What If I Havent Gotten My Stimulus Check Yet

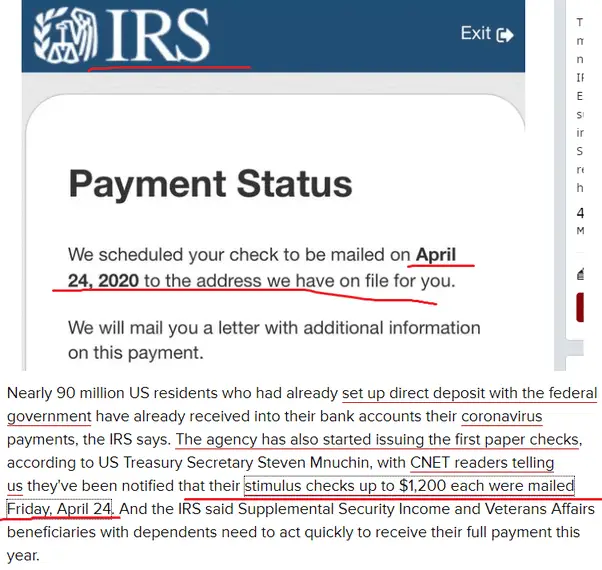

First, head over to the governments site and sign in to your account to check on your payment status. If it shows the stimulus check was issued to you but you havent gotten it yet, you can run a payment trace to track it down. If the check wasnt cashed, the IRS will reverse the payment, and youll be able to claim it on your taxes. You can do this through the Recovery Rebate Credit.

If the check was cashed , youll have to make a claim and go through a whole process to get your stimulus money. That really stinks. Sorry in advance if you fall into that category. But with any luck, they should be able to straighten things out for you.

How To Return A Paper Check You Have Not Cashed Or Deposited

If youre one of those folks who has to send the money backand you havent cashed or deposited your check yetheres what you need to do:

- Write Void in the endorsement section of the check, but dont fold or staple itdont even put a paper clip on it.

- On a sticky note or sheet of paper, write down the reason youre sending the check back.

- Mail the check and the explanation back to your local IRS office .

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayers latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

The state is sending out payments in two ways: direct deposit and debit card in the mail.

If you filed your 2020 taxes electronically and you received a tax refund by direct deposit, then you can expect to receive your Middle Class Tax Refund by direct deposit as well, the Franchise Tax Board said.

Pretty much everyone else will be getting a debit card, the agency said.

Don’t Miss: How Can I Get My 3rd Stimulus Check

Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment was possible due to a budget surplus. Couples filing jointly received $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

If youre eligible but didnt receive a rebate yet, you can apply online starting November 1. The application period will only last 30 days and will close on November 30, 2022.

Applicants must provide their Social Security number, active Delaware drivers license that was issued before December 31, 2021 and a valid Delaware residential mailing address. Payments will be sent out to qualifying applicants after the application period closes and all applications are reviewed.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

Stimulus Check 2 2021

The timeline for the distribution of the second stimulus check was much shorter. Congress approved the coronavirus relief bill on Dec. 21, 2020 and it was signed into law on Dec. 28. The first direct deposits were made Dec. 29, and the first paper stimulus checks were put in the mail on Dec. 30.

The deadline for the IRS to provide the second check via mail, direct deposit, or debit card was Jan. 15, 2021. Anyone who did not receive their second check by Jan. 15 will have to file a tax return to get it.

Also Check: How To Get Your Stimulus Checks

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

State Treasurer’s Office Covid

Note: This section includes historical updates from 2020. For the latest State Treasurer’s Office updates, visit our Newsroom or sign-up for our quarterly eNewsletter here.

CARES Act Update The state receives its second payment of CARES Act relief funds in the amount of $906,880,279, completing the $1.9 billion allocated for South Carolina.

Maintaining Good Financial Habits in a Time of COVID-19 Treasurer Loftis shares important steps to take during this time to ensure peace of mind and financial well-being.

CARES Act Update A partial payment of $998,234,321 in CARES Act relief funds is received by the State Treasurers Office, properly accounted for and prudently invested pursuant to state law.

Notice of Direct Mail Effective March 30, 2020 Guidance related to the direct mailing of all vendor and payroll checks to payees.

Resources

Read Also: When Did We Get Stimulus Checks In 2021

How Can I Get Help Completing Getctcorg

All first stimulus checks were issued by December 31, 2020. If you didnt get your first stimulus check in 2020 or didnt get the full amount you are eligible for and you dont have a filing requirement, you can use GetCTC.org. GetCTC has a chat box that you can use to communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

What If I Owe Child Support Payments Owe Back Taxes Or Student Loan Debt

If you are overdue on child support or owe back taxes or student loan debt, you could see your stimulus check reduced or eliminated based on the amount you owe. The Bureau of the Fiscal Service will send you a notice if this happens.

Your payment will not be interrupted if you owe back taxes or have student loan debt you will receive the full amount.

If you use direct deposit and owe your bank overdraft fees, the bank may deduct these from your payment.

Also Check: Check My Stimulus Check History

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

- Veterans Affairs

- Railroad Retirement

Social Security Payments For December: When Is Your Money Coming

Social Security payments for December started going out this week. See when your payment will arrive.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The Social Security Administration this week started disbursing December payments. In , you’ll get your first increased benefit amount. For those who receive Supplemental Security Income, you’ll get your first increase in December. We’ll explain why below and how the timing of Social Security payments works.

This month, keep an eye out for a letter in the mail about your Social Security benefits increase for 2023. It’ll have details about your individual benefit rate increase for next year — or you can also check your benefits online using your My Social Security account.

Read more: Stimulus Checks: 18 States Are Sending Tax Rebates to Residents

Read Also: Stimulus Money For Small Business

Colorado: $750 Rebate Payments

Colorado sent tax rebates of $750 to individual tax filers and $1,500 for joint filers. Colorado residents for the entire 2021 tax year who are 18 or older and filed their 2021 state income tax return were eligible for the payment.

Only physical checks were sent out in an effort to prevent fraud. Residents who filed their state tax returns by June 30 should have received a refund by September 30. Taxpayers who filed an extension can expect their check by January 31, 2023.

Read more: Everything You Need To Know About The Colorado Stimulus Check

How About Homeless People

About $5 billion will be allocated to help the homeless, including the conversion of properties like motels into shelters.Another $5 billion will be used for emergency housing vouchers to help several groups of people from the homeless to people at risk of homelessness, including survivors of domestic violence find stable housing.

Health Insurance

Read Also: Where Is My 2nd Stimulus Check

Payment Status Not Available: What Should You Do

The IRS Get My Payment tool will only let you input new direct deposit or bank account information if youre seeing a Need More Information status, breaking with tradition from previous stimulus check rounds. That works either by submitting a financial product that includes a routing and account number with it, whether it be a bank account or prepaid debit card.

The easiest way to make sure that the IRS has the most accurate picture of your financial situation and personal whereabouts is by submitting your 2020 tax return. You now have until May 17 to submit your 2020 tax return, after the IRS on March 17 announced it was delaying the deadline by a month.

However, given the unprecedented and unconventional nature of the current tax season, the Treasury Department and IRS may have already attempted to send out your payment before your tax information was processed.

You could also update your mailing address by submitting a Form 8822, Change of Address, or notifying the IRS orally of your move. But be prepared: You might experience delays waiting for confirmation, given that the IRS has already begun distributing these stimulus checks. As always, a direct deposit is the fastest way to guarantee you receive a payment.

More: Stimulus Check Calculator: How Much Might You Receive

While the current bill shells out $600 direct payments, Trump is pushing to bring that amount to $2,000 — a proposal that has support from Democratic lawmakers but has been rejected by GOP leadership.

House Speaker Nancy Pelosi on Monday is bringing a vote on a stand-alone bill to increase economic impact payments to $2,000 to the House floor. While itâs expected to pass the House, itâs unclear whether Senate Majority Leader Mitch McConnell will take up the measure in the Senate.

Recommended Reading: Is Economic Impact Payment Same As Stimulus

What Gaos Work Shows

1. IRS can use data to tailor outreach efforts.

It was challenging for IRS and Treasury to get payments to some peopleespecially nonfilers, or those who are not required to file tax returns. These people were eligible for the payments for a couple of reasons:

- first, there was no earned income requirement, so Americans with no or very little income could receive economic relief and

- second, the payments were refundable tax credits, so eligible individuals can claim the full amount even if it exceeds what they owe in taxes.

In 2020, Treasury and IRS used other data to identify and reach out to around 9 million potentially eligible nonfilers. In May 2021, TIGTA identified potentially 10 million individuals eligible for payments, but IRS has no further plans to reach out to these individuals.

We recommended that Treasury and IRS use available data to develop an updated estimate of total eligible individuals which they could use to better tailor and redirect their ongoing outreach and communications efforts for similar tax credits.

2. Improved collaboration will also help outreach to underserved communities.

We recommended that Treasury and IRS focus on improving interagency collaboration and use data to assess the effectiveness of their efforts to educate more people about refundable tax credits and eligibility requirements.

Havent Received Your Third Stimulus Payment Yet

The IRS will continue to send checks via the Treasury. The majority who have received a first or second payment dont need to do anything more to get the third payment, which often will be sent out automatically. Following the model of the second round of checks, payments should be issued automatically to people who:

- Filed 2019 or 2020 federal tax returns. The IRS will use the taxpayers latest processed return.

- Registered for the first round of stimulus payments through the non-filer portal on IRS.gov by Nov. 21, 2020.

- Receive Social Security , Supplemental Security Income , or Railroad Retirement Board or Veterans Affairs benefits.

Those receiving Social Security and other federal benefits will generally receive this third payment the same way as their regular benefits.

The IRS Get My Payment Tool allows you to provide information to the agency for a stimulus check and to track payment status.

If you got your payment based on your 2019 return and find that youre entitled to more based on your 2020 return, the IRS will compute the additional amount owed to you.

Don’t Miss: Amount Of 3rd Stimulus Check

What Should You Do With Your Third Stimulus Check

Lets be real: Three stimulus checks in a year or so is not normal. This third payment can go a long way to help you catch up on bills, pay off debt, or build up your savings. And for a lot of folks, those stimulus checks have kept food on the table. In our State of Personal Finance study, we found that 41% of people who got a stimulus check used it to pay for necessities like food and bills.

So, based on your situation, heres where you start:

If youre out of work or missing a paycheck, use this stimulus money to protect your Four Walls:

Focus on the necessities so you can have peace of mind as you keep looking for work or get your income back up. That means if youre working the Baby Steps and youre out of work, pause your plan for now. Pile up cash until you have a steady income again. Then you can attack your debt. Theres nothing like fighting through a financial crisis to light your fire to be debt-free as soon as possible!

On the other hand, if your job is safe and you feel like itll stay that way, use your stimulus money to build momentum on whatever Baby Step youre on. Put your debt snowball into overdrive. Knock out your fully funded emergency fund . Or talk to your investment professional about giving your retirement a big boost !

No matter your situation, dont forget to budgetits the best way to make your money go further. EveryDollar is our free and simple budgeting app that will help you see exactly where you need to cut back on your spending.

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

Don’t Miss: When Was The 1200 Stimulus Check Sent Out

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

How Will I Get My Payment If I Got A Refund Anticipation Check Or Refund Anticipation Loan When I Filed My Taxes

The IRS will attempt to deliver your payment to the account information provided on your tax return. Some RALs and RACs are issued through debit cards. If the card is still active, you will receive your payment on the card. If the account or card is no longer active, the deposit will be rejected, and the IRS will send a paper check to the address on the tax return.

You can request a payment trace to track where and how your payment was delivered. You should only request a payment trace if you received IRS Notice 1444 showing that your first stimulus check was issued or if your IRS account shows your payment amount and you havent received your first stimulus check. See Question 24 to learn more about how to request a payment trace.

Read Also: Small Business Stimulus Package 2021

How Do I Get Relief Money

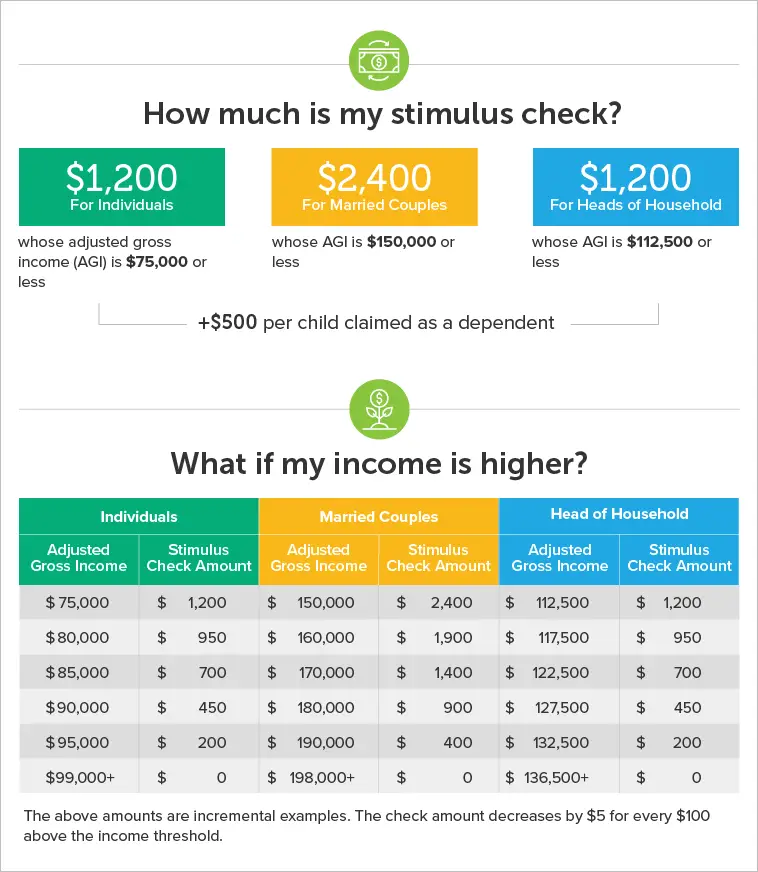

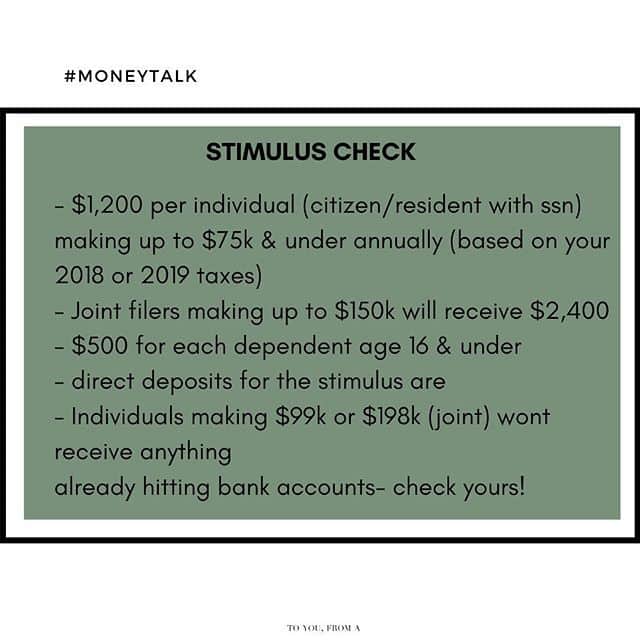

The emergency stimulus checks could be as much as $1,200 per person, $2,400 for married couples filing taxes jointly and $500 per dependent child.

Income amounts for the payments made this year are based on 2019 tax returns, or 2018 tax returns for people who havent filed their 2019 return yet.

Those who are eligible for relief payments dont have to do anything to get it, and if they filed a 2018 or 2019 tax return with direct deposit information on it, the money will be deposited there when the IRS issues payments.