How To Claim The Recovery Rebate Credit On A Tax Return

You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return, whichever is applicable. If you file your return using any of the best tax preparation software on the market, the program will guide you through the worksheet.

âWhen you file your 2020 or 2021 tax return, youâll have to report the stimulus checks you received with the recovery rebate credit you are entitled to claim,â says Samantha Hawkins, a certified public accountant and founder of Hawkins CPA Solutions in Upper Marlboro, Maryland.

You can find the amount of your first stimulus payment on your Notice 1444, which was mailed by the IRS. The tax agency followed up with a Notice 1444-B for the second stimulus round and Notice 1444-C for the third.

If you donât have the notices, you can create an online account with the IRS to verify the payments you received.

If you got less than the full stimulus payment for any of the rounds, the worksheet asks you questions about your income. In some cases, you may be entitled to claim an additional stimulus payment.

You can claim missing or partial first- and second-round stimulus payments only on your 2020 federal tax return. Any missing or partial third-round stimulus payments can be claimed on your 2021 federal tax return only.

If youâre behind on your returns, you have until Sept. 30 to file your 2020 taxes penalty-free. Taxpayers who got extensions to file their 2021 returns must submit those by Oct. 17.

How To Calculate The Recovery Rebate Credit

Similar to the eligibility rules, calculation of the 2021 recovery rebate credit is generally the same as the calculation of third-round stimulus checks, except that they’re based on information from different sources. Third stimulus checks were generally based on information from either your 2019 or 2020 tax return, whichever was most recently filed when the IRS began processing your payment. If you didn’t file a return for either of those two years, the IRS sent a third stimulus check based on whatever information, if any, was available to it. In many cases, that information came from the Social Security Administration , Railroad Retirement Board, or Veterans Administration if you receive benefits from one of those federal agencies. However, the amount of your recovery rebate credit is based entirely on information found on your 2021 tax return.

As with the stimulus checks, calculating the amount of your recovery rebate credit starts with a “base” amount. For most people, the base amount for the 2021 credit is $1,400. For married couples filing a joint tax return, the base amount is $2,800 . Then you add on $1,400 for each dependent claimed on your 2021 return.

Finally, after the credit is reduced , you need to subtract the total third-round stimulus check and “plus-up” payments you received last year from the credit amount.

Here’s an example of how the calculation works:

Americans Who Didnt Receive Any Stimulus Checks At All

Many Americans out there just havent received any of their promised stimulus checks. If thats you, you should jump at the opportunity to claim your credit.

A number of circumstances can cause these delays for you: Perhaps youve moved and the IRS doesnt have your new address on file. Maybe the IRS did have the correct address or bank account information, but it never hit your checking account or perhaps got lost in the mail. All of these would be instances when you should apply to reconcile your payment on your tax return.

As always, its good practice to go back through your records and find any documents from the IRS showing your designated stimulus amount, if you have them. Then, look back through your deposit statements around the time when both stimulus checks mightve been cashed or deposited .

The IRS Get My Payment tool will be helpful for tracking both of those checks statuses. That portal should also give you information showing the date of payment and the method , according to the IRS.

If all of your research validates these suspicions, its time to claim your Recovery Rebate Credit.

You May Like: How Much Was Second Stimulus Check

What If I Already Filed My Return And My Refund Was Adjusted

If you are filed your 2020 or 2021 tax return before starting a trace and did not include the payment amount on line 16 or 19 of the Recovery Rebate Credit Worksheet, you may receive a notice saying your Recovery Rebate Credit was adjusted.

After the trace has been completed and it is determined your payment has not been cashed, an adjustment will be made and a check sent to the taxpayer. You will not need to take any additional action to receive the credit.

Your Stimulus Checks Arent Taxable

Itâs essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people donât entirely grasp how stimulus payments affect their taxes.

âThe part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit,â says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than youâre entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you donât have to pay any stimulus money back.

Don’t Miss: Amount Of 3rd Stimulus Check

Here’s Why Your Tax Refund Or Missing Stimulus Money Could Have Been Seized

Stimulus checks are technically considered a tax credit, no matter how you get them. Typically, the IRS can reduce a taxpayer’s refund to repay outstanding debts like past-due child support, unpaid student loans and certain other federal and state liabilities. The CARES Act stated that the first stimulus check could not be garnished for these purposes, except for overdue child support.

The went a step further and protected the second round of stimulus checks from all garnishment, including child support. However, it also limited that exception only to advance payments, and retroactively revised the CARES Act’s rules as well — meaning that your Recovery Rebate Credit that arrives on your tax refund for missing stimulus money is treated differently from the stimulus money that arrived for others in the mail, according to the Taxpayer Advocate Service, an independent organization within the IRS.

For the third check, because of the way it was passed, it’s open to garnishment from private debt collectors, but not child support payments.

Bottom line: If you’re eligible for a stimulus payment through a Recovery Rebate Credit, but you have certain outstanding debts, some or all of your credit could be withheld to pay those debts, the Taxpayer Advocate Service wrote in a blog post.

To Complete The Form 3:

- Write EIP1, EIP2 or “EIP3” on the top of the form to identify which payment you want to trace.

- Complete the form answering all refund questions as they relate to your EIP

- When completing item 7 under Section 1:

- Check the box for Individual as the Type of return

- Enter 2020 (if this is for the first or second stimulus payment, or enter “2021” if this is for the third stimulus payment as the Tax Period

- Do not write anything for the Date Filed

Don’t Miss: Who Gets The Stimulus Checks

What Is A Recovery Rebate Credit

The IRS has lots of different rules, regulations and terms that make things confusing for filers, but pay no attention to the man behind the curtain: The Recovery Rebate Credit is simply just another name for your stimulus check. And if you were one of the lucky Americans who received two EIPs with no problems, you technically just received an advance of that Recovery Rebate Credit.

Americans can claim that credit by filling out a new, special section on their 2020 Form 1040 or 1040-SR if theyre a senior. That also goes for taxpayers who normally dont have to file a tax return, according to the IRS.

But rest assured: Receiving a stimulus check wont come back to bite you. The IRS says that the credit will only increase the amount you receive as a tax refund or decrease the amount you owe, rather than subtract from the refund youre entitled to. Your stimulus check also isnt considered taxable income.

Eligibility For The Recovery Rebate Credit

The eligibility rules for the recovery rebate credit are basically the same as they were for third-round stimulus checks. The big difference is that eligibility for the stimulus check was typically based on information found on your 2019 or 2020 tax return, while eligibility for the recovery rebate credit is based on information from your 2021 return. So, you could qualify for a stimulus check but not for the credit and vice versa.

You’re generally eligible to claim the recovery rebate credit if, in 2021, you:

- Were a U.S. citizen or U.S. resident alien

- Can’t be claimed as a dependent on another person’s tax return and

- Have a Social Security number valid for employment that’s issued before the due date of your 2021 tax return .

For married couples filing a joint return, if only one spouse has a valid SSN, you can only claim up to $1,400 for the spouse with a valid SSN. If you’re claiming the extra $1,400 for a dependent, the dependent must also have a valid SSN or adoption taxpayer identification number . Generally, if neither you nor your spouse have a valid SSN, you can claim only up to $1,400 for each qualifying dependent claimed on your tax return. However, if either you or your spouse was an active member of the U.S. Armed Forces at any time during 2021, only one of you needs to have a valid SSN to receive up to $2,800, plus up to $1,400 for each qualifying dependent.

Don’t Miss: Is The Mortgage Stimulus Program Real

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

My Stimulus Payment Was Too High

Some individuals whose income increased too much in 2019 were not eligible for a full stimulus payment, but they got one anyway since the IRS based the payment on their 2018 taxes. Those individuals will not have to pay back the payment.

In other cases, families were paid an extra $500 or $600 for children who were 17 or older . This could happen if the IRS took the number of children who qualified for the child tax credit in 2018 without updating childrens ages for 2019. But in other cases, it looks like the IRS took the number of dependents from a familys 2018 tax return, without regard to their age. The IRS has said that those who received such overpayments will not have to pay them back.

Read Also: How Many Federal Stimulus Checks Were Issued In 2021

Also Check: Who Sends The Stimulus Checks

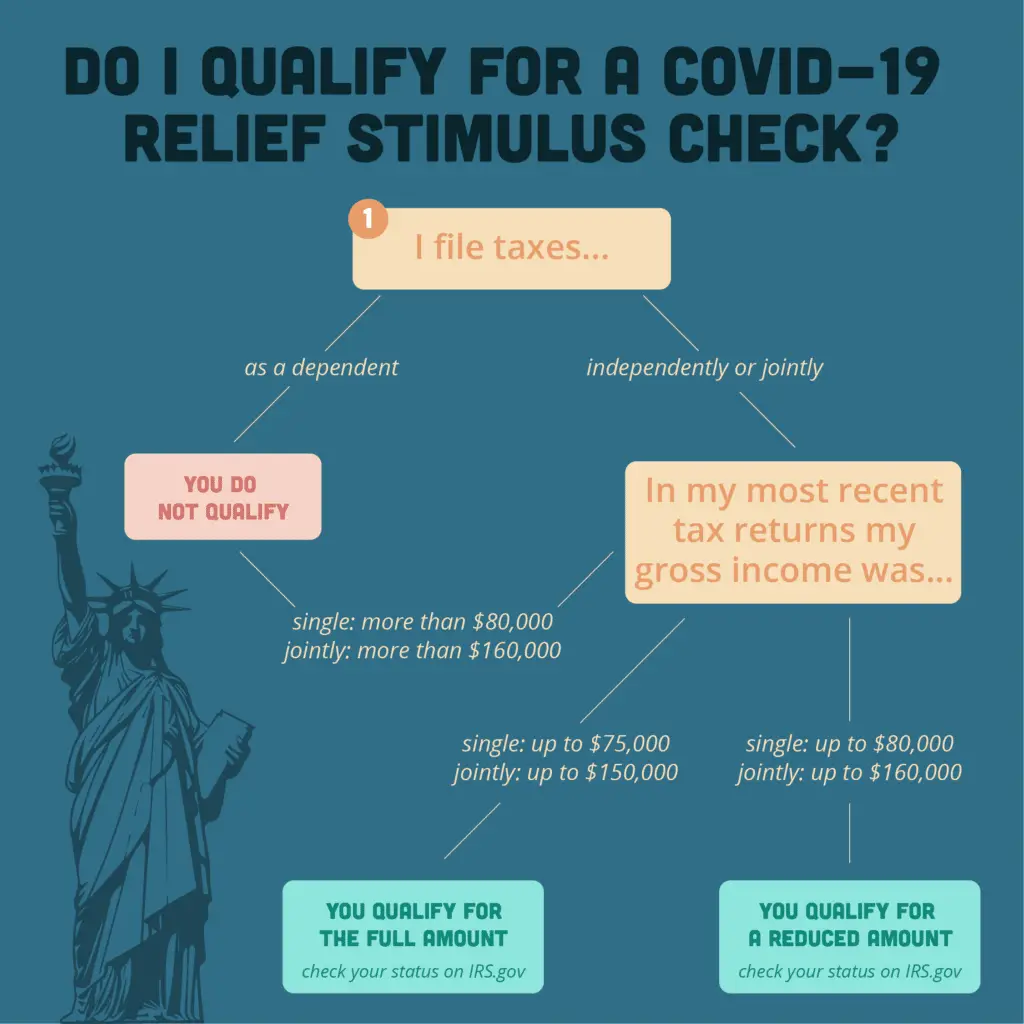

Individual Taxpayers With Agi Of $80000 Or More Aren’t Eligible

The new stimulus check will begin to phase out after $75,000, per the new “targeted” stimulus plan. If your adjusted gross income, or AGI, is $80,000 or more, you won’t be eligible for a third payment of any amount. However, if you make between $75,000 and $80,000, you could get a portion of the check. You’d receive the full amount if your yearly income is less than $75,000. Here’s how to estimate the stimulus check total you could receive.

How Do I Request A Recovery Rebate Credit

You can request a Recovery Rebate Credit for any portion of the stimulus payment that you should have received but didn’t. You do this by filling out line 30 of Form 1040 . The 2020 instructions for Form 1040 and Form 1040-SR include a worksheet you can use to calculate the amount of credit you are eligible for.

Read Also: Track My Second Stimulus Check

What Information Will The Trace Provide Me

The IRS will process your claim for a missing payment in one of two ways:

- If the check was not cashed, they will reverse your payment and notify you. If you find the original check, you must return it as soon as possible. You will need to claim the 2020 Recovery Rebate Credit on your 2020 tax return to receive credit for EIP 1 and EIP 2, and then claim the 2021 Recovery Rebate Credit on your 2021 tax return for EIP 3, if eligible.

- If the check was cashed, the Treasury Departments Bureau of the Fiscal Service will send you a claim package that includes a copy of the cashed check. Follow the instructions. The Treasury Departments Bureau of the Fiscal Service will review your claim and the signature on the canceled check before determining whether the payment can be reversed. If reversed, you will need to claim the Recovery Rebate Credit on your 2020, or 2021 return depending on what EIP payment in reference, if eligible.

What Is The Reason I Did Not Receive A Stimulus Check

There are a few possible reasons you did not receive a payment.

The income requirements for the third round of checks has changed and your earnings could push you above the threshold for a check.

Checks were sent to individuals with an AGI below $75,000, rising to $150,000 for married couples filing jointly and $112,500 for heads of household.

Those who havent filed their tax returns for 2020 will have their 2019 forms used to determine how much they receive.

If you changed bank account in the past year and havent updated your tax files then the money could be sent to the wrong place.

Americans may be struggling to receive stimulus checks because of money sent to the wrong accounts.

Your money could have been picked up by a debt collector such as if you owe money on loans or credit cards.

- Your check is coming by mail

The IRS has prioritized sending checks to those whose direct deposit details it has on file.

How many are owed a stimulus check

A recent report from the Treasury Inspector General for Tax Administration shows that 10million people are still waiting on their stimulus payments.While most received them in form of a paper check and direct deposit, others selected to get them in a debit card.

But many mistook those cards as junk mail and regrettably threw them out.The report by TIGTA said that manually verifying the stimulus claims and debit card policies has delayed the payments for many people.

See the 24 states offering UBI.

You May Like: Who To Contact About Stimulus Check Not Received

Didn’t Get A Stimulus Check Yet Here’s Why You Might Not Qualify

The IRS has been sending waves of third stimulus checks to over 100 million people, but there are still tens of millions who may not get it.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps, operating systems and devices, as well as mobile gaming and Apple Arcade news. Shelby oversees Tech Tips coverage and curates the CNET Now daily newsletter. Before joining CNET, she covered app news for Download.com and served as a freelancer for Louisville.com.

Other reasons could be preventing you from getting a check, too. Here’s everything we know about who is and isn’t qualified for a $1,400 per person stimulus check. Also, here are nine unusual stimulus check facts you didn’t know. This story was recently updated.

File Electronically And Choose Direct Deposit

The amount of the 2021 Recovery Rebate Credit will reduce the amount of tax owed for 2021, or, if it’s more than the tax owed, it will be included as part of the individual’s 2021 tax refund. Individuals will receive their 2021 Recovery Rebate Credit included in their refund after the 2021 tax return is processed. The 2021 Recovery Rebate Credit will not be issued separately from the tax refund.

To avoid processing delays, the IRS urges people to file a complete and accurate tax return. Filing electronically allows tax software to figure credits and deductions, including the 2021 Recovery Rebate Credit. The 2021 Recovery Rebate Credit Worksheet on Form 1040 and Form 1040-SR instructions can also help.

The fastest and most secure way for eligible individuals to get their 2021 tax refund that will include their allowable 2021 Recovery Rebate Credit is by filing electronically and choosing direct deposit.

Anyone with income of $73,000 or less, including those who don’t have a tax return filing requirement, can file their federal tax return electronically for free through the IRS Free File program. The fastest and most secure way to get a tax refund is to file electronically and have it direct deposited contactless and free into the individual’s financial account. Bank accounts, many prepaid debit cards, and several mobile apps can be used for direct deposit when taxpayers provide a routing and account number.

Recommended Reading: How Many Government Stimulus Checks Were There