How Do I Know If I Received The Third Stimulus Check

Use the IRS Get My Payment tool to track stimulus money For the third stimulus check: It’s worth visiting the IRS’ online portal designed to track the status of your 2021 payment. Generally, it should tell you when your check will be processed and how you’ll receive it: for example, as a paper check in the mail.

Can I Track My Payment

The IRS reopened its “Get My Payment” website following the passage of the American Rescue Plan, allowing people to track when they might receive their stimulus checks. The IRS created this portal last year for the $1,200 stimulus checks directed by the Coronavirus Aid, Relief and Economic Security, or CARES, Act.

When people check the “Get My Payment” site for the new $1,400 checks, they typically see one of several messages.

First, some people will see that their payment has been processed, along with a payment date and whether the payment will be sent via direct deposit or mail. If a check is sent by mail, the IRS will either send a paper check or a pre-paid debit card.

Others may see a message that they are eligible, but their payment hasn’t been processed and therefore there’s no payment date available.

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who were eligible to receive the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check between June 23 and July 1, 2022.

The Oregon Department of Revenue website contains FAQs for residents with concerns about receiving their payment.

Read Also: Update On 4th Stimulus Check For Social Security Recipients

New Mexico Stimulus Checks

New Mexico “stimulus” payments for eligible residents come in the form of two tax rebates in 2022. The first tax rebate amount is $500 for joint filers, head-of-household filers, and surviving spouses with incomes under $150,000, and $250 for single filers and married people filing separate tax returns. The second tax rebate is worth $1,000 for joint filers, head-of-household filers, and surviving spouses, and $500 for single filers and married residents filing separately.

The first-round of tax rebates began in July, while the second-round payments began in June. However, payments will continue to be sent to people who file a 2021 New Mexico tax return by May 23, 2023. As a result, some New Mexicans will receive rebate checks in December. If you filed a 2021 return but haven’t received a rebate, you can all the New Mexico Department of Taxation and Revenue at 866-285-2996.

For New Mexico taxes in general, see the New Mexico State Tax Guide.

When Will I Get My Stimulus Check

The IRS has begun distributing stimulus payments. The first batch of stimulus payments could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks.

For information on when you can expect your stimulus payment, check the IRS Get My Payment tool, which will be live starting March 15th.

You May Like: I Still Haven’t Gotten My First Stimulus Check

Do College Students And Adult Dependents Qualify For Stimulus Payments

Yes. Adult dependents, including college students and disabled adults, may receive up to $1,400. But their eligibility for payment and the amount theyll receive will depend on the adjusted gross income of the person who claims them on their taxes. See the question above for income limits and phase-out details.

Social Security Payments For December: When Is Your Money Coming

Social Security payments for December started going out this week. See when your payment will arrive.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The Social Security Administration this week started disbursing December payments. In , you’ll get your first increased benefit amount. For those who receive Supplemental Security Income, you’ll get your first increase in December. We’ll explain why below and how the timing of Social Security payments works.

This month, keep an eye out for a letter in the mail about your Social Security benefits increase for 2023. It’ll have details about your individual benefit rate increase for next year — or you can also check your benefits online using your My Social Security account.

Read more: Stimulus Checks: 18 States Are Sending Tax Rebates to Residents

You May Like: Irs Stimulus Phone Number Live Person

Tips For Individuals During The Coronavirus Pandemic

- If you dont need to use your stimulus check for anything urgent, consider investing or saving the money. A financial advisor can help you get started if you need help managing your money or investments. SmartAssets free tool can match you with financial advisors in your area in just five minutes. Get started now.

- If you are struggling to keep up with loan or credit card payments, you can take steps to protect your credit score and speak with your bank directly to see whether you can defer loan payments or waive certain fees.

- If you can afford it, investing in index funds during a recession is a safe option. But if youre looking for a slightly more aggressive approach, check out some free investment classes to learn more.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

You May Like: How To Find Out How Many Stimulus Checks I Received

St Round Of Stimulus Checks: April 2020

It was specified in the CAREs Act that qualified tax-paying adults would get a check of up to $1,200 and their dependent children under the age of 16 would receive checks of up to $500 as part of a stimulus package .

Those earning less than $75,000 were eligible for the payments, which were provided to those earning up to $99,000 . Individuals received their first stimulus payments on April 11 and 12, either by direct deposit into their bank accounts, paper checks mailed to them, or the Economic Impact Payment Card, a prepaid debit card delivered to them in late May or early June of last year.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Read Also: Irs Forms For Stimulus Checks

Heres What Else You Should Know

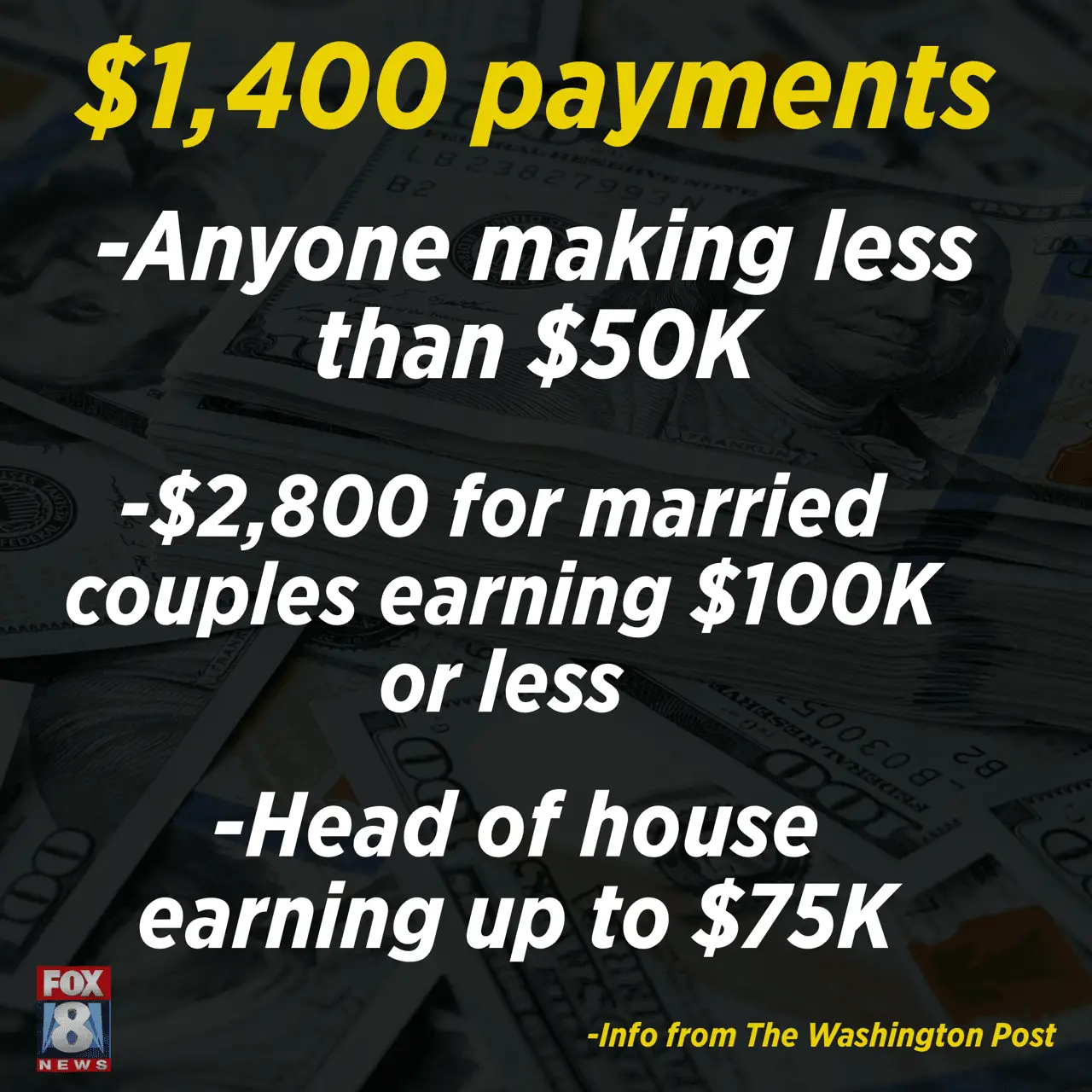

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

Families can also receive $1,400 per dependent, regardless of the dependentâs age.

The Child Tax Credit was also temporarilyextended by Congress to consider more families and increase how much they can receive.

Most families are eligible for $3,000 per child between the ages of six and 17 and $3,600 for each child under six. You can check the IRSâs site to determine if you qualify.

Tax returns can also be completed and submitted through CTCâs site, including the simplified filing tool which was updated on Wednesday.

GAO discovered that people within certain groups may have faced difficulty receiving their payments.

This includes those who:

What If You Didnt File Tax Return Or Register With The Irss Non

You may still be eligible to receive a payment. If you didnt receive a first or second round stimulus payment you may be able to claim the Recovery Rebate Credit when you file your 2020 federal income tax return. For the third round, we will update this page as additional information becomes available from the IRS.

Dont Miss: When Will We Get The $1400 Stimulus Check

Also Check: Where’s My Stimulus Check 2021 Tracker

How Many Stimulus Checks Did Americans Get

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

Also Check: Irs Stimulus Check Sign Up

What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Don’t Miss: Were There Stimulus Checks In 2021

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Is There A $1400 Stimulus Check Coming

Another $1,400 stimulus check could be coming your way from the federal government. Parents who had a child in 2021 are likely eligible for another stimulus payment in 2022, according to Insider. After the baby is born, parents can receive the additional $1,400 after filing their tax return in 2022.

Don’t Miss: Who Is Eligible For 4th Stimulus Check

Third Stimulus Check: More $1400 Payments Are Still Being Sent Out Heres What To Do If You Havent Got Yours

MORE $1,400 stimulus checks are being sent out and there’s a way Americans can make sure they get their payment.

Most of the remaining cash is being issued to taxpayers who claimed that they were missing the money in their 2020 return.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

Those who do not typically file tax returns, but did so in order to receive their check, should also expect to see the cash soon.

Tax Foundation economist Erica York told CNBC that most people who are eligible should receive their payment automatically.

However, York said that those people who are more difficult to reach – if they do not have a source of income or bank account, for example – may still have their payments outstanding.

Americans who are eligible for the cash, but have not yet received it, should file a tax return if they have not already.

This will provide the IRS with information on the recipient so that their cash will arrive faster.

Despite many not receiving their third check, hope continues to grow that Congress will approve another lot of stimulus checks as part of the President’s next stimulus package.

More than 75 lawmakers now support a further round of stimulus checks, possibly with recurring monthly payments until the end of the pandemic.

A Change.org petition for monthly recurring checks of $2,000 has racked up over two million signatures and appeared on the fundraising site’s top 10 petitions that changed 2020.

Can You Track Payment Status For Paper Checks

Yes. You can use the IRS Get My Payment app to check the status of your payment, including how the payment will be made. If you have previously given the IRS your direct deposit information and you are eligible for a payment, the app will say which bank account will receive the direct deposit. If you have not provide direct deposit information, the app will show that your payment is coming via paper check.

The Get My Payment app will also show you a scheduled delivery date, and say whether or not a payment is scheduled, the IRS says. If you are receiving a paper check, the date shown on the Get My Payment app will be the day its scheduled to be mailed, which is earlier than it will show up in your mailbox.

Take note that many people have been frustrated with Get My Payment, and for a variety of reasons their inquiries have resulted in Payment Status Not Available messages. But on April 26, after Get My Payment went offline briefly for maintenance, the IRS announcedsignificant enhancements to the app, and the agency encouraged people to try to use the tool again.

We urge people who havent received a payment date yet to visit Get My Payment again for the latest information, IRS Commissioner Chuck Rettig said in a statement. IRS teams worked long hours to deliver Get My Payment in record time, and we will continue to make improvements to help Americans.

Recommended Reading: Are There Any New Stimulus Checks Coming Out

When Will Ssi Get Their Third Stimulus Check

A date has yet to be set for when those receiving Social Security and other federal beneficiaries will get their money. Though the IRS has said those recipients will generally receive the third payment the same way as their regular benefits.

The IRS said if someone did not file a tax return and they receive SSA, RRB, SSI or VA benefits and their benefits are currently deposited to a Direct Express card, then the 2021 Economic Impact Payment will be deposited to that card.

RELATED: VERIFY: When will Social Security recipients get the third stimulus check?

When Will Your Stimulus Check Arrive

The stimulus payments are being distributed to taxpayers either by direct deposit or by paper checks or debit cards arriving by mail. If youve been paying your taxes via direct deposit, the IRS should already have your banking information on file and will make the payment directly to your bank account.

For direct deposit, the IRS uses data already in its system to determine which bank account to send the payment to. That most likely happens by attaching a routing and account number to your 2020 or 2019 tax filing, as well as inputting one earlier in 2020 for receiving your first stimulus check. Those receiving payments by mail will have to wait a little longer.

This round, the Treasury Department is also working with the Bureau of the Fiscal Service to identify federal records of recent payments to and from the government to find a possible bank account alternative for delivering stimulus payments as a direct deposit. The move helped accelerate the stimulus check delivery timeline, the IRS said in a statement.

In most cases, individuals arent required to take action to receive their checks and are discouraged from contacting the IRS, according to a Treasury Department release.

The IRS and Treasury Department anticipate sending out more tranches on a weekly basis moving forward.

Recommended Reading: When We Getting Stimulus Checks

South Carolina Stimulus Checks

South Carolina is sending tax rebate payments this year to people who file a 2021 South Carolina income tax return showing a state tax liability by February 15, 2023. The amount you receive depends on your 2021 South Carolina income tax liability, but it won’t be more than $800.

If you filed your 2021 South Carolina tax return by October 17, 2022, your rebate will be issued by the end of 2022. If you file after October 17 but before February 15, 2023, your payment will be issued by March 31, 2023.

The South Carolina Department of Revenue has an online tool to track the status of your rebate.

For South Carolina taxes in general, see the South Carolina State Tax Guide.

More Money For Small Businesses

Both bills would provide $15 billion to the Emergency Injury Disaster Loan program, which provides long-term, low-interest loans from the Small Business Administration. Severely impacted small businesses with fewer than 10 workers will be given priority for some of the money.

They also provide $25 billion for a new grant program specifically for bars and restaurants. Eligible businesses may receive up to $10 million and can use the money for a variety of expenses, including payroll, mortgage and rent, utilities and food and beverages.

The Paycheck Protection Program, which is currently taking applications for second-round loans, would get an additional $7 billion and the bills would make more non-profit organizations eligible.

Another $175 million would be used for outreach and promotion, creating a Community Navigator Program to help target eligible businesses.

Also Check: When We Getting Our Stimulus Check