If The First Two Stimulus Payments Never Showed Up Do This

The IRS is no longer automatically sending out the first and second payments that were approved in 2020. If you believe youre still owed money from either of those payment rounds, your best chance of claiming those funds is to file for the Recovery Rebate Credit as part of the 2020 tax season.

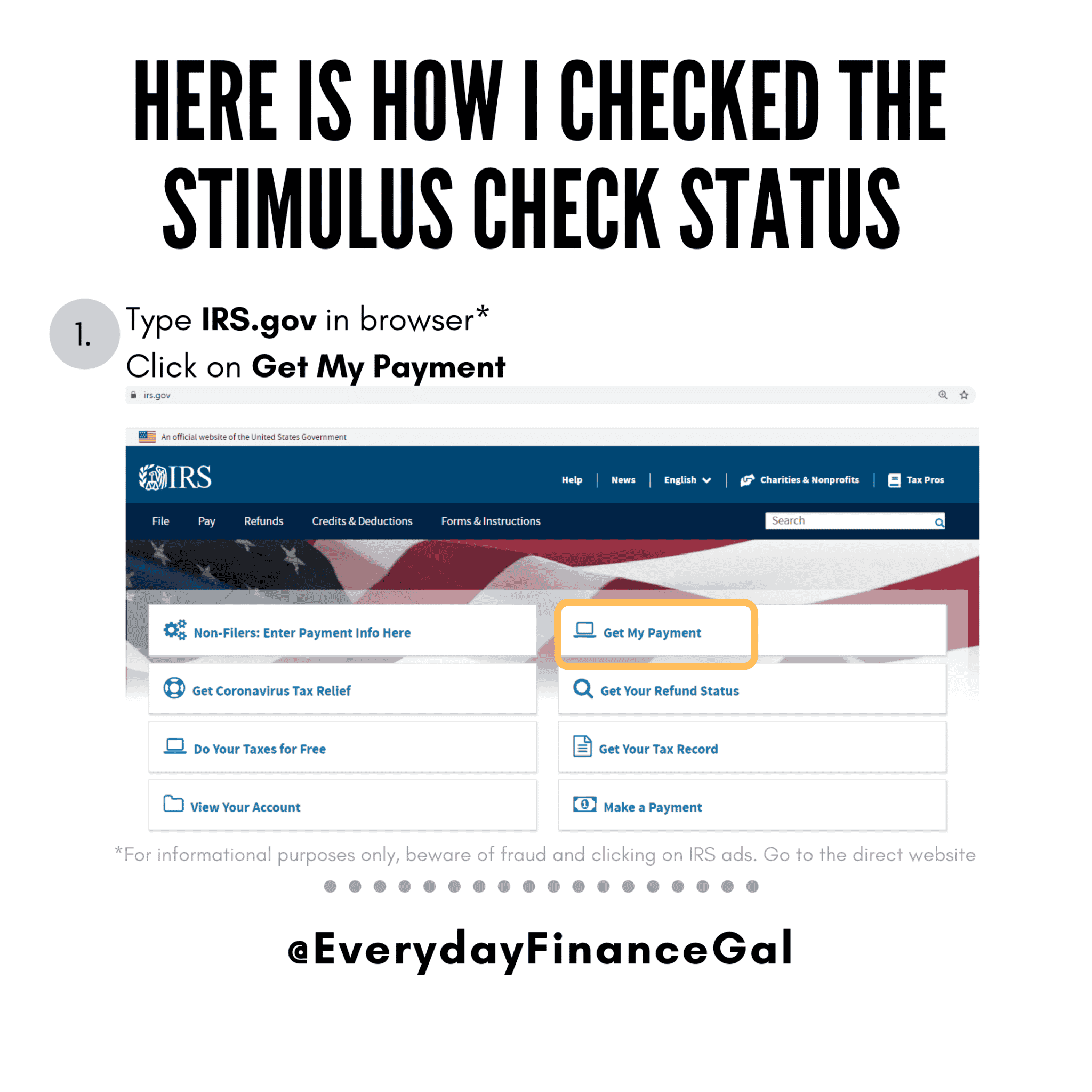

If youre eligible, youll need to know the amount of money the IRS allotted you, which you can find out online or from the letter the agency mailed. The IRS said the updated Get My Payment tracker wont give you information on the first and second checks. Instead, you need to set up and check your IRS account for information on those payments.

Are Social Security Recipients Getting An Extra Check

A benefits boost: $200, plus COLA changesAnyone who is a current Social Security recipient or who will turn 62 in 2023 the earliest age at which an individual can claim Social Security would receive an extra $200 per monthly check. There are some additional tweaks that would boost benefits over the long-term.

Social Security 2017 Trustees Report

On July 13, 2017, the Social Security Board of Trustees released its annual report on the current and projected financial status of the Old-Age and Survivors Insurance and Disability Insurance trust funds.

The combined asset reserves of the OASDI trust funds are projected to become depleted in 2034, the same as projected last year, with 77 percent of benefits payable at that time.

In the 2017 Report to Congress, the trustees also announced:

- The combined trust fund reserves are still growing and will continue to do so through 2021. Beginning in 2022, the total annual cost of the program is projected to exceed income.

- The DI trust fund will become depleted in 2028, extended from last years estimate of 2023, with 93 percent of benefits still payable.

- The projected actuarial deficit over the 75-year long-range period is 2.83 percent of taxable payroll 0.17 percentage point larger than in last years report.

sThe longevity of our programs relies on the accurate, up-to-date data provided in these yearly reports. You can view the full 2017 Trustees Report at www.socialsecurity.gov/OACT/TR/2017/.

Read Also: What’s Happening With The Stimulus Checks

Recipients Of Disability Benefits Who Have Other Sources Of Income

If you receive social security disability benefits and other sources of income that bumps your total income over $75,000, expect a reduction in the amount you receive via a Coronavirus stimulus check. If you are married and filed a joint tax return, expect a similar reduction in the amount of the stimulus check if you and your spouses income exceed $150,000.

The stimulus payments are steadily reduced for individuals and married couples with incomes in excess of $75,000 or $150,000 . In addition, the stimulus payments are phased out entirely for individuals earning in excess of $87,000 and married couples who earned in excess of $174,000.

The income thresholds in the new legislation are much stricter and less generous in comparison to the income thresholds used pursuant to the CARES Act. In the first Coronavirus relief legislation, individuals earning less than $99,000 remained eligible to receive a stimulus check and married couples earning less than $198,000 were able to get a stimulus check.

An Important Update To The Goldberg Kelly Payment Continuation Period

The COVID-19 pandemic has made it more difficult for Supplemental Security Income recipients to file a request for reconsideration within the time required to qualify to continue their benefits. The pandemic has also impacted our ability to receive and process these requests quickly. In recognition of these challenges, we are announcing a change to our procedures for requesting reconsideration following receipt of a Notice of Planned Action , also known as a Goldberg Kelly notice.

SSI recipients who file a reconsideration request more than 15 days after the date of a NOPA, but within 65 days of the date of the NOPA, will receive unreduced benefits unless they waive it in writing. For these cases, we will find that there is good cause for the late filing of the request for unreduced benefits.

Your clients can find more information about our revised procedures at secure.ssa.gov/apps10/reference.nsf/links/10292021100254AM.

Also Check: I Never Got Any Of The Stimulus Checks

Are Social Security Disability Recipients Eligible For Stimulus Checks

Yes, people in both the Supplemental Security Income and SSDI programs are typically eligible to receive the first and second stimulus check. The IRS has stated that these recipients should automatically qualify to receive the second stimulus check, with very few exceptions.

To receive a stimulus check you must have a Social Security number and you cannot be claimed as a dependent on someone elses tax return. Also, your household income must not be greater than the following thresholds: $75,000 single $112,500 head of household or $150,000 married.

Long Beach Social Security Disability Attorneys

If you or a loved one is unable to work due to a disabling injury, medical condition or disease our skilled and experienced Social Security Disability Attorneys are here to help you get the maximum SSDDI benefits for which you qualify.

The Law Office of Cantrell Green is a group of highly qualified and experienced disability attorneys who have obtained millions of dollars in Social Security Disability benefits for thousands of clients in Long Beach, Orange County and the greater Los Angeles. Our attorneys care about every client, and fight tirelessly to obtain the benefits you deserve.

You May Like: What States Are Getting The Fourth Stimulus Check

Was There A Stimulus Check In 2021

Stimulus Update | 2021 $1,400 stimulus payment can be claimed for dead people in 2022. BALTIMORE The American Rescue Plan signed into law by President Joe Biden in March of 2021 delivered $1,400 stimulus checks to most Americans. The money was intended to help people get through the COVID-19 pandemic.

You May Like: How To Claim 2021 Stimulus Check

What If I Receive Social Security Through The Direct Express Debit Card

The IRS says that people who receive government benefits such as Social Security, Railroad Retirement benefits, Supplemental Security Income or Veterans Benefits through Direct Express a debit card that automatically receives payments will get their second stimulus checks deposited onto that card.

But the IRS cautioned, The bank information shown in Get My Payment will be a number associated with your Direct Express card and may be a number you dont recognize.

Dont Miss: Irs Stimulus Payments Check Status

Don’t Miss: Stimulus Check 2021 Irs Status

Information Regarding Economic Impact Payments For Social Security And Ssi Beneficiaries With Representative Payees And People Living In Us Territories

The Social Security Administration issued an update today about COVID-19 Economic Impact Payments to certain groups of Social Security and Supplemental Security Income beneficiaries. Beneficiaries who have their regular monthly payments managed for them by another person, called a representative payee, will begin receiving their EIPs from the IRS in late May.

Special rules apply to beneficiaries living in the U.S. territories: American Samoa, Guam, Puerto Rico, the Northern Mariana Islands, and the U.S. Virgin Islands. In general, the tax authority in each territory, not the IRS, will pay the EIP to eligible residents based on information the IRS will provide to the territories. It is anticipated that beneficiaries in the territories could begin receiving their EIP in early June.

The Social Security Administration has been working with the IRS to provide the necessary information about Social Security and SSI beneficiaries in order to automate and expedite their Economic Impact Payments, said Andrew Saul, Commissioner of Social Security. While millions of our beneficiaries have already received their EIPs from the IRS, we continue to work hard for those beneficiaries who are awaiting their payment from the IRS.

For additional information about payments to beneficiaries with representative payees, please refer to .

The Online Petition For A Fourth Stimulus Check

A Denver restaurant owner has created an online petition on Change.org, asking the US congress to provide people with monthly stimulus checks. The petition has collected as many as three million signatures for the time being.

“Our country is still deeply struggling,” reads the description.

“The recovery hasn’t reached many Americans – the true unemployment rate for low-wage workers is estimated at over 20 percent and many people face large debts from last year for things like utilities, rent and child care.

“I’m calling on Congress to support families with a $2,000 payment for adults and a $1,000 payment for kids immediately, and continuing regular checks for the duration of the crisis.

“Otherwise, laid-off workers, furloughed workers, the self-employed, and workers dealing with reduced hours will struggle to pay their rent or put food on the table.”

You May Like: When Was The Stimulus Checks Sent Out

Which Federal Beneficiaries Are Included

Many federal beneficiaries who filed 2019 or 2020 returns or used the online Non-Filers tool last year were issued Economic Impact Payments, if eligible, during the past three weeks, the IRS said.

The latest update applies to Social Security, Supplemental Security Income, and Railroad Retirement Board beneficiaries who didnt file a 2019 or 2020 tax return or didnt use the Non-Filers tool.

Can I Still Sign Up For A New Direct Express Account

You can sign up for a new Direct Express account at any time to receive monthly federal benefits electronically, but if you dont currently have an account, youll receive your third stimulus check a different way, likely .

If you closed your Direct Express account or theres an error sending money to an inactive account, the payment will be returned to the IRS, which will reissue the stimulus money another way probably via mail sent to your last known address. If you moved, make sure to inform the IRS and USPS of your new address.

To contact Direct Express to enroll in a new account for monthly benefits, call 1-800-333-1795, Monday through Friday from 6 a.m. to 4 p.m. PT . Note that Direct Express representatives may not be able to answer stimulus check questions.

If you have missing stimulus money for yourself or your dependents, you need to claim it when you file your tax return.

Don’t Miss: Stimulus Checks For Healthcare Workers

New Information For Kansans Who Have Representative Payees Who Live In Residential Facilities And/or Are Medicaid Recipientssee Full Information At The Bottom Of This Page

– Representative payees do NOT have legal authority over economic impact payments, as they are not Social Security benefits.

– The payments are NOT meant to be used by group homes or nursing homes for your care.

– This payment will NOT affect your current or future eligibility for Medicaid, SNAP, SSI, Subsidized Housing or TANF, as long as it is spent with the next year. See all new questions and answers at the bottom of this page or on page 3 of the PDF.

How And When Will I Receive The Payment

– If you filed taxes in 2018 or 2019, you can check your payment status at , and you can choose to receive your payment as direct deposit or check if the payment has not been sent yet. – If you are an SSI or SSDI recipient, your payment will come through direct deposit, Direct Express debit card, or a paper check whatever method your SSI or SSDI benefits are normally received. – You can see if your payment has been delivered and to which bank account it was sent, and when you can expect to receive your payment at. Information for SSI or SSDI recipients is not available at this site yet, but according to the federal government, those payments are expected to arrive before early May 2020.

Read Also: When Did They Send Out The Third Stimulus Check

What If I Receive Both Social Security And Ssi

If you received Social Security benefits before May 1997, or if you receive both Social Security and SSI, the payment schedule is different. Instead of getting your payments on a Wednesday, you’ll receive your Social Security payment on the third day of each month and your SSI on the first day of each month.

However, those payment dates change if the first or third day of the month falls on a weekend. For instance, Oct. 1 fell on a Saturday this year, so SSI recipients received their October payments a day early on Sept. 30 and their Social Security payment on Monday, Oct. 3. The same will apply in December for January 2023 payments.

How Can I Find Out If My Social Security Office Is Open

Date: April 7, 2022

Local Social Security offices are offering more in-person appointments and have resumed in-person service for people without an appointment. As we expand in-person service, we strongly encourage you to continue to go online, call us for help, and schedule appointments in advance.

- How to get help from Social Security, including online and the best times to call.

- What you should know before you visit a Social Security office, so we can help you safely.

- Options that could help you have your hearing sooner if you are appealing a decision.

- The small number of offices that temporarily:

- may provide service only by appointment due to construction, inability to permit people to wait outside the office, or other reasons.

- may be closed to the public.

You May Like: Irs.gov 2nd Stimulus Check

Heres When Social Security Recipients Get Their Stimulus Check

When do Social Security recipients get their stimulus checks?

Heres what you need to know.

Stimulus Checks

If you receive Social Security – including retirement, survivors or disability – or receive Supplemental Security Income , you may be wondering how and when you will receive a stimulus check, or Economic Impact Payment, under the CARES Act. The CARES Act is the $2.2 trillion stimulus package to help provide financial assistance in the wake of COVID-19. . The process may be confusing, so its important to make sure you understand clearly when you can expect a stimulus check. Heres the breakdown.

Social Security Benefits To Increase In 2018

When we announce the annual cost-of-living adjustment , theres usually an increase in the Social Security and Supplemental Security Income benefit amount people receive each month. By law, federal benefit rates increase when the cost of living rises, as measured by the Department of Labors Consumer Price Index .

The CPI-W rises when prices increase, making your cost of living go up. This means that prices for goods and services are, on average, a little more expensive. The COLA helps to offset these costs. As a result, monthly Social Security and SSI benefits for more than 66 million Americans will increase2.0 percent in 2018.

Other changes that will happen in January 2018 are based on the increase in the national average wage index. For example, the maximum amount of earnings subject to Social Security payroll tax will increase to $128,400. The earnings limit for workers younger than full retirement age will increase to $17,040, and the limit for people turning 66 in 2018 will increase to $45,360.

For information about the 2018 COLA, visit www.socialsecurity.gov/cola.

Recommended Reading: When Are The Next Stimulus Checks Going Out

Also Check: How To Recover Stimulus Check

Why You Did Not Qualify For A Stimulus Check

Several people have commented that they have not received or not gotten the correct amount on their stimulus checks. The IRS has provided the following reasons

- Your adjusted gross income in your most recent tax filing approved by the IRS was greater than than the limits shown above, which are $99,000 $136,500 $198,000

- You CANNOT be claimed as a dependent on someone elses return. This includes as a child child, student or older dependent.

- You dont have a valid Social Security number and/or are a nonresident alien.

- You filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019. These are quick filing forms, but you need a standard filing

Donât Miss: What Was The First Stimulus Check Amount

Someone Filed An Unemployment Claim Using My Information And It Wasnt Me What Can I Do

Date: January 6, 2021

The Financial Crimes Enforcement Network has identified multiple fraud schemes in which filers submit applications for unemployment insurance benefits using other peoples information. Receiving unemployment benefits could affect the amount of monthly benefits you receive. If you believe you are a victim of this fraud scheme:

- Contact your appropriate State fraud UI hotline to report the fraud. The Department of Labor has phone numbers for each state fraud hotline.

- When you report the fraud, request that they provide you with written documentation that you have reported the alleged fraud. At a minimum, request a case number for your fraud report, and write down the case number, the name of the person you spoke to, and the time and date of your call.

- Retain this information, along with any written confirmations, to ensure you can provide evidence that you reported the fraud if you need it later.

- If you receive Supplemental Security Income benefits, and you suspect UI fraud, contact your local Social Security Office immediately.

Also Check: How To Get Stimulus Check Without Filing Taxes

I Received A Letter From Social Security That Says My Supplemental Security Income Payment Will Change Unless I File An Appeal How Can I File This Appeal

Date:

You can file an appeal by taking one of the following actions.

Online at SSA.gov

The quickest and easiest way to file an appeal is online at our Appeal a Decision page. Select Reconsideration and then the Request Non-Medical Reconsideration button. Follow the instructions on the screens to complete and submit the appeal electronically.

Send Us a Form by Mail or Fax

You may also download, complete, and print the form Request for Reconsideration and then mail the completed form to your local Social Security office. You can find the local office fax number and address from the Social Security Office Locator page by entering your ZIP code.

If you still have questions about filing an appeal on online, by mail, or fax, please call us at 1-800-772-1213 or call your local office. You can find the telephone number for your local office in the letter we sent you or by going to the Social Security Office Locator page and entering your zip code. We can answer your questions and send you the appropriate appeal request form to complete and send back to us.