Tracking The Status Of Illinois Tax Rebates

If you qualify for one or both of the Illinois tax rebates, but youre still waiting for your money to arrive, you can check the status of your payment using the Wheres My Rebate? tool on the Illinois Department of Revenues website .

To use the online tool, youll need to provide your:

- Social Security number or taxpayer identification number and

- Adjusted gross income as reported on your 2021 Illinois income tax return or property tax rebate form, or your Illinois PIN number.

If you filed a joint Illinois income tax return with your spouse, try using the information for your spouse if you dont get a response using your information.

You can also call the Department of Revenue or email them to get a rebate status report.

You May See A ‘payment Status Not Available’ Message

Don’t be alarmed if the Get My Payment tool gives you a message that says “Payment Status Not Available.” You may see this message until your payment is processed, according to the IRS. So you may not have to do anything.

But it could also mean you’re not eligible for a payment. So you may want to double-check your eligibility and plug your numbers in our stimulus check calculator to see whether you’re due money.

Wondering Where The Latest Economic Impact Payment Is Heres How To Track Your Stimulus Check And What To Do If You Have Problems

Almost everyone who is eligible has received the first and second rounds of the U.S. governmentâs economic impact payments, or âstimulus funds.â But the third roundâpart of the American Rescue Plan Act of 2021âmay provide additional relief to eligible individuals.

The IRS started processing payments in mid-March. Your payment might already be in your account or on its way. But if itâs not, donât worry. The funds could take time to roll out. Hereâs how you can check the status of your payment.

Read Also: How To Know If You’re Eligible For Stimulus Check

How To Check The Status Of My Stimulus Payment

President Biden Signed The American Rescue Plan Into Law On Thursday, March 11th. Checks Could Start Being Sent This Coming Weekend. The First Group Of Checks Will Be Issued To Those That Have Their Bank Information Registered With The IRS.

The Internal Revenue Service Will Allow Qualified Americans To Check The Status Of Their Third Economic Impact Payment . The One-Time Payment Of $1400 For Individuals, And $2800 For Couples. The Income Threshold Is $180,00 For Married Couples And $80,000 For Individual Filers. There Is Also A Child Tax Credit Of Up To$3,600 per child.

If You filed A 2019 Or 2020 Tax Return.

- The IRS Portal Will Allow Taxpayers To Check the Status Of Their Stimulus Payments.

- Confirm Your Payment Type .

- Ability To Enter Bank Account Information.

If You Did Not File A 2019 Or 2020 Tax Return

For Eligible Non-Filers

- You Did Not File a 2018 Or 2019 Federal Income Tax Return Because Your Gross Income Was Under $12,200 .

- You Werent Required To File A 2019 or 2020 Federal income Tax Return For Other Reasons.

Website Info

Here Are Some Key Things To Know About This Tool And Who Can Use It

- Before using the tool, people must verify their identity by answering security questions.

- If the answers do not match IRS records after multiple attempts, the user will be locked out of the tool for 24 hours. This is for security reasons. Those who can’t verify their identity won’t be able to use Get My Payment. If this happens, people should not contact the IRS.

- If the tool returns a message of “payment status not available,” this may mean the IRS can’t determine the person’s eligibility for a payment right now. There are several reasons this could happen. Two common reasons are:

- A 2018 or 2019 tax return is not on file and the agency needs more information or,

- The individual could be claimed as a dependent on someone else’s tax return.

Recommended Reading: Who Qualified For Stimulus Check 2021

How To Claim Your $1400 Stimulus Check In 2022

- 10:37 ET, Dec 29 2021

SOME Americans can claim a $1,400 stimulus check in the new year.

However, there is specific criteria to follow to receive the cash in 2022.

The new payment will go out to people who were eligible for the third round of stimulus checks that went out earlier this year, but haven’t yet received them.

The last lot of checks are due to go out when eligible taxpayers file their 2021 tax return next year.

How Can I Check The Status Of My Stimulus Payment

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

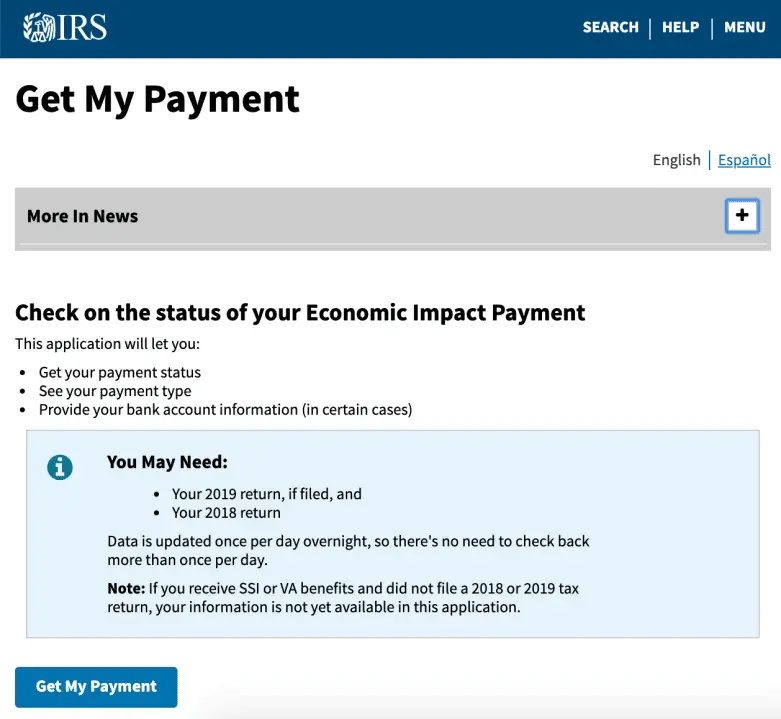

You can track the status of your payment via the I.R.S.s Get My Payment tool. Be aware that the volume of users sometimes overwhelms the site.

Also Check: Get My Stimulus Payment Phone Number

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Whats The First Step To Take

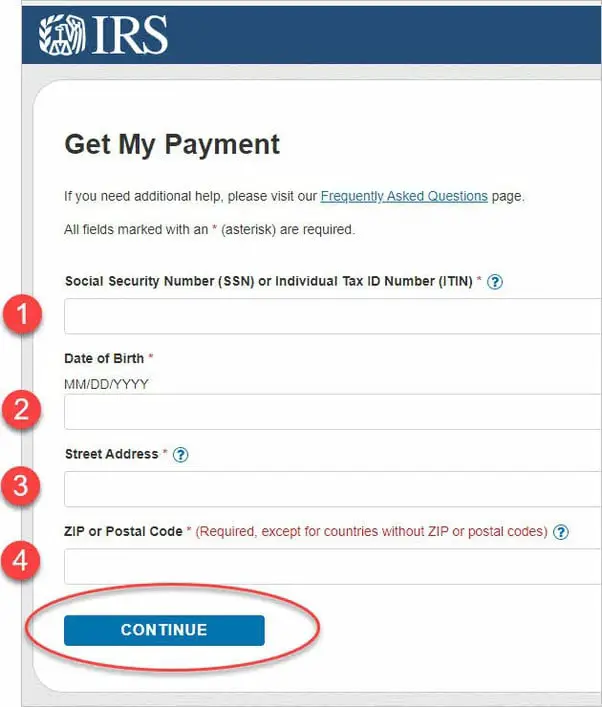

First, you need to log into the Internal Revenue Services Get My Payment tool.

Youll be able to find out when the IRS sent out your check, how much it should be, how itll be paid if theres a delay and more.

To use it, youll need your Social Security Number or Individual Tax ID Number .

If youve forgotten your SSN or need a new card, see how you can get a replacement on the official SSN website.

Youll also need to enter your date of birth and address.

Also Check: Irs Tax Stimulus Checks Second Round

Stimulus Checks Could Be Seized To Cover Past Due Debt

If you owe child support or other debts, your first check was seized to cover those debts. The third check is subject to being taken by private debt collectors, but not the state or federal government. The same goes for the second payment, too, if you’re claiming missing money in a recovery rebate credit. You may receive a notice from the Bureau of the Fiscal Service or your bank if either of these scenarios happens.

In the case of the third check, we recommend calling your bank to confirm the garnishment request from creditors and ask for details about how long you have to file a request with a local court to stop the garnishment. If you think money has already been mistakenly seized from the first two checks, you can file a recovery rebate credit as part of your 2020 tax return — but only if you filed a tax extension.

You can track down your stimulus payment without picking up the phone.

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Read Also: Set Up Direct Deposit For Stimulus Check

Recommended Reading: Didn’t Get Stimulus Payment

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

You May Like: I Didn’t Receive My Third Stimulus Check

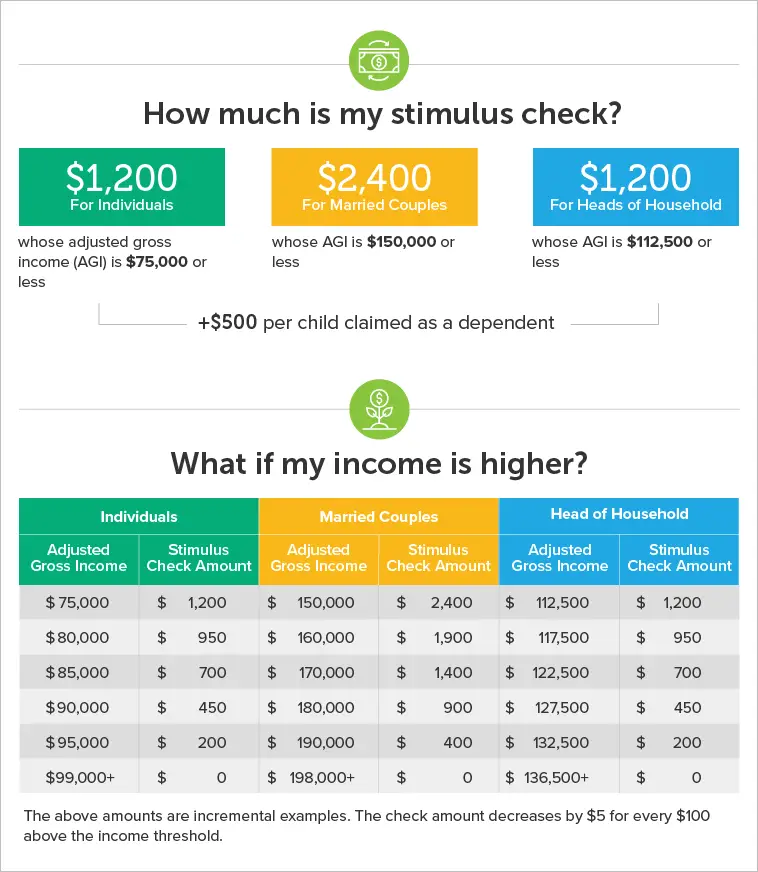

$1200 Stimulus Checks: The First Round Of Payments

From the original CARES Act, the maximum payment for an individual is $1,200 . Most people will get the full amount, however, some will get less. The amount of your stimulus check is based on the most recent federal tax return you filed with the IRS . Additionally, households can receive an extra $500 for each qualified dependent child.

What To Do If The Irs ‘needs More Information’

If the Get My Payment tool gave you a payment date but you still haven’t received your money, the IRS may need more information. Check the Get My Payment tool again and if it reports “Need More Information,” this could indicate that your check has been returned because the post office was unable to deliver it, an IRS representative told CNET. Here are more details on how the tracker tool works and what the messages mean.

You May Like: Update On 4th Stimulus Check For Ssi

What Is The Earned Income Tax Credit

The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit, which has been available for decades and is aimed at helping low-income workers. Prior to the legislation, childless workers between 25 to 64 could only get up to $538, but the pandemic law boosted that to $1,502.

The law also increased the amount that can be claimed by working families with children, increasing it to as high as $6,728 for parents with three children.

Most people can claim the EITC if they earn under $21,430 for single taxpayers or $27,380 for married people filing jointly.

When You’ll Receive Your Payment

The final date to qualify has already passed for filers other than those with pending ITINs. If you have already filed, you don’t have to do anything.

If you have not received a payment by now, you will most likely receive a paper check. In addition, if you did not receive a refund with your tax return or owed money at the time of filing, you will receive a paper check.

Payments will go out based on the last 3 digits of the ZIP code on your 2020 tax return. Some payments may need extra time to process for accuracy and completeness. If your tax return is processed during or after the date of your scheduled ZIP code payment, allow up to 60 days after your return has processed. Please allow up to three weeks to receive the paper checks once they are mailed out.

| Last 3 digits of ZIP code | Mailing timeframes |

|---|

Don’t Miss: Updates On The 4th Stimulus Check

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Don’t Lose The Irs Letter That Confirms Your Stimulus Payment

If the IRS issues you a stimulus check, it sends a notice by mail to your last known address within 15 days after making the payment to confirm delivery. The letter contains information on when and how the payment was made and how to report it to the IRS if you didn’t receive all the money you’re entitled to. You’ll need to reference this information if you don’t receive your full payment and need to claim your money later. Here’s how to recover the information if you lost or tossed the letter.

Recommended Reading: Claiming Stimulus Check On Taxes 2021

How To Get Missing Funds From Previous Stimulus Payments

If you’re certain you meet the qualifications to receive the first or second stimulus check, what to do next depends on your situation.

If you never got your money or a confirmation letter from the IRS that your payment was sent, you needed to file for the money on your tax return this year. We’ve got full instructions for how to file for your recovery rebate credit here, but basically, you’ll use the 2020 Form 1040 or Form 1040-SR to claim a catch-up payment. However, the last day to file your taxes has passed, so this will only work for those who filed a tax extension.

The tax return instructions include a worksheet to figure out the amount of any recovery rebate credit for which you’re eligible, according to the IRS. If you’re part of a group that doesn’t usually file taxes , you’ll still need to file this year. You should also save your IRS letter — Notice 1444 Your Economic Impact Payment — with your 2020 tax records, as you’ll need it to file the claim.

You can also file for a Recovery Rebate Credit if you didn’t receive the correct amount of money for your child dependents in your first or second check. The same goes for parents of 2020 babies .

What To Know About Adding Your Direct Deposit Details

You can’t use the Get My Payment tool to sign up for a new account or correct details about your payment. Even if the IRS is unable to deliver your payment to a bank account and the money is returned to the government, you won’t be able to correct the details online — the IRS says it will send the money again by mail.

The extended tax deadline was May 17. With the agency’s delay in processing tax returns, trying to register for a new direct deposit account with your 2020 tax return won’t get you into the system quickly enough. However, if you haven’t submitted your taxes yet, signing up for a new direct deposit account could still get you IRS money faster in the future, such as tax refunds or the upcoming child tax credit.

You May Like: Contact Irs About Stimulus Check

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.