Who Is Eligible For A Stimulus Check

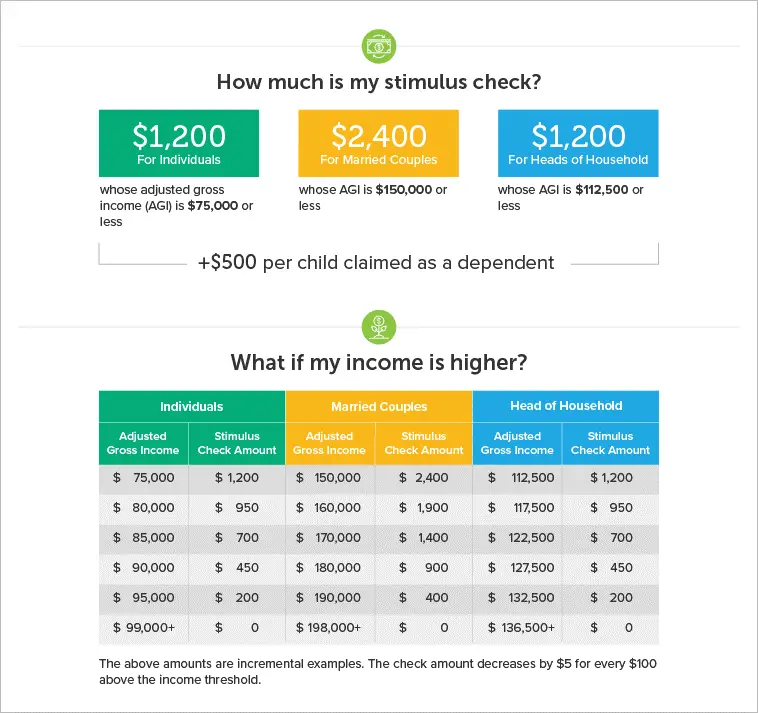

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

California: Up To $1050 Rebate

Payments for Californias Middle-Class Tax Refund started hitting bank accounts and mailboxes at the beginning of October, with the most recent batch sent out on October 24. An estimated 23 million Golden State residents are eligible for these payments. To find out if you qualify, you can check the State of Californias Franchise Tax Board website. The Franchise Tax Board expects 90% of payments to be issued in October.

A one-time payment of $350 will go to individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Eligible recipients who received Golden State Stimulus payments by direct deposit should have seen their Middle Class Tax Refund deposited between October 7 and October 25. All remaining direct deposits were slated to occur between October 28 and November 14.

If you received your California stimulus payments by debit card, youll also receive the Middle Class Tax Refund by debit card between October 24 and December 10. Remaining debit card payments will be sent by January 14, 2023.

Read more: California Residents Receive Another Round of Stimulus Payments

Th Stimulus Check Update And Payment Status In 2022 Latest News And Developments

This article provides updates, income qualification thresholds and FAQs on the approved and proposed COVID relief stimulus checks, also known as Economic Impact payments.

While multiple rounds of payments have been made over the last two years, many are asking if the government will make another of payments to help folks cope with high inflation and the rising costs of basic goods and services.

Each round of stimulus check payments had slightly different rules so please ensure you review each payment round separately. Click the links below to jump to the relevant stimulus payment.

If you have not received one or more of your stimulus payments, then you will need to claim this as a recovery rebate in your tax return filing this year.

Also Check: Is There Another Stimulus Check Coming In 2021

Minnesota: $488 Payments For Frontline Workers

Some frontline workers received a one-time payment of $488 in October, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020, and June 30, 2021, and werent eligible for remote work.

Workers with direct Covid-19 patient-care responsibilities must have had an adjusted gross income of less than $175,000 between December 2019 and January 2022 workers without direct patient-care responsibilities must have had an adjusted gross income of less than $85,000 annually for the same period. Applications for the payment are now closed.

Whats Next For State Stimulus Checks

Even with all these measures making their way through various legislatures, Americans remain crunched between what they need and what they can afford.

And while gas rebates and stimulus checks can help buffer the blow of rising prices, there are those who remain leery of sending out additional payments, especially with past pandemic relief programs believed to have contributed to our current rate of inflation.

Jaime Peters, assistant dean and assistant professor of finance at Maryville University in St. Louis, explains that for some lawmakers, inflation-related stimulus payments will simply feed the beast, putting even more money into the market where the supply of goods cant meet demand.

This creates a conundrum for families who are coming up short on the supply of funds to get the goods they need each day.

Read Also: What Was The First Stimulus Check Amount

You May Like: I Never Got My California Stimulus Check

Can I Switch How I Get My Stimulus Check

If you received direct deposit the first time, the IRS will use your data that’s already in the system to get you the second stimulus check. If the bank account listed is closed or inactive, you’ll receive the payment in the mail. And to prevent fraud, the IRS won’t let you change the direct deposit information for a stimulus payment already on file.

During the first round of stimulus checks, you could use the Get My Payment application to provide the IRS with your bank information up until May 13 to ensure you’d get the money via direct deposit. If you received a paper check last time, the IRS hasn’t indicated whether you can add your bank account information this time, or if there is a deadline to do so, but they only have until Jan. 15 to issue the payments, according to the legislation.

If you recently moved, you should provide the IRS with your new address via a Form 8822, or in writing.

Why Are States Giving Out A Fourth Stimulus Check

It all started back when the American Rescue Plan rolled out. States were given $195 billion to help fund their own local economic recovery at the state level.1 But they dont have forever to spend this moneystates have to figure out what to use it on by the end of 2024, and then they have until the end of 2026 to spend all that cash.2That might sound like forever, but the clock is ticking here.

Some states have given out their own version of a stimulus check to everyone, and others are targeting it at specific groups like teachers. And other states? Well, they havent spent any of it yet.

Some states like Colorado, Maryland and New Mexico are giving stimulus checks to people who make less than a certain amount of money or who were on unemployment. So far, California is the only state to give out a wide-sweeping stimulus check.3 Other states like Florida, Georgia, Michigan, Tennessee and Texas are putting the money toward $1,000 bonuses for teachers.

Read Also: When Are Stimulus Checks Coming

How Can I File My Taxes

If you know you need to file a 2020 tax return, you should do so as soon as possible to get your Economic Impact Payment and any tax refund that you are eligible for.

Online: If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software. MyFreeTaxes is an online tool that helps you file your taxes for free. You can use these online programs until November 20, 2021.

Irs Has Sent $6 Billion In Stimulus Payments Just In June Here’s How To Track Your Money

Your stimulus check could be on its way, along with child tax credit money and unemployment tax refunds. We’ll explain the state of the payments today.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET, where he leads How-To coverage. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

Don’t think that the child tax credit payments going out in just over two weeks are all the IRS is focused on. The tax agency continues to send weekly batches of the third stimulus checks, with more than $6 billion in stimulus payments going out just in June. Some of that money includes “plus-up” adjustments for people who received less money than they were supposed to get in earlier checks.

Even though many of us got our stimulus money in the earlier batches in spring, some have had to wait weeks or months for their checks. The IRS sent money first to people who’d already filed their 2019 or 2020 tax returns because those were the easiest to verify. So if you’re still waiting for your stimulus check up to $1,400 — or think you might be due a plus-up payment — we’ll tell you what to do next.

Read Also: Stimulus Check 1 And 2

Payment Status Not Available: What Should You Do

The IRS Get My Payment tool will only let you input new direct deposit or bank account information if youre seeing a Need More Information status, breaking with tradition from previous stimulus check rounds. That works either by submitting a financial product that includes a routing and account number with it, whether it be a bank account or prepaid debit card.

The easiest way to make sure that the IRS has the most accurate picture of your financial situation and personal whereabouts is by submitting your 2020 tax return. You now have until May 17 to submit your 2020 tax return, after the IRS on March 17 announced it was delaying the deadline by a month.

However, given the unprecedented and unconventional nature of the current tax season, the Treasury Department and IRS may have already attempted to send out your payment before your tax information was processed.

You could also update your mailing address by submitting a Form 8822, Change of Address, or notifying the IRS orally of your move. But be prepared: You might experience delays waiting for confirmation, given that the IRS has already begun distributing these stimulus checks. As always, a direct deposit is the fastest way to guarantee you receive a payment.

You May Like: Where Do The Stimulus Checks Come From

Third Round Of Stimulus Checks: March 2021

Barely a week after the second round of stimulus payments were completed, new president Joe Biden entered office and immediately unveiled his American Rescue Plan, which proposed a third of round of payments to Americans, including some of those who might have missed out on the first two rounds.

On Thursday 11 March, Biden signed his $1.9tn American Rescue Plan into law. The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800. In addition, families with dependents were eligible for an extra payment of $1,400 per dependent, regardless of the dependent’s age this time, there was no limit to the number of dependents that could be claimed for.

The first stimulus payments were issued swiftly – just hours after Biden has signed the bill, the first batch of 164 million payments, with a total value of approximately $386 billion, arrived by direct deposit in individuals bank accounts. Some received their payments on the weekend of 13/14 March 2021. Since then, payments had been sent on a weekly basis including “plus-up” payments until the end of the year. Like before, those who didn’t get all the EPI3 funds in 2021 due to them will be able to claim them when they file their tax returns in the spring of 2022.

Also Check: Claiming Stimulus Check On Taxes 2021

If You Didn’t Get Your First Check

The IRS used your 2019 income tax return to determine your AGI. If you’ve moved since filing that return, that is the only address they have on file for you. If you received a refund for 2019 and had that refund deposited directly into your bank account, that’s the last bank account the IRS has on file. That means that if you’ve changed banks since that time, they likely sent your stimulus check to the last bank on record. By law, banks are required to send those checks back to the IRS.

If you’re missing either of your stimulus checks, it’s not too late to make a claim. Fill out the Recovery Rebate Credit on your 2020 tax form to let the IRS know that funds are still owed. If you owe taxes for 2020, the government will keep your rebate to cover them. For example, if you owe $2,000 but missed out on the $600 stimulus check, the IRS will keep the $600, and your tax bill will drop to $1,400. On the other hand, if you are due a tax refund, the IRS will add the rebate to your refund.

The good news is that we know for sure there is another round of stimulus in the pipeline. Right now, our best guess is that it should reach you within three weeks of the day Congress passes stimulus legislation.

What Is The Third Round Of Stimulus Checks Being Sent

Often, stimulus checks are given during times when the economy finds itself at a standstill. With the Coronavirus pandemic and lockdowns closing multiple businesses and preventing people from getting out of their houses , people no longer felt they had too much money to spend anymore. Since people were no longer buying that much, the economy reached a low point. A second stimulus check was also given over the second half of 2020, to aid in the COVID-19 pandemic.

Enter the third round of stimulus checks. Starting in 2021, stimulus checks were sent to the taxpayers so that they could give the economy a boost. Generally speaking, people will get somewhere around $1,400 for themselves on this third round of stimulus checks. They will also receive $1,400 for each one of the qualifying dependents mentioned on their tax return.

The third round of stimulus checks being sent will be calculated based on the latest processed tax return of the taxpayer, be it 2019 or 2022. If the IRS has received as well as processed the tax return of a taxpayer in 2020, then the agency will make the calculations based on that.

Don’t Miss: Are We Receiving Another Stimulus Check

I Claimed An Adult Dependent On My 2019 Or 2020 Taxes But That Person Is No Longer My Dependent What Should I Do

Check with your dependent to find out if theyve already filed a tax return since their dependent status ended. They may have already received a stimulus payment of their own. If they have not filed their own tax return and you receive a larger payment that accounts for your former dependent, you dont need to return it.

You May Like: Irs.gov Stimulus Check Sign Up

Update On A Fourth Stimulus Check

Millions have been clamoring for recurring stimulus payments, and some lawmakers have expressed support for more relief aid through the pandemic. But President Joe Biden hasn’t pledged support to a fourth check, focusing instead on his proposed family and jobs packages and the recent infrastructure deal.

In a press conference on June 3, White House press secretary Jen Psaki played down the possibility of a fourth check, asserting that the administration has already put forward an economic recovery plan. Through the debate in Washington over additional economic impact payments continues, it’s looking increasingly unlikely that there will be any more direct payments this year.

Don’t Miss: How Many Stimulus Payments Were There In 2021

How You Can Expect To Receive Your Stimulus Payment

The most important thing to remember if youre an adult dependent looking for a stimulus payment: You wont be individually receiving these stimulus payments. Rather, theyll be incorporated in the lump sum that your parent or guardian receives.

The IRS and Treasury Department are delivering stimulus checks through three main methods: direct deposit, as well as mailed physical check or a prepaid debit card. If your household has a bank account and routing number on file with the IRS, the payment will most likely hit your familys bank account, the fastest method of delivery. New to this round, the Treasury Department is also working across government agencies to access any bank accounts that might have been on file for other federal payments, potentially speeding up the delivery process.

Mailed checks or debit cards will likely take longer, potentially adding weeks to the process. Be sure to keep a watchful eye out for any letters or notices that come from the IRS or Treasury Department and hold onto any documents referring to your stimulus payment.

The IRS started delivering the third stimulus check round on March 12 and has now delivered roughly four-fifths of all payments, according to a . The IRS will continue delivering paper checks and debit cards on a weekly basis, a process that started officially on March 19.

State And City Stimulus

Some states have also given out extra stimulus payments, including California and Maine, with many using funds from the Rescue Act.

In 2021, California launched two-state stimulus programs: the Golden State Stimulus I and Golden State Stimulus II.

These stimulus checks are worth up to $1,200 and $1,100, respectively.

Furthermore, the state recently issued about 139,000 stimulus checks.

Moreover, California plans to send out up to another 70,000 stimulus checks starting mid-March.

Those getting paper checks need to allow up to three weeks for them to arrive.

Eligible Maine residents received $285 stimulus payments until the end of 2021, and its unclear if this will continue into 2022.

Another city in California, Santa Ana, started sending out $300 payments loaded on prepaid Visa debit cards last year.

So far about 2,700 have been distributed and we plan to give out up to the full 20,000 cards either in person or notifying qualified residents by mail to pick them up, a Santa Ana official told The Sun in December.

According to a statement by the city, those with poverty rates above the Santa Ana median of 42% will qualify for the support.

Also, thousands of St Louis, Missouri residents were able to claim a $500 stimulus check in December.

However, applications for the moment are paused and the city will keep the public informed on any potential future reopening of its portal.

Oregon is another state that has launched its own stimulus program.

Read Also: How To Get Unclaimed Stimulus Checks