Missed The Deadline To Claim Your Child Tax Credit Or Stimulus Money What To Know

If you didnt claim your child tax credit money or third stimulus check by last nights cutoff, well explain what you need to do.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When shes not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The deadline for claiming your missing stimulus or child tax credit payments this year has passed but that doesnt mean youll never get that money. While the IRS Free File form is indeed closed, you can still claim any money owed to you when you file your taxes in 2023.

Some 9 million people who havent received their payments never filed a tax return this year, either because theyre not required to file or because they need more time. The IRS used tax returns to determine eligibility for both of these payments.

Keep reading to find out what you can do to receive any stimulus payments or child tax credit money owed to you. For more, see if your state is mailing out stimulus checks this month.

Recommended Reading: Are There Any Stimulus Checks Coming

Can My Stimulus Payment Be Garnished

Like the last stimulus check payments the third stimulus check cannot be offset to pay various past-due federal debts or back taxes. This does not apply to child support payments that are in arrears. If youre behind on child support your stimulus check can be fully or partially garnished either wont get a stimulus check or will receive a reduced one.

Recommended Reading: Will There Be Another Stimulus Package

Child Tax Credit Payment From Third Stimulus Still Coming

Separate from the direct payments for the third stimulus check, tens of millions of eligible American families will be getting another credit on their tax returns in the spring due to the American Rescue Plan. They will get at least half of the child tax credit and some will get all of it.

The total amount is $3,600 for each child up to age 5 and $3,000 for each child ages 6-17. Income limits to receive the maximum amount on the child tax credit were $75,000 for individual parents, $112,500 for a head of household and $150,000 for parents who filed their taxes jointly.

Just as the Economic Impact Payments were an advance on the Recovery Rebate Credit, eligible families were able to take an advance on the child tax credit in the form of monthly payments from July to December.

Those parents who took half of the child tax credit money through the monthly installments will get the other half $1,800 or $1,500 per child at tax time. Those who completely opted out of the monthly payments will get the full amount. Those who opted out of some but not all payments will get something in between.

Those who do not regularly file tax returns typically those with very low incomes and did not apply to receive the credit in 2021 can file a tax return in the spring and get the full amount as well.

Don’t Miss: Where Can I Cash My Stimulus Check 2021

How Will I Get My Check If I Havent Filed A 2019 Or 2020 Tax Return

If you receive Social Security or Railroad Retirement Benefits and did not file a tax return in 2019, you will not have to file a return in order to receive your paymentthe IRS has your information already.

If you dont receive those benefits and did not file a tax return for 2019 or 2020, you may need to file one to confirm your eligibility. Check your status in the Get My Payment portal for instructions.

Here’s What Veterans And Ssi Ssdi Beneficiaries Should Know

The IRS tracking tool Get My Payment is designed to tell you the status of your third stimulus check. People who receive Social Security benefits like SSDI and SSI and veterans who don’t file taxes can also see their payment status in the tracker tool. Tens of millions of Social Security recipients and veterans should have already received their $1,400 payment.

Also Check: Claiming Stimulus Check On Taxes 2021

The Irs Has An Online Tool That Lets You Track The Status Of Your Third Stimulus Check

Getty Images IRS.gov

The IRS has already delivered over 100 million third stimulus checks. But if youre still asking yourself wheres my stimulus check, the IRS has an online portal that lets you track your payment. Its called the Get My Payment tool, and its an updated version of the popular tool Americans used to track the status of their first- and second-round stimulus checks.

Note that you cant check the status of your first- or second-round stimulus payments with the updated tool. To find the amounts of these payments, create an online IRS account or refer to IRS Notices 1444 and 1444-B, which the IRS mailed after first- and second-round stimulus checks were issued. If you didnt get an earlier payment, or your received less than the full amount, you might be able to get what youre owed by claiming the Recovery Rebate credit on your 2020 tax return. Third-round stimulus payments arent used to calculate the 2020 Recovery Rebate credit, but they will be used to figure the credit amount on your 2021 tax return.

The updated Get My Payment tool more-or-less works the same way as the portal used for first- and second-round stimulus checks. But heres a refresher course on what the tool does, what information you need to provide, and what information the tool gives you. Check it out now so you know what to expect before entering the portal on the IRSs website.

What Is A Plus

A plus-up supplemental payment is a new or larger payment you may be eligible to get if you recently submitted your 2020 tax return and your income or number of dependents changed.

For example, if you received a partial third stimulus payment based on your 2019 income, but your income declined in 2020, you may receive another payment to make up the difference between the two amounts. Your original third stimulus payment and your plus-up payment together will equal the amount youre eligible to receive based on your 2020 tax return.

On April 1, the IRS announced that new payment batches include supplemental payments for these people. As of late June 9, more than 8 million plus-up payments have been issued.

Also Check: What To Do If You Didn’t Receive Your Stimulus Check

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

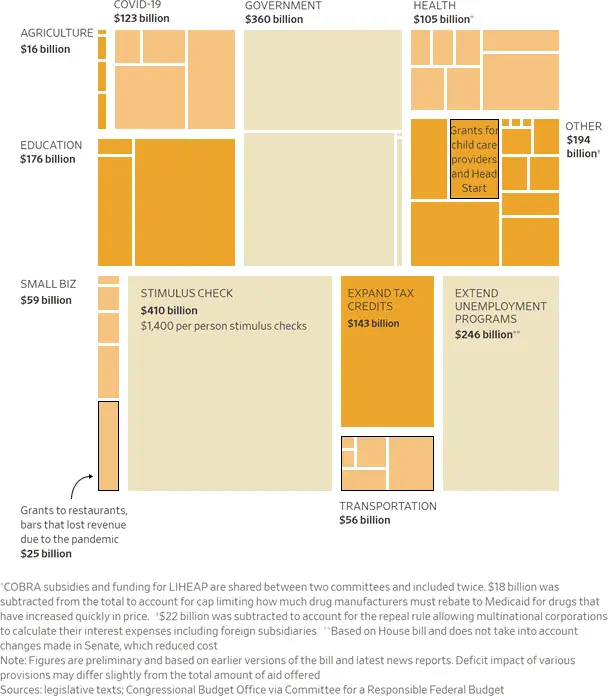

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Where Is My 3rd Stimulus Check

Asked by: Jodie Bode

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

Don’t Miss: How To Claim The Third Stimulus Check

How Are Married Couples Affected If Only One Spouse Has A Social Security Number

As with EIP2, joint filers where only one spouse has a Social Security number will normally get the third payment. This means that these families will now get a payment covering any family member who has a work-eligible SSN.

For taxpayers who file jointly with their spouse and only one individual has a valid SSN, the spouse with a valid SSN will receive up to a $1,400 third payment and up to $1,400 for each qualifying dependent claimed on the 2020 tax return.

Active Military: If either spouse is an active member of the U.S. Armed Forces at any time during the taxable year, only one spouse needs to have a valid SSN for the couple to receive up to $2,800 for themselves in the third stimulus payment.

Havent Received Your Third Stimulus Check Call The Irs Phone Number And Tell Them

If you havent received your third government stimulus payment yet, theres a way to track it down without going to the IRS website and navigating the seemingly endless maze of menu links, FAQs and status messages.

Stimulus Update: States Give Out Thousands of Bonus $1,000 Checks Will You Get One?

Just pick up your phone and punch in these 10 numbers: 800-919-9835. Thats the IRS Economic Impact Payment phone number, which connects you with a live representative.

As noted on the Toms Guide website, the phone number is a good option if you have a hard time navigating the IRSs dedicated stimulus check website, or if you have a question that cant be answered on the site.

Just keep in mind that the IRS has been overwhelmed with inquiries during the pandemic, with millions of Americans clogging up the phone lines to ask about their tax refunds, stimulus payments and other benefits.

More: A Petition Nearing 3 Million Signatures Calls for $2,000 Monthly Stimulus Checks for Every American

When you call the number, youll likely be greeted by an automated recording that will attempt to help you before youre connected with a live representative. Be prepared to sit on hold for a while, and make sure you have your questions and basic personal information ready.

Meanwhile, something you should never do is accept phone calls from someone claiming to be with the IRS the IRS never calls. If someone calls you claiming to be with the IRS, they are almost certainly trying to scam you.

Don’t Miss: Who Gets The 4th Stimulus Check

What To Do If The Irs Needs More Information

If the Get My Payment tool gave you a payment date but you still havent received your money, the IRS may need more information. Check the Get My Payment tool again and if it reports Need More Information, this could indicate that your check has been returned because the post office was unable to deliver it, an IRS representative told CNET. Here are more details on how the tracker tool works and what the messages mean.

Wheres My Stimulus Check Everything You Need To Know And What Comes Next

2021 has proven to be the year of the stimulus check, and then some. Over the past 12 months, there have been more than a half-dozen stimulus checks distributed by the federal government. That group includes a third stimulus check for $1,400, as well as six monthly child tax credit payments. So many stimulus payments, in other words, that answering the question Wheres my stimulus check? must first be preceded by, well, which one are you talking about?

The checks flowing from the federal government transferred as much as $16 billion to taxpayers on a monthly basis for at least six months, according to the IRS. And that only refers to the child tax credit payments. Plus, theres still a smattering of stimulus checks at the state level to different constituent groups. Below, well take a closer look at it all.

More Amazon Deals from BGR

Also Check: Who Is Receiving The Stimulus Check

Recommended Reading: How To Apply For Homeowners Stimulus Check

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

How Inmates Should File For Stimulus Checks

Inmates and their loved ones should move quickly, given the impending deadlines to submit a claim and receive a stimulus check in 2020. Here are some useful tips based on information from a dedicated page, www.caresactprisoncase.org, set up by Lieff Cabraser Heimann & Bernstein, LLP and the Equal Justice Society. Impacted individuals will find resources as well as a contact form to reach out to lawyers at Lieff, who are representing the Plaintiffs and the Class. If you or your loved one is currently serving time in a state or federal facility or was recently released, please contact us for more information about your rights by filling out this form, the site states. Your inquiries in pursuit of legal advice are privileged and confidential, and you will not be charged a fee to speak with us.

If you already filed a claim before September 24: Many inmates filed a claim and were rejected or had their stimulus check intercepted and returned. Based on the court order, the IRS must automatically re-process your claim by October 24, 2020. You can check the status of your payment on the IRSs portal: www.irs.gov/coronavirus/get-my-payment. If you do not receive payment by November 1 and do not see it scheduled on the Get My Payment portal, Lieff recommends reaching out to one of its lawyers.

Recommended Reading: When Will The $1400 Stimulus Checks Be Mailed Out

You May Like: Latest News On The Stimulus Checks

You May See A ‘need More Information’ Message

According to the IRS FAQ, a Need More Information message in the Get My Payment tool means your payment was returned because the US Postal Service wasn’t able to deliver it.

The FAQ says you’ll be able to have your payment reissued as a direct deposit by providing a bank routing and account number, a prepaid debit card or a financial service account that has a routing and account number associated with it. The FAQ says you can also update your mailing address to receive your payment.

You Receive Social Security Benefits Or You Dont Typically File Taxes

If you receive Social Security Benefits, or dont earn enough income to file taxes, the IRS experienced a delay in validating your eligibility for the third stimulus payment. The IRS had to wait to receive information from the Social Security Administration before it could review and verify if you qualified for a payment, and for how much.

After receiving the SSA information on March 25, the IRS announced on March 30 that most, if not all, of the Social Security recipients and other federal beneficiaries who do not normally file a tax return and are eligible for a stimulus check, should receive their payments electronically on or around April 7.

This includes those who receive Social Security retirement, survivor or disability , Supplemental Security Income , and Railroad Retirement Board recipients who did not file a 2019 or 2020 tax return or did not use the Non-Filers tool

The IRS announcement also stated that the Get My Payment tool will be updated to reflect this change on the weekend of April 3-4 for those that are expecting to receive their payments by April 7.

Also Check: How Much Was All The Stimulus Checks

Where Is My Stimulus Check

To learn the status of your stimulus payment, you can visit the Get My Payment portal at IRS.gov to:

- Learn about eligibility to receive a payment.

- Learn the status of your stimulus payment.

- Find out if the payment will be made via direct deposit to your bank account or by check via the postal mail. If the payment will be made via direct deposit, the IRS website will list the last four numbers of the bank account that will receive the deposit.

- Learn what to do if you did not receive an Economic Impact Payment for which you qualified.

When will the next wave of stimulus checks arrive in my account?

As always, you can use Online Banking or the Armed Forces Bank mobile app to monitor your account balance and transactions as often as you need to. We recommend setting up a transaction alert so you can be notified by text message* or email that your direct deposit has arrived.

Can Homeless People Get A Stimulus Check

Yes, they can get a stimulus payment. The only way to get a payment is to file a tax return with the IRS. You can do this for free. If you dont have a fixed address and you dont have a bank account, check with a local community or religious organization or with a homeless shelter to see if you have options for getting your mail from the IRS delivered there.

Keep in mind that it may take some time for the IRS to process your tax return and your stimulus payment.

Recommended Reading: Do We Get Another Stimulus Check This Month