My Small Business Needs Help

My small business needs help.

The Treasury Department is providing critical assistance to small businesses across the country.

* How to file your taxes with the IRS: Visit IRS.gov for general filing information. Havent filed your taxes? Heres information for non-filers. If your income is less than $72,000 you may be eligible to file your taxes for free, or call 829-1040.

Coronavirus Stimulus / Relief For Businesses May 2021

We are here to help you for COVID-19 related inquiries. We understand that you may have specific questions related to the stimulus that need to be addressed now! The University of Pittsburgh Institute for Entrepreneurial Excellence and Small Business Development Center have members of our consulting team available for virtual meetings to help you with questions and issues you may have. Please feel free to reach out to schedule a meeting via our main number at 412.648.1542 or email .

Shuttered Venue Arts Program

This program, which is part of the December 2020 stimulus legislation, is expected to begin accepting applications here shortly.

The program targets as much as $15 million in grants for live venue operators or promoters, theatrical producers, live performing arts organization operators, museum operators, motion picture theatre operators, or talent representatives who demonstrate a 25% reduction in revenues with special amounts set aside for organizations with fewer than 50 full-time employees.

Because of implementation delays, the grants are now available even if youre participating in the Paycheck Protection Program, with certain restrictions.

» READ MORE: Whats in the stimulus bill? Heres how you can benefit, from checks to healthcare to tax credits and more.

Also Check: Where’s My Stimulus. Gov

More Aid Will Be Made Available For Hospitality Businesses

The Restaurant Revitalization Fund is allocating $25 billion dollars to help companies in the food services industry.

If you’re a small business where patrons gather primarily for food or drink, you’ll eligible for a grant that helps cover things like:

- Principal and interest payments on a mortgage, not including any prepayments on principal

- Rent payments, not including prepayments

Grants are calculated by subtracting your business’s 2020 revenue from its 2019 revenue.

During the first 21 days of the grants, the SBA will prioritize applications from restaurants owned and operated or controlled by women, veterans, or socially and economically disadvantaged individuals.

Communities Will Begin A Community Navigator Pilot Program

Navigating the pandemic hasn’t been easy for small businesses. The stimulus is putting $175 billion towards community navigator programs that can help small businesses with COVID-19 awareness and relief programs.

Business owners who lack access will be prioritized, including but not limited to: businesses owned by socially and economically disadvantaged individuals, women, and veterans.

Read Also: Is 2021 Stimulus Check Taxable

House Passes $19 Trillion Stimulus Bill With A Variety Of Small Business Relief

The U.S. House of Representatives passed, by a vote of 219212, a $1.9 trillion COVID-19 relief package early Saturday morning that includes $1,400 stimulus checks to individuals, an extension of unemployment benefits, and tens of billions in aid for small businesses and not-for-profits.

The bill, titled the American Rescue Plan Act of 2021, H.R. 1319, also includes phased increases in the minimum wage that would bring it to $15 an hour by 2025. That part of the bill likely will not be considered in the bill’s next stop, the Senate. That’s because the Senate parliamentarian ruled Thursday that the minimum wage hike could not be part of the bill because it is being considered using budget-reconciliation rules, which clears the way for the Senate to pass the legislation by a simple majority.

Vice President Kamala Harris could overrule the Senate parliamentarian but was not expected to do so. This would guarantee that any bill passed by the Senate would be different from the House version, requiring changes and likely follow-up votes by both chambers in March.

The American Rescue Plan Act includes numerous tax provisions, including a $1,400 recovery rebate credit plus $1,400 for each dependent for 2021. Advance payments of the credit will be sent to individuals as economic impact payment checks. For more details, see the JofA article “Tax Provisions in the American Rescue Plan Act.”

The bill also includes:

Small business items

PPP funding

Work Opportunity Tax Credit

Extended through 2025, this income tax can be as much as $9,600 per new employee when the employee meets certain criteria, such as being released from prison, getting off welfare or returning to work after being unemployed for more than six months. Some employers I know are using this tax credit to fund hiring bonuses for new employees.

Also Check: Stimulus For Healthcare Workers 2021

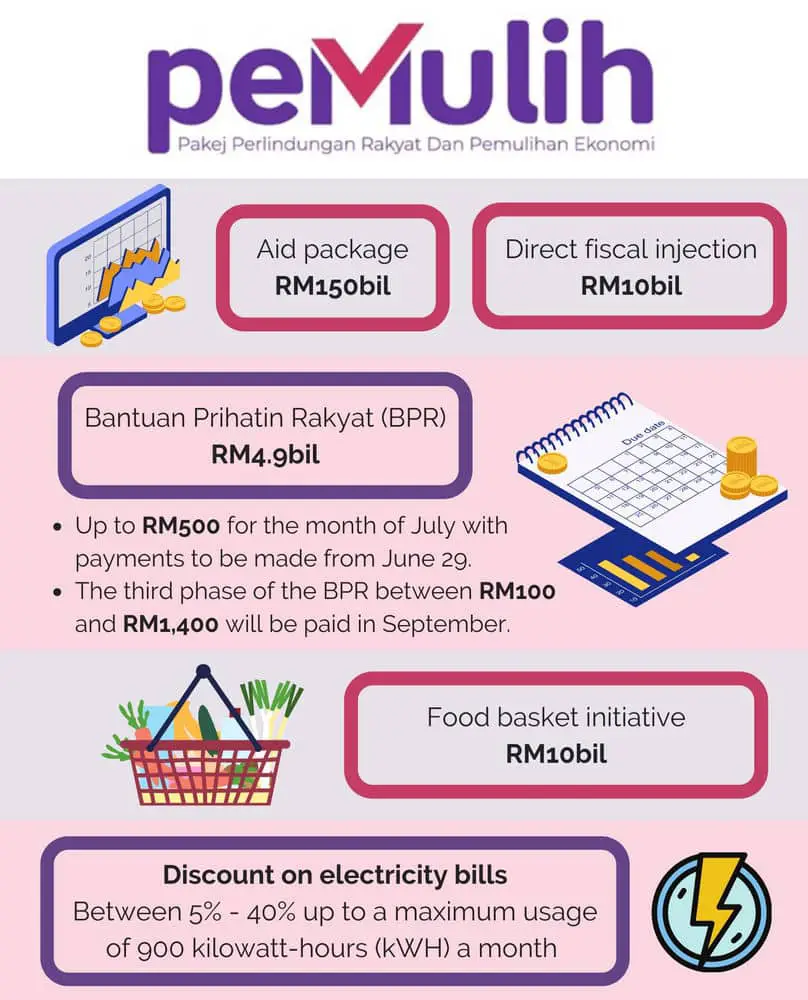

What Is A Stimulus Package

In simple words, a Stimulus Package is a governmental measure to support a floundering economy during a crisis. By boosting government spending, it becomes possible to lower taxes and interest rates and encourage employment growth. It considers that government intervention can correct the recession and, as a result, stimulate economic activity.

The Second Stimulus Package: A Guide For Small Businesses

In the last days of 2020, the US government passed a stimulus bill packed with benefits for small businesses. You could boil a cup of tea, sit down, and enjoy a read through the 5,000 plus page bill. But if thatâs not your thing, weâve done that for you.

Hereâs a guide to what you need to know.

Read Also: Sign Up For Stimulus Check

City Events Grants Program

A $4 million event grants program will offer funding of up to $100,000 for eligible businesses, property owners and not-for-profits to run a wide range of events in city venues. As part of the grants program, successful recipients will be able to apply to the State Government for the use of locations such as Elizabeth Quay, Yagan Square and the Cultural Centre Precinct.

The event grants will be available from 1 July 2022 to 30 June 2023 through the Department of Local Government, Sport and Cultural Industries, with applications opening next month.

How Bench Can Help

Get ready for your next PPP loan application by having your bookkeeping up to date. Use the financial reports we provide to prove a 25% reduction in revenue. Our expert bookkeepers can answer any questions you have about the relief programs ensuring youâre getting the support you need to keep your business thriving. Then, once itâs time to file your taxes, youâll have access to everything you need for a stress-free tax season.

Read Also: What Month Was The Third Stimulus Check

Cobra Health Care Subsidies

One of the most significant new policy changes for employers in the ARPA is the inclusion of new COBRA health care premium subsidies for employees who have been laid off or terminated.

Employers are required to offer COBRA coverage to the majority of former employees for up to 18 months. Still, the former employee often has to pay the total cost of the coverage without the employer subsidizing the cost. The ARPA changes this so employers, plans or insurers must provide subsidized COBRA coverage to eligible individuals from April 1 through September 30, 2021.

While employers will incur higher upfront costs, the ARPA also created new advanceable and refundable tax credits to offset the costs. Employers are able to recover the cost by claiming a tax credit against standard payroll taxes.

Read more about COBRA subsidy changes here.

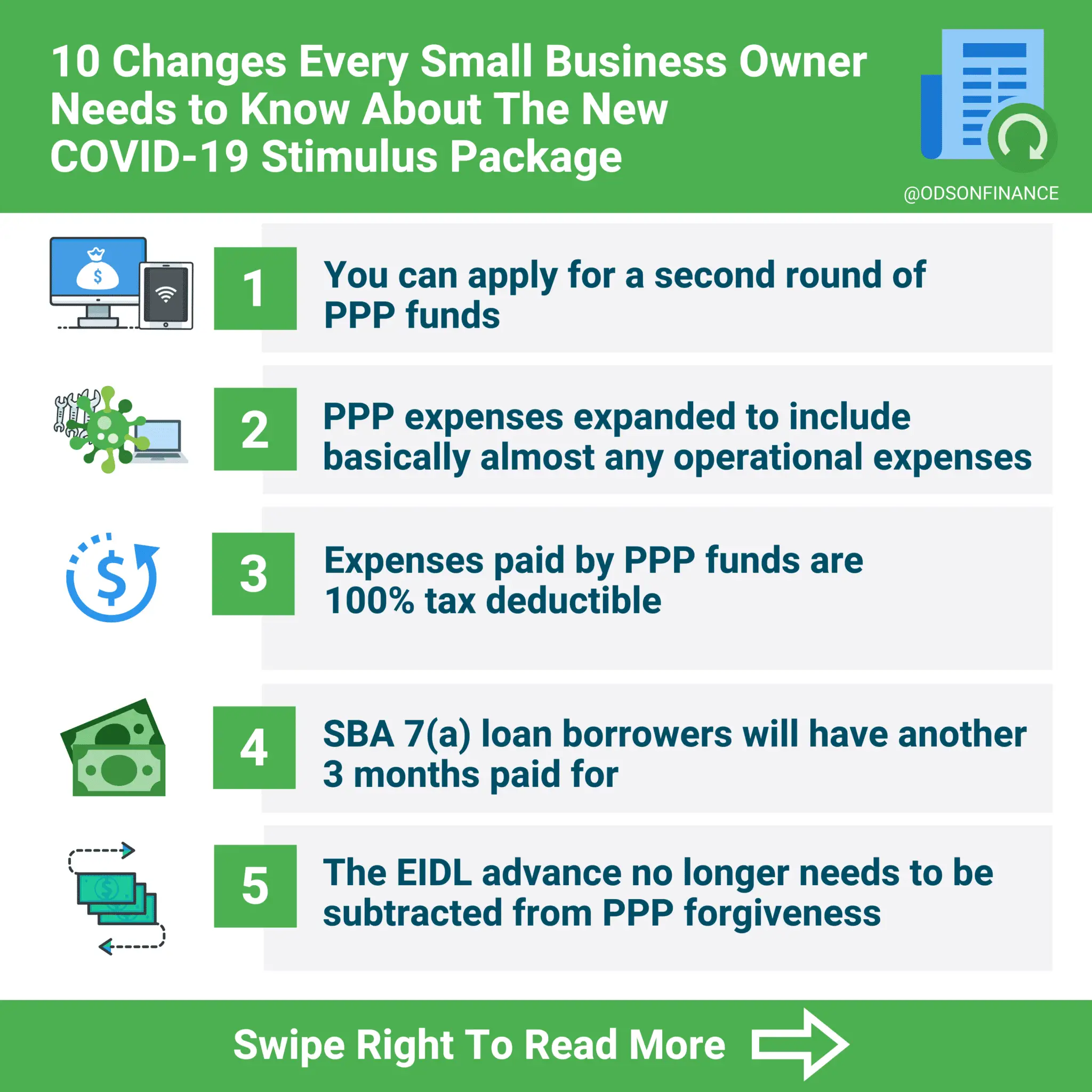

More Small Businesses Are Now Eligible For Ppp Loans

While the PPP loan deadline is still March 31st, 2021, more businesses will be eligible to apply for funding .

Certain non-profit organizations may now be eligible for an initial PPP loan if:

- The organization does not receive more than 15% of receipts from lobbying activities

- The lobbying activities do not comprise more than 15% of activities

- The cost of lobbying activities of the organization did not exceed $1 million during the most recent tax year that ended prior to Feb. 15, 2020 and

- The organization employs not more than 300 employees.

Larger not-for-profits with these distinctions may also be eligible for PPP funding:

- Larger 501 organizations and veterans organizations that employ not more than 500 employees per physical location.

- Larger 501 organizations, domestic marketing organizations, and additional covered not-for-profit entities that employ not more than 300 employees per physical location.

Beyond non-profit organizations, online news and periodical publishers with more than one location and fewer than 500 employees may also be eligible for PPP funding.

Also Check: Will We Get Another Stimulus Check Soon

Closed: Independent Performing Arts Theatres And Cinemas Assistance Program

The Independent Performing Arts, Theatres and Cinemas Assistance Program will provide payments of up to $50,000 to provide cash flow assistance to a range of larger, indoor entertainment venues that are particularly affected by capacity constraints. Payments will be based on the seating capacity limit. Eligible venues include:

- Regional and outer metropolitan Performing Arts venues network

- Other Independent Theatres:

To be eligible, venues must:

- Be able to demonstrate a 30 per cent reduction in revenue for any six-week consecutive time frame between 1 January 2022 to 30 April 2022, compared to the equivalent period in 2021

Applications for this grant have now closed.

Gov Wolf: Effective April 4 More Options For Restaurants And Other Businesses Mass Gathering Maximums Increase

HARRISBURG As COVID-19 cases have declined and vaccination rates are climbing, Governor Tom Wolf today announced the lifting of some targeted restrictions on restaurants and other businesses, as well as increased gathering limits.

UPDATE: MARCH 15, 2021

PA COVID-19 Hospitality Industry Recovery Program

The PA COVID-19 Hospitality Industry Recovery Program will begin accepting applications on Monday, March 15. The program allows businesses in the hospitality industry that were affected by the pandemic to receive grants of up to $50,000 to offset losses.

This program is administered County by County. Please visit your County links below to learn more about the application process and program guidelines.

Shuttered Venue Operators Grant Program

The Shuttered Venue Operators Grant program was established by the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act, signed into law on December 27, 2020. The program includes $15 billion in grants to shuttered venues, to be administered by the SBAs Office of Disaster Assistance.

SBA Re-Opening Paycheck Protection Program to Small Lenders on Friday, January 15 and All Lenders on Tuesday, January 19

PPP First-time applicants

Continuing the Paycheck Protection Program and Other Small Business Support

Section 03: Emergency Rulemaking Authority

- Requires the SBA Administrator to establish regulations to carry out this title no later than 10 days after enactment of this title.

Section 05: Hold Harmless

Recommended Reading: Will Social Security Recipients Get The $1400 Stimulus Check

What Is The Coronavirus Stimulus Package

The CARES Act was signed into law at the end of March. The Act contains several provisions that provide help for small businesses, individuals, big businesses, and more. Altogether, the economic stimulus package provides some $2 trillion in aid from the federal government.

Many of the programs described in the CARES Act are beginning to go into effect. Our guide will break down the provisions that matter the most to businesses like yours.

- : More parts of the CARES Act

We’re Not Out Of The Woods Yet

If you’re eligible for any of the benefits attached to the newest stimulus package, we encourage you to apply. While the pandemics end is in sight, the road ahead is still long for many business owners impacted by COVID-19.

For more advice on getting your business back on track throughout the pandemic, visit our Back on Track Hub here.

Read Also: Wheres My Stimulus Check.gov

Closed: Small Business Assistance Grant

The Small Business Assistance Grant December 2021 assists small businesses that were directly financially impacted by the Chief Health Officers COVID Restrictions from 23 December 2021 to 4 January 2022.

The Small Business Assistance Grant December 2021 is available to small businesses operating within the hospitality sector, the music events industry or the creative and performing arts sector.

Eligible employing businesses will receive $1,130 for each impacted day , while eligible non-employing small businesses will receive $400 for each impacted day .

The final grant payment available will be based upon the number of days that your business was impacted over this period, as demonstrated in your application and supporting evidence.

Applications for this grant have now closed.

- Have an annual turnover of more than $50,000.

- Have a valid and active Australian Business Number .

- Have an Australia-wide payroll of less than $4 million.

- Operate in the food and beverage industry.

- Have a local government approved alfresco plan.

Applications for this grant have now closed.

Sba Loan Payment Subsidies

The CARES Act passed by Congress in March 2020 required the SBA to make six monthly loan payments for businesses that obtained certain types of regular SBA loans, including:

- 7 loans: general small business loans of up to $5 million

- 504 loans: loans of up to $5.5 million to provide financing for major fixed assets such as equipment or real estate

- Microloans: short-term loans of up to $50,000 for small businesses.

The stimulus bill extends this loan payment subsidy to up to 14 monthly payments for various types of businesses that have been hard-hit by the pandemic, including: food service and accommodation arts, entertainment, and recreation education and laundry and personal care services. The bill also makes these payments tax-free for the borrower.

You May Like: How Many Stimulus Checks Were In 2021

Biden’s Covid Relief Means Small Businesses Can Save Big On Taxes In 2021

More than $5tn has been spent on stimulus programs in the US to fight Covids economic impact and a significant amount has been earmarked for small businesses

Thanks to the stimulus programs, there are now five ways small can save big on their taxes in 2021 and even get money back.

The signing of the American Rescue Act this week means that more than $5tn has been spent on stimulus programs in the US to fight the economic impact of the Covid pandemic. A significant amount of this money has been earmarked towards funding small businesses, such as the paycheck protection program and the economic injury disaster loan program. However, all of the stimulus programs contained generous tax incentives that can not only save business owners a significant amount on their taxes in 2021, but also provide additional funding. Here are five that every small business owner should be considering.

Specific Funding Is Set Aside For Minority

The new stimulus package sets aside $3 billion in grant funding for minority-owned businesses in underserved communities. This funding aims to address the criticism that the first stimulus package didnt do enough to get funding to the communities with the greatest needs.

Details are still being hammered out on how this funding will be distributed well provide updates when those details become available.

Also Check: When Did I Get My Stimulus Check

Economic Injury Disaster Loan Program Grants

Special grants have been set aside for very small businesses located in low-income communities that have no more than 300 employees and that have suffered an economic loss of more than 30%, as determined by the amount that the entitys gross receipts declined during an eight-week period between March 2, 2020, and Dec. 31, 2021, relative to a comparable eight-week period immediately preceding March 2, 2020.

Additional grants are also available for businesses in those areas that have fewer than 10 employees. You can see if youre eligible here and apply for grants here through Dec. 31, 2021.

% Deduction For Business Meals

Meals and beverages business owners have with customers, clients, employees, and other business associates in restaurants, bars, and similar establishments are deductible as a business expense. However, for decades the tax law has limited this deduction to 50% of the total cost of the meal. The stimulus bill changes this. For 2021 and 2022 only, 100% of the cost of such business meals is deductible. This is intended to help restaurants and bars, which have been especially hard hit by the pandemic.

Read Also: Social Security Recipients Stimulus Checks

Stimulus Package : Understanding Relief For Small Businesses

In an effort to focus on helping small businesses, Congress is extending the program created under the CARES Act through March 31, 2021. Expanding on the previous legislation, more funding is available to certain small businesses in the form of SBA-backed PPP and EIDL loans. Even if youve received a PPP loan from the previous rollout, you may be eligible to apply for a second draw loan. PPP loans offer forgiveness if funds are used for:

- Mortgage or interest on a mortgage

Ppp Expenses Are Now Tax Deductible

Previously, the IRS stated that expenses covered by a PPP loan would not be tax deductible âeven if you havenât applied for forgiveness. It was also unclear whether the forgiven amount would be considered taxable income.

The new bill amends and simplifies the program. Now, any expenses covered by a PPP loan can be claimed as tax deductible. The forgiven amount of a PPP loan will not be included as taxable income.

You May Like: Who Qualified For 3rd Stimulus Check

Closed: Nightclub Assistance Program

The Nightclub Assistance Program will provide payments of up to $50,000 for eligible nightclubs impacted by capacity limits and social distancing. Payments will be based on the nightclubs licence capacity limit. To be eligible, nightclubs must:

- Be able to demonstrate a 30 per cent reduction in revenue for any six-week consecutive time frame between 1 January 2022 to 30 April 2022, compared to the equivalent period in 2021

Applications are managed by the Department of Local Government, Sport and Cultural Industries and close at 5pm on 30 June 2022.

Applications for this grant have now closed.