How Do I Get My Stimulus Check

If youve filed a tax return for tax year 2019 or 2018 or submitted your information to the 2020 IRS Non-filer portal, you dont need to do anything. The IRS shouldve automatically sent your payment. Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security Insurance and Veterans Affairs beneficiaries shouldve also automatically received a check.

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or by using GetCTC.org if you dont have a filing requirement.

To use GetCTC.org, youll need a phone number or email address. Youll also need to provide your full name , mailing address, date of birth, Social Security Number, bank account information , 2019 Adjusted Gross Income , and details for any qualifying children you have.

9. What if I dont have an email address?

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2022.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Recommended Reading: How Much Stimulus Check Are We Getting

How To Claim Stimulus Funds In Your 2021 Tax Return

The third round of stimulus payments is worth up to $1,400 per person if your adjusted gross income is $75,000 or less as a single filer, or $160,000 or less as a joint filer. Families are entitled to $1,400 per dependent for dependents of any age.

Before claiming the funds, make sure they weren’t sent to you already. You can confirm the amount of the third payment and whether it was sent to you by logging into your IRS online account or the Get My Payment app. You can also refer to a letter sent to you by the IRS, known as Notice 1444-C, which will tell you how much is owed to you.

If you lost your stimulus check or suspect it was stolen, you can request the IRS to trace your payment and get the amount automatically reimbursed to you as a tax refund. If you’re filing your 2021 tax return before your trace is complete, do not include the payment amount on the Recovery Rebate Credit Worksheet, the IRS says.

Otherwise, you’ll need to complete the Recovery Rebate Tax Credit worksheet and submit it as part of your 2021 tax return. The worksheet will help you calculate how much you can claim. Then, claim it on line 30 in Form 1040 or Form 1040-SR of your 2021 tax return.

Tax software will also guide you through this process and automatically add all the information to your tax return.

And remember, you can file your tax return for free if your income is $73,000 or less, using the IRS Free File Program.

Why Does The Irs App Say Payment Status Not Available

The IRS says there are multiple scenarios that may cause the Get My Payment app to display a payment status is not available message. If youre not eligible for a payment or havent filed your 2018 or 2019 tax returns, you may receive that message. That error message may also show up if you only recently filed a tax return, or provided your information through a portal for people who dont usually file taxes The IRS says your payment status will be updated when it finishes processing your information.

The IRS said theres also a possibility that the system doesnt have your data. Were working on adding more data to allow more people to use it, the agency says on its FAQ page. The IRS told TIME it encourages people to regularly check their status and said it will eventually be updated. The apps data is updated once a day.

According to The Verge, payment status not available also appears if you input your information incorrectly, so be careful when typing in your Social Security number, birthday and address.

Some people have been sharing tips to fight formatting issues. For example, some have found that the system only works if they input their street address in capital letters. Others say it only worked if they excluded the number sign before their apartment.

When asked on April 16 if people were receiving payment status not available messages because of technical glitches, the IRS directed TIME to the above statement.

Read Also: North Carolina Stimulus Check 2022

Where Is My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can request a trace of your stimulus check. You should only request a payment trace if you received IRS Notice 1444-B showing that your second stimulus check was issued or if your IRS account shows your payment amount and you havent received your second stimulus check.

Learn more about requesting a payment trace here.

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

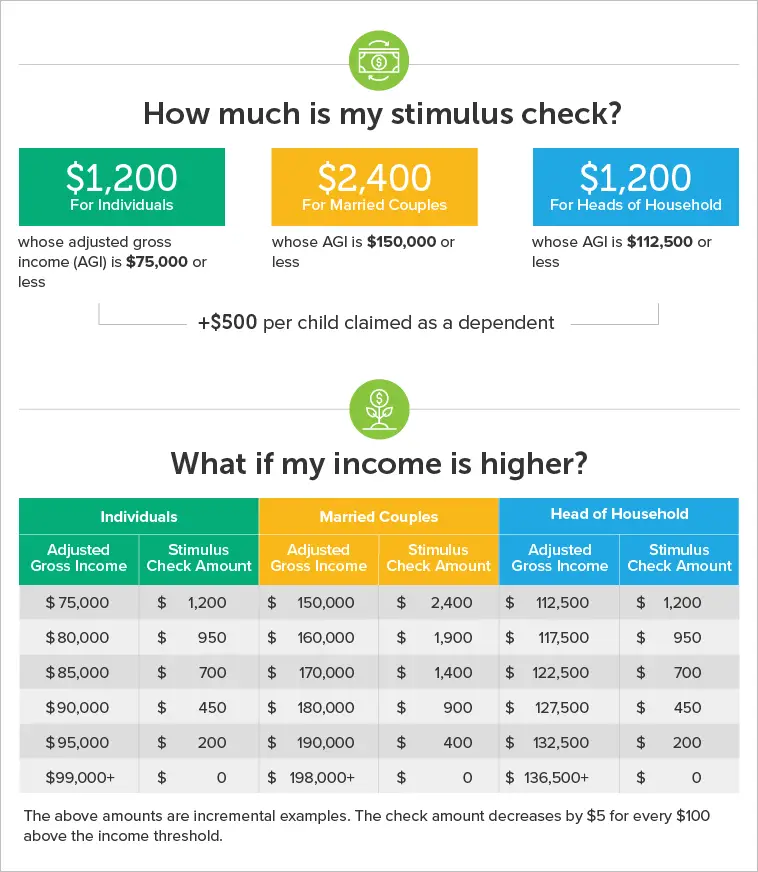

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

Also Check: How Do I Get Third Stimulus Check

What To Do If There’s A Direct Deposit Issue

The IRS tracking tool for the third stimulus check doesn’t allow you to add direct deposit information this time unless the IRS can’t deliver your payment. So if you have a problem, what do you do? Your check may have bounced back to the IRS if the agency tried to send your payment to a now-closed bank account or to a temporary prepaid debit card a tax preparer set up for you. If your payment was returned to the IRS, the agency will mail your check to the current address it has on file for you. If that check is returned, then the IRS will let you enter your banking information in the Get My Payment tool, the IRS said.

First, we suggest you call your bank or tax preparer — it never hurts to cover all your bases to confirm that an attempt was made to deposit money into a closed account or debit card.

Unfortunately, you’ll need to wait and monitor the Get My Payment tracker to keep tabs on your check delivery. We also recommend signing up for a free service to track your check to your mailbox.

Read More On Payments

For the third tranche, generally, you were sent a check if you filed a 2020 tax return and met the income restrictions.

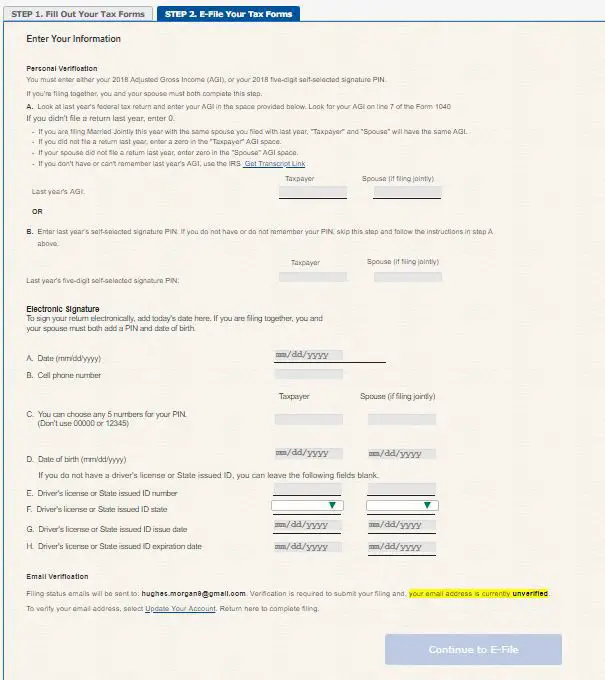

The following information was needed for the return:

- Step 1: Full name, current mailing address and email address

- Step 2: Date of birth and valid Social Security number

- Step 3: Bank account number, type and routing number, if you have one

- Step 4: Identity Protection Personal Identification Number you received from the IRS earlier this year, if you have one

- Taxpayers who previously have been issued an Identity Protection PIN but lost it, must use the Get an IP PIN tool to retrieve their numbers

- Step 5: Drivers license or state-issued ID, if you have one

- Step 6: For each qualifying child during 2019: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse

Filers cannot be claimed as a dependent of another taxpayer and must have an adjusted gross income of $75,000 or less if single to claim the full stimulus payment.

Read Also: Where’s My Stimulus Payments

Another Stimulus Check Could Help Fight Inflation But A Fourth Is Unlikely Experts Say

Story at a glance

- Some experts think Americans could greatly benefit from a cash infusion issued by the federal government to cope with rising inflation.

- Three economic impact payments were sent to all Americans under two administrations, alongside an expansion of the child tax credit and expanded unemployment benefits.

- All those programs have expired, and the Biden administration has been unable to get any of them extended on a permanent basis.

Even though pandemic relief measures like stimulus checks and child tax credits have expired, some policy experts believe another cash infusion could help many Americans and be politically advantageous coming as inflation skyrockets the cost of gas, groceries and more everyday essentials.

The federal government has issued three economic impact payments, or stimulus checks, since the coronavirus pandemic began. The last check for $1,400 was sent to Americans in March 2021. That money was a relief for many, keeping nearly 11 million people out of poverty across two administrations, data from the U.S. Department of Health & Human Services shows.

The most impactful programs for alleviating poverty were economic impact payments under the ARP and unemployment compensation, said the HHS report.

Magg doesnt believe another stimulus check is likely, and while the Biden administration works with Congress to come up with a legislative solution, the Labor Department announced inflation has hit nearly 8 percent over the last year.

When Will You Get Your Money

The exact date you’ll receive your money depends on your circumstances, but the IRS has already begun sending electronic payments to millions of Americans.

The speed with which you’ll receive your payment largely depends on how you filed your taxes. The IRS can distribute electronic payments quickly, but they must print and mail paper checks for some recipients, which takes additional time.

On April 15th, the IRS launched a portal to track the status of your stimulus payment. To track your payment, you’ll need your social security number, your birthday, your address and your zip code provided you filed your 2019 or 2018 tax return. If you are a qualified non-filer, there are additional links on the IRS’s website to input your information so you can still receive your check.

On April 2, Treasury Secretary Steve Mnuchin said that eligible Americans who have signed up for direct deposit payments should receive them within two weeks, a process which is already underway. A spokesperson for the Treasury Department expects 50 million to 70 million Americans to receive their checks via direct deposit by April 15, according to The Washington Post.

However, if you didn’t sign up for direct deposit when filing your tax return and require a paper check, you might experience some delays. In fact, because the government lacks banking information for millions of Americans, $30 million in paper checks won’t begin distribution until April 24, or longer.

Read Also: What’s Happening With The Stimulus Checks

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Is There A Deadline To Get My Stimulus Check

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement. You must use GetCTC.org

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

Recommended Reading: Direct Express Pending Deposit Stimulus Check

I Havent Filed My 2019 Tax Return Yet What Should I Do

As long as you filed a 2018 tax return, you should be fine. The IRS says that it will use your 2018 tax filings to make its calculations on your Economic Impact Payment. If you filed a 2019 tax return, the IRS will use that information instead.

If you havent filed a 2018 or 2019 tax return and were not exempt from doing so file those returns electronically as soon as you can. For most Americans, filing a return from those tax years is the only way you can receive a stimulus payment.

If you filed your 2018 tax returns with a mailing address or direct deposit information thats no longer accurate, the only way to update that information is by filing your 2019 tax returns electronically with the updated information. If the IRS already has incorrect information about you, you cant use the Get My Payment app to update it.

The IRS has extended the deadline for filing 2019 taxes to July 15, 2020.

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Read Also: What Were The Three Stimulus Payments