All Third Economic Impact Payments Issued Parents Of Children Born In 2021 Guardians And Other Eligible People Who Did Not Receive All Of Their Third

IR-2022-19, January 26, 2022

WASHINGTON The Internal Revenue Service announced today that all third-round Economic Impact Payments have been issued and reminds people how to claim any remaining stimulus payment they’re entitled to on their 2021 income tax return as part of the 2021 Recovery Rebate Credit.

Parents of a child born in 2021 or parents and guardians who added a new qualifying child to their family in 2021 did not receive a third-round Economic Impact Payment for that child and may be eligible to receive up to $1,400 for the child by claiming the Recovery Rebate Credit.

While some payments of the Economic Impact Payments from 2021 may still be in the mail, including, supplemental payments for people who earlier this year received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns. The IRS is no longer issuing payments as required by law. Through December 31, the IRS issued more than 175 million third-round payments totaling over $400 billion to individuals and families across the country while simultaneously managing an extended filing season in 2021.

The American Rescue Plan Act of 2021, signed into law on March 11, 2021, authorized a third round of Economic Impact Payments and required them to be issued by December 31, 2021. The IRS began issuing these payments on March 12, 2021 and continued through the end of the year.

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Haven’t Gotten Your Third Stimulus Yet Here’s What To Know

On Wednesday, April 21st, the IRS sent out another round of stimulus checks to 2 million people marking 161 million recipients of stimulus checks, at a total of $379 billion, in six separate rounds of payments. But 161 million people is not everybody and in fact, many people are still waiting for their stimulus checks to hit their bank accounts or arrive in the mail.

Heres what to know about continued payment rollouts, those plus-up payments if the IRS underpaid you for your stimulus check, how long the IRS has to send all of the stimulus checks, and what to do if you still havent gotten your payment.

You May Like: 4th Stimulus Check For Single Person

Filing A Payment Trace To Find Missing Stimulus Money

You can request an IRS payment trace if you received the confirmation letter from the IRS that your payment was sent , or if the Get My Payment tool shows that your payment was issued but you have not received it within certain time frames. This is the case for all three checks. Check out our guide to requesting an IRS Payment Trace here.

Third Stimulus Check: There’s Still Time To Claim Payment Worth Up To $1400 Per Person

As part of the relief package, all Californians with a registered vehicle would receive $400 tax rebates on a debit card, but when can taxpayers expect to see that money if the plan gets approved?

There’s still time to claim a third stimulus payment worth up to $1,400 per person.

Eligible taxpayers who didn’t receive the payment or may be due more money than they initially received are allowed to claim a tax credit on their 2021 federal tax return by the April 18 deadline.

The vast majority of the third stimulus payments were automatically delivered to taxpayers’ bank accounts or via a check in the mail last spring. The payments were authorized by the American Rescue Plan in March 2021 and were meant to help people struggling financially because of the Covid-19 pandemic.

But the payments were calculated last year based on the most recent federal tax return on file at the time. If a taxpayer’s income or family size changed in 2021, the individual may be eligible for more money.

Other people may have missed out on the stimulus payment altogether. Those with incomes so low they don’t have to file taxes may have never received their payment because the Internal Revenue Service did not have their information.

Also Check: How Much Was Each Stimulus Check

Do College Students And Adult Dependents Qualify For Stimulus Payments

Yes. Adult dependents, including college students and disabled adults, may receive up to $1,400. But their eligibility for payment and the amount theyll receive will depend on the adjusted gross income of the person who claims them on their taxes. See the question above for income limits and phase-out details.

How Much Are The Payments Worth

The third round of stimulus payments is worth up to $1,400 per person. A married couple with two children, for example, can receive a maximum of $5,600.

Families are allowed to receive up to $1,400 for each dependent of any age. Earlier rounds limited the payments to dependents under the age of 17.

Generally, low- and middle-income US citizens and US resident aliens are eligible for either a full or partial third-round stimulus payment.

Individuals earning less than $75,000 of adjusted gross income, heads of households earning less than $112,500 and married couples earning less than $150,000 are eligible to receive the full amount of $1,400 per person.

But the payments gradually phase out as household income increases. Individuals who earn at least $80,000 a year of adjusted gross income, heads of households who earn at least $120,000 and married couples who earn at least $160,000 are not eligible for any money regardless of how many dependents they have.

Undocumented immigrants who dont have Social Security numbers are not eligible for the payments. But their spouses and children are eligible as long as they have Social Security numbers.

Also Check: What Was The First Stimulus Check Amount

How To Claim Your Missing $600 Or $1200 Payments

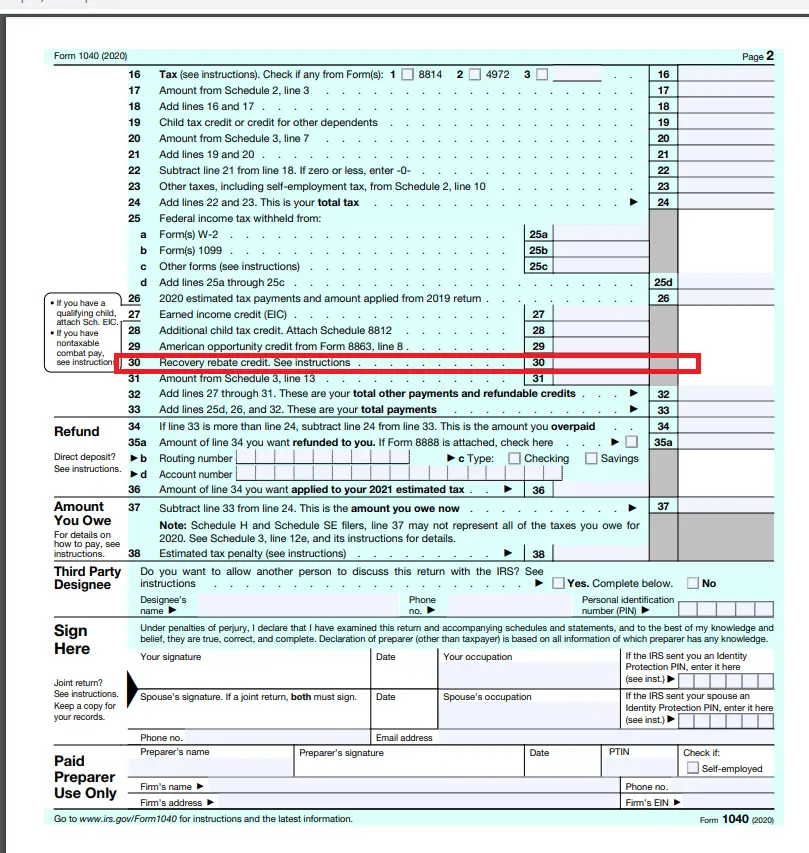

The stimulus checks are generally advance payments of a tax credit.

The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first $1,200 stimulus check or the second $600 payment if that money is due to you line 30 of Forms 1040 or 1040-SR.

On that part of the return, filers can start with the amount of stimulus money they already received and calculate any more funds which they are due. That can be done either through a worksheet provided with the tax form or through tax preparation software.

More from Personal Finance:

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

You May Like: Will There Be Another Federal Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

The Latest On $1400 Stimulus Checks

This tax season, the government is also issuing a third tranche of third stimulus checks for up to $1,400 per individual, plus $1,400 per eligible dependent.

Last week, the IRS and other agencies said about 127 million checks have been sent to date, for a total of approximately $325 billion.

Those $1,400 payments are generally based on 2019 or 2020 tax returns, whichever was most recently filed and processed by the IRS. Those who used the IRS non-filer tool last year should also automatically get their payments.

There are also advantages to filing a 2020 return in order to receive the $1,400 payment, according to the IRS.

If your income dropped from 2019 to 2020, you could be eligible for a larger payment. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed.

Filing a 2020 tax return also lets you update your direct deposit information.

This tax season, non-filers are also required to file a tax return in order to get their payment, provided they have not already submitted their information to the government.

Of note, people who receive federal benefits such as Social Security, Supplemental Security Income, Railroad Retirement Board and Veterans Affairs will generally receive their stimulus checks automatically, though there have been delays in processing some of those payments.

Also Check: How To Check Eligibility For Stimulus Check

What Is A Plus

A plus-up supplemental payment is a new or larger payment you may be eligible to get if you recently submitted your 2020 tax return and your income or number of dependents changed.

For example, if you received a partial third stimulus payment based on your 2019 income, but your income declined in 2020, you may receive another payment to make up the difference between the two amounts. Your original third stimulus payment and your plus-up payment together will equal the amount youre eligible to receive based on your 2020 tax return.

On April 1, the IRS announced that new payment batches include supplemental payments for these people. As of late June 9, more than 8 million plus-up payments have been issued.

Im Not A Us Citizen Will I Be Eligible For A Stimulus Payment

You may be eligible. Much like the last round of stimulus payments, if you have a Social Security number, theres a good chance you fall into one of the classifications for immigrants who qualify for a payment.

If you do not have a Social Security number but your spouse is an active duty military member, you may still receive the full $2,800 .

You May Like: Number For Irs Stimulus Check

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

You May See A ‘need More Information’ Message

According to the IRS FAQ, a Need More Information message in the Get My Payment tool means your payment was returned because the US Postal Service wasn’t able to deliver it.

The FAQ says you’ll be able to have your payment reissued as a direct deposit by providing a bank routing and account number, a prepaid debit card or a financial service account that has a routing and account number associated with it. The FAQ says you can also update your mailing address to receive your payment.

Also Check: Are We Going To For Stimulus Check

Individual Taxpayers With Agi Of $80000 Or More Aren’t Eligible

The new stimulus check will begin to phase out after $75,000, per the new “targeted” stimulus plan. If your adjusted gross income, or AGI, is $80,000 or more, you won’t be eligible for a third payment of any amount. However, if you make between $75,000 and $80,000, you could get a portion of the check. You’d receive the full amount if your yearly income is less than $75,000. Here’s how to estimate the stimulus check total you could receive.

Changes Increase Electronic Payments Speed Relief To Americans Answers To Common Questions

FS-2021-05, March 2021

WASHINGTON The Internal Revenue Service and the Treasury Department are disbursing the third round of Economic Impact Payments to the public as rapidly and securely as possible.

These payments were authorized by Congress in the American Rescue Plan Act, enacted on March 11, 2021. For those who haven’t received a payment yet, here are answers to some common questions about this set of stimulus payments, which differ in some ways from the first two sets of stimulus payments in 2020, referred to as EIP1 and EIP2.

Read Also: How Many Stimulus Checks So Far

What The Online Get My Payment Tool Can’t Tell You

The IRS tool won’t give you hourly updates — the status information is updated once daily — nor will it tell you how much stimulus money you’re getting or provide details on the first two stimulus checks approved in 2020. You won’t find steps for what to do if you run into payment problems.

The IRS doesn’t want you to call if you have payment trouble. The agency says its representatives don’t have information beyond what’s shown in the tool. Here’s what we recommend doing to address a stimulus issue.

Another way to find out more info on your third payment is to create an IRS account online. If you are sent a plus-up payment after your 2020 tax return is processed, you should see the amount of your plus-up payment with your online account.

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

Read Also: Is There Another Stimulus Check Coming Out Soon

Is My Stimulus Payment Being Mailed Or Sent Direct Deposit

The IRS will send payments by direct deposit, paper check, and prepaid debit cards. They will likely deliver your third stimulus the same way you received the previous stimulus or your tax refund.

To ensure you receive the stimulus payment by direct deposit, file your 2021 tax return and choose direct deposit for your refund delivery method. If youve received your refund by direct deposit in prior years, filing your 2021 return now gives you the opportunity to verify your bank account information .

When the second stimulus checks were delivered, an IRS error caused some payments to be returned. This issue has been resolved and will not impact how your third stimulus is delivered.

How Many More Checks Will The Irs Issue

The last batch of payments was only the latest to be rolled out by the IRS. According to the IRS, there are plans to continue issuing the Economic Impact Payments to those who qualify on a weekly basis. That means there will be more batches of payments that roll out in the near future.

That said, the IRS is focusing on getting payments to eligible individuals whose information was not previously on file with the IRS. This includes people who do not regularly file tax returns, or those who received smaller payments than they should have qualified for. Those supplemental payments are known as “plus-up” payments, and will be distributed as the IRS processes 2020 tax returns and determines those who are qualified to receive them.

Plus-up payments are primarily expected to roll out to Americans who saw their income reduced in 2020. This could include those who lost their jobs, had a child, got married, or could no longer be claimed as a dependent last year.

Recommended Reading: $2 000 Monthly Stimulus Check Update

Never Got Your Stimulus Payment The Irs Is Here To Help

Here’s What You Need to Remember: Fortunately, if your direct deposit never arrived and you never cashed your initial stimulus check, the IRS will mail you a replacement. The agency claims that this will on average take another six weeks, although the offices staffing shortages and the ongoing mailing of stimulus checks and plus-up payments could delay it longer.

It has now been more than two months since the March 2021 American Rescue Plan Act sent out the third round of $1400 stimulus checks.

In this case, it might be useful to request a payment trace from the IRS. Heres how.

1) Make Sure You Qualify

Before engaging the services of the IRS, its helpful to make sure that you qualify for payments.

Depending on your circumstances, you might also qualify for additional payments. The IRS has begun issuing plus-up payments supplementing the regular stimulus check, based on your 2020 tax return. If you had a child during the pandemic, for instance, you probably qualify for a plus-up payment.

2) Use the Get My Payment Tool

The IRS has provided a web tool updating users on the status of their stimulus checks. To use it, you need to enter your Social Security number, your address, and your date of birth. Once this is done, the IRS will display the status of your check and whether it has been dispatched or not.

3) Wait

To keep people from delaying them with unnecessary requests, the IRS has requested that a waiting period be observed before a payment trace is requested.