Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

Which States Are Sending New Stimulus Checks

California announced the Golden Gate Stimulus deal, which will provide a payment to 5.7 million people. The aid is already being distributed. Taxpayers earning between $30,000 and $75,000 per year will receive one-time payments of $600. Households with dependents will receive an additional $500.

New Mexico has issued payments to low-income households, who for whatever reason didnât receive the first three rounds of stimulus checks. There will be one-time payments of $750 per household.

In Texas, some local school districts are providing their employees with stimulus checks in the form of retention bonuses.

In Maryland, taxpayers with qualifying income could receive up to $500. Income caps vary from $21,710$56,844. In Colorado, anyone who receives unemployment benefits between March and October 2020 automatically received a one-time payment of $375.

Through its unique offer, Vermont is trying to lure people to move to the state. It will reimburse people up to $7,500 for qualifying moving expenses if youâre ready to work in certain industries.

In Georgia, Florida, Tennessee, Texas, and Colorado, teachers will be receiving a lot of stimulus money. As part of the American Rescue Plan, state and local governments have received $350 billion in assistance. Most of this aid will go to schools, which will pay their teachers and other school staff a bonus of up to $1,000. In Minnesota, grocery store workers and medical center staffers received bonus checks.

Stimulus Check Qualifications: Find Out If Youre Eligible For $1400 Or More

The rules arent the same for who qualifies for a third stimulus check this time around. Heres how to find out if youre eligible to receive the $1,400 payment.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland As.

Associate Producer

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNETs services and software team. She covers tips and tricks for apps and devices, as well as Apple Arcade news.

The third stimulus checks are hitting the 130 million mark by direct deposit and as paper checks and EIP cards. A third wave of checks is ramping up for this weekend and next week. If your check for up to $1,400 per household member hasnt come yet, its a good idea to triple-check your eligibility. If you do, heres how to track your payment and what to do if theres a problem with your check.

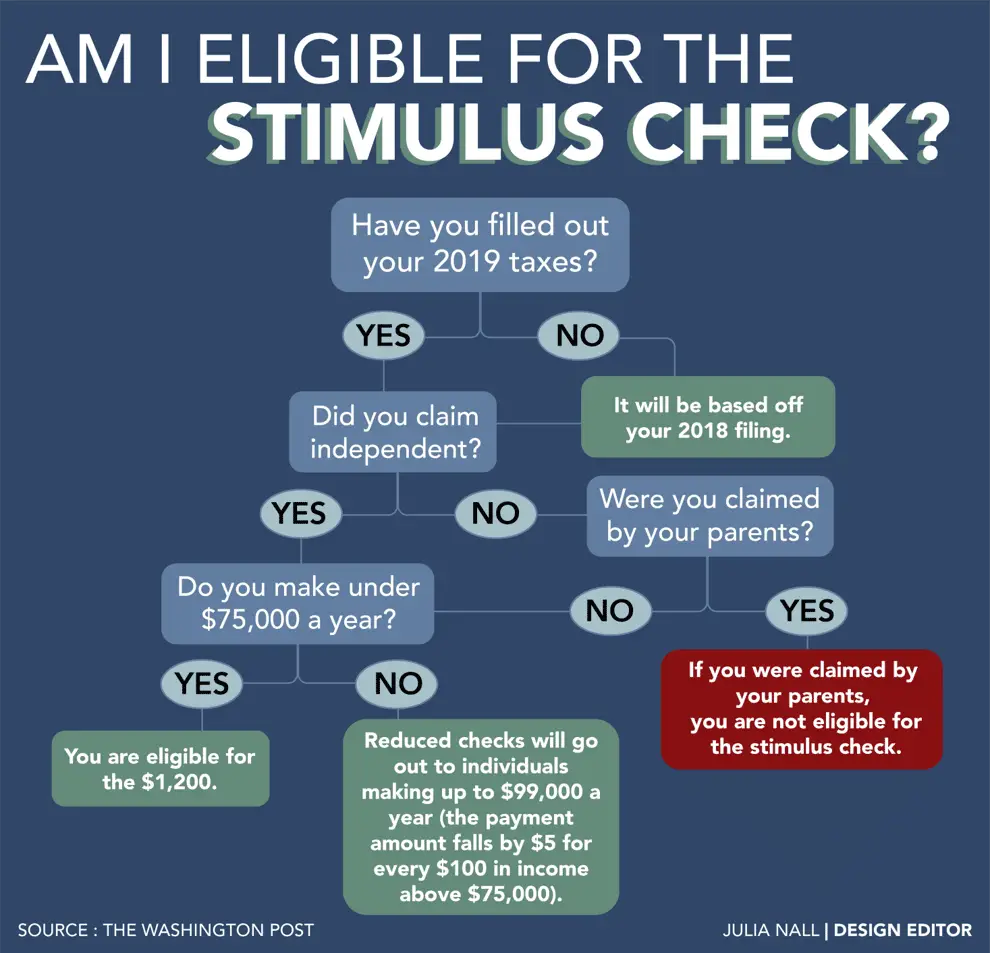

The requirements for the third payment have changed significantly from the first and second checks. For example, there are new income limits and rules for age, citizenship and tax status that can affect the size of your payment. Well walk you through what those qualifications are to help you determine whether you should expect a check or whether youll be completely left out.

Read Also: Irs Phone Number For Stimulus Check 2021

Recommended Reading: File For Missing Stimulus Check

Is There Anything Extra I Need To Do If I Have Shared Custody Of My Child

For the first two stimulus checks, some parents who shared custody of a child but werent married to each other were entitled to each claim money for the same child. That was only if they alternated years for claiming the dependent in other words, if one parent claimed the child on their taxes in odd years and the other claimed the child on their taxes in even years.

This is no longer allowed for the third check, and were told it wont work that way for the child tax credit payments either. Heres what we know so far about child tax credit and shared custody situations.

If the child switches homes this year, the parents will need to agree on who will claim the child on their taxes this year. The parent that claims the child and receives the child tax credit payments will need to fill out Form 8332 and include it with the tax return. If you dont qualify or want to get the money in one lump sum, you can also opt out of early payments. Remember, if youre not eligible but receive the money, you may have to pay the IRS back during tax time.

Recovery Rebate Tax Credit

When you file your 2021 federal income tax return this year, youre going to see a line on the second page for the Recovery rebate credit. Pay close attention to that line, especially if you didnt receive a full third-round stimulus check, you didnt file a 2019 or 2020 tax return, your income dropped in 2021, you had a baby in 2021, you got married last year, youre a recent college graduate, or you otherwise had a significant change of circumstances in 2021. If youre eligible for a third stimulus check, this credit could save you a lot of money.

Your third stimulus check and the credit amount are calculated in the same way. However, your stimulus check was based on information from either your 2019 or 2020 tax return. The tax credit is based on what you put down on your 2021 tax return. So, the failure to file a 2019 or 2020 return, or a change of circumstances from 2020 to 2021, could result in a difference between the amount of your third stimulus check and the credit amount.

If the recovery rebate credit is higher than your third stimulus check, your 2021 tax bill will be lower, and you might even get a refund. If your stimulus check was higher than the allowed credit, you get to keep the difference. So, you win either way!

For more information, see Whats the Recovery Rebate Credit?

Don’t Miss: Is The Homeowners Stimulus Real

Covid + Credit: 4 Things To Know About Stimulus Checks & The Cares Act

Reading Time: 7 minutes

The $2 trillion Coronavirus Aid, Relief, and Economic Security Act, approved in late March by Congress, provides relief across the economic spectrum provided you can understand every opportunity the massive piece of legislation offers. With news during the Coronavirus/Covid-19 pandemic breaking at a rapid pace, it can be hard to decipher the legislative efforts aimed at helping you. Were here to guide you through that process. Here are four things to know about the CARES Act.

The Last Of The $1400 Stimulus Checks Will Get Distributed To Eligible Parents This Tax Season

The third round of stimulus checks went out to more than 169 million U.S. taxpayers last year. The consensus on Capitol Hill remains that the $1,400 stimulus checksthe largest payment of the three roundswill be the last of the COVID-19 direct payments.

That said, the IRS hasnt finished sending out that third round: Another $1,400 stimulus checks will go out to eligible parents and guardians of 2021 newborns once the 2021 tax returns are filed this year. Thats because when the IRS sent out the $1,400 checks last year, it used taxpayers last tax return on filewhich, of course, wouldnt have included any children born in 2021. Thats why the check will get applied to parents and guardians 2021 tax returns, according to reporting by Fortune and Insider.

But having a 2021 newborn alone wont score parents and guardians that additional check. They will also need to meet the income eligibility requirements. To get the payment, single filers would need to make no more than $75,000 per year in adjusted gross income, while couples filing jointly would need to stay below $150,000. Parents earning above those levels would see their checks reducedand be completely phased out if theyre a single filer earning above $80,000 or a couple filing jointly earning above $160,000.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.

Also Check: Irs Sign Up For Stimulus

Read Also: Who Is Getting The New Stimulus Checks

Stimulus Check: Do You Have To Pay Tax On The Money

The majority of people who qualify for a stimulus check have already received their direct deposits, paper checks or prepaid debit cards. But the payments $1,200 for most single earners and $2,400 for most married couples have raised plenty of questions about how theyll impact taxes.

Chief among those is whether the payments, which are designed to help families weather the economic hit from the coronavirus pandemic, are subject to income taxes. In other words, should people set aside a chunk of the payment to pay the IRS when they file their 2020 tax returns?

Something a lot of people dont realize is that stimulus payments are not taxable, Christina Taylor, head of tax operations at Credit Karma Tax, told CBS MoneyWatch. Theyre actually an advance on a new credit on your 2020 federal income taxes.

Its understandable that theres confusion among consumers. The IRS and Treasurys official term for the payments economic impact payments doesnt hint at the fact the payments are actually a type of tax credit, for example. Because the checks are advances on a tax credit for 2020, taxpayers will get another chance to reconcile their income and dependents information when they file their 2020 tax returns in early 2021.

When Should You Request An Irs Payment Trace

Since the third stimulus checks are still being sent, you could hold out a little longer before taking action. If you didnt get your first or second check at all, though, its time to do something. This chart shows when you can and should request an IRS payment trace, which is designed to hunt down a stimulus check the agency says it sent. More below on exactly how a payment trace works, how to get started and when to use it.

Read Also: Irs.gov Stimulus Phone Number

How To Best Use Your Stimulus Money

If youve been waiting for your stimulus check for this long, you might already have plans for your tax refund. Taking care of overdue bills, high-interest credit card balances and immediate needs like food and shelter should be your first priority when deciding what to do with the money.

But if you have all your basic needs covered and feel secure in your job, there are additional ways you might want to use your tax refund.

This could be a good time to start your emergency fund. A high-yield savings account that earns a better interest rate than the national 0.05% average could help you stretch your money a little further and save more for future needs.

The Vio Bank High Yield Online Savings Account offers one of the highest APY rates for high-yield savings accounts right now . There is a minimum $100 deposit required to open an account, which is low enough that you could use a portion of your tax refund and still have money left over for other expenses.

There are no monthly charges to open a Vio savings account, as long as you opt to go paperless.

-

Annual Percentage Yield

-

None, if you opt for paperless statements

-

Maximum transactions

Up to 6 free withdrawals or transfers per statement cycle *The 6/statement cycle withdrawal limit is waived during the coronavirus outbreak under Regulation D

-

Excessive transactions fee

Stimulus Payments Tax Credits Still Available

In the new letter, the IRS is reminding people to file their 2021 tax returns an essential step for those eligible to claim stimulus check payments and other credits.

The agency says people who haven’t filed tax returns in previous years may benefit significantly by filing a 2021 tax return. It’s the only way to secure not only the rebate credit, but also certain other tax credits that were expanded in the American Rescue Plan Act and other legislation.

The IRS says many of the people receiving a letter in the next few weeks are eligible for the Child Tax Credit or the Earned Income Tax Credit.

We don’t want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take, IRS Commissioner Chuck Rettig said.

The expanded 2021 child tax credit, which is available for taxpayers who meet certain income requirements, totals $3,000 per child between ages 6 and 17 and $3,600 for children ages 5 under.

The American Rescue Plan also increased the Earned Income Tax Credit significantly for workers who do not have children. Some low- and moderate-income families are eligible for expanded benefits under this tax credit as well.

The late filing deadline for 2021 tax returns is Oct. 17, but taxpayers can still access tax credits after that date. The IRS says it will offer its free filing service until Nov. 17 for people who earn $73,000 or less, giving plenty of time to claim these benefits.

Also Check: How To Find Stimulus Check History

Get The Information You Need

The stimulus guide includes an FAQ section for understanding important info, including:

- Who is eligible to receive a stimulus check?

- How will the IRS determine income for the stimulus payment?

- How much money you will receive.

- Will the stimulus money be considered income that has to be claimed on taxes?

- How will you get the stimulus payment?

- The stimulus checks impact on other benefits or if debts are owed to other agencies.

Irs Free File Open Until November 17

To help get the word out about these tax benefits, the IRS announced on October 13, that it is sending letters to more than nine million individuals and families who appear to qualify for these stimulus benefits but did not claim them by filing a 2021 federal income tax return.

This includes people eligible not only for the 2021 recovery rebate credit and the child tax credit but also the earned income tax credit. The letters should arrive in the coming weeks.

Also, in addition to filing a 2021 tax return at ChildTaxCredit.gov, the IRS says that Free File will remain open for an until November 17, 2022. Thats one month later than the tool is normally available. If your income is $73,000 or less, Free File allows you to file your tax return online at no cost to you.

Read Also: Will We Get Another Stimulus Check Soon

Aggressive State Outreach Can Help Reach The 12 Million Non

About 12 million Americans risk missing out on the stimulus payments provided through the recent CARES Act because they, unlike millions of people who are receiving the payments automatically from the IRS, must file a form by November 21 to receive it this year, or file a 2020 tax return next year to receive it in 2021. This group includes very low-income families with children, people who have been disconnected from work opportunities for a long period, and many low-income adults not raising children in their home.

Governors and other state officials can play a central role in reaching these 12 million individuals, up to 9 million of whom roughly 3 in 4 participate in SNAP or Medicaid, which states and counties administer.

This group of non-filers eligible for payments are disproportionately people of color because they are likelier to have lower incomes due to historical racism and ongoing bias and discrimination. Twenty-seven percent of the 9 million people are Black higher than their share of the U.S. population while another 19 percent are Latino. Ensuring that low-income people of color receive the payments for which they qualify is especially important given emerging evidence that they are being hit hardest by both the economic and health effects of the pandemic.

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Also Check: How Do I Get The First Stimulus Check