Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

How A Life Change Affects Your Stimulus Check/payment Eligibility

With the third stimulus check dispersal under way, millions have already received their third stimulus payments. But the more Americans get their checks, the more questions arise specifically about how life changes affect your stimulus payment.

The first, second and now third economic impact payment or stimulus payments can be paid in advance. Your eligibility and amount is based off your most recently filed tax return but what if that information is incorrect?

For example, what if you havent filed taxes yet but got married in July 2020? Or had a baby? What if youre dealing with the aftermath of a divorce or the recent death of a loved one? What if you already received your first and second stimulus checks, but it was for the wrong amount? What if you graduated from college in 2020 and arent a dependent anymore?

For the first and second stimulus payments, if your situation changed, youll claim the rest youre owed through the Recovery Rebate credit on your 2020 return. For the third , youll wait to claim the credit on your 2021 tax return.

The IRS understood the need to get stimulus payments out quickly. As a result, some taxpayers have found differences in the amount they should have received due to tax filing changes and income changes.

Below, well clear things up about who is eligible for a stimulus checks, payment, and the credit and how life changes affect your eligibility.

Read Also: How Many Economic Stimulus Payments Have There Been

How Will The Irs Know Where To Send Your Payment What If You Changed Bank Accounts

The IRS says it will use the data already in its systems to send the new payments. The IRS says, Taxpayers with direct deposit information on file will receive the payment that way. For those without current direct deposit information on file, they will receive the payment as a check or debit card in the mail. For those eligible but who dont receive the payment for any reason, it can be claimed by filing a 2020 tax return in 2021. Remember, the Economic Impact Payments are an advance payment of what will be called the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR.

Invest It In The Stock Market

If you have a healthy emergency fund, you might consider investing your Trump stimulus check directly into the stock market. Over the long run, the stock market has returned an average of 7% annually, inclusive of dividend reinvestment. This means the typical investor is going to double their money about once every decade. Plus, no asset class has consistently outperformed the stock market over the long run.

You May Like: Stimulus Check Who Gets It

Recommended Reading: Contact Irs About Stimulus Payment

What Will The Status Report Look Like

For third-round stimulus checks, the “Get My Payment” tool will display one of the following:

1. Payment Status. If you get this message, a payment has been issued. The status page will show a payment date, payment method , and account information if paid by direct deposit. Note that “mail” means either a paper check or a debit card. If you don’t recognize the bank account number displayed in the tool, it doesn’t necessarily mean your deposit was made to the wrong account or that there’s a fraud. If you don’t recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. Need More Information. This message is displayed if your 2020 return was processed but the IRS doesn’t have bank account information for you and your payment has not been issued yet. It could also mean your payment was returned to the IRS by the Post Office as undeliverable. As mentioned above, if your payment is returned, you’ll have the opportunity to provide the IRS your bank account or debit card information so they can issue a direct deposit payment . If you don’t provide any account information, the IRS can’t reissue your payment until they receive an updated address.

The portal is updated no more than once daily, typically overnight. As a result, there’s no reason to check the portal more than once per day.

How Do I Get My Check If I Havent Filed A 2019 Tax Return

If you receive Social Security or Railroad Retirement Benefits and did not file a tax return in 2019, you will not have to file a return in order to receive your paymentâthe IRS has your information already. If you donât receive those benefits and did not file a tax return for 2019, you may need to file one to confirm your eligibility. Check your status in the Get My Payment portal for instructions.

You May Like: Stimulus Checks For Grocery Workers

Eligibility For A ‘plus

You can estimate how much money the IRS owes your household for the third stimulus check. Just make sure to triple-check that you meet the qualifications, including the income limits.

Because of the overlap with tax season 2020, many people may receive some, but not all, of their allotted amount. If your income changed in 2020, in some cases, the IRS may owe you more money than you received if the income figure used to calculate your payment from your tax returns in 2018 or 2019 is less in 2020. Likewise, if you now have a new dependent, such as a new baby, you may be owed more money.

The IRS is automatically sending “plus-up payments” to make up the difference. If you don’t get one, you may need to claim the missing money another way later in 2021 or even in 2022, since tax season is officially over now.

What If The Irs Sent The Check To A Closed Account

Because people can’t update their bank account information on the “Get My Payment” site, there’s concern that some checks might be sent to accounts that were recently closed. If that’s the case, the IRS says you’ll have to wait until you file your 2020 tax returns.

The stimulus checks are actually a tax rebate that can be applied to your annual tax returns but that means people may be waiting weeks or even months for their stimulus money to show up through their tax refund.

You May Like: How Much Were Stimulus Checks In 2021

What To Do About A Missing Or Stolen Eip Debit Card

At least 5 million people will receive their third stimulus check on a prepaid debit card called the Economic Impact Payment Card, instead of a paper check. For the third payment, the EIP card arrives in a white envelope sent from “Economic Impact Payment Card.” The letter will have a US Department of the Treasury seal.

The card has the Visa name on the front and the issuing bank, MetaBank®, N.A., on the back. Information included with the EIP Card explains that this is your Economic Impact Payment. If you receive an EIP Card, visit EIPcard.com for more information.

If you’ve misplaced or thrown away your card, the EIP card service has an FAQ on what to do if your card is lost or stolen. You can also call 800-240-8100 to request a replacement. It’s free, according to a spokesperson for the Treasury Department. To request a new card, press option 2 when prompted.

However, the EIP card website says, “Your Card will be deactivated to prevent anyone from using it and a new replacement Card will be ordered. Fees may apply.” We recommend calling the above number for a lost or stolen card and speaking to a representative. If you may have lost or thrown away a paper check, read the mail fraud section below.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

You May Like: What To Do If I Never Got My Stimulus Check

How Much Will My Check Be For

- Single taxpayers who earned less than $75,000 and couples who filed jointly and made less than $150,000 will receive $350 per taxpayer and another flat $350 if they have any dependents. A married couple with children, therefore, could receive as much as $1,050. This is the largest bracket, KCRA reported, representing more than 80% of beneficiaries.

- Individual filers who made between $75,000 and $125,000 — and couples who earned between $150,000 and $250,000 — will receive $250 per taxpayer, plus another $250 if they have any dependents. A family with any children could receive $750.

- Individual filers who earned between $125,000 and $250,000 and couples who earned between $250,000 and $500,000 would receive $200 each. A family with children in this bracket could receive a maximum of $600.

I Missed The Deadline For Getting A Cares Act Stimulus Payment Can I Still Get This Payment

Yes. Some people who typically donât file a tax return were required to register for a stimulus payment. If you didnât register and didnât receive a maximum $1,200 payment from the first stimulus package, you may be eligible to receive those funds through a tax credit by filing a 2020 tax return when the IRS system opens Feb. 12, 2021.

If youâre a non-filer who didnât register for the CARES Act stimulus payment, you cannot do so for the second round of payments. Youâll have to wait to file a 2020 tax return to claim the Recovery Rebate Credit.

Read Also: Did They Pass The Stimulus Check

Are Inmates Still Eligible For The $600 Stimulus Check

The bill text doesnt specify stimulus payment restrictions for people who are incarcerated so they likely are. When the CARES Act was passed, the IRS moved to block people in prison from receiving stimulus checks, but a judge ordered the Treasury and IRS to distribute payments to them.

Incarcerated people who filed a tax return in 2019 will likely receive a payment by mail or direct deposit. People who didnt may need to work with their facility to complete a 2019 return and submit it to the IRS.

What If I Receive Social Security Through The Direct Express Debit Card

The IRS says that people who receive government benefits such as Social Security, Railroad Retirement benefits, Supplemental Security Income or Veteran’s Benefits through Direct Express a debit card that automatically receives payments will get their second stimulus checks deposited onto that card.

But the IRS cautioned, “The bank information shown in Get My Payment will be a number associated with your Direct Express card and may be a number you don’t recognize.”

Read Also: Can You Still Get Your Stimulus Check

Can You Use The Portal If You Didn’t File A Tax Return

You couldn’t use the “Get My Payment” tool to track the status of your first stimulus check if you didn’t file a 2018 or 2019 federal income tax return. However, there was another online tool that non-filers could use to give the IRS with the information it needed to process a payment.

The non-filers tool wasn’t used for second stimulus checks, though. Instead, if you didn’t file a 2019 tax return, and you didn’t use the non-filers tool to get your first-round payment, then you have to wait to claim your second stimulus check money as a Recovery Rebate credit on your 2020 return.

The IRS is not using the non-filers tool for third-round stimulus checks, either. As a result, if you don’t file a 2019 or 2020 tax return, you’ll have to claim any money you’re owed as a Recovery Rebate credit on your 2021 return, which you won’t file until next year. However, you can avoid having to wait until next year by filing a 2020 return before the May 17, 2021, deadline.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

You May Like: Get My Stimulus Payment 1400

Who May Be Eligible To Receive More Stimulus Money

- Parents of a baby born in 2021 who claim the child as a dependent on their 2021 tax return

- Families who added a dependent, such as a parent, grandchild or foster child, on their 2021 tax return who was not listed as a dependent on their 2020 return

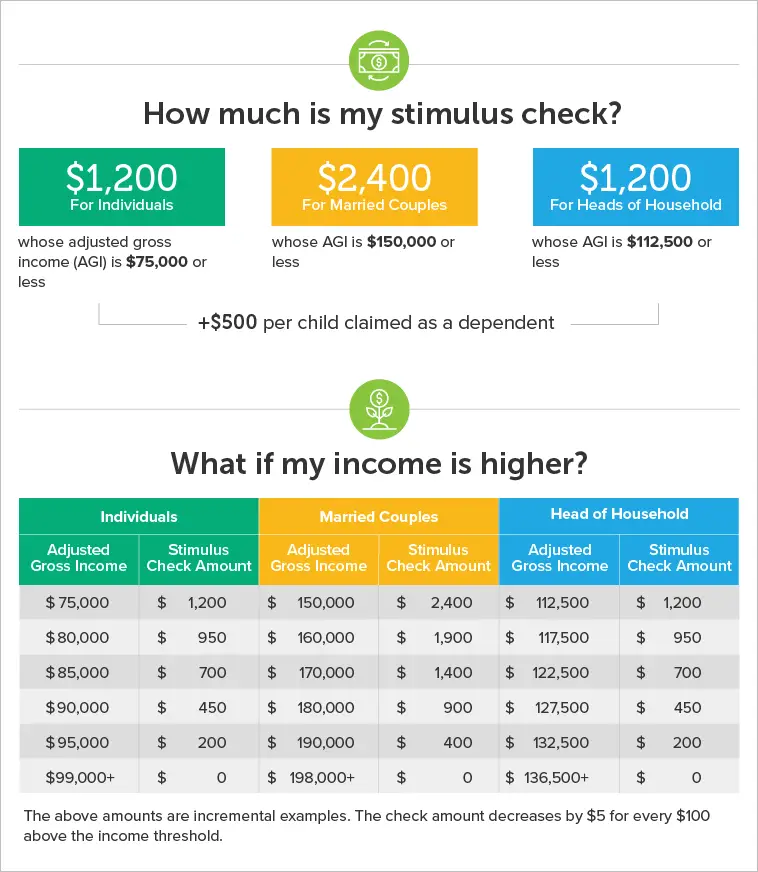

- Single filers who had incomes above $80,000 in 2020 but less than that in 2021 married couples who filed a joint return who earned more than $160,000 in 2020 but made less money in 2021 and head-of-household filers with incomes above $120,000 in 2020 but less than that in 2021

- Single filers who had incomes of between $75,000 and $80,000 in 2020 but earned less in 2021 married couples who file jointly who had incomes of between $150,000 and $160,000 in 2020 but less than that in 2021 and heads of household who had incomes of between $112,500 and $120,000 in 2020 but made less money in 2021

Even if you didnt qualify for the first and second round of stimulus payments in 2020, if you had a tough time financially in 2021 and your income is lower , you will get the credit on your 2021 return, Steber says.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

How Much Will I Get

The payments are based on income and family size.

Single taxpayers who earn less than $75,000 a year and couples who file jointly and make less than $150,000 a year will receive $350 per taxpayer.

Taxpayers with dependents will receive an extra $350, regardless of the total number of dependents.

In other words, a couple that earns a combined $125,000 and has two children would qualify for $350 per adult plus $350 for their children, for a total of $1,050.

You May Like: Irs.gov Stimulus Check 4th Round

Will There Be A Third Stimulus Check Of $2000

Maybe. The CASH Act bill, which included $2,000 stimulus checks for qualifying individuals, passed in the House in December but was blocked from reaching the Senate floor by Senate Majority Leader Mitch McConnell .

But with Democrats almost certainly taking a slim majority in the Senate, a third stimulus check is back on the table. On Tuesday, Joe Biden said that if Democrats Jon Ossoff and Raphael Warnock won their respective Senate races in Georgia, he would send $2,000 checks to qualifying Americans. Its unclear if this would be an additional $2,000 on top of the $600 checks that have already been sent out, or that Americans would be sent the difference between the two amounts.

Will My 2020 Tax Return Affect My Payment Amount

In some cases, yes. If youâre entitled to a larger payment based on your 2020 tax return compared to your 2019 return, you will be eligible to receive the difference as a tax credit. If you lost your job or saw your income drop this year during the pandemic, this situation may apply to you. But you wonât see any additional funds via a tax credit until 2020 returns are filed this spring.

If the stimulus payment you are due is lower based on your 2020 income, you get to keep the higher payment that was sent to you based on your 2019 return.

Read Also: Is Texas Giving Stimulus Money