How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

Stimulus Is Coming Next Door In Pennsylvania

Pennsylvania began sending out payments to older renters, homeowners, and people with disabilities in July 2022, but the deadline for filing a claim was Dec. 31, 2022. This means that payments will spill over into 2023 as well for qualifying residents who get their paperwork in before the deadline, the site said.

Exact Date Major Arts And Crafts Retailer With 850 Stores Closes Locations

This could apply to you if you welcomed a new child to the world this year.

Eligible families will need to file their 2021 tax return next year they will then get their stimulus payment once the tax return is processed.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

Read Also: Stimulus Check For Social Security Recipients 2021

Whats A Gross Income And Where Can I Find Mine

Your gross income includes income from selling your main home and gains reported on Form 8949 or Schedule D and from sources outside the US.

Your gross income doesnt include any Social Security benefits unless:

- Youre married but filing separately and lived with your spouse at some point in 2019.

- Half your Social Security benefits plus your other gross income and any tax-exempt interest is more than $25,000 filing single .

Also Check: Stimulus Check 1 And 2

I Think I Got Paid Too Much Will I Have To Return My Stimulus Payment

During the first and second rounds of payment, if your stimulus amount was too much based on your income, you did not have to pay back the difference. That is likely to be the case for this round of payments as well.

If you received a payment in errorfor instance, for someone who died in 2020the IRS offers instructions for returning a payment.

You May Like: Do We Get Another Stimulus Check This Month

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Also Check: How To Get The 1400 Stimulus Check

Americans Who Did Not Previously Qualify For The Third Stimulus Check May Be Able To Claim The Direct Payment In The Tax Return They File This Year

Americans who missed out on a third-stimulus-check payment in 2021 may be able to claim the money in their tax return this year.

Sent out as part of President Bidens $1.9tn American Rescue Plan, which was signed into law in March 2021, the third stimulus check saw eligible US taxpayers receive up to $1,400 each, with households getting an additional $1,400 per dependent.

Same initial income thresholds as previous stimulus checks – but lower phase-out limit

As was also the case with the first and second stimulus checks – which were approved in April and December 2020, respectively – the full amount went to individuals on up to $75,000 a year and joint filers with an annual income under $150,000.

However, fewer higher earners were eligible for a smaller payment: individuals with an annual income over $80,000 and joint filers earning anything above a combined $160,000 a year were left out.

This compares to a final phase-out limit of $99,000/$198,000 in the first round of stimulus checks, and $87,000/$174,000 in the second.

Over 170 million third stimulus checks sent out

As of July 2021, the Internal Revenue Service said it had distributed over 171 third-stimulus-check payments totaling more than $400 billion – and these figures are now likely to rise during tax season in 2022.

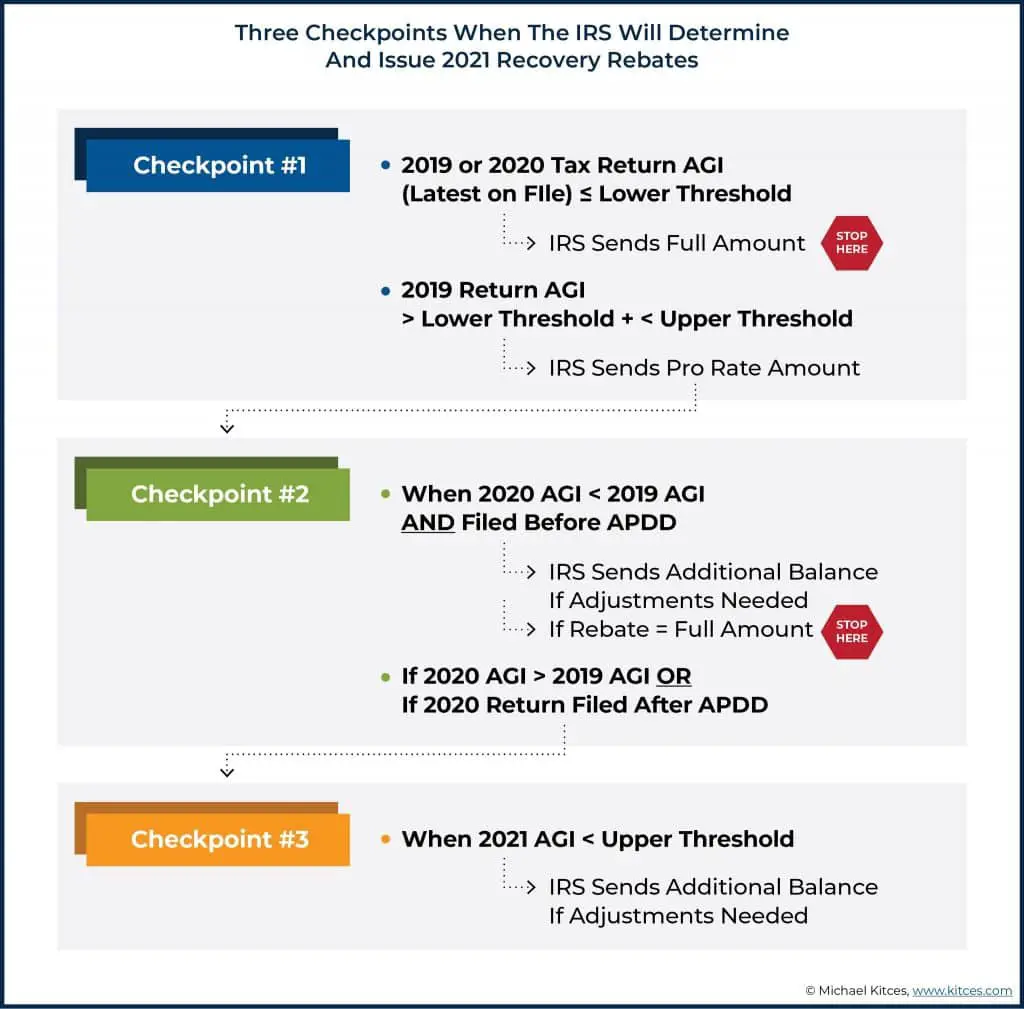

Which Tax Return Is Used For My Third Stimulus Check

The IRS uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check. The new stimulus plan targets lower income ranges to exclude higher-earning taxpayers from getting a payment.

As we pointed out before, individuals making under $75,000 get the maximum stimulus payment of $1,400 . But payments are capped at $80,000 for single filers and $160,000 for couples. So filing at the beginning of the tax season with a lower income may help you qualify for a bigger check. But, if your income went up in tax year 2020, then you may want to delay filing so that eligibility is determined by your lower 2019 income.

You might also want to file early if the size of your family increased in 2020. The new stimulus plan includes a child tax credit that pays up to $3,600 for each qualifying child under 6 years old, and $3,000 for every child between ages 6 and 17. This means that if you became a parent during the tax year, you could get an additional payment by claiming your child as a dependent earlier.

SmartAssets child tax credit calculator will help you figure out how much you could get for each child.

You can use SmartAssets tax return calculator to figure out your 2021 tax refund or tax bill.

You May Like: Is Economic Impact Payment Same As Stimulus

Is There A Stimulus Check For 2022

In addition to the pandemic relief stimulus payments and the 2021 child tax credit, you may have heard about so called 2022 stimulus checks. Those 2022 stimulus checks are essentially rebates coming from various statesnot pandemic stimulus payments from the federal government.

Why are states sending rebate checks? Because of pandemic relief funding, many states have extra cash on hand, and so are sending rebate checks to their residents in 2022. Some states like California, and Massachusetts are still sending those payments. But several other states will send rebates or have already sent them.

The Irs Classifies Me As An Older Adult What Should I Know

Many older adults, including retirees over age 65, received a first stimulus check under the CARES Act and were eligible for the second one — and are for the third as well. For older adults and retired people, factors like your tax filings, your AGI, your pension and if you’re part of the SSI or SSDI program will affect whether you receive a stimulus payment.

The third stimulus check makes older adult dependents eligible to receive more money on behalf of the household. Here’s how to determine if you qualify for your own stimulus check or count as a dependent.

How much stimulus money you could get depends on who you are.

Also Check: South Carolina Stimulus Check 2021

How The Third Stimulus Check Became Law

The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

Biden said at the signing of the bill: this historic legislation is about rebuilding the backbone of this country and giving people in this nation working people and middle-class folks, the people who built the country a fighting chance. Thats what the essence of it is.

House Democrats had moved the $1.9 trillion COVID-19 relief bill to Bidens desk with a 220-211 vote just one day earlier. But progressives in the party expressed concern over Senate amendments that excluded higher-earning taxpayers from getting a stimulus payment.

Biden agreed to narrow income level requirements as a concession to moderate Senate Democrats who wanted to cap payments for individual taxpayers at $80,000 and joint tax filers at $160,000.

The Senate bill narrowly passed with a 50-49 vote on March 6 after an overnight marathon of disputed amendments and negotiations. A 50-50 tie between both parties was avoided because Senator Dan Sullivan could not vote after returning to Alaska for a family funeral.

How Much Does The Third Stimulus Check Pay

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by Congress in December 2020, and adding up to $2,000.

Congress passed the coronavirus relief plan with targeted income limits for maximum stimulus payments to individual taxpayers earning under $75,000 and joint filers making up to $150,000. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples.

Eligibility for the third stimulus checks is based on your tax filing status. For more information on who qualifies for a third stimulus check, our tables below will help you calculate different payment options.

Recommended Reading: How Many Stimulus Checks Did We Receive

Maine: $850 Direct Relief Payments

Gov. Janet Mills signed a supplemental budget on April 20 to authorize direct relief payments of $850 for Maine taxpayers.

Full-time residents with a federal adjusted gross income of less than $100,000 are eligible. Couples filing jointly will receive one relief check per taxpayer for a total of $1,700.

Taxpayers are eligible for the payment regardless of whether they owe income tax to the state.

Residents who did not file a state tax return for 2021 can file through Oct. 31 to claim their payment.

The one-time payments, which are being funded by the states surplus, started rolling out via mail in June to the address on your 2021 Maine tax return.

The supplemental budget also includes an increased benefit for Maines earned income tax credit recipients.

How To Claim Your Recovery Rebate Credit

A reminder: The IRS will not automatically calculate any Recovery Rebate Credit amount for which you may be entitled when you file.

“Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money,” the IRS said in its fact sheet.

To see if you are eligible for a payment, you can find more information on the Recovery Rebate Credit on the agency’s website.

If you have no income or up to $73,000 in income, you can file your federal tax return for free using the IRS’ Free File program.

For people who already received their third stimulus checks, there is no need to include information on those payments in their 2021 returns, according to the IRS.

If you are still missing a first or second stimulus check that was sent by the government in 2020, you will have to file a 2020 tax return rather than claim that money on your 2021 return, according to the IRS.

You May Like: Do You Pay Tax On Stimulus Check

Another State With Generous Stimulus Checks Is Colorado

Colorado state residents who filed their 2021 taxes on time most likely already received payments of $750 for singles and $1,500 for joint filers by Sept. 30. However, those who filed an extension by the Oct. 17 deadline may still be awaiting their payment, which is slated to arrive no later than Jan. 31, 2023.

It isnt only blue states that have been sending out stimulus checks.

Idaho approved 2022 Special Session rebates that will be paid out by the end of March 2023. The amount of the rebate is the greater of 10% of a taxpayers 2020 income tax liability, $300 for single filers or $600 for joint filers, Yahoo said. “The state Tax Commission anticipates sending about 800,000 payments totaling as much as $500 million.

How Will The Government Send You The Stimulus Check

The IRS will use the direct deposit information you provided from the taxes youve filed for 2019 or 2020.

You may be able to use the IRS Non-Filers tool to provide your information like the first round. But so far, the IRS has not announced whether that tool will be available if this stimulus bill is passed.

The tool was for eligible U.S. citizens or permanent residents who had gross income below $12,200 for 2019 and werent required to file a 2019 federal tax return.

If you have no direct deposit information on file or if the account provided is now closed, the IRS will mail you a check or pre-paid debit card instead.

If you received no payment and you think youre eligible or you got the wrong amount, youll be able to claim it on your 2021 tax return.

Also Check: When Was The Last Stimulus Check In 2021

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Irs Announces $1400 Stimulus Checks Going Out To Millions

The IRS has sent out letters alerting nine million households that they are eligible for $1,400 stimulus checks for individuals and $2,800 checks to couples.

Eligible recipients mostly include taxpayers who don’t need to file federal income tax returns because they don’t earn enough to warrant one, and because of that, didn’t get one or more of the original stimulus checks. Those recipients include single filers making less than $12,550 , and couples making less than $25,100 . This mostly affects those receiving Social Security but many others might be eligible as well.

Those who are could see a nice amount of direct payments. Along with the stimulus checks for individuals and couples, there is also another $1,400 for dependents, plus other benefits like the Child Tax Credit, which is worth up to $3,600 per child, child and dependent care credits up to $8,000, and the Earned Income Tax Credit, which is worth up to $7,000.

In a press release, IRS Commissioner Chuck Rettig explained, “We don’t want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take.” He added, “We encourage people who haven’t filed a tax return yet for 2021 to review these options. Even if they aren’t required to file a tax return, they may still qualify for several important credits.”

Meanwhile, if you have gotten your federal payments, you might still be eligible for more direct payments from your state.

You May Like: How To Apply For Homeowners Stimulus Check