Why Are So Many People Missing Their Stimulus Checks And Child Tax Credits

To receive stimulus funds, Americans were required to file a tax return, regardless of income level. In normal years, those earning under a certain threshold are not required to file. But to ensure proper distribution of funds, the IRS asked that everyone file a return. For those with no permanent address or bank account or who did not file taxes, funds may have been misdirected or not distributed at all.

“Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower incomes, limited internet access, or experiencing homelessness,” the GAO report stated.

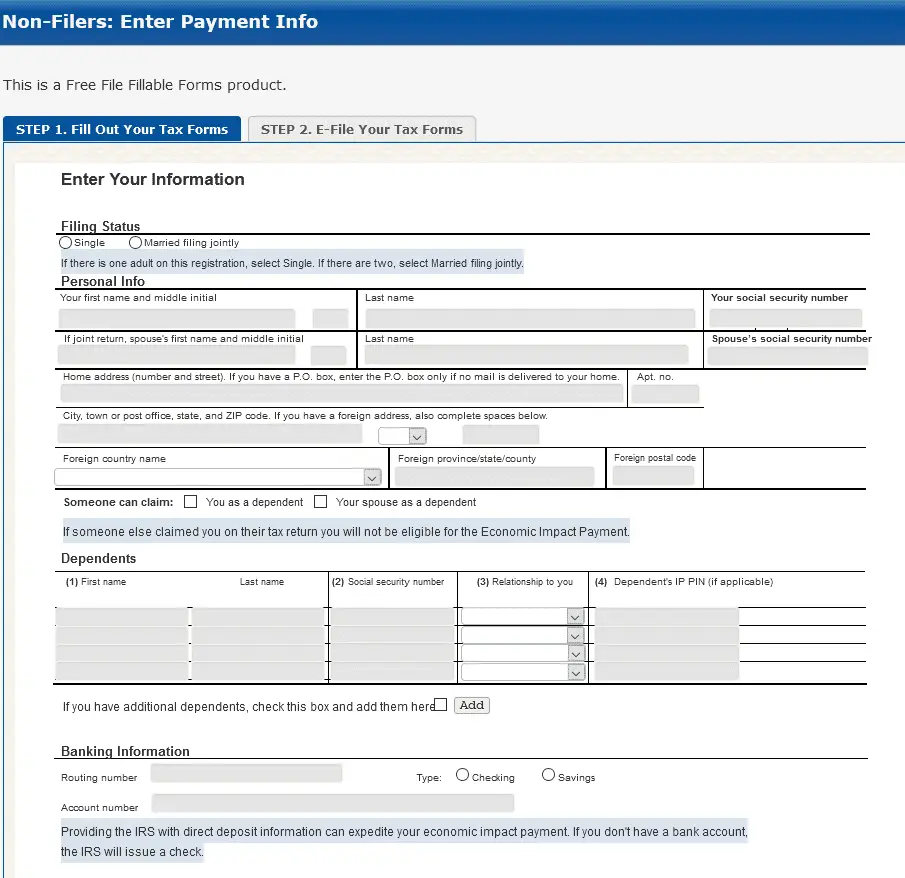

Fill Out Income And Personal Identification Information

STEP 2 E-file your tax forms, requests both required and optional information.

Required:

- Personal verification: The form asks for your 2019 Adjusted Gross Income. If you did NOT file taxes last year, enter 0 in the box. Ignore part B which asks for last years self-selected signature PIN.

- Electronic signature: Instead of signing your name, your signature is a 5-digit PIN number that you create.

Note: these fields are required for you and your spouse if you are married filing jointly.

Optional:

- Cell phone number

- Drivers license or state issued ID number, state, issue date, and expiration date leave blank if you dont have one

Who Should Not Use The Non

Anyone who already filed either a 2018 or 2019 return does not qualify to use this tool. Similarly, anyone who needs to file either a 2018 or 2019 return should not use this tool, but instead they should file their tax returns. This includes anyone who files a return to claim various tax benefits, such as the Earned Income Tax Credit for low-and moderate-income workers and working families.

The IRS also has seen instances where people required to file a Form 1040 for 2019 are trying to use the Non-Filers tool. The IRS urges people with a filing requirement to avoid complications later with the IRS, and file properly without using the Non-Filer tool.

Students and others who file a return only to receive a refund of withheld taxes should also not use this tool. In addition, students and others claimed as dependents on someone else’s tax returndon’t qualify for an Economic Impact Payment and are not eligible to use the Non-Filers tool.

For more Information on Economic Impact Payments, including answers to frequently-asked questions and other resources, visit IRS.gov/coronavirus.

Don’t Miss: Who Qualified For 1400 Stimulus Check

Most People Who Qualify Under The Cares Act Should Receive Their Payment Automatically But Some May Need To Submit Their Information To The Irs To Receive Their Economic Impact Payment

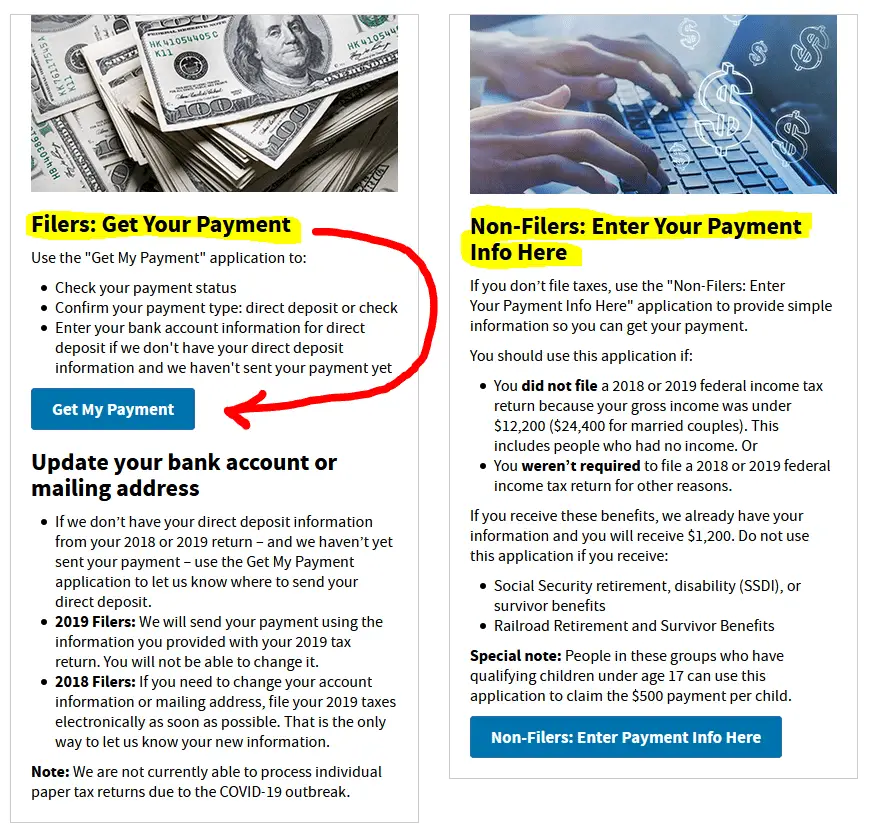

As a result of the hardships presented by the coronavirus, Economic Impact Payments are being issued by the Internal Revenue Service. While most people will receive their payment automatically, there are some cases where non-filers will need to take action and submit their information to the IRS.

The best way to submit your info to receive the payment is through the IRS Non Filers Enter Payment Info portal. There, youll choose how you want to receive your payment. The fastest way to receive payment is through direct deposit, either to your bank or credit union account, or to an eligible prepaid card.

Snap And Medicaid Agencies Can Reach About 9 Million Eligible People Not Receiving Automatic Payments

We estimate that approximately 9 million of the 12 million people who wont automatically receive the payments receive state- or county-administered benefits such as SNAP or Medicaid, a fact that underscores the key role for state government in reaching this group. They have low incomes and are among those who most need the payments to cover essential expenses. The payments for which they qualify, worth a combined $9 billion, represent a significant sum both individually and collectively. In Alabama and North Carolina, for example, their payments total an estimated $209 million and $324 million, respectively, or nine toten times the amount of basic cash assistance those states provide annually through their Temporary Assistance for Needy Families programs , our estimates suggest.

While many SNAP and Medicaid recipients file federal income tax returns and hence will receive their payments automatically, state agencies are the primary organizations able to reach those who dont file. State agencies are uniquely placed to use existing contact information to alert eligible people about the payments and connect them with services to help them obtain their payment.

As state agencies reach out to the 9 million people, the following groups would be useful targets for outreach efforts:

| TABLE 1 |

|---|

Recommended Reading: Will There Be Another Stimulus Package

Recommended Reading: How Many Stimulus Checks Did We Get In 2020

Who Is Eligible To Use The Tool

This free resource is designed for:

-

People whose gross income from their 2018 or 2019 federal income tax return was under $12,200 for single filers or $24,400 for married couples

-

People who arent required to file a 2018 or 2019 federal income tax return for other reasons

-

People who receive Social Security, Social Security Disability Insurance or Railroad Retirement benefits and have children younger than 17

Governors And State Snap Medicaid Agencies Have Key Role

Governors and state agencies that administer SNAP and Medicaid can play a central role in raising awareness about the payments and connecting non-filers with assistance in getting them. Governors can direct agencies to use available resources to identify individuals eligible for the payments and provide support to help this vulnerable group apply. They also can use their leadership positions to educate the public and organize statewide outreach efforts governors have led many past outreach efforts, such as campaigns to promote federal tax refunds, childrens health care coverage, and immunization campaigns. Governors can drive such efforts through their chief-executive authority, their convening power, and by leveraging their ability to drive significant earned and unearned media interest . In states that administer SNAP and/or Medicaid at the county level, county leaders can play a similar role.

State agencies administering SNAP and Medicaid also can help identify people eligible for the payments and educate them about their eligibility and how to claim the funds. Though many of these agencies face overwhelming workloads now, incorporating this outreach into their regular activities would yield a high impact at relatively low cost. These agencies have daily contact with program participants by phone, in person, or in writing.

Read Also: How Many Stimulus Checks Were Issued In 2021

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: How To Cash My Stimulus Check

Recovery Rebate Claims 2022

With the Recovery Rebate tool in place, users can recover or claim the missing stimulus money. Most people who were eligible for the second stimulus payments will eligible even for the third.

In some situations, it is being observed that the second stimulus check is missing from the platform for some individuals. Issues that have led to a missing second stimulus check includes individuals who are child dependents, direct deposits, change in home address, or an accidental garnishment.

File the returns this year by filling up Form 1040 or 1040SR, to immediately become eligible for receiving the Recovery Rebate Credit. Additionally, one can save Notice 1444 for their Economic Impact Payment alongwith the 2020 tax records.

The IRS opened up the filing process on February 12th. And can filings for federal tax returns are open till 15th April 2021.

Heres how users can fill in their details.

- They are eligible to use the IRS free file tool if their earnings are less than $72000 in a year.

- Go to the Free File site, and choose the IRS Free File offer.

- From the available options choose any to learn how they can file their returns.

- With the instructions provided fill in Credit Form 1040 or Form 1040-SR completely free of cost.

- The stimulus check deadline usually depends on the mode of payment dispatch. And is 21 days if dispatched through direct deposit provisions.

Read Also: I Never Received Any Stimulus Checks

What Does It Mean When The Irs Accepts Your Return For A Stimulus Check

Ideally, the acceptance of the returns for the stimulus checks means that the IRS has reviewed your returns and after initial inspection, the team has agreed to accept your returns.

They verify some normal details like your personal information and also find out a little about your dependents to find out if someone else on your dependent list has got any kind of claims.

It would mean that you have qualified for the stimulus check that the government is rolling out this year. Its been two times now that the stimulus has been rolled out for the citizens, one came up in 2020 and one has come up this year.

Also Check:- IRS Stimulus Check Application For Non-Filers

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who received the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check by July 31, 2022.

Recommended Reading: Fourth Stimulus Check Irs.gov

If I Sign Up For The Child Tax Credit Will It Affect My Other Government Benefits

No. Receiving Child Tax Credit payments will not change the amount you receive in other Federal benefits like unemployment insurance, Medicaid, SNAP, SSI, TANF, WIC, Section 8, SSDI or Public Housing. The Child Tax Credit is not considered income for any family. So, these programs do not view tax credits as income.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: Is There Going To.be Another Stimulus Check

Some Federal Benefit Recipients Already Have Received An Economic Impact Payment

The IRS emphasizes that federal benefit recipients in these groups who file tax returns already started to receive Economic Impact Payments earlier this month, along with other taxpayers.

Because some federal benefit recipients do not file tax returns, the IRS did not have in its tax systems the current information needed to generate the Economic Impact Payments. Last year, the IRS took the unprecedented step to receive and review data from other federal agencies and use that data to deliver payments automatically to these recipients. This action which had never occurred in previous stimulus efforts minimized risk and burdens for the American public during the pandemic. Due to regular changes in the federal benefits population, the IRS needed to receive updated information this month from other government agencies. With these critical updates, eligible federal benefit recipients who don’t normally file an income tax return will get a payment automatically in the next few weeks.

Making these automatic payments to federal beneficiaries involves a complex, multi-step process to handle recipient data from the other agencies. For the first round of Economic Impact Payments last year, recipients in these groups received payments within four to six weeks after the CARES Act was signed into law. For the American Rescue Plan signed March 11, the IRS projects that it is on track to deliver Economic Impact Payments to federal beneficiaries at the same or faster speed.

More Than 32000 Delawareans May Be Eligible For Stimulus Payments

Non-filers have until October 15th to register State Treasurer Colleen Davis urges Delawareans not typically required to file federal income tax returns to watch their mail for a letter from the Internal Revenue Service saying they may qualify for a federal Economic Impact Payment . The letter urges recipients to visit the special Non-Filers:

Recommended Reading: Social Security Recipients Stimulus Checks

Many Families Have Had Complicated Experiences Receiving Their Stimulus Checks Sometimes Receiving Some Payments But Not Others And Many Are Unsure How Much More They Deserve Or How To Get The Rest

Policymakers and advocates often assume that receipt of benefits like the stimulus is binary filers and federal beneficiaries received the EIPs, and non-filers did not. In practice, there is often much more ambiguity, with families having received some payments and not others, or not being sure exactly which payments they did or did not receive. While some of these cases are based on families imperfect understanding of eligibility rules and procedures, others are genuinely ambiguous, and there is no substitute for clearer reporting and better direct customer service.

Of our 11 interviewees, four received payments with no issues. Of the remaining seven, five were such ambiguous edge cases and even the other two reported some irregularities:

Two other interviewees got their own payments in relatively good order, but told us stories about others who had confusing experiences that cannot be easily collapsed into receipt or non-receipt:

Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for these Economic Impact Payments. This includes those experiencing homelessness, the rural poor, and others. For those eligible individuals who didn’t get a first or second Economic Impact Payment or got less than the full amounts, they may be eligible for the 2020 Recovery Rebate Credit, but they’ll need to file a 2020 tax return. See the special section on IRS.gov: Claiming the 2020 Recovery Rebate Credit if you aren’t required to file a tax return.

You May Like: How Much Was The Third Stimulus Check For

Irs Form To Apply For Stimulus Check If No Tax Return Filed

IRS has finally created the online formNon-Filers: Enter Payment Info-to apply for the coronavirus stimulus check if no tax return filed for reasons such as you receive veterans disability compensation, or a pension, or a survivor benefits from the Department of Veterans Affairs, or your income level does not require you to file a tax return.Non-Filers: Enter Payment Info is secure, and the information entered will be safe. .

Through this free online form, IRS can identify you and your dependents, and pay the stimulus payments directly to your bank account deposit. IRS can also use the address and other information to calculate the Economic Impact Payment and send a check to you .It is also an important tool for saving oneself from scammers targetting stimulus check

How Long Does It Take The Irs To Process A Non

It takes 5 to 10 days for the IRS to process a non-filer return. If successfully validated, non-filers can expect a paper IRS Verification of the non-filing letter at the address provided in the telephone request.

For the people who dont exactly file a tax return, there is a simple process to file it.

- Bank account number, routing, and type.

- IP PIN received from the previous IRS.

- Drivers license and state-issued identification.

When non-filers enter payment information, they will take the applicant from the IRS site to the Free File Fillable Forms.

Follow the below steps to give in the information.

- Create an account with the email ID and phone number.

- Create a User ID and password.

- You will next have to fill in your filing status.

- Enter detailed personal information.

- Further, have a valid SSN and incorporate it into the form.

- Complete the entire bank information.

- You will also need to incorporate the drivers license.

You would receive an email confirmation from the Customer Service of the Free File Fillable Forms. Applicants will either receive a confirmation stating all the incorporated information is correct or if there needs to be a correction.

You May Like: 4th Stimulus Check Texas Update