I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

What Do I Do With The Stimulus Check Letter

If you are using a professional tax preparer, give them Letter 6475 along with all of your other applicable tax documents. If you’re preparing your own return, use the amount shown in Letter 6475 in the Recovery Rebate Worksheet to determine if any credit applies. Then enter that credit on Line 30 of IRS Form 40.

The Recovery Rebate Worksheet is included in the instructions for IRS Form 1040 and calculated automatically by tax preparation software.

“Having the wrong amount on your return could trigger a manual review,” according to the H& R Block website, which could delay a refund for weeks.

Stimulus Payments: Find Tax Info You Need To See If You Get More

Use Letter 6475 or the IRS website to report your 2021 stimulus payments in order to qualify for more.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Your chance to file a 2021 tax return on time is running out — tax deadline day is Monday, April 18. It’s also your final chance to claim any additional stimulus payments you might be eligible for.

The American Rescue Plan provided third stimulus check payments last year of up to $1,400 for each adult and child. If you didn’t receive the full amount of your eligible money you’ll need to claim the recovery rebate credit on your 2021 federal tax return.

Also Check: New Jersey Stimulus Check 2022

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Is The Third Stimulus Check Considered Income

No. The Economic Impact Payment is not considered to be taxable income. “And you shouldn’t report it as income on your 2021 federal income tax return,” according to Letter 6475.

You also do not need to repay any of the third stimulus payment money that you received. That’s true even if you’d qualify for a smaller payment based on what you’d calculate for your 2021 Recovery Rebate Credit.

CHILD TAX CREDITS:Don’t throw away this document. Why IRS Letter 6419 is critical to filing your 2021 taxes.

Also Check: Telephone Number For Stimulus Check

Filed A Tax Return But Still Didn’t Receive Your Money Here’s What Else It Could Be

If you filed your taxes this year but still haven’t received your stimulus check or child tax credit money that you’re eligible for, there are some other things that could be holding it up.

- You don’t have a bank account set up.

- It was your first time filing.

- You have a mixed-status household.

- You haven’t updated your address with the IRS or USPS.

- You’re experiencing homelessness.

- You have limited or no internet access.

If none of these reasons apply to you, it may be time to file a payment trace with the IRS either by calling 800-919-9835 or mailing in Form 3911.

I Didnt Receive My Stimulus Checks Last Year Or They Were Less Than I Was Expecting Can I Still Get One

If you were eligible for a stimulus payment last year but did not receive it , you might be eligible to get those funds via the Recovery Rebate Credit.

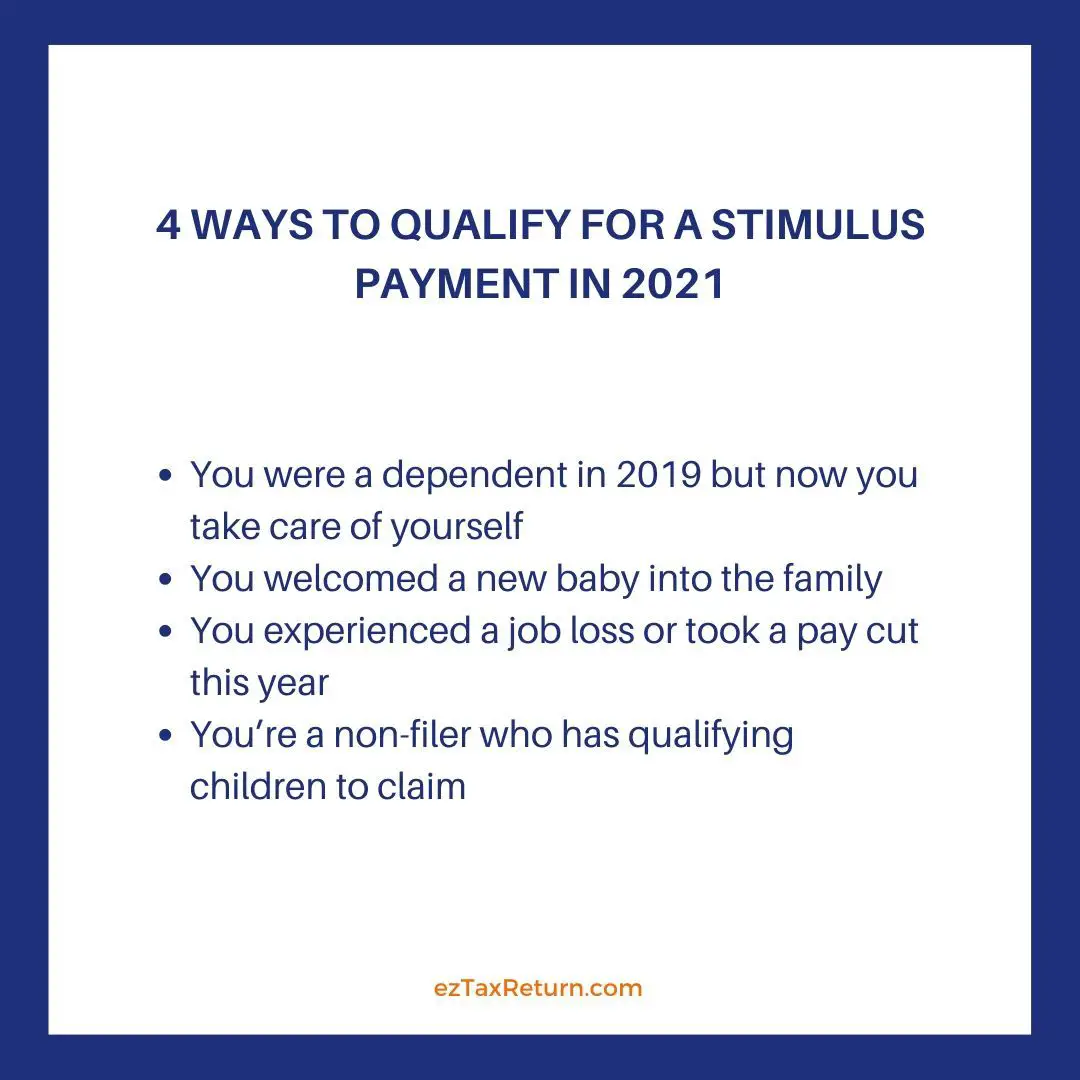

Phillips says that since the ultimate eligibility for the Recovery Rebate Credit is based upon the items on your 2020 tax return, and the IRS used 2019 tax returns to determine eligibility, they may have not had the information to determine you were eligible for an additional amount. The good news is when you file your 2020 tax returns, youll be able to get those amounts either through a bigger refund or reducing your balance due, he says.

Here are a few reasons you may be owed a check, or more money than you received: You had a child in 2020 you had a big change in income during 2020 or you became a new independent filer in 2020 who meets the qualifications.

If you believe youre eligible, Phillips says you can complete the Recovery Rebate Credit Worksheet found in the Form 1040 instructions, which looks at your income, the amount of payments you got as an advance, and then determine if you should be eligible for any more, he notes. Any extra stimulus money you qualify for should be reported on Line 30 of your tax return.

Per the IRS, you have to file a 2020 tax return to claim the Recovery Rebate Credit, even if dont usually file a tax return. The rebate credit is based on your 2020 information given to the IRS, instead of the 2018 or 2019 tax returns that were used for the prior two stimulus checks.

Read Also: I Havent Received My Stimulus Check

What Does Irs Letter 6475 Look Like

These letters started going out in late January and say, Your Third Economic Impact Payment in bold lettering at the top. You can also find the terms “Letter 6475” on the bottom at the very righthand corner.

Earlier in the program, the IRS sent out a “Notice 1444-C” that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, you might have more than one notice. Letter 6475 gives you a total dollar amount.

How Much The 2021 Tax Credits Are Worth

The American Rescue Plan Act passed by Congress in 2021 temporarily made enhanced tax credits available to millions of Americans.

That included a Recovery Rebate Credit that provided third stimulus checks of $1,400 per person.

It also made existing tax credits the child tax and earned income tax credits more generous.

The child tax credit included up to $3,600 for children under age 6 and $3,000 per child ages 6 through 17. Up to half of those amounts were paid in advance through monthly child tax credit payments. However, to claim the remaining sums or the total amount if a family did not receive advance payments they need to file a federal 2021 income tax return.

The earned income tax credit, which applies to low- and middle-income workers, was also enhanced for that tax year. Workers with no children may qualify for up to $1,502, which increases to as much as $6,728 for filers with three or more children. Because eligibility was expanded for workers without children and younger and older age thresholds, more workers qualify for the credit in the 2021 tax year.

Recommended Reading: What Does The Stimulus Debit Card Look Like

What If I Dont Need To File A Tax Return And Didnt Get My Stimulus Check

If you are a nonfiler and would otherwise not be required to file a tax return, according to the IRS, you will need to file a Form 1040 or Form 1040-SR to claim stimulus payments if you are eligible in the form of a Recovery Rebate Credit.

No matter what your situation or how you want to file, TurboTax has you covered. With TurboTax you can do your taxes yourself, get help from an expert along the way or hand them off from start to finish to a dedicated tax expert.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Read Also: What Month Was The Third Stimulus Check

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Is Your $1400 Stimulus Check Taxable

Many Americans have questions about the stimulus checks that are being distributed as part of the Recovery Act.

The $1,400 checks that are currently being distributed as part of the American Rescue Plan, which passed Congress and was signed by President Biden in March, have been rolling out to Americans over the course of the last month.

With April 15 coming upeven though the filing deadline has been extended to May 17many people are curious how getting this payment will affect their taxes.

The good news is they wont.

Per CNBC, none of the stimulus checks that have arrived in any of the three stimulus packages to pass since the start of the pandemic are taxable.

No, the payment is not income and taxpayers will not owe tax on it, the IRS said of the stimulus payments. The payment will not reduce a taxpayer’s refund or increase the amount they owe when they file their 2020 tax return next year. A payment also will not affect income for purposes of determining eligibility for federal government assistance or benefit programs.

Those who did accidentally listed their stimulus money as income for 2020 will need to get a refund.

If you accidentally listed your checks as income, you will pay more in taxes when filing your return and will eventually have to receive a refund from the IRS. Theres no guarantee the IRS will catch your mistake for you when processing your 2020 return, Mark Steber, chief tax information officer at Jackson Hewitt, told CNBC.

Image: Reuters

You May Like: Stimulus Checks Direct Deposit Date

What Is The Child Tax Credit

The enhanced Child Tax Credit increased this benefit as high as $3,600 a child in 2021, up from its normal amount of $2,000 per child. The tax credit is aimed at helping parents pay for the cost of raising children.

The IRS sent monthly checks to parents with eligible children for the last six months of 2021, which represented half of the annual credit. The IRS said that families can claim the other half of the credit now even if they received monthly checks in the second half of 2021.

First Round Of Cares Act Stimulus Checks: What Expats Should Know

Q. What did the CARES Act 2020 Coronavirus stimulus check mean for U.S. expats?

A. The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance.

It was part of the CARES Act Coronavirus stimulus package, which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. In it are a variety of benefits for both individuals and corporations to ease the financial burden of the shutdowns and shelter-in-place orders. For the average American, the main benefits are cash payments and a variety of other debt relief options. The amount each taxpayer got depends on a variety of factors.

Q. Did I qualify for a CARES Act stimulus check if I live overseas?

A. Yes, expats qualified for the CARES Act stimulus checks. You qualified if you fell within the income threshold, had a social security number, and filed taxes even if you lived overseas. If you didnt get it, you can still apply for it retroactively as a tax credit on your 2020 tax return.

Q. What is the Recovery Rebate Credit?

A. If you didnt get the full amount you were owed, you may be able to apply for the Recovery Rebate Credit. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Q. How much was the CARES Act stimulus check for?

Q. Did I have to pay back the amount I got?

A. No

Also Check: Date Of Stimulus Check 2021

Stimulus Checks Are Tax Free

More than 160 million Americans received a stimulus payment worth up to $1,200, or double for couples, last year. A second round of payments began going out in January, worth up to $600 per individual, including children younger than 17.

The amounts are calculated on a sliding scale and start phasing out for individuals with adjusted gross incomes of more than $75,000, heads of household who earn more than $112,500, and married couples filing jointly earning more than $150,000.

The money isnt taxed, because thepayments were technically an advance on a 2020 tax credit.

Will You Have To Pay Taxes On Your Stimulus Checks

In response to the economic devastation caused by the coronavirus pandemic, Congress authorized a series of stimulus payments for Americans in 2020 and 2021.

As they were sent out in the midst of global upheaval, many Americans gladly accepted them without fully understanding the ultimate ramifications. The good news is that Congress sent out the payments with no strings attached. Heres what youll need to know when you file your return for tax year 2021.

More Advice:How To Itemize Deductions Like a Tax Pro

Don’t Miss: Netspend All Access Stimulus Check 2021

How Do I Return A 2021 Stimulus Check

How should an individual return an Economic Impact Payment?

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Don’t Miss: Will We Get Any More Stimulus Checks

What If I Haven’t Gotten Last Year’s Stimulus Checks

If you haven’t gotten one or either of the stimulus checks from 2020, you’ll have to file for a Recovery Rebate Credit when you do your taxes this year in order to get the money you are owed.

The Recovery Rebate Credit is a tax credit against your 2020 income tax. The IRS explains that taxpayers who claim this credit will either see an increase in their tax refund or a decrease in the amount of the taxes they owe.

Say, hypothetically, that you have a $2,000 tax bill this year but are still owed the full $1,800 from the two 2020 stimulus checks. You will only owe $200 due to the tax credit’s offset.

Alternatively, if you expect to receive a tax refund, the total amount of your refund may be higher this year when stimulus money is factored in.

To get an idea of what to expect, refer to IRS Notice 1444 and IRS Notice 1444-B. These are the letters you should have received in the mail detailing the amount of your Economic Impact Payment.