When Is The Next Stimulus Check Released

MILLIONS of Americans have gotten stimulus payments in the past two years, but is a fourth check on the way?

The short answer probably not.

The direct payments were intended to help struggling citizens and stimulate the economy by giving them more money to spend during the financial downturn.

As a result of the pandemic, we saw multiple stimulus check packages passed across the nation.

Since federal stimulus seems to be over, states have stepped up and offered rebates and other direct payments to help those struggling.

Almost 20 states have sent or will be sending checks to offset rising inflation.

Recommended Reading: How Much In Total Were The Stimulus Checks

If I Owe Someone Money Can They Take My Stimulus Checks

Maybe. Anyone filing a 2020 or 2021 income tax return to claim stimulus checks will receive the money as a tax refund. Stimulus checks should not be kept by the IRS for back tax debt.

If you owe a debt to a different federal or state agency your tax refund could be taken by that agency before you get it. This is sometimes called a garnishment or offset

If you have a question about a garnishment or offset for a student loan debt, a debt related to public benefits , or a federal tax debt you can .

What should I do if I didnt get the full amount I am owed or if I have another problem with my Stimulus Checks?

If you didnt get your stimulus checks, even after filing your 2020 and 2021 tax returns, or if you have another problem with your Stimulus Checks you can . We may be able to help.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

You May Like: I Never Got Any Of The Stimulus Checks

When Will I Get My Stimulus Payment How To Track $1400 Checks

Stimulus checks are coming.

Stimulus checks will be deposited in Americans bank accounts as early as this weekend.

The first batch of payments will be sent by direct deposit, which some recipients will start receiving as early as this weekend, and with more receiving this coming week, the IRS said on Friday. Additional batches of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card. The vast majority of these payments will be by direct deposit.

Some payments may appear pending until the official first payment date of March 17, officials said.

Additional batches of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card. The vast majority of these payments will be by direct deposit.

Starting Monday, Americans can use the Get My Payment tool to track their stimulus check.

Bidens $1.9 trillion American Rescue Plan passed the Senate last Saturday and the House on Wednesday no Republican voted for the bill. The legislation offers a third round of direct payments to millions of Americans, payments to support families with children and an extension of unemployment assistance, which was set to expire this month, through at least September.

The direct payments $1,400 for adults earning less than $75,000 and couples less than $150,000, as well as $1,400 for dependents could amount to $5,600 for many families of four.

People Who Dont File A Tax Return

Question: What if I donât file a 2019 or 2020 tax return?

Answer: Some people donât file a tax return because their income doesnât reach the filing requirement threshold. If thatâs the case, the IRS will send a third stimulus check based on whatever information, if any, is available to it. That information potentially could come from the Social Security Administration, Railroad Retirement Board, or Veterans Administration if youâre currently receiving benefits from one of those federal agencies. If thatâs the case, youâll generally receive your third stimulus payment the same way that you get your regular benefits. If you supplied the IRS information last year through its online Non-Filers tool or by submitting a special simplified tax return, the tax agency can use that information, too.

Some people who receive a third stimulus check based on information from the SSA, RRB, or VA may still want to file a 2020 tax return even if they arenât required to file to get an additional payment for a spouse or dependent.

Read Also: When Will South Carolina Receive Stimulus Checks

Read Also: New Mexico Stimulus Check 2022

How To Claim Your Missing $600 Or $1200 Payments

The stimulus checks are generally advance payments of a tax credit.

The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first $1,200 stimulus check or the second $600 payment if that money is due to you line 30 of Forms 1040 or 1040-SR.

On that part of the return, filers can start with the amount of stimulus money they already received and calculate any more funds which they are due. That can be done either through a worksheet provided with the tax form or through tax preparation software.

More from Personal Finance:

Covid+credit: When Will I Get My $1200 Stimulus Check

Reading time: 4 minutes

Americans everywhere have been hit hard by the Coronavirus/Covid-19 pandemic, with much of the economy in a holding pattern amid nationwide efforts to curb the spread of the virus. Fortunately for those in need, some short-term economic relief is coming in the form of federal government stimulus checks.

As a part of the record-setting $2 trillion Coronavirus Aid, Relief, and Economic Security Act approved in late March by Congress, most adults will receive a one-time payment of up to $1,200, though the exact amount depends on your income. Adults will receive an additional $500 for every qualifying child age 16 or under, and married couples without children earning below a certain threshold will receive a total of up to $2,400. You do not need to apply to receive a payment.

Now that U.S. government stimulus checks have turned from a dream into a reality, what’s the top question on everyone’s mind? When will I receive my money? The short answer? It’s complicated.

You May Like: Irs Ssi Stimulus Check 2022

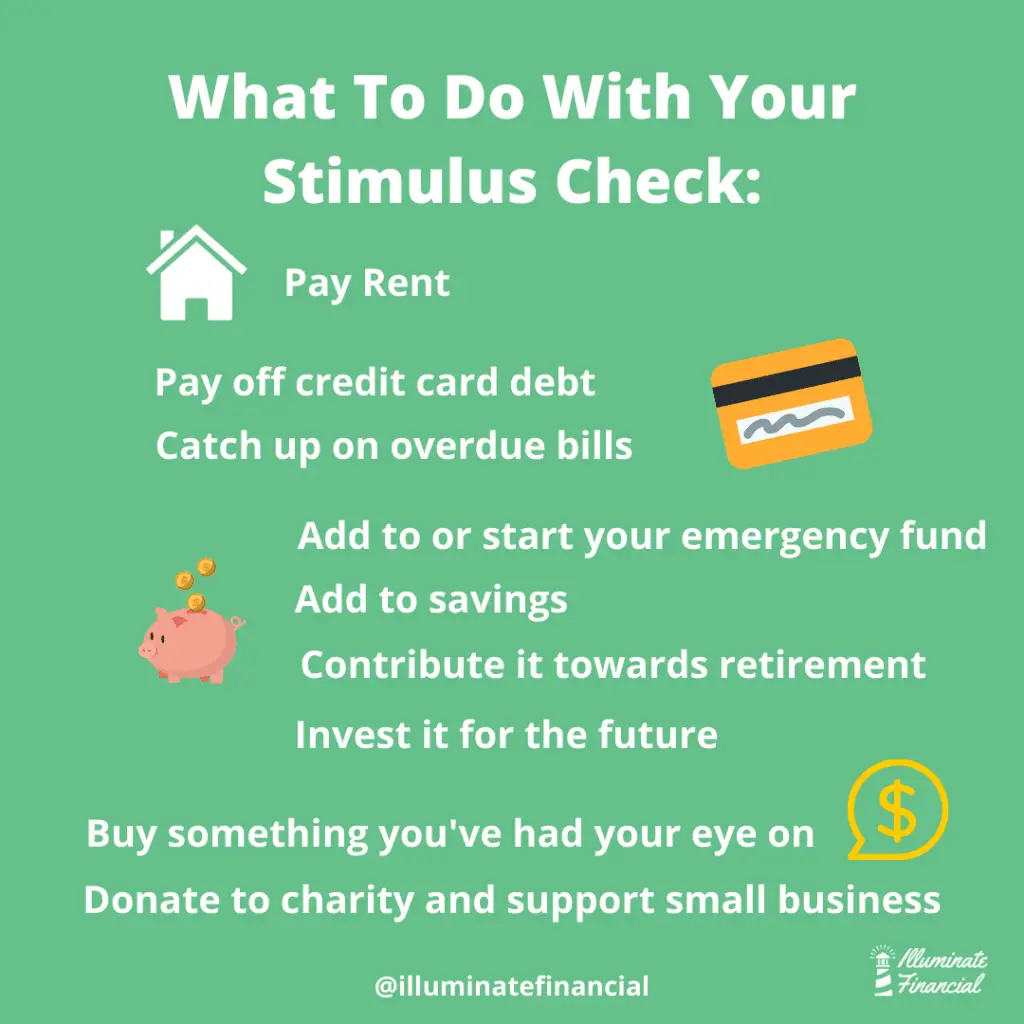

What Else Can I Do

If the IRS Economic Payment line doesnt work for you, then you can also try to contact the IRS through the IRS Customer Service hotline at 1-800-829-1040. Similarly, you can contact the IRS to inquire about income taxes at 1-800-829-1954. However, both these numbers have automated messagesbut they dont provide information about stimulus checks. There are two other approaches you can take:

Within 15 days of after the payment of your stimulus check is made, the IRS should send you a letter with details about your stimulus check, including the amount and how you were paid. The letter also includes the same phone number for the IRS Economic Impact Payment line800-919-9835to contact the IRS with any questions regarding your stimulus check.

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

- Veterans Affairs

- Railroad Retirement

Also Check: Haven’t Received Any Stimulus Checks

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Other Ways To Get Cash

Although not an offer of government support, there are other ways to supplement one’s income.

Some include a cash-back program that allows people to receive credit for purchasing goods.

For example, major cashback site Ibotta claims its average user earns $150 each year from online purchases and groceries.

And TopCashback claims it gives its average member $345 in cash back.

Other incentives come through banks offering huge sign-up bonuses during the pandemic.

There are even sign-up bonuses for getting a job during the nationwide labor shortage.

Given that there is a massive labor shortage, some companies are paying thousands in hiring bonuses in an effort to lure workers in.

Don’t Miss: How To Look Up Stimulus Check

How To Track Your Stimulus Check Online

With the IRS Get My Payment tool, you can get a daily update on your payment status. The online app can also alert you with a message if thereâs a problem with your payment that you may need to address. Another option is to create an online account with the IRS, if you havenât already.

If you get sent a plus-up payment after your 2020 tax return is processed, the amount of your third payment will no longer show up in the tool, according to the IRS. In that case you will only see the status of your plus-up payment.

If you expect your payment to come in the mail, you can use a free tool from the US Postal Service to track your mailed stimulus payment.

Most People Who Qualify Under The Cares Act Should Receive Their Payment Automatically But Some May Need To Submit Their Information To The Irs To Receive Their Economic Impact Payment

As a result of the hardships presented by the coronavirus, Economic Impact Payments are being issued by the Internal Revenue Service. While most people will receive their payment automatically, there are some cases where non-filers will need to take action and submit their information to the IRS.

The best way to submit your info to receive the payment is through the IRS Non Filers Enter Payment Info portal. There, youll choose how you want to receive your payment. The fastest way to receive payment is through direct deposit, either to your bank or credit union account, or to an eligible prepaid card.

You May Like: Who Was Eligible For The Third Stimulus Check

Confirm That Youre Eligible

While a reported 150 million Americans are eligible for an Economic Impact Payment, not everyone qualifies. Youre not qualified if you had an adjusted gross income in 2019 of more than $99,000 for individuals, $146,500 for head-of-household filers, and $198,000 for married couples filing jointly.

Additionally, if youre claimed as a dependent on someone elses return, dont have a valid Social Security number, or are a nonresident alien, youre not eligible.

Dont Miss: How Much Was The First And Second Stimulus Check

Amount And Status Of Your Payment

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending the payment.

If you are sent a plus-up Economic Impact Payment after your 2020 tax return is processed:

- The amount of your initial third payment will no longer show in your online account. You will only see the amount of your plus-up payment.

- The status of your initial third payment will no longer show in Get My Payment. You will only see the status of your plus-up payment.

Recommended Reading: Student Loan Forgiveness Stimulus Check

Other Payments You Can Claim Using The Tool

Additionally, by visiting GetCTC.org, you can claim the Child Tax Credit and Earned Income Tax Credit along with the third stimulus check.

To file for Child Tax Credit, you may e-file online.

To receive your payment, users must answer the questions provided truthfully and accurately.

Filling out the form only takes 15 minutes to complete.

If you would like to claim additional money with EITC, you may contact your employer for your W-2.

Wheres My Third Stimulus Check

OVERVIEW

The American Rescue Plan, a new COVID relief bill, includes a third round of stimulus payments for millions of Americans. Get updated on the latest information as it evolves.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

A third round of stimulus checks is on the way for millions.

The American Rescue Plan, a new COVID relief bill, was signed into law on March 11, 2021. The bill includes a third round of stimulus payments for millions of Americans. We know these funds are important to you, and we are here to help.

If you are eligible, you could get up to $1,400 in stimulus checks for each taxpayer in your family plus an additional $1,400 per dependent. This means a family with two children could receive $5,600.

The IRS began issuing the first batch of stimulus payments, and they could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks. If youre eligible, check the status of your stimulus payment and the way itll be sent to you by going to the IRS Get My Payment Tool, which will be live on March 15th.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Don’t Miss: Stimulus Check For Grocery Workers

Hawaii: $300 Rebate Payments

In June, Hawaiis legislature approved sending a tax rebate to every taxpayer. Taxpayers earning less than $100,000 per year will receive $300, and those earning more than $100,000 per year will receive $100. Dependents are eligible for the rebate, too.

Taxpayers who filed their 2021 state income tax returns by July 31, 2022, should have received their returns in September, and those who requested paper checks should have received them by October 31. Taxpayers who filed their returns after July 31 should receive their check up to 10 weeks after their return is accepted by the tax department.

Dont Miss: Irs Didnt Get Stimulus

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Recommended Reading: Netspend All-access Stimulus Check Activation

New $1400 Stimulus Check Coming Soon

Giving birth this year is the deciding factor, as far as who gets one of these new payments or not. Parents who welcome a newborn child at any point in 2021 are likely eligible for another stimulus payment, for $1,400, in 2022, according to both Fortune and Insider. They would get that check upon filing their federal taxes in 2022.

The way things stand now, what that also appears to mean is that parents would not only get that $1,400 check. But any parent who welcomes a newborn child in 2021 also likely qualifies for the temporarily expanded child tax credit. We say likely, because theres still an income threshold. Sorry millionaires, not you!

As weve explained on numerous occasions now, the latter was made possible by the $1.9 trillion stimulus law from earlier this year. However, depending on when the child is born such as if its in late December? For those parents, it would be too late to have this years monthly child tax credit checks reflect that change. In which case, the parents would get the money next year, after filing their taxes in 2022.