Why Wont The Stimulus Checks Come

Although another round of direct stimulus checks is not on the agenda, Bidens priority for 2022 is to try and push through his massive $2T Build Back Better bill, which is awaiting Senate approval after it passed the House.

However, Biden will have to convince Sen. Joe Manchin to get on board with the bills provisions before it has a chance of getting passed through the Senate, and Manchin repeatedly has voiced concerns about inflation.

The bill features a massive expansion of the social safety net, including an expansion of the Child Tax Credit that was introduced as part of pandemic relief last year.

If the situation with omicron worsens in the weeks and months to come, maybe another round of direct relief might come.

All three rounds of stimulus checks were distributed at times when there was a sharp rise in COVID-19 cases.

If the omicron variant is severe enough to warrant pandemic restrictions to be reintroduced, The White House might have to reconsider the idea of sending out more direct payments to offset the loss of income for individuals and loss of revenue for businesses.

Ways To Claim The Money

GetCTC.org, which is available in English and Spanish, provides a simplified filing process with questions to prompt users to input their information. The tool allows for people to claim the $1,400 stimulus checks, child tax credit and earned income tax credit for the 2021 tax year.

“Taxes can be intimidating GetCTC has prompts built into it,” Caines said.

Notably, if you want to claim the earned income tax credit using GetCTC.org, you will have to have a W-2 demonstrating your income handy.

For people who have earned income they can show through 1099 forms or self-employment income, other filing tools may let them claim the 2021 enhanced earned income tax credit, Caines said.

IRS Free File, which will stay open until Nov. 17 for the 2021 tax year, lets people whose incomes are $73,000 or less file online. Free fillable forms are available for any income level.

Individuals and families who miss both the GetCTC.org and IRS Free File deadlines still have up to three years to file their tax returns and claim the 2021 tax credits for which they may be eligible.

People who miss this week’s deadlines may want to try to find a Volunteer Income Tax Assistance site near them that will handle prior year returns, Caines said.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Also Check: Ssdi Stimulus Checks Deposit Date

Still Living Paycheck To Paycheck

While the stimulus checks and now-expired Child Tax Credit provided direct aid to families, “most federal aid programs miss the mark, and only reach a fraction of the intended recipients,” noted Greg Nasif, political director of Humanity Forward.

He added, “They barely functioned even before the pandemic and they leave parents with a full-time job navigating bureaucratic hurdles.” In his view, providing “speedy, efficient, direct cash support” is the best option for helping struggling families.

Many people never applied for unemployment benefits because they didn’t think they were eligible, while others may have given up due to long waits and other issues.

Even those who qualified for aid didn’t always receive it. Only 4 in 10 jobless workers actually received unemployment aid, according to a from economist Eliza Forsythe.

Th Stimulus Checks Given Out To Teachers

For other states, their fourth stimulus checks are taking on a new lookas teacher bonuses! Its no secret that teachers are the unsung heroes of our communities, and theyve been put through the wringer during the pandemic. To show them the appreciation that they more than deserve, some states are giving teachers a fourth stimulus.

In Florida, teachers will be getting a $1,000 bonusalthough some of the details of who qualifies are up in the air. If youre a teacher in the Sunshine State, check with your district to see if you can get in on this.15

Georgia is extending the $1,000 bonus to both full-time teachers and administrators. Part-time teachers will still score a bonus of $500, and theres even a plan in place to give a bonus to pre-K teachers.16

Earlier in 2021, Michigan used a grant to pay bonuses of $500 to its teachers and $250 to school support staff. No word yet on whether theyll give out another bonus, though.17

Our very own Tennessee is giving full-time teachers $1,000 and part-time teachers $500 to thank them for their hard work.18

Now, nothing has happened statewide yet, but some districts in the Lone Star State are giving out their own bonuses. Districts are gifting things like 24% raises, a $500 bonus, and even a $2,000 incentive for some teachers to return to the classroom.19

You May Like: How To Fill Out 1040 Form 2020 For Stimulus Check

Why Did I Get An Extra $1400 Stimulus Check

Additional funds may be due to those whose circumstances have changed since they filed their 2019 tax returns, such as if their income dropped last year or they added an additional dependent to their family. If that is the case, the IRS will issue an additional payment once their 2020 return is processed.

A Fourth Stimulus Check Is Possible

For most Americans, it is extremely unlikely a fourth stimulus check will be provided. Here are a few key reasons why:

For all of these reasons, another check is unlikely to happen unless conditions take a dramatic turn for the worse — such as another COVID-19 variant that is vaccine resistant, easily transmitted, and more deadly.

Don’t Miss: How Do I Get My 2nd Stimulus Check

A $3600 Tax Credit This Year

Some recipients, however, decided that for whatever reason they didnt need or want the six monthly checks upfront. In that case, theyre getting the child tax credit instead as a lump-sum benefit this year.

As a reminder, for every child under the age of 6, a family could get an expanded child tax credit of as much as $3,600. Meaning, if those families decided to forgo the monthly checks? They can still get that $3,600 this year as a tax credit, never mind that the Senate has still not acted to re-up the monthly payments this year.

The same is true, by the way, if any families eligible for the lower tier of the expanded child tax credit choose a lump-sum benefit this year. They could get up to $3,000, if they, too, decided to forgo the monthly payments last year.

The Ssdi Payment Schedule For Everyone Else Depends On Their Birthday

Payments for those who haven’t been receiving SSDI money since 1997 or before follow the same schedule as Social Security. Here’s how it works:

- If your birthday falls between the first and 10th of the month, your payment will be sent out on the second Wednesday of the month.

- If your birthday falls between the 11th and 20th of the month, your payment will be sent out on the third Wednesday of the month.

- If your birthday falls between the 21st and 31st of the month, your payment will be sent out on the fourth Wednesday of the month.

Recommended Reading: How Do I Get The 3rd Stimulus Check

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Is There A Cap On The Third Stimulus Check

Theres a strict income limit for the third stimulus payment The third stimulus check comes with a $1,400-per-person maximum. To target or restrict the third check to lower- and middle-income households, the legislation includes eligibility rules that exclude individuals and families at the highest income levels.

Recommended Reading: Who Qualified For Stimulus Checks In 2021

Who Would Benefit From The $1400 Stimulus Checks

The checks will be received by any individual whos earning $75,000 or less annually, including child dependants, i.e. children under the age of 17. You can read the details on who qualifies for this round of stimulus here.

People who make more than $75,000 will still receive stimulus checks too but for reduced sums the higher a persons salary is, the lower the stimulus checks. People who earn more than $99,000 per year will not receive any stimulus.

In addition to that, the full $1.9 trillion plan also includes additional funds for small businesses hit by the pandemic and quarantine restrictions, such as an increase to unemployment benefits from $300 to $400 per week, funds for Covid-19 vaccinations and testing, as well as a mandate to raise the national minimum wage to $15 per hour.

Any of these may be dropped or trimmed down during negotiations with Senate Republicans, unfortunately, with the exception of the $1,400 which can be passed through budget reconciliation.

Even just those $1,400 are expected to have a drastic effect on the economy, however. According to a recent study published in the Institute on Taxation and Economic Policy, a $2,000 stimulus check can give ~60% of Americans an average income boost of 11%. The bottom 20% of Americans would see their average income boosted by 29%.

Also Check: When Was The Second Stimulus Checks Sent Out

Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment is possible due to a budget surplus. Couples filing jointly will receive $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

Instructions to claim the rebate havent yet been released for residents who havent filed a 2020 state tax return. Instructions are anticipated to be announced by Oct. 17.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

Read Also: Will There Be Another Stimulus Check In 2020 To

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually received a rebate of $250 . The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns should have received a rebate in July. Single individuals without dependents received $500 households with married couples or single adults with dependents received $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Read more: New Mexico Residents To Receive Tax Rebate Of Up To $500

California: Up To $1050 Rebate

Californias new budget includes payments of $350 for individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Californians can expect to receive payments between October 2022 and January 2023 via direct deposit and debit cards.

Read more: California Families To Receive Stimulus Checks Up To $1,050

Also Check: Stimulus Check Who Gets It

I Retired At 29 On A Teachers Salary

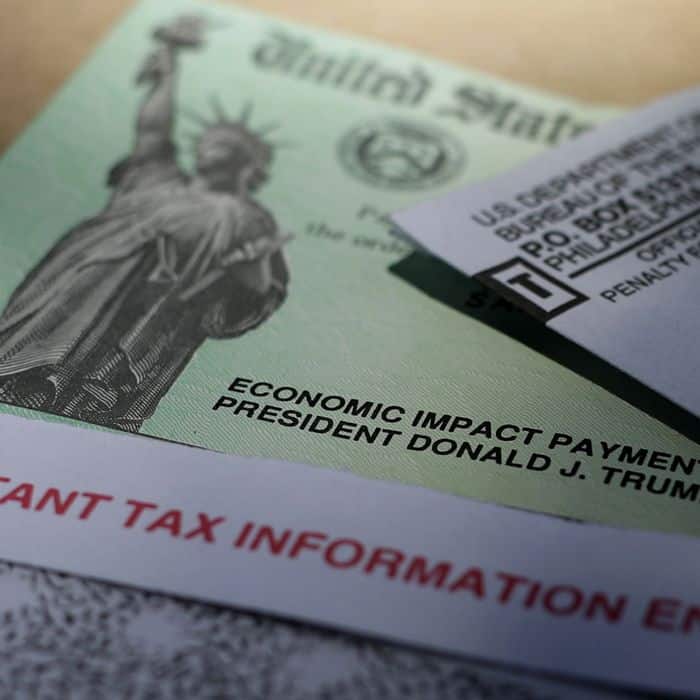

Over 2.2 million more stimulus checks have gone out in the past six weeks, the feds announced, bringing the total number of payments distributed as part of the third batch of checks to more than 171 million.

The latest round of 2.2 million checks is worth more than $4 billion, the IRS, Treasury Department and Bureau of the Fiscal Service said in an announcement.

Of the 2.2 million, about 1.3 million, worth an estimated $2.6 billion, were sent to people for whom the IRS previously did not have information to issue a stimulus check but who recently filed a tax return, the federal agencies said

The batch also included supplemental payments for people who received payments based on their 2019 tax returns earlier this year, but were eligible for a new or larger amount based on their 2020 tax returns, the feds said.

There were more than 900,000 of these so-called plus-up payments sent out in the last six weeks, with a value of more than $1.6 billion, the government said.

In total, more than $400 billion have been sent out to Americans since the third batch of checks started going out on March 12, according to the government agencies.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Don’t Miss: Do You Have To Claim Stimulus Check On 2022 Taxes

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

No Economic Recovery For Others

The pandemic has further highlighted the growing imbalance across the broader economy. While many households have financially flourished during COVID, many others have fallen behind where they were in early 2020. Much of the gap depends on whether wage earners could work remotely during the shutdown or had public-facing jobs that required them to be on-site.

Financial insecurity is still widespread, and the loss of a job and the loss of hours were some of the main reasons over the course of the pandemic. Nine percent of American adults reported a shortage of food in their household over the previous week, according to a Center on Budget and Policy Priorities analysis of U.S. Census survey data from late September and early October. Approximately 16 percent of renters have fallen behind on their rent, including 23 percent of renters with children in their household. The federal eviction moratorium, which ended October 3, didn’t forgive rent that was owed, it pushed the debt into the future. And evictions continued in some parts of the country regardless. Meanwhile, only a fraction of the $46 billion Congress allocated for rental assistance has actually made it to tenants and landlords. As of late September, over a quarter of American adults reported some difficulty keeping up with expenses in the prior week.

Also Check: Qualifications For 3rd Stimulus Check

Stimulus Checks 202: Coming To These States

Many states had a monetary arrangement surplus in 2022 or excess money from Covid stimulus check funds help out.

This suggests a reward for certain residents who can expect one-time direct stores in a ton of time for the Christmas season. For sure, we are examining the December events at this point when the primary pumpkin zing hits store resigns, this present time is the ideal open door.