How Do I Know How Much Money I Got From Stimulus Checks In 2020

While many people qualified for the full $1,200 and $600 stimulus checks, for others, the amounts might be a little different. And if youre wondering exactly how much you got in stimulus payments in 2020, Phillips points to a few places to look.

He says the best place to start is by looking at the IRS notice 1444-A and 1444-B . If you dont have that, you can look at your bank records and get a pretty good idea, or you can log in or create an IRS account, and that information will be there, says Phillips.

Where Can People Get More Information

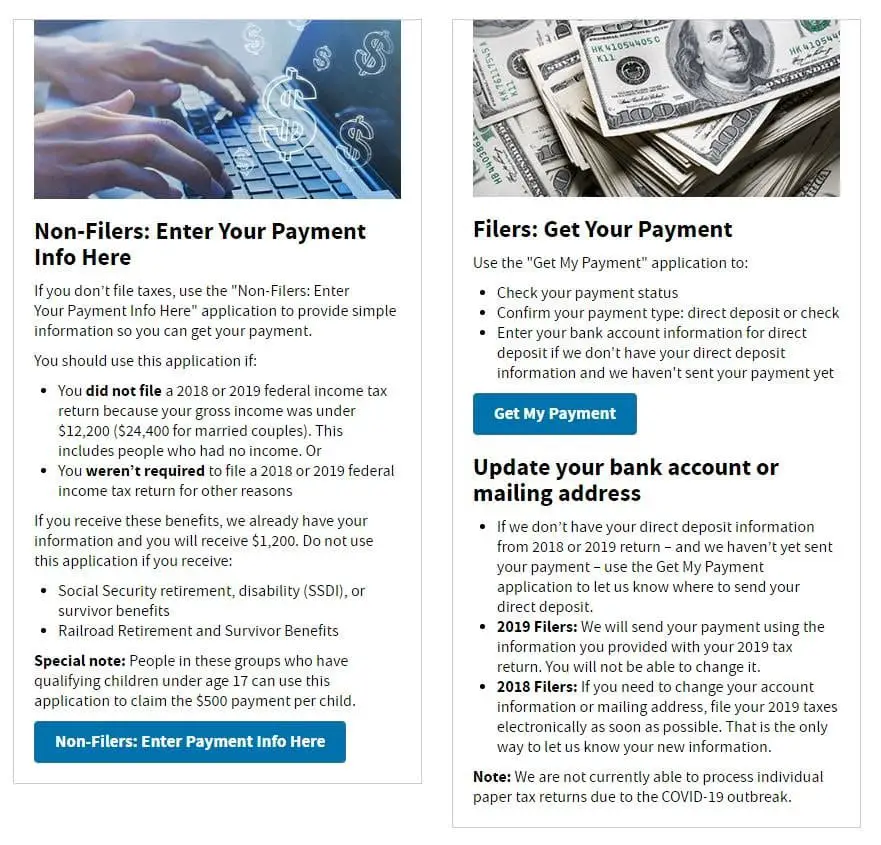

Taxpayers who are required to file a tax return, can go to IRS Free File to file electronically. If they aren’t required to file, they should go to the Non-Filers: Enter Payment Info Here tool and submit their information to receive an Economic Impact Payment.

For the complete lists of FAQs, visit the Economic Impact Payment and the Get My Payment tool pages on IRS.gov. The IRS updates these FAQs regularly.

The IRS encourages people to share this information with family and friends.

How Will Stimulus Payments Affect Taxes

As part of economic legislation aimed at mitigating the impact of the coronavirus, millions of individuals and families were eligible to receive stimulus payments, also referred to as economic impact payments by the Internal Revenue Service. The federal government sent out two stimulus payments in 2020, and one in 2021. Many people wonder if those payments are taxable or otherwise affect their taxes.

Recommended Reading: Where’s My Second And Third Stimulus Check

What Is A Refundable Tax Credit

A deduction on your tax return is a good thing, but a refundable tax credit is even better. A typical tax credit can reduce your taxes owed to zero, but it cant create a tax refund. A refundable tax credit can.

For instance, suppose you owed the IRS $800 in taxes, and you had a refundable tax credit of $1,200. The IRS would give you a tax refund check of $400.

The beauty of the refundable tax credit is that you get the benefits of the money from the credit this year rather than having to wait until 2021 to use the credit on your 2020 tax return.

So, theres no need to worry about setting aside a portion of your stimulus check to pay taxes.

What If I Wait Until The April 15 Tax Due Date Or File For An Extension

April 15 is the due date for all 2020 tax returns, but filing your taxes sooner will not only potentially speed up delivery of any tax refund you might collect but also position you to get any missing stimulus money weeks or even months faster. We made a handy comparison chart here that looks at the timing.

Filing for a tax extension wont postpone your having to pay taxes you may owe. Those will still be due by April 15 otherwise, you accrue interest on the amount, which youll eventually have to pay on top of your income taxes. And you of course are delaying receiving your stimulus payment.

Recommended Reading: Will Social Security Recipients Get The $1400 Stimulus Check

You May Like: What If I Never Got Any Stimulus Checks

Am I Allowed To Skip A Required Minimum Distribution For 2021

Under the CARES Act, required minimum distributions for 2020 were waived. However, RMD is back on for 2021.

If you dont take a RMD you might get a penalty of 50% of the shortfall, on top of whatever taxes are due on the original amount.

RMDs are based on the balance in your traditional IRAs, 401s and other retirement-savings plans as of Dec. 31, 2020, and an IRS life-expectancy factor based on your age.

The SECURE Act, passed in late 2019, raised the age to start taking the required withdrawals to 72. For 2022, the IRS released new tables for all three life expectancy tables affecting RMD.

Josh Rivera

Follow Josh on Twitter

Coronavirus Aid Relief And Economic Security Act

As Coronavirus continues to disrupt the U.S. economy, many have turned to the federal government for hope. To help provide relief in these unprecedented times, the Coronavirus Aid, Relief and Economic Security Act a $2 trillion stimulus package to help individuals, families and businesses was signed into law.

This relief takes many shapes, such as:

- Widespread stimulus legislation, including efforts such as stimulus checks, mortgage relief for those adversely impacted by the economic slowdown, student loan interest relief, and more.

- The Federal Reserve has announced actions to stabilize and backstop the economy.

But how do some of these efforts work and who will they directly impact? Lets take a look at the stimulus checks, how they work, who qualifies, how do you get one, and how your taxes will be affected.

Heres how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

The Internal Revenue Service can help you understand more about tax refund offsets.

Also Check: Do You Have To Pay Taxes On Stimulus Checks 2021

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Is My Stimulus Payment Taxable And Other Tax Questions

With tax filing season about to begin, heres what you need to know.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

The tax filing season opens on Friday,and with it comes a question different from other tax years: How will the stimulus payments and unemployment income affect taxes?

Because of the pandemic and the governments relief program, millions of people received both types of payments but they are treated differently for tax purposes.

The good news is that you dont have to pay income tax on the stimulus checks, also known as economic impact payments.

The federal government issued two rounds of payments in 2020 the first starting in early April and the second in late December. If you got the full amount in both rounds, and your income and family circumstances havent changed, youre all set. You dont need to include information about the payments on your 2020 tax return, the Internal Revenue Service says.

If they dont owe you any more money, you dont have to do anything, said Kathy Pickering, chief tax officer at the tax preparation company H& R Block.

A refresher: The first payment was for up to $1,200 per person, plus $500 for each child. The second was up to $600 per person, plus $600 for each child.

You should receive a form, 1099-G, detailing your unemployment income and any taxes that were withheld, which you enter on your tax return.

Don’t Miss: How To Cash My Stimulus Check Without Id

Should I Hold Off On Filing My Tax Return

It likely wont make a difference in the longer term other than to update dependent or payment data, but the IRS will only use your 2020 tax return data to determine eligibility for this round of stimulus checks if they have processed your return . If your 2020 return has not been filed and processing, they will use 2019 tax data for payment.

If your 2020 return is filed and/or processed after the IRS sends you a third stimulus check, but before July 15, 2021 the IRS would send you a second payment or require a repayment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return.

You May Like: Give Me The Latest On The Stimulus

Do You Have To Pay Taxes On Your Coronavirus Stimulus Check

Money, Home and Living Reporter, HuffPost

Last April, the government sent the first round of direct payments to Americans as part of the larger coronavirus stimulus package. In January, a second round of stimulus checks began going out, and Congress is currently working out the details of a third payment.

While the money is much needed by those who lost income as a result of the pandemic, many are wondering whether theres a catch. Will the money be taxed later? Is it simply a tax refund advance that will need to be paid back next year?

If youre confused about how stimulus payments affect your taxes, youre not the only one. Heres what you need to know.

You May Like: Are The Stimulus Checks For 2021 Taxable

Some Taxpayers Will Receive The Rebate By Direct Deposit And Some Will Receive A Paper Check

If you received a refund by direct deposit this year, youll likely receive your rebate by direct deposit in the same bank account, with the description VA DEPT TAXATION VATXREBATE. All other eligible taxpayers will receive their rebate by paper check in the mail.

- If you’ve moved in the last year and have a current forwarding order with the USPS, then your check will be forwarded to your new address.

- Were not able to update your bank account information. If the bank account where you received your Virginia refund by direct deposit is closed, youll receive your rebate by paper check in the mail.

Do I Have To File My 2020 Taxes To Get The $1400 Stimulus Check

Democratic leaders are actively trying to pass an economic aid bill including a $1,400 stimulus check. Drafts indicate the IRS would use the most recent tax filing you submitted, either 2019 or 2020.

So no, its unlikely youd have to file your 2020 taxes before the checks are sent if you qualified for previous rounds.

You May Like: I Didn’t Get The 1400 Stimulus Check

Why Are Federal Stimulus Checks A Tax Credit

Normally, you claim tax credits with your federal tax returncome tax time.

If you qualify for the credit, the money will reduce yourtax liability or will be paid to you if it is a refundable credit

But, this is a different type of tax credit. The U.S.government wants to stimulate the American economy now, so they aredistributing the payments now, instead of when you file your 2020 taxes nextyear.

When you file your 2020 tax return, youll receive anyadditional credit youre due. For example, if you had a child in 2020, theadditional $500 for qualifying children wont be included in your advance butyoull be able to receive it when you file your 2020 return tax year.

On the other hand, in most instances, if you received an advance that is more than your credit you wont have to repay the excess.

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

You May Like: Do I Pay Taxes On Social Security Income

Don’t Miss: Do We Supposed To Get Another Stimulus Check

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

I Used The Irs 2020 Or 2021 Non

The IRS has issued all first, second, and third stimulus checks. If you have not received your first,second, or third stimulus check, you will have to claim your stimulus checks asthe Recovery Rebate Credit. You will need to file a 2020 tax return to claim the first or second stimulus checks and file a 2021 tax returnto claim the third stimulus check. .

You May Like: Will There Be Another Stimulus Check In 2020 To

Also Check: Senior Citizens 4th Stimulus Check

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Key Details On Income Dependent Eligibility For New Round Of Relief Payments In Newly Enacted Relief Package

WASHINGTONAnother round of stimulus checks is heading to bank accounts now that President Biden has signed the coronavirus relief legislation into law, and money is starting to reach people this weekend.

When are the payments coming?

Officials from the Treasury Department and the Internal Revenue Service said the government sent the first batch of direct deposits on Friday. Some households may see the money over the weekend. The official payment date is March 17, and it may take that long for the payments to clear at some banks. Subsequent batches of direct deposits will happen over the coming weeks.

Recommended Reading: Amount Of All Stimulus Checks

Recommended Reading: How To Get Government Stimulus Check

What If Dont Normally File A Tax Return

The IRS said this third round of stimulus will be based on tax year 2019 or 2020 information, or information obtained by the Social Security Administration and Veterans Affairs Administration. If you are a non-filer who also does not receive a SSA or VA benefit, then use the Non-filer Sign-up tool, described below.

The IRS recently launched a new Non-filer Sign-up tool on its website. Although this non-filer portal is labeled as for non-filers claiming advance payments of the child tax credit, it is also available for others, including single individuals and people experiencing homelessness. It will allow individuals to provide their information to the IRS so that they can receive any of the three Economic Impact Payments , also known as stimulus payments, that they may be missing. If an individual did not get the full amounts of the EIPs, they may use this tool if they:

- Are not required to file a 2020 tax return, didnt file a 2020 tax return, and dont plan to, and

- Want to claim the 2020 Recovery Rebate Credit and get their third EIP.

The new Non-filer Sign-up tool is for people who did not file a tax return for 2019 or 2020, and who did not use the IRS Non-filers tool last year to register for Economic Impact Payments.

Recommended Reading: How Is Capital Gains Tax Calculated On Sale Of Property