Your Financial Situation Changed From 2019 To 2020

Any changes to your financial situation in 2020 may affect your payment amount and receipt.

For most people, this will result from job or income loss due to the pandemic. If your income was higher than the phaseout thresholds in 2019, but your hours were cut or you only worked for part of 2020, you can claim the stimulus money you didnt receive using the Recovery Rebate Credit on your 2020 tax return.

If you had a baby in 2020, got married or divorced, you were previously claimed as a dependent, or you have a child who aged out of being claimed as a dependent, you may receive more after claiming the credit as well.

When youre ready to file 2020 federal taxes, an accountant or tax filing service may be helpful to clarify your exact eligibility. If you file on your own, your Form 1040 will include a Recovery Rebate Credit worksheet to help you determine the total amount youre eligible for.

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

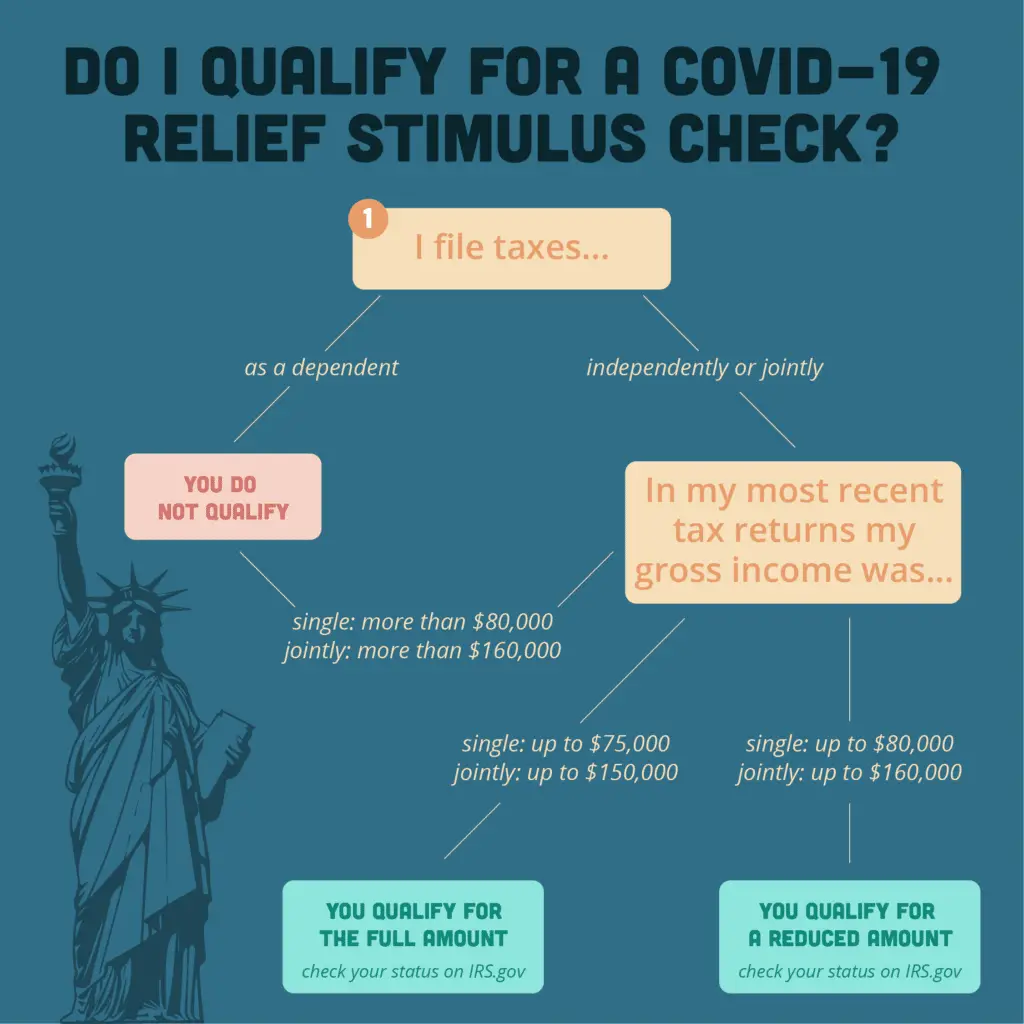

Are Adult Dependents Eligible For A Payment

No. Only dependent children who are under 17 years old are eligible for an additional $600 stimulus payment, which goes to the taxpayer who claimed them on their 2019 tax return.

Some stimulus proposals have included adult dependents, including approximately five million 17- and 18-year-olds, four million college students aged 19-23 and five million adult dependents like elderly parents. Most recently, Bidens American Rescue Plan includes $1,400 payments for adult dependents.

Recommended Reading: How Do I Change My Direct Deposit For Stimulus Check

Don’t Miss: Update On The Stimulus Package

If I Owe Someone Money Can They Take My Stimulus Checks

Maybe. Anyone filing a 2020 or 2021 income tax return to claim stimulus checks will receive the money as a tax refund. Stimulus checks should not be kept by the IRS for back tax debt.

If you owe a debt to a different federal or state agency your tax refund could be taken by that agency before you get it. This is sometimes called a garnishment or offset

If you have a question about a garnishment or offset for a student loan debt, a debt related to public benefits , or a federal tax debt you can .

What should I do if I didnt get the full amount I am owed or if I have another problem with my Stimulus Checks?

If you didnt get your stimulus checks, even after filing your 2020 and 2021 tax returns, or if you have another problem with your Stimulus Checks you can . We may be able to help.

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

You May Like: New Stimulus Check 2022 Update

Are Some People Seeing That Money After Glitches

The IRS noted on Friday that some recipients who used refund anticipation loans or similar products may have had their payment directed to the temporary bank account established when their 2019 tax return was filed.

“The IRS and tax industry partners are taking immediate steps to redirect stimulus payments to the correct account for those affected. The IRS anticipates many additional taxpayers will receive payments following this effort.”

The effort to fix this problem was ongoing Friday, so there continues to be much confusion for many taxpayers. And you might not always see the correct answer by using the “Get My Payment” tool at IRS.gov.

“For those taxpayers who checked Get My Payment and received a response indicating a direct deposit was to be sent to an account they do not recognize, the IRS advises them to continue to monitor their bank accounts for deposits,” the IRS said Friday.

“The IRS emphasizes that the information taxpayers see in the Get My Payment tool, including account numbers and potential deposit dates, may not display an accurate account number as we continue to work through updates.”

On the plus side, several taxpayers who had issues in early January told me later this week that they did end up receiving a direct deposit of their second stimulus payment after all.

Tax preparation firms set up temporary bank accounts so that the refunds can be sent to those accounts, the fees can be deducted and then the client receives the remaining refund cash.

How Can I Check The Status Of My Stimulus Check

Follow these steps to check the status of your stimulus money:

2. Provide the following information:

-

Social security number or individual tax ID number

-

Your date of birth

-

Your street address

-

Note: if you recently moved, use the same information the IRS would have on file from your last tax return

Your 5 digit zip code

3. Hit the continue button for an update on your status

Recommended Reading: Gas Stimulus Checks 2022 Ohio

Can I Still Get A Stimulus Check

If you think youre eligible for a COVID stimulus payment or the 2021 child tax credit, and didnt already receive those funds, you can file a simple tax return by visiting ChildTaxCredit.gov.

But youll need to move quickly. Thats because if youre not required to file a tax return, this years deadline to file a simplified return is November 15. If you are required to file, but missed the April 18 filing deadline, you have until on ChildTaxCredit.gov and see if youre eligible to receive a stimulus payment or child tax credit.

However, if you dont owe taxes to the IRS, the IRS has said that you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. But because that can get confusing, its probably best to file for the 2021 tax year as soon as you can.

According to the Government Accountability Office, groups that were most likely to have missed out on pandemic relief stimulus payments or the child tax credit , were people who never filed a tax return or who filed for the first time during the pandemic. The federal government also had difficulty getting stimulus checks and child tax credits to people without bank accounts or reliable internet access, and people who were experiencing homelessness in 2020 and 2021.

My Child Was 16 In 2019 But If I Claim Him In My 2020 Return He Wont Qualify For The Dependent Stimulus

Note that when you file your 2020 tax return, the age criteria for the dependent stimulus check still applies. Some people are finding that they would have been eligible for first and/or second dependent stimulus because it allowed 2018 OR 2019 tax information. to be used for the dependents age . However if they claim the missing dependent stimulus as a recovery rebate credit via their tax return they will have to use the 2020 age for this and many kids who turned 17 in 2020 would no longer be eligible to get this payment.

Also Check: Stimulus Check For Ssi Recipients 2022

What Is The Recovery Rebate Credit

Taxpayers will need to file a 2020 federal income tax return to claim the Recovery Rebate Credit if they didn’t get the money or they received less money than they’re eligible to get, such as if a child’s stimulus wasn’t included in the payout.

The Recovery Rebate Credit will reduce how much they owe on their 2020 income tax return or boost their tax refund sometime in March or April or later.

The Recovery Rebate Credit is listed on Line 30 of the 1040 Form for the 2020 tax year.

The second payments are up to $600 for individuals who qualify and up to $1,200 for a married couple filing a joint return with no children. An extra $600 is added to the latest payout, for example, for each qualifying child ages 16 and younger.

If you received less money or didn’t get that check or direct deposit before you file a tax return, you’d need to turn to Line 30 on the 1040 to fix the trouble spots and help you claim what you are owed.

Stimulus check: Here are 6 reasons why you might not have your stimulus check yet

The good news for some is that if you already received more stimulus money than you would have qualified for based on your 2020 situation, then you don’t have to repay the difference, Luscombe said.

Request A Payment Trace

After you receive your stimulus payment, you should also get a notice from the IRS in the mail which says the amount you were paid. If you receive this notice, but havent gotten your stimulus payment, its possible that it was lost or stolen.

In this case, you can start a trace by contacting the IRS. If the check wasnt cashed, youll receive a replacement, and if it was cashed, you will have to file a claim with the Bureau of the Fiscal Service youll receive instructions on how to do this. Keep in mind that you need to wait until a certain amount of time has passed to start a trace, like four weeks if the payment was mailed, or six weeks if it was mailed but you have a forwarding address on file with your post office.

Read Also: Irs Stimulus Payments Phone Number

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

Former first and second stimulus check rules for military filers:

Don’t Miss: How Many Stimulus Checks Do We Get

It Went To The Wrong Account

The IRS is distributing stimulus checks based on information you provided on any one of the following: your 2019 tax return, the Get My Payment page, the Non-Filers tool or from a federal agency that gives you benefits. Unfortunately, you can’t change it now.

What to do: For the first round of stimulus checks, the IRS said banks would reject deposits sent to closed accounts, and it would mail the payments instead. You can also plan to claim the Recovery Rebate Credit on your 2020 tax return. As a reminder, that’s the one you’ll file this spring.

Check The Get My Payment Tool

The IRS website has been uploading data for your third stimulus payment into a tool on its website called Get My Payment. If your information has been updated, you’ll be able to see the date you can expect to receive your stimulus payment, or the date it was deposited or mailed. You should also be able to see whether your money was direct deposited or whether you’ll be receiving the payment by mail.

Many people are seeing a message that says either the IRS doesn’t have enough information yet or you aren’t eligible for the payment. This message doesn’t necessarily mean you aren’t eligible for the payment. This information may be updated this coming weekend.

Here are some of the issues people are seeing, either with their actual deposit or with the Get My Payment tool.

Don’t Miss: Where’s My Stimulus Payments

Stimulus Checks Could Be Seized To Cover Past Due Debt

If you owe child support or other debts, your first check was seized to cover those debts. The third check is subject to being taken by private debt collectors, but not the state or federal government. The same goes for the second payment, too, if you’re claiming missing money in a recovery rebate credit. You may receive a notice from the Bureau of the Fiscal Service or your bank if either of these scenarios happens.

In the case of the third check, we recommend calling your bank to confirm the garnishment request from creditors and ask for details about how long you have to file a request with a local court to stop the garnishment. If you think money has already been mistakenly seized from the first two checks, you can file a recovery rebate credit as part of your 2020 tax return — but only if you filed a tax extension.

You can track down your stimulus payment without picking up the phone.

Why Can’t I Claim My Second Stimulus Check Now

With the first round of stimulus checks, qualified individuals who were waiting for their payment could request their money right away through an IRS portal. One commonly asked question is why this isn’t the case this time around.

With the first stimulus check, the Treasury Department and IRS sent payments automatically to taxpayers for whom bank account information was on file and created an online portal that allowed everyone else to register for and receive the payment. People could still claim and receive their initial $1,200 stimulus check months after most of the payments had been given out.

There’s a good reason the government decided to do this. At the time the first stimulus check was granted as part of the CARES Act, the majority of Americans had already filed their tax returns, so there wasn’t any other mechanism in place to get deserving U.S. residents their money.

With the second stimulus check, it just so happens that 2020 tax season is right around the corner. In fact, the IRS recently announced that tax season will start on Feb. 12, so the best course of action if you’re entitled to a second stimulus payment but didn’t get it would be to file your 2020 tax return as soon as possible on or after that date — making sure to claim your Recovery Rebate Credit, of course.

You May Like: How Much Were The Stimulus Checks In 2021

File For A Recovery Rebate Credit On Your Tax Return To Claim Missing Money Here’s How

If you think the IRS owes you a full or partial stimulus check for any reason , you have one more chance this year to claim missing stimulus check money by filing a Recovery Rebate Credit as part of your 2020 taxes. It may be that your check total doesn’t match your estimated total for the first stimulus payment or the second check , or maybe there was a delivery error, or an accidental garnishment, or a dependent was left out, like a new baby not represented on last year’s taxes.

To start the Recovery Rebate Credit claim process, first confirm your payment status online through the IRS. If you see a confusing message or a possible error, you may be a candidate for a rebate or a payment trace.

You need to file for the credit when you submit your federal tax returns this year. The IRS started processing 2020 tax returns on , and federal tax returns will be due May 17 due to an extension the IRS approved.

File for your missing money from the first and/or second stimulus on the 2020 Form 1040 or Form 1040-SR. The tax return instructions include a worksheet to figure out the amount of any Recovery Rebate Credit for which you’re eligible, according to the IRS. However, this worksheet requires you to know the amounts of your stimulus payments. Again, CNET’s stimulus check calculators for the second and first payments can provide an estimate.