Your Stimulus Payments Won’t Be Taxed But There Is One Exception

The IRS doesn’t consider stimulus payments to be income, which means you won’t be taxed on your stimulus money. That also means a direct payment you get this year won’t reduce your tax refund in 2021 or increase the amount you owe when you file your 2020 tax return. You also won’t have to repay part of your stimulus check if you qualify for a lower amount in 2021. If you didn’t receive everything you were owed this year, you can claim your full stimulus check amount as a Recovery Rebate Credit on your 2020 federal income tax return when you file this month .

However, another big caveat here: If you are filing for any missing stimulus money as a Recovery Rebate Credit on your tax return this year, the IRS can potentially garnish that money to pay for any back taxes you owe. Again, an independent taxpayer advocacy group within the IRS is working with the agency to address this issue to protect those funds for vulnerable taxpayers.

Is the stimulus money really yours? That depends.

More Details About The Third Round Of Economic Impact Payments

FS-2021-04, March 2021

The Internal Revenue Service, on behalf of the Treasury Department, worked to quickly begin delivery of the third round of Economic Impact Payments authorized by Congress in the American Rescue Plan Act in March 2021. Here are answers to some common questions about this set of stimulus payments, which differ in some ways from the first two sets of stimulus payments in 2020, referred to as EIP1 and EIP2.

The Irs Is Also Warning Taxpayers Not To Contact Them For Certain Other Reasons

You should not contact the IRS just to determine if you were eligible for a payment or to confirm how much you should have received, however. Instead, you have two ways to check this: through your online IRS account or by letters the agency recently sent. According to the IRS, taxpayers have been able to view the total amount that was issued to them for their third stimulus payment online since Jan. 15.

And on March 30, the IRS said it just finished mailing Letters 6475 to recipients of the third-round of EIPs. This letter provides taxpayers with the total amount they were issued for the third payments, as well as any plus-up payments they received.

Recommended Reading: Stimulus Check For Expecting Mothers 2022

Heres What We Know About A 4th Stimulus Check

While many Americans are still awaiting the arrival of third stimulus checks, many lawmakers are pushing for recurring direct payments throughout 2021 as part of a fourth stimulus package.

STATEN ISLAND, N.Y. While many Americans are still awaiting the arrival of third stimulus checks, many lawmakers are pushing for recurring direct payments throughout 2021 as part of a fourth government package.

The third stimulus payments of up to $1,400 per American are still being dolled out by the Internal Revenue Service.

In fact, the IRS, the U.S. Department of the Treasury, and the Bureau of the Fiscal Service announced this week that more than two million supplemental stimulus checks are being delivered in the fifth batch of Economic Impact Payments .

So far, a total of 159 million disbursements with a total value of $376 billion has been dolled out as part of the $1.9 trillion American Reduce Plan, according to the IRS.

However, for many Americans still suffering amid the coronavirus pandemic, the third stimulus isnt enough.

According to U.S. Census Bureau data collected in March 2021, nearly 30% of Americans came up short when trying to cover household expenses.

Direct stimulus payments have helped suppress poverty in the U.S. In fact, a fourth stimulus check alone would help 6.6 million people out poverty in 2021, according to a report from the Urban-Brookings Tax Policy Center.

FOURTH STIMULUS?

But Biden has yet to say whether he supports a fourth stimulus payment.

Who Is Qualified For An Additional Payment

If you are a taxpayer in the USA whose income was lower in 2020 than it was in 2019, then you are eligible to receive what is being referred to as a plus-up payment.

This also applies to anyone who claimed an elderly or disabled dependent when they handed in their taxes in 2020, as well as elder or disabled relatives or college students who are under the care of individuals.

The deadline to submit your 2020 tax return and therefore become eligible to receive the plus-up payment is December 31, 2021, so it is better to act sooner rather than later.

In order to get the payment before the end of 2021, you should submit that tax return with some time to spare, so that it can be processed and so that the payment can be sent your way.

To check all the specifics in the eligibility process, visit the IRS website.

Read Also: How Do I Change My Direct Deposit For Stimulus Check

Recommended Reading: How To Check If You Received Stimulus Check

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

Stimulus Check Missing Payment Issues Or Errors

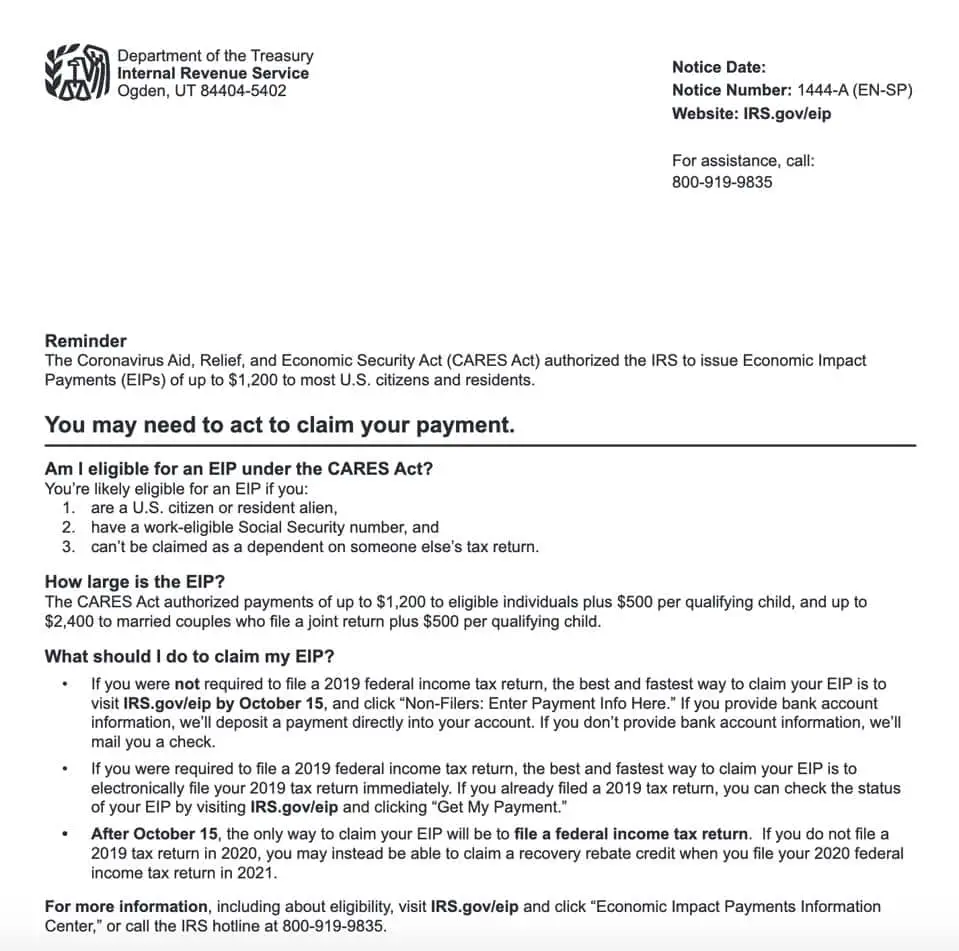

The IRS will also be mailing Stimulus Payment letters to each eligible recipients last known address 15 days after the payment is made. The letter will provide information on how the Payment was made and how to report any failure to receive the Payment. Note that the IRS or other government departments will not contact you about your stimulus check payment details either.

Why didnt I get a stimulus check? Remember that the IRS has to have your direct deposit details, which is normally only provided if you received a 2018 or 2019 refund. If you file a return and they cannot use their portal to add direct deposit details, then your payment will come via check which could take several weeks. At this checks will likely start arriving at your IRS registered address from the end of April.

Finally you will also likely be able to claim any missing payments in your 2020 tax return as a tax credit. All this unfortunately will mean delays in getting your stimulus payment until issues are worked through.

Recommended Reading: Irs Phone Number For Stimulus Check 2021

Projected Timeline For Sending Third Stimulus Checks

The IRS delivered virtually all of the second round of stimulus checks in less than a month, starting Dec. 29, 2020, two days after then-President Donald Trump signed the $900 billion bill into law.

Congress gave the IRS until Jan. 15, 2021, to issue the bulk of the 147 million payments so that the agency could quickly pivot to preparing for tax-filing season. After that, taxpayers were instructed to claim any missing stimulus money from the first or second rounds on their 2020 tax returns in the form of a tax credit.

The third round of payments hit at the height of the 2020 tax-filing season, and it was difficult for the IRS to ship all of the stimulus checks in less than a month and process millions of returns at the same time. To give itself some breathing room, the IRS moved the deadline for filing and paying federal income taxes to May 17.

The third stimulus payments are being rolled out in tranches, or groups, by direct deposit and through the mail as a check or debit card. The vast majority of all economic impact payments will be issued by direct deposit, the IRS says, and it will continue to send batches of EIPs every week.

The IRS, via the Treasury, sent the first tranche of payments on March 12, a total of 90 million payments worth about $242 billion. Most of these payments went to people who had filed 2019 or 2020 federal income taxes, or who had used the online IRS Non-Filers Tool.

May 5

May 12

May 26

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Recommended Reading: Who Qualifies For Stimulus Check 2021

Incarcerated People Are Eligibly For All 3 Stimulus Checks

Though there was a lot of confusion about this at first, people who are in prison and jail are eligible to qualify for the first stimulus check of up to $1,200 per adult, as well as the second check of up to $600 and the third check of up to $1,400. A ruling this fall from a federal judge in California required the IRS to contact those incarcerated who can file a claim for a stimulus check. As with others who are missing any of the payments, you’ll need to fill out 2020 Form 1040 or 1040-SR to claim either the first or second check.

New Payments Differ From Earlier Economic Impact Payments

The third round of stimulus payments, those authorized by the 2021 American Rescue Plan Act, differs from the earlier payments in several respects:

- The third stimulus payment will be larger for most people. Most families will get $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents will get $1,400, while a family of four will get $5,600.

- Unlike the first two payments, the third stimulus payment is not restricted to children under 17. Eligible families will get a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

Also Check: How To Apply For Homeowners Stimulus Package

Highlights Of The Third Round Of Economic Impact Payments Irs Will Automatically Calculate Amounts

In general, most people will get $1,400 for themselves and $1,400 for each of their qualifying dependents claimed on their tax return. As with the first two Economic Impact Payments in 2020, most Americans will receive their money without having to take any action. Some Americans may see the direct deposit payments as pending or as provisional payments in their accounts before the official payment date of March 17.

Because these payments are automatic for most eligible people, contacting either financial institutions or the IRS on payment timing will not speed up their arrival. Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits. A payment date for this group will be announced shortly.

The third round of Economic Impact Payments will be based on the taxpayer’s latest processed tax return from either 2020 or 2019. This includes anyone who successfully registered online at IRS.gov using the agency’s Non-Filers tool last year, or alternatively, submitted a special simplified tax return to the IRS. If the IRS has received and processed a taxpayer’s 2020 return, the agency will instead make the calculation based on that return.

For those who received EIP1 or EIP2 but don’t receive a payment via direct deposit, they will generally receive a check or, in some instances, a prepaid debit card . A payment will not be added to an existing EIP card mailed for the first or second round of stimulus payments.

Irs Says Its Sending Millions More Additional Stimulus Checks

The IRS on Wednesday said it is continuing to distribute federal stimulus checks to eligible Americans, with another 2.2 million payments issued as recently as July 21. Some of those payments include plus-up adjustments for people who received less money than they were entitled to in earlier checks.

The latest round of payments is part of the Biden administrations efforts under the American Rescue Plan to deliver $1,400 to each eligible adult and child. The IRS said it has now delivered more than 171 million payments worth more than $400 billion, with the last batch of checks amounting to more than $4 billion.

The tax agency added that it is continuing to issue stimulus checks on a weekly basis. Payments are still going out to people for whom the IRS didnt previously have enough information to issue a check but who recently filed a tax return, as well as for people who qualify for extra money known as plus-up payments.

The IRS has said it has sent more direct relief via the third stimulus check than compared with the two previous rounds of payments. More than half of the payments have been sent to households earning less than $50,000, while about 1 in 10 stimulus checks were sent to Social Security and other government-aid beneficiaries who arent required to file a tax return, and to those who used the Non-filer tool on the IRS website, the agency has said.

Recommended Reading: How Much Is The Next Stimulus

Recommended Reading: How To Get 2022 Stimulus Check

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

You Might Need To Contact The Irs If You’re Missing Your Third Stimulus Payment

The IRS posted a new alert on March 30, warning some taxpayers that they might need to contact the agency immediately in regards to a missing payment. “Individuals are encouraged to double-check their bank accountsespecially in early spring and summer of 2021to see whether they received a third-round payment in advance last year,” the IRS advised.

If you did not receive your third payment but your online IRS account shows a payment amount larger than zero or you received a notice indicating that a payment was issued to you, you will need to reach out to the agency. “They should contact the IRS as soon as possible to see if a payment trace is needed,” the agency warned.ae0fcc31ae342fd3a1346ebb1f342fcb

You can either call the IRS or mail/fax a completed Form 3811 to the agency to request a payment trace. “You will generally receive a response 6 weeks after we receive your request for a payment trace, but there may be delays due to limited staffing,” the agency said.

Also Check: South Carolina Stimulus Check 2021

Your Third Stimulus Check Can Be Seized Here’s What To Know

Bad news: The new stimulus bill doesn’t have the same protections to prevent your third payment from being garnished for a past-due payment as with the second check. We’ll explain what that means for you.

For millions of people, third stimulus checks have already been delivered. But for others, they may never see all of the money that gets direct-deposited into their bank accounts. Unlike the second stimulus check, the new stimulus bill doesn’t have the same protections against your $1,400 check being seized by debt collectors.

If you’re waiting on your check to arrive, you’re likely wondering many things: Can my third check be garnished to pay overdue child support? Can states, banks, creditors or my landlord take my money to cover an outstanding debt? If I claim missing money from the first or second stimulus checks on my 2020 tax return, can that get taken too? Will my third stimulus check be taxed? What happens if the IRS sends me too much money by accident?

We’ll help provide you with all the information you need so you can prepare before the third payment hits your bank account — or before the IRS processes any missing stimulus money on your tax return. For example, tracking your stimulus check can help you determine when it’ll be directly deposited into your account. CNET also has guides to stimulus checks as they relate to SSI and SSDI, adults who are over age 65 or retired and if you pay or receive child support. This story was updated recently.