Missouri Unveils Tax Break Worth $1000

Missouri citizens have reason to celebrate because Governor Michael L. Parson just signed legislation dropping the state income tax rate for millions.

Starting January 1, 2023, the tax rate will drop by 5.3 percent down to 4.95 percent.

While Washington D.C. politicians ignore record inflation and skyrocketing consumer prices, we wont make the same mistake here in the state of Missouri, Mr Parson said.

The law decreases the top individual income tax rate from 5.2 to 4.95 percent where the majority of taxpayers will see a roughly five percent decrease in their tax liability.

Additionally, this will eliminate the bottom income tax bracket and allow residents to earn their first $1,000 tax-free.

What States Are Paying A Fourth Stimulus Check

There likely wont be another stimulus check from the federal government coming anytime soon. But a number of states have approved a fourth stimulus check for their residents welcome news amid rampant inflation. And more states could do the same in months to come. Lets break down which states are paying a fourth stimulus check and how much you could get.

For help with managing stimulus payments or with any other financial questions, consider working with a financial advisor.

Nonfilers: You May Need To File Your 2020 Tax Return This Year To Get The Right Stimulus Check Amount

With the second payment, the IRS used your 2019 tax returns to determine eligibility. Nonfilers, who weren’t required to file a federal income tax return in 2018 or 2019, may still be eligible to receive the first stimulus check under the CARES Act. And this group will qualify again. Here are reasons you might not have been required to file:

- You’re over 24, you’re not claimed as a dependent and your income is less than $12,200.

- You’re married filing jointly and together your income is less than $24,400.

- You have no income.

- You receive federal benefits, such as Supplemental Security Income or Social Security Disability Insurance. See below for more on SSDI.

Recommended Reading: State Of Maine Stimulus Check

California: Up To $1050 Rebate

Payments for Californias Middle-Class Tax Refund started hitting bank accounts and mailboxes at the beginning of October, with the most recent batch sent out on October 24. An estimated 23 million Golden State residents are eligible for these payments. To find out if you qualify, you can check the State of Californias Franchise Tax Board website. The Franchise Tax Board expects 90% of payments to be issued in October.

A one-time payment of $350 will go to individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Eligible recipients who received Golden State Stimulus payments by direct deposit should have seen their Middle Class Tax Refund deposited between October 7 and October 25. All remaining direct deposits were slated to occur between October 28 and November 14.

If you received your California stimulus payments by debit card, youll also receive the Middle Class Tax Refund by debit card between October 24 and December 10. Remaining debit card payments will be sent by January 14, 2023.

Read more: California Residents Receive Another Round of Stimulus Payments

How To Opt Out Of Monthly Child Tax Credit

If you dont want these advance payments, youll have to go through a few steps to opt out. But its pretty simple really. The IRS set up a Child Tax Credit Update Portal for you to opt out and make any changes.

Dont worryeven though the first payment has already gone out, its not too late to opt out of the advance Child Tax Credit payment. Actually, you have the chance to opt out each month. Really! You just have to do it at least three days before the first Thursday of the month.8 So if you want to opt out in September, make sure to opt out by August 30, just to be safe.

Pro tip: If youre married and filing jointly, then both you and your spouse need to opt out of the Child Tax Credit.

Don’t Miss: I Still Haven’t Gotten My First Stimulus Check

What Is The New Child Tax Credit Amount

Heres how the numbers break down: The American Rescue Plan bumps the Child Tax Credit up to $3,000 for children ages 617 and $3,600 for children under age 6.3 Expecting a baby in 2021? First of all, congrats! And heres some more good news for youbabies born in 2021 will qualify for the full $3,600. Have a college student? Parents can receive a one-time payment of $500 for each full-time college kid ages 1824.4

So, for a family that has three children , heres how it all breaks down:

Lets say they have three kids that are ages 12, 7 and 4 and a household income of $72,000 a year. Their new Child Tax Credit would be $9,600.

But remember, instead of applying the full amount of the credit to income taxes they might owe or getting a refund after they file their taxes, parents can get the credit up front in monthly payments of $250 for each qualifying child .5 So that family of three in our example would get $800 a month from July through December. Wow!

Right now, this change would be only for 2021but theres talk in Congress and the White House to make it a permanent thing for the next five years under Bidens American Families Plan. Yep, there are a lot of plans and acts to keep straight these days.

You Might Get A Fourth Stimulus Check

You Might Get a Fourth Stimulus Check

We’re reader-supported and only partner with brands we trust. When you buy through links on our site we may receive a small commission at no extra cost to you.Learn More. Product prices and availability are accurate as of the date and time indicated and are subject to change.

Are we getting another stimulus check? If you live in certain states, the answer is yes. Its no secret that gas, grocery, and housing costs are skyrocketing rapidly. As we look for financial relief, some states are giving taxpayers a fourth stimulus.

Keep in mind that each state isnt receiving a federal stimulus. It could be a tax rebate, dividend, or stimulus check, varying from state to state.

Some states have already sent out checks, and some are coming in October through January 2023. Taxpayers can get up to $1,050.

Is your state giving you some cash relief? Check our list and find out if youll get a 2022 stimulus check.

And if youre looking for ways to get more cash in your pocket, download the KCL app and keep tabs on our food recalls and list of class-action settlements.

Recommended Reading: Senior Citizens Stimulus Check 2021

Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment was possible due to a budget surplus. Couples filing jointly received $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

If youre eligible but didnt receive a rebate yet, you can apply online starting November 1. The application period will only last 30 days and will close on November 30, 2022.

Applicants must provide their Social Security number, active Delaware drivers license that was issued before December 31, 2021 and a valid Delaware residential mailing address. Payments will be sent out to qualifying applicants after the application period closes and all applications are reviewed.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

These Cities Will Issue The City

Many cities have decided to step up and distribute fourth stimulus checks. The common trend in these cities is an aim to help those hardest hit by the pandemic.

These are the United States cities that are distributing city-specific stimulus checks to their residents:

- Chicago, Illinois: Monthly assistance to low-income individuals throughout 2022.

- Los Angeles, California: A variety of programs and assistance to encourage food security and housing for low-income households.

- Pittsburgh, Pennsylvania: Support programs and resources for unemployed individuals, artists, service workers, and more.

- Seattle, Washington: Food, rent, and financial support for individuals significantly impacted by the pandemic.

- Santa Ana, California: Emergency rental assistance through March 31, 2022.

Recommended Reading: Give Me The Latest On The Stimulus

What To Do If You Havent Been Paid Your Stimulus Check In 2023

If you havent been paid your stimulus check, there are steps you can take to claim your money.

First, you have to be eligible. You have to be:

- a U.S. citizen or U.S. resident alien

- Not a dependent of another taxpayer.

- Earning not more than $150,000 if you are married and filing a joint return, $112,500 if a head of household, or $75,000 as a single filer.

Stimulus check 1 and 2

If you did not receive your first or second stimulus check, you can file a 2020 tax return because thats the only way you will be able to claim unpaid funds from your first and second stimulus check through the Recovery Rebate Credit.

This credit is for those who did not receive any stimulus money at all or received the incorrect amount. You can claim a partial credit and get any additional funds.

You can claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Third Stimulus Check

The third round of Economic Impact Payments was enforced by the American Rescue Plan Act of 2021. The IRS started sending the checks in March 2021.

As of writing this, the IRS has issued all third Economic Impact Payments and related plus-up payments and most eligible people already received the payments.

California

Idaho

Delaware

Illinois

Hawaii

Florida

Georgia

Second $600 Stimulus Check Details

While the CAA legislation, under which the stimulus payments were funded, required that the second round of payments be issued by Jan. 15, 2021, some second round Economic Impact Payments may still be in the mail and delivered by the end of February. The IRS however has confirmed has issued all first and second Economic Impact Payments it is legally permitted to issue, based on information on file for eligible people.

Get My Payment was last updated on Jan. 29, 2021, to reflect the final payments and will not update again for first or second Economic Impact Payments.

If you havent yet received your payment and GMP is not showing payment details then the IRS is recommending you claim this via a recovery rebate credit in your 2020 tax return that you will file this year. Major tax software providers have updated their software to allow tax payers to claim their missing first or second stimulus payment as a recovery rebate with their 2020 tax filing.

Under the COVID-related Tax Relief Act of 2020, the IRS has delivered more than 147 million EIPs totaling over $142 billion. Due to the lower income qualification thresholds and smaller payments this was lower than the 160 million payments made via the first stimulus check.

President Biden also recently signed an Executive Order for the IRS to provide a new tool to claim missing stimulus checks and conduct more analysis to ensure those who were unable to get their first or second check are notified around their eligibility.

You May Like: Who Do I Contact About My Stimulus Check

Special Reminder For Those Who Dont Normally File A Tax Return

People who dont normally file a tax return and dont receive federal benefits may qualify for stimulus payments. This includes those without a permanent address, an income or bank account.

If youre eligible and didnt get a first, second or third Economic Impact Payment or got less than the full amounts, you may be eligible for a Recovery Rebate Credit, but youll need to file a tax return.

Some Debit Cards Are Eligible To Receive Payments

Debit cards that are used by many tax preparation companies such as H& R Block and Intuits TurboTax as well as the Direct Express programs do qualify to receive these direct payments. Thats because these cards are linked to an actual bank account and all should qualify for the economic stimulus direct payment. This is relatively new information.

Recommended Reading: New York Stimulus Check 4

Don’t Miss: Latest News On The Stimulus Checks

Who Is Eligible For The Third Stimulus Check

For the first two stimulus payments, single taxpayers earning up to $75,000 a year and couples earning up to $150,000 a year were able to get the full amount. Parents also received stimulus payments for each dependent child under age 17.9,10

Those income limits didnt change for the third stimulus payment even though it targeted the payments to lower income earners. Under the American Rescue Plan, payments phased out for single filers making between $75,000 and $80,000 and couples making between $150,000 and $160,000.11

Eligibility for the third stimulus check also expanded to cover any non-child dependents. That means taxpayers who supported certain eligible dependents age 17 and older might have received more money too.12

More Stimulus Payments In The Inflation Reduction Act

President Biden and the Democrat controlled Congress narrowly passed a scaled down version of the Build Build Better act, known as the Inflation Reduction Act .

While this bill included funding for several groups and additional taxes on corporations, it did not include another stimulus check or economic impact payment in 2022 or in 2023.

While many individuals and families could have benefited from some form of government support, especially with higher interest rates, there simply was not enough political support for further payments or tax credit expansions that could spur further inflation.

There was however some relief for medicare recipients and record raises for those on the Federal GS pay scale and subject to Military pay charts, thanks to a record 2023 COLA increase.

Get the latest money, tax and stimulus news directly in your inbox

Don’t Miss: Stimulus Checks For California Residents

What Is A Stimulus Check

A stimulus check is a direct payment to American families by the U.S. government in response to COVID-19.

This has nothing to do with Freedom Checks, Superpower Checks, or Federal Rent Checks, which are all related to investment opportunities. This piece is about stimulus checks sent to people by the government.

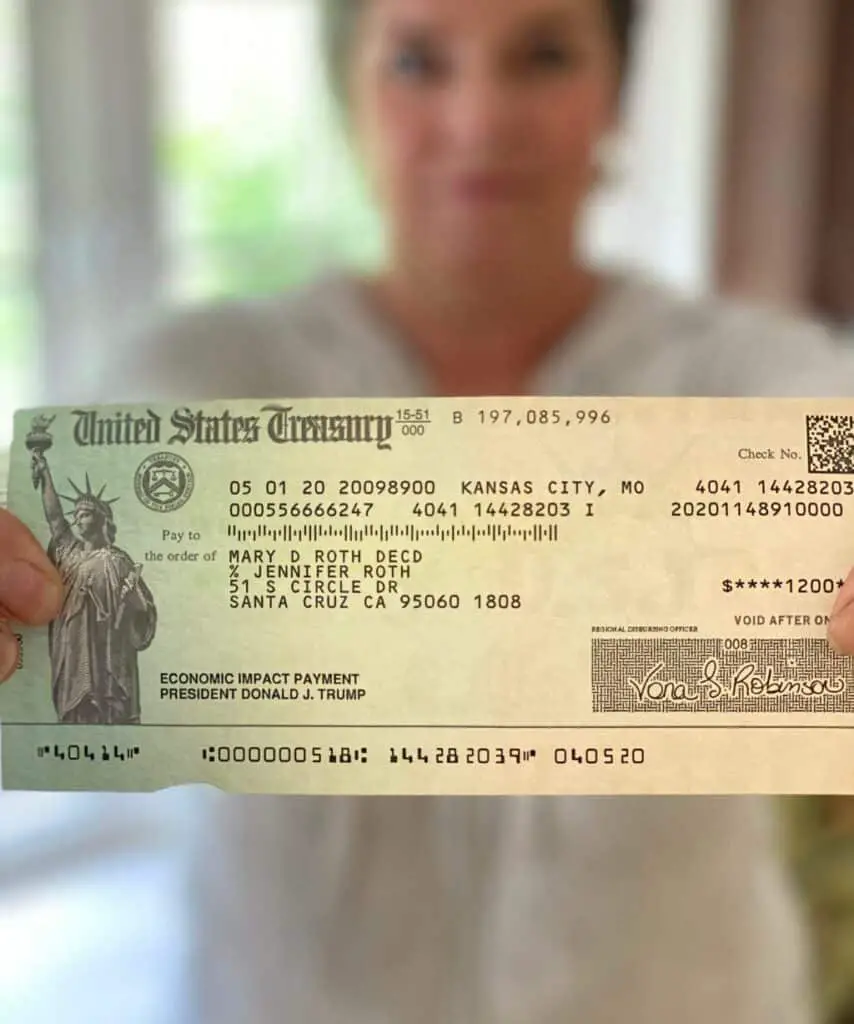

Since the start of the pandemic, three stimulus checks have been paid out:

- The Coronavirus Aid, Relief, and Economic Security Act was the first direct payment of up to $1,200 per eligible adult and $500 per eligible dependent child.

- The second stimulus check was paid out in December of 2020, paying up to $600 per eligible adult and dependent child.

- The American Rescue Plan Act on March 11, 2021, which secured the third stimulus check of up to $1,400 per adult and dependent.

After paying out the first stimulus payment, American families still needed more financial relief as the pandemic raged on. In December 2020, the U.S. government passed a second stimulus check.

When President Joe Biden was voted in on the promise of providing additional financial relief, he signed a bill authorizing a third stimulus check as soon as he took office. He signed The American Rescue Plan Act into law on March 11, 2021. It is expected to be the last direct payment Americans receive.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Alternative Forms Of Pandemic Relief Continuing In 2022

America has an active COVID-19 Economic Relief program. There are many plans and relief options provided to help people get back on their feet if theyre financially impacted by the pandemic. While most of the benefits are offered through government entities and non-profit organizations, it is worth reviewing the different efforts being taken to help.

In addition to the government relief programs, companies and services are available to help if youre struggling financially. Well review several options worth considering based on your unique needs.

Recommended Reading: How To Claim Stimulus Check 2021

Social Security Cash Up To $1800 To Land In Millions Of Bank Accounts In Days

The proposal came after it was heard from many seniors who shared their hardships in the aftermath of the pandemic.

Shannon Benton with the Senior Citizens League told The Sun: âWe have received hundreds of emails from people concerned about making ends meet.

âThe high cost of living adjustment, for many, just exacerbated their financial woes by bumping their income above program limits to qualify for medicare savings programs and extra help.â

The Senior Citizens League isnât the only one that is trying to get Congressâs attention.

Whos Eligible For The New York Stimulus Check

If youre a New York City property owner, there are two credits you can qualify for.

Youre eligible for the New York stimulus check if you:

New York Credit:

- are a resident of New York

- qualify for the 2022 School Tax Relief program

- have income below $250,000 for the 2020 tax year

- have a school tax liability for the 2022-23 school year that is more than their 2022 STAR benefit

New York City Credit:

- the property you file taxes for is your primary residence

- income less than $250,000 for the 2020 tax year

Also Check: Amount Of Stimulus Checks 2021