as a household employee that were not reported on a W-2.

The IRS notes that you should use Line 1c to report any tip income that you didn’t report to your employer and the value of any “noncash tips” that you received last year, including tickets or passes to events. “Although you dont report these noncash tips to your employer, you must report them on line 1c,” according to the IRS instruction booklet for 2022.

More:Ann Arbor man wonders about $933 IRS said he was owed

Recommended Reading: 766 Tax Relief Credit Stimulus