I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

When Can I File

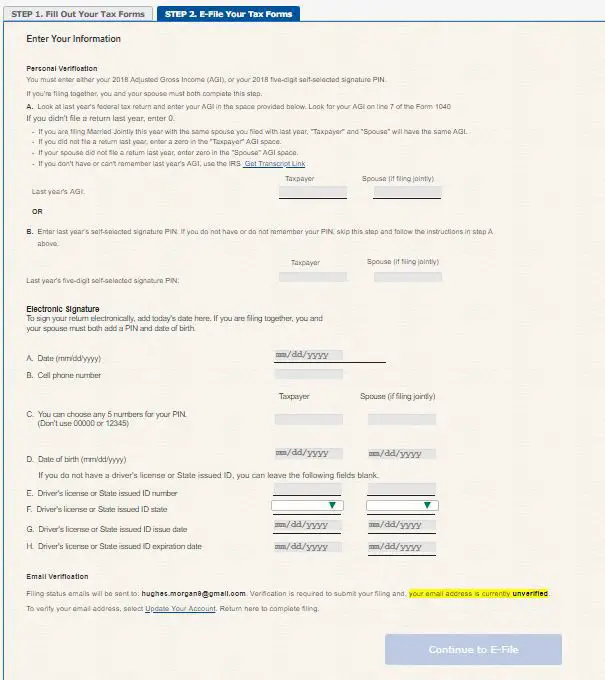

The tax season was pushed back a few weeks to Feb. 12 this year to give the agency time to program systems to reflect tax law changes implemented late in 2020, including the second round of stimulus checks.

Tax preparation companies are already accepting returns. Assuming you have all the paperwork you need, you can prepare your return now to be filed on Feb. 12. And remember: If your income was $72,000 or less in 2020, you can use the IRS’s Free File Program to file your federal return for free.

Who Qualifies For The Recovery Rebate Credit And Stimulus Payments

You qualify for the recovery rebate credit only if the IRS didnât give you a stimulus payment, or if you received a partial payment.

To find out you whether you missed out on money you were entitled to, you can contact the IRS, review your IRS online account or use the tax agencyâs Get My Payment tool.

Three rounds of pandemic stimulus checks were issued in 2020 and 2021. Hereâs a refresher.

Read Also: How Much Was All 3 Stimulus Checks

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

How Do I Get The Stimulus Payments

To issue the third stimulus payment, the IRS needs to know current information about you and your children. If you have submitted a 2019 or a 2020 tax return, or if you used the IRS Non-filer Portal in 2020 to claim your stimulus payments, then the IRS has enough information to send your family your third stimulus automatically.

If you have not submitted any information to the IRS in the last year or if you need to claim any of the first two stimulus payments you can submit your information through our simplified filing portal and get your payments.

Don’t Miss: How Do I Get The Stimulus Check

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

What Is The Recovery Rebate Credit

The Recovery Rebate Credit is a tax credit you can get if you were eligible for stimulus checks and didnt receive them or got less than the full amount. You can claim the credit for the first and second stimulus checks when you file a2020 tax return.To get the third stimulus check you must claim the credit when you file a 2021 tax return.

Recommended Reading: Update On The Stimulus Package

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Who Isnt Eligible For The Recovery Rebate Credit

If you received full stimulus payments, you arenât eligible for any more cash. And you canât take the credit if someone else can claim you as a dependent.

Additionally, only U.S. citizens or âresident aliensâ qualify for the recovery rebate credit. If you are a ânonresident alienââ someone who has not passed the green card testâyou do not qualify for the credit.

You also are not eligible if you donât have a Social Security number. But if youâre married and your spouse has an SSN, there are certain instances where you might still qualify for the credit even if youâre not in the Social Security system.

You May Like: Irs Get My Payment Stimulus Check

How Do I Claim These Benefits

The IRS is urging people who believe they are eligible for the tax credits but havent filed a tax return to go ahead and file a return with the tax agency, even if they havent yet received a letter from the IRS. But the deadline for filing a return to claim these benefits is Thursday, November 17.

The IRS reminds people that theres no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline, the IRS said.

There are a few ways people can claim the benefits:

- File a return with Free File before November 17, 2022. Free File is available to people who earn less than $73,000.

- File a simplified 2021 tax return through GetCTC before November 15, 2022.

The IRS said it urges people to file their tax form electronically and to choose direct deposit in order to get their tax credits as soon as possible.

How To Claim Your Rebate Credit

To get your money, youll need to claim the 2021 Recovery Rebate Credit on your 2021 return. Filing electronically can guide you through the form. Dont claim any missing first or second stimulus payments on your 2021 return rather, youll need to file a 2020 return or an amended return to get these payments.

The rebate credit does not count toward your taxable income. And be aware that youll need to fill out your tax return accurately and include the precise amount of stimulus payments the IRS has actually paid you to avoid a delay in your returns processing. If you enter the incorrect amount, it can hold up the processing of your return, Greene-Lewis cautions. The agency will not automatically calculate your 2021 rebate. It is on you, the taxpayer, to claim the Recovery Rebate Credit, Steber says.

Adam Shell is a freelance journalist whose career spans work as a financial market reporter at USA Today and Investors Business Daily and an associate editor and writer at Kiplingers Personal Finance magazine.

Also of Interest

Recommended Reading: I Didn T Get My Second Stimulus Check

How To Claim Missing Stimulus Check Money On Your Taxes

Nows the time to claim all the money youre owed if you havent received it already. Before you sit down to file your taxes and claim the credit, make sure you know the total amount you received in the third EIP and any plus-up payments for a smooth process.

Once youve determined how much money you can claim which you can do via the Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040-SR instructions report it on line 30 of your Form 1040.

If youre using a tax software program like TurboTax or H& R Block, youll be prompted to determine if youre eligible for the 2021 Recovery Rebate Credit and to claim it if so.

Read Also: Who Is Getting The New Stimulus Checks

Why Havent We Received The Full Amount Of The Check

The American Rescue Plan Act occurred during the year 2021. Stimulus checks related to this plan were sent out throughout the year. There were three checks in total and in the third round of payments they were up to $1,400 per individual.

But the flaw in the reinstatement of the money for some filers is in that the IRS based the payment on the number of dependents on the 2019 or 2020 tax return. This means that the information could have changed by 2021, so there is a chance that some of the money due back to many citizens may not have been.

Therefore, if your family has increased in the last year, you may be able to make a direct claim and thus get a larger stimulus check in 2023. Remember that you can contact the IRS through the telephone number 800-829-1040 and that any of their employees will be able to help you solve your problem.

Don’t Miss: How Much Was The First And Second Stimulus Check

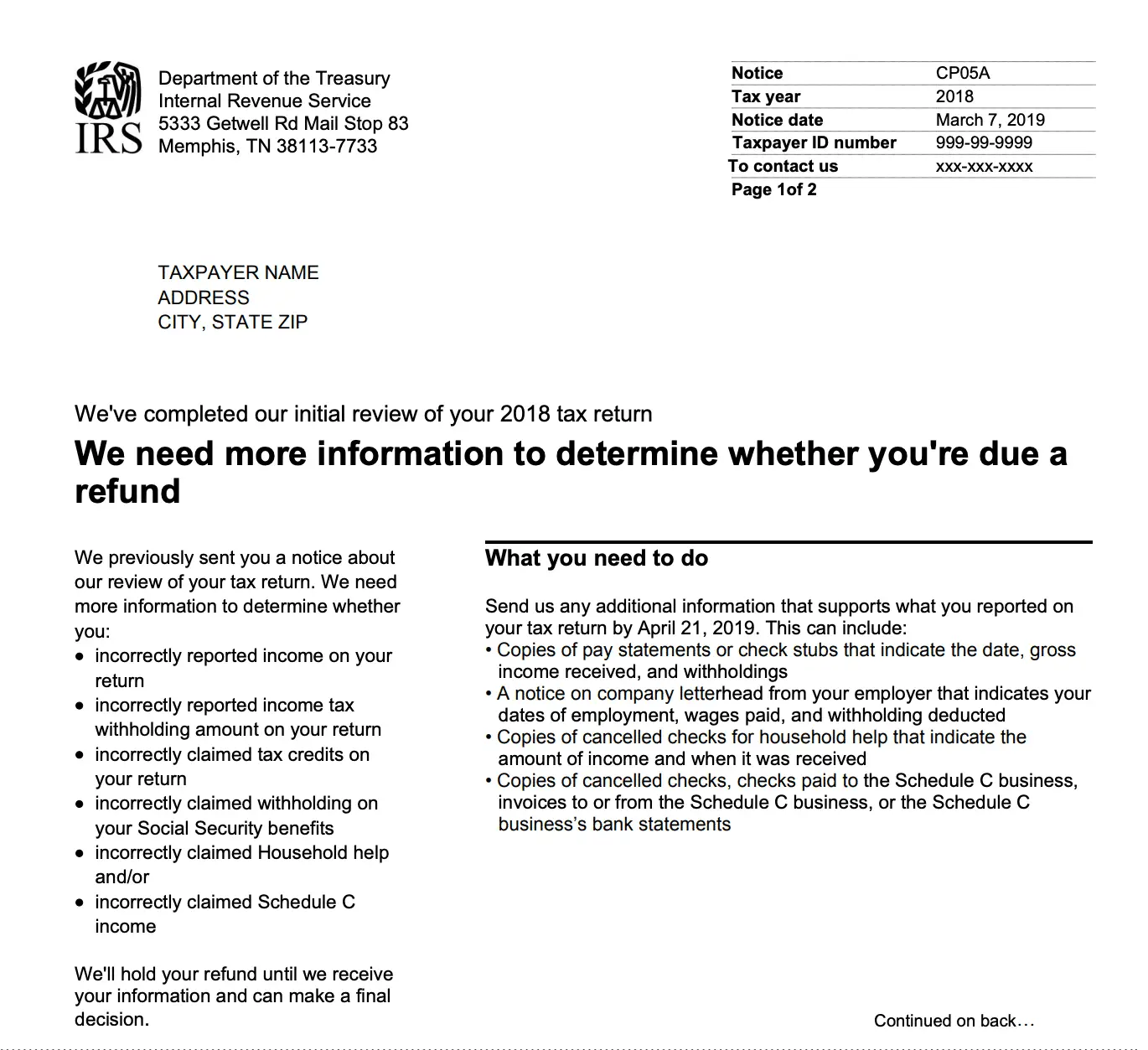

Theres A Glitch With Your Bank Tax Prep Software Or The Irs

This explanation may be the most frustrating of all for people wondering where the heck their stimulus checks are. But a mistake made by your bank, the IRS, or the tax-prep software you used to file returns could screw up your stimulus payment.

As the Washington Post reported, the stimulus payments for millions of taxpayers may be delayed because of a glitch with tax-prep software firms, such as TurboTax, H& R Block, and Jackson Hewitt. The IRS might not have direct deposit information for you if you used one of these services and received an advance on your tax refund, or if you paid for the service by deducting the fee from your tax refund. And if the IRS doesnt have your direct deposit info, your stimulus check will be delayed. If you think this situation applies to you, use the IRS Get My Payment app to provide the agency with your direct deposit details.

$1800 Recovery Rebate Credit: Which College Students Should Apply

The CARES Act and late sent two total stimulus checks to each qualifying low- and middle-income adult worth a cumulative $1,800 and then $1,100 for each of their dependent children younger than 17. With most college-aged students older than 17, they were excluded from both checks by design, along with other adult dependents, including individuals with disabilities.

Its only for those under the age of 17, and again, the eligibility will be for the parents taxes and not for the dependents tax return information in order to receive that stimulus, says Mark Jaeger, director of tax development at TaxAct. The adult dependents would not be eligible.

But college students want to be particularly careful because they often straddle the lines between independent and dependent taxpayer statuses.

The IRS has a five-part test to determine whether adults are eligible to be claimed as a dependent. If theyre a full-time student for at least five months of the year, they have to be under the age of 24. Most of the time, they have to be related to the adult taxpayer whos claiming them and share the same permanent address. And the biggest qualifier: Dependent college students can have a job, but they cannot provide more than half of their own support.

Recommended Reading: Where’s My Stimulus Check Nj

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Recommended Reading: Set Up Direct Deposit For Stimulus Check

How Can I Get My Stimulus Checks

The IRS has sent out all first, second, and third stimulus checks. If you didnt receive one or more of your stimulus checks, you can still get them.

First and second stimulus checks

You can get your first and second stimulus check by claiming them as the Recovery Rebate Credit when you file a2020federal tax return .. You can file your taxes virtually by going to GetYourRefund.orgthrough October 1, 2022.

Third stimulus check

To get your third stimulus check, you will have to file a2021federal tax return and claim the third stimulus check as the 2021 Recovery Rebate Credit. Note that this is a different tax year than you must file for the first and second stimulus checks..

Read Also: Who Can I Call To Get My Stimulus Check

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Recommended Reading: Where Is My Stimulus Refund

What Happens If My Stimulus Check Was Sent As A Debit Card Instead Of As A Check

The IRS sent aletterto prison officials explaining that if debit cards couldnt be processed at your prison facility, prison officials have to return the debit cards to the IRS fiscal agent at:

Fiserv1007 North 97th CircleOmaha, NE 68122

The debit cards will be voided.You can file a 2020 tax form to get your first and second stimulus checks, and/or a 2021 tax form to get your third stimulus. Include a letterasking for your payment by check because you cannot get debit cards in prison. It may be helpful to contactMetabank, the debit card company, to report your card as lost. You can ask that they cancel the debit card and then inform the IRS you didnt receive the money so the IRS can issue you a check.for more details.

Learn more about how to get your missing stimulus checks.

Recommended Reading: 4th Stimulus Check N.y.

Are Stimulus Checks Considered Taxable Or Untaxed Income For Title Iv Purposes Including Pj

KA-34871

Please rate this Q& A on how helpful this guidance is to you. Thank you!

Close954 page views

This guidance is not award-year-specific and applies across award years.

2022-23 Verification Waiver: Beginning May 18, 2022 and for the remainder of the 2022-23 FAFSA processing and verification cycle, the U.S. Department of Education waives verification of all FAFSA/ISIR information, except for identity/Statement of Educational Purpose in Verification Tracking Groups V4 and V5. See Dear Colleague Letter GEN-22-06 and AskRegs Q& A, How Do We Implement the Verification Waiver For the Remainder Of 2022-23?, for guidance. The following guidance is still relevant depending on context and/or application of the waiver.

This AskRegs Knowledgebase Q& A was updated on May 4, 2021 to include U.S. Department of Education confirmation of guidance previously provided by NASFAA, particularly as it relates to untaxed income.

No. NASFAA has confirmed with ED that Economic Impact Payments are neither taxable income nor untaxed income for Title IV purposes. They are also not estimated financial assistance . They are ignored for all Title IV need analysis and packaging purposes.

The IRS does not consider stimulus payments under the Coronavirus Aid, Relief, and Economic Security Act , the 2021 Coronavirus Response and Relief Supplemental Appropriations Act , or the American Rescue Plan Act of 2021 to be taxable income. ED does not consider stimulus payments to be untaxed income either.

Notes:

What If You Have Trouble With The Tool

To use the Get My Payment tool, you must first verify your identity by answering security questions. If the information you enter does not match IRS records, you will receive an error message. To avoid this:

- Double-check the information requested

- Make sure what you enter is accurate

- Try entering your street address in a different way and

- Use the US Postal Services ZIP Lookup tool to look up the standard version of your address, and enter it into exactly as it appears on file with the Postal Service.

If your answers do not match the IRS records three times, youll be locked out of Get My Payment for security reasons. If that happens, you must wait 24 hours and try again. If you cant verify your identity, you wont be able to use Get My Payment. Unfortunately, theres no fix for that: the IRS says not to not contact them.

However, if you verified your identity and received Payment Status Not Available, this means that the IRS cannot determine your eligibility for a payment right now. There are several reasons this could happen, including:

- You didnt file either a 2018 or 2019 tax return or

- Your recently filed return has not been fully processed.

Again, the IRS says theres no fix for that and you should not contact them.

Also Check: How Much Stimulus Was Given In 2021