Wheres My Second Stimulus Check

OVERVIEW

As a part of the Coronavirus Response and Relief Supplemental Appropriations Act recently signed into law, the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers. Here are answers to some of the top questions you may have about the second stimulus checks.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

As a part of the Coronavirus Response and Relief Supplemental Appropriations Act recently signed into law, the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers.

Here are answers to some of the top questions you may have about the second stimulus checks:

If you have an adjusted gross income of up to $75,000 , you could be eligible for the full amount of the recovery rebate $600 for eligible individuals, $1,200 for joint taxpayers, and an additional $600 for each dependent child under 17.

*Note, adjusted gross income is your gross income like wages, salaries, or interest minus adjustments for eligible deductions like student loan interest or your IRA deduction. Your AGI can be found on line 8b of your 2019 Form 1040.

The same eligibility rules apply to the second stimulus payment as the first one. You must have a valid Social Security number, and you cant have been claimed as a dependent on someone elses 2019 tax return.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

Recommended Reading: Can You Claim Stimulus On 2021 Taxes

Amended Return May Be Needed For Those Eligible To Claim The Credit And Irs Records Show No Economic Impact Payment Was Issued

For eligible individuals who didn’t claim a Recovery Rebate Credit on their 2021 tax return and IRS records do not show the issuance of an Economic Impact Payment, they will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return, to claim the remaining amount of stimulus money for which they are eligible. This includes individuals who may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020.

Individuals can use the Interactive Tax Assistant, Should I File an Amended Return?, to help determine if they should amend their original tax return.

Taxpayers who need to file an amended return to claim the 2021 Recovery Rebate Credit even if they dont usually file taxes – should use the worksheet in the 2021 instructions for Form 1040 and 1040-SR to determine the amount of the credit. Enter the amount on the Refundable Credits section of the Form 1040-X and include “Recovery Rebate Credit” in the Explanation of Changes section.

Individuals who filed their 2021 return electronically and need to file an amended return, may be able to file Form 1040-X electronically.

If a taxpayer did not file their 2021 return electronically, they’ll need to submit a paper version of the Form 1040-X and should follow the instructions for preparing and mailing the paper form.

How To Claim Your Missing $600 Or $1200 Payments

The stimulus checks are generally advance payments of a tax credit.

The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first $1,200 stimulus check or the second $600 payment if that money is due to you line 30 of Forms 1040 or 1040-SR.

On that part of the return, filers can start with the amount of stimulus money they already received and calculate any more funds which they are due. That can be done either through a worksheet provided with the tax form or through tax preparation software.

More from Personal Finance:

You May Like: How Much Stimulus Should I Have Gotten

Why Is The Amount On My Form 1099

The amount of refund shown on your Form 1099-G could be different from the amount of refund you received for any of the following reasons:

-

You reported consumer use tax on your D-400

-

You made a contribution to the NC Nongame and Endangered Wildlife Fund, the NC Education Endowment Fund, or the NC Breast and Cervical Cancer Control Program

-

You chose to apply a portion of your overpayment toward the following years estimated tax

-

A portion of your overpayment was offset to a prior tax year or external agency having a claim against your refund

-

You received interest which is reported separately on a Form 1099-INT

How To Claim The Recovery Rebate Credit On A Tax Return

You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return, whichever is applicable. If you file your return using any of the best tax preparation software on the market, the program will guide you through the worksheet.

âWhen you file your 2020 or 2021 tax return, youâll have to report the stimulus checks you received with the recovery rebate credit you are entitled to claim,â says Samantha Hawkins, a certified public accountant and founder of Hawkins CPA Solutions in Upper Marlboro, Maryland.

You can find the amount of your first stimulus payment on your Notice 1444, which was mailed by the IRS. The tax agency followed up with a Notice 1444-B for the second stimulus round and Notice 1444-C for the third.

If you donât have the notices, you can create an online account with the IRS to verify the payments you received.

If you got less than the full stimulus payment for any of the rounds, the worksheet asks you questions about your income. In some cases, you may be entitled to claim an additional stimulus payment.

You can claim missing or partial first- and second-round stimulus payments only on your 2020 federal tax return. Any missing or partial third-round stimulus payments can be claimed on your 2021 federal tax return only.

If youâre behind on your returns, you have until Sept. 30 to file your 2020 taxes penalty-free. Taxpayers who got extensions to file their 2021 returns must submit those by Oct. 17.

Recommended Reading: What Were The Three Stimulus Payments

Who Should Apply For A Recovery Rebate Credit

The IRS has prepared a special worksheet for Americans who think they might be eligible for a Recovery Rebate Credit on their 2020 tax return. Youll have to fill that out when claiming your credit. But there are a few groups of people who might want to pay close attention in particular.

The 2020 tax return is the great corrector for all changes, issues or lost money that you didnt receive with your stimulus check, says Mark Steber, senior vice president and chief tax officer at Jackson Hewitt. You may be due $1,200, $1,800 or $2,400. The skys the limit if youve got three children and are married and havent gotten your payment.

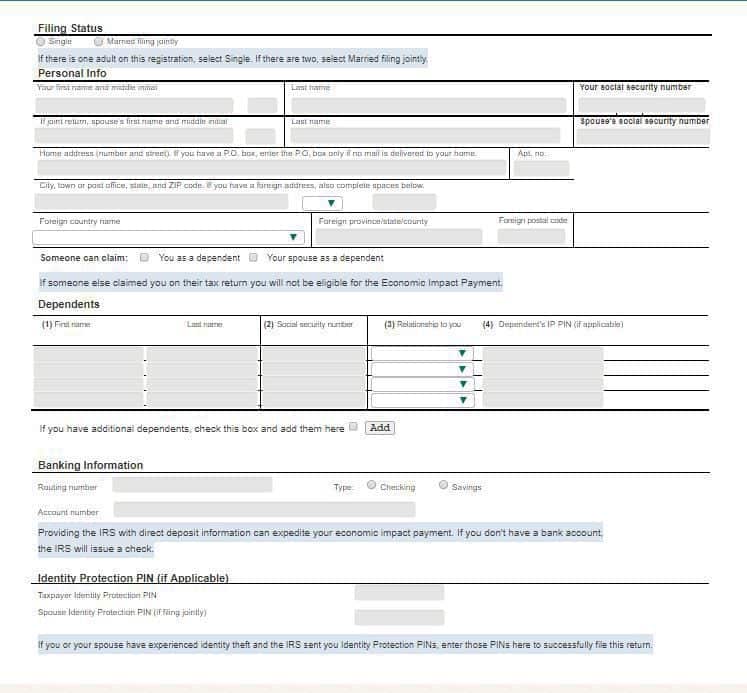

Eligibility For The Covid

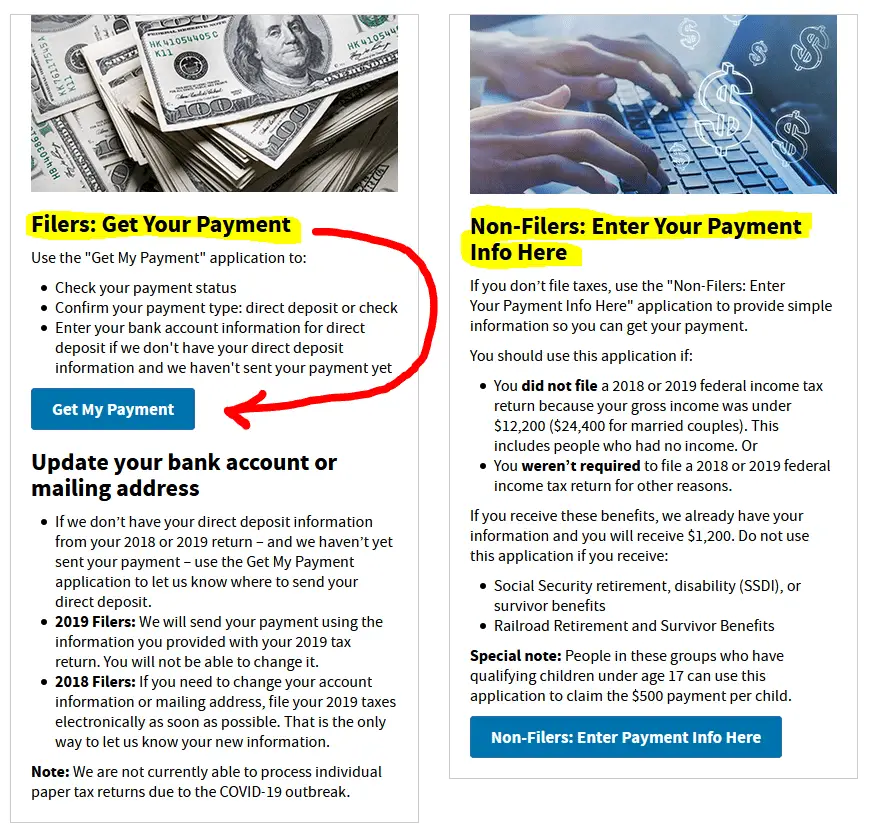

Every individual making $75,000 or less will receive a check for $1,200. Couples making less than $150,000 and that file taxes jointly should each receive $1,200 for a total of $2,400, with an additional $500 for each child. Those making between $75,000 and $99,000 a year should receive reduced checks on a sliding scale. Those making more than $99,000 individually or $198,000 jointly are ineligible.

Eligibility is being determined by 2019 and 2018 tax returns, but for those that are not required to file taxes, the IRS has set up a separate tool. Follow the link in these instructions for non-filers. The government will verify your income for those years and, if you qualify and have a bank account registered for tax refunds, you should receive a direct deposit. If you dont have a bank account registered with the IRS for direct deposits, you should receive a stimulus check in the mail.

Read Also: Updates On The 4th Stimulus Check

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Recommended Reading: How Are Stimulus Checks Distributed

Correcting A Mistake After The 2021 Tax Return Is Filed No Amended Return Needed

Individuals who made a mistake calculating the Recovery Rebate Credit and claimed an amount on line 30 for the 2021 Recovery Rebate Credit should not file an amended return. The IRS will correct the amount of the 2021 Recovery Rebate Credit and send a notice identifying the changes made.

If a correction is needed, there may be a delay in processing the return. If the taxpayer agrees with the changes made by the IRS, no response or action is required to indicate they agree with the changes. If the taxpayer disagrees, they can call the toll-free number listed on the top right corner of their notice.

California Adjusted Gross Income

You must have $1 to $75,000 of California AGI to qualify for GSS II. Only certain income is included in your CA AGI . If you have income thats on this list, you may meet the CA AGI qualification. To receive GSS II and calculate your CA AGI, you need to file a complete 2020 tax return by October 15, 2021. Visit Ways to file, including free options, for more information.

Income included in CA AGI

Generally, these are included in your CA AGI:

- Wages and self-employment income

- Gains on a sale of property

Visit Income types for a list of the common types of income.

Income excluded from CA AGI

Generally, these are not included in your CA AGI:

- Social Security

- Supplemental Security Income /State Supplementary Payment and Cash Assistance Program for Immigrants

- State Disability Insurance and VA disability benefits

- Unemployment income

You would generally not qualify for GSS II if these were your only sources of income. However, if you have income that is included in CA AGI in addition to this list, you may qualify for GSS II.

For information about specific situations, refer to federal Form 1040 and 1040-SR Instructions and California 2020 Instructions for Form 540. Go to Line 17 of Form 540 for CA AGI.

If you receive Social Security

You may be wondering whether or not you qualify for GSS II if you receive Social Security income. Social Security income is not included in CA AGI. However, if you have $1 or more of CA AGI , you may qualify for GSS II.

Also Check: When Were The 3 Stimulus Checks Sent Out

Who Qualifies For The Middle Class Tax Refund

You must have lived in California for at least half of the 2020 tax year and filed your state tax return by Oct. 15, 2021, to qualify.

Any California resident who filed state taxes individually and made $250,000 or less is eligible for the Middle Class Tax refund, as are couples who filed jointly and made $500,000 or less. Individual filers who earned over $250,000 in 2020 and couples who made more than $500,000 combined are not eligible for the refund, nor is anyone who was claimed as a dependent in the 2020 tax year.

In addition, you must have lived in the state of California for at least half of the 2020 tax year, have filed your state tax return by Oct. 15, 2021, and still be a California resident on the date the MCTR payment is issued.

You May Like: How Much Was The Stimulus In 2020

Didnt Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, well also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Also Check: New Round Of Stimulus Check

Stimulus Update: Will There Be Another Stimulus Check In 2023

Although the country is dealing with record-high inflation, the federal government will not be issuing a fourth stimulus check in 2023. AP

If youve noticed the record-high inflation while shopping, you might be wondering if the federal government will extend a COVID-19 pandemic-era benefit.

While individual states are offering relief programs, it doesnt seem like the federal government will offer a fourth stimulus check anytime soon.

Congress has not passed any legislation authorizing a fourth stimulus check. Other pandemic-era programs, such as the Child Tax Credit, also have expired.

At this time, were not hearing that there are plans for additional federal stimulus checks in 2023, Mark Steber, chief tax information officer with Jackson Hewitt, recently told VERIFY.

Despite lawmakers plans to move forward without a fourth stimulus check, there are still people at the grassroots level pushing for extra stimulus help at the federal level.

A 2020 Change.org petition calling for $2,000-per-month payments for every American is still gathering signatures. It recently surpassed 3.049 million signatures.

These stimulus checks were issued in 2020 and 2021. They totaled more than $3,000 to help people affected by the economic downturn caused by the pandemic.

Our journalism needs your support. Please subscribe today to NJ.com.

Katherine Rodriguez can be reached at . Have a tip? Tell us at nj.com/tips.